📈 10 Essential investment lessons of Warren Buffett

Warren Buffett has been writing annual shareholders letters for more than 4 decades. I read them all and summarized them in 10 key lessons.

Principle 1: The longer you invest, the better.

Today, Warren Buffett’s net worth is equal to more than $100 billion. More than 95% (!) of this wealth was created after his 65th birthday. The power of compounding is truly beautiful.

Principle 2: Do not borrow money to invest

“My partner Charlie Munger says there are only three ways a smart person can go broke: liquor, ladies and leverage" - Warren Buffett

Principle 3: Boring companies are usually great investments

Invest in what you understand. When you don’t understand what you buy, you are not able to make good and rational investment decisions. Boring companies are usually great investments. Good investing is as watching paint dry.

To give an example: when you would have invested $1.000 in Coca-Cola in 1989 and reinvested all quarterly dividends, you would collect more than $56.000 (!) in annual dividends today.

Principle 4: Invest in companies with integer management

The interests of management and shareholders should be aligned. When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

Principle 5: Buy quality businesses

In the long term, earnings growth is the main determinant for increasing stock prices. Invest in robust companies with a healthy balance sheet and high margins which can grow their earnings attractively.

Principle 6: Be disciplined

Every investment strategy will underperform the market from time to time. As an investor you are running a marathon, not a sprint. Write down your investment goals and stick to the plan.

Principle 7: Market fluctuations are your friend

The best thing that can happen to investors who will still be buying shares in the next 10 years, is falling stock prices.

Use it to your advantage.

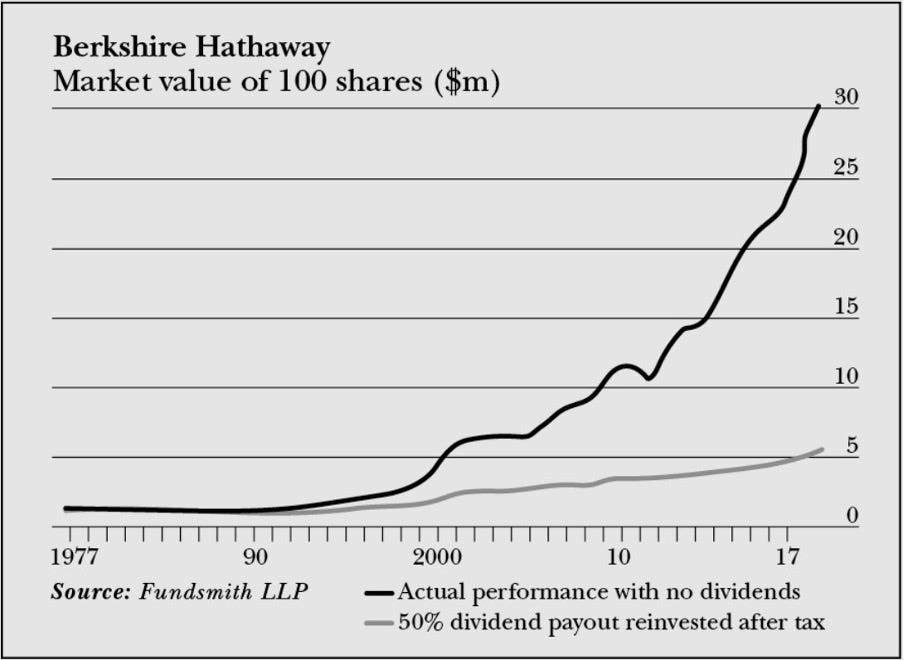

Principle 8: Invest in companies who can reinvest a lot in organic growth

Organic growth is the most preferred source of growth. When you invest in companies which can reinvest their earnings in organic growth for years or even decades, the earnings of the company will explode over time.

Principle 9: Your best ideas should have the largest weight in your portfolio

When you know what you own, overdiversifying can be harmful to your results. More than 40% of Buffett’s portfolio is invested in Apple. 87% (!) of Berkshire Hathaway’s assets are invested in only 10 stocks.

Principle 10: Pricing power is crucial

A company with pricing power can pass increasing costs to their customers. Companies with pricing power are usually characterized by high gross margins. When a company has a very high and stable gross margin, it is usually also a good indication that the company has an economic moat.

The end. Do you want to learn more about Warren Buffett’s investment strategy? I mapped all annual letters of Berkshire Hathaway in 1 PDF. You can download the PDF for free here:

Hi there, thanks for all the wonderful work you are doing!

I have one comment on point 9 in this article. "87% (!) of Berkshire Hathaway’s assets are invested in only 10 stocks.". While this is true for their investment portfolio, it is far from true for their entire asset base. They have many other wonderful businesses that are not visible on that image. BNSF, BHE, GEICO, etc. In any case, even if we look at all of their assets, I am sure that the concentration will still be there, so your points are directionally correct. Only the numbers might be slightly off.

Cheers and keep it up!

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it”. Amazing that Mr. Buffett has earned 95% of his wealth after age 65. No wonder he will elected to wait on his enormous philanthropy. Thank you for sharing his timeless wisdom.