🏰 How to deal with market downturns

#QualityTuesday

In this series, we will teach you 5 things about the stock market in less than 5 minutes. We would like to welcome the more than 500 subscribers who joined our Substack since last week. If you are reading this and are not subscribed yet, feel free to do this via the button hereunder:

1️⃣ How to deal with market downturns

In 2009, Berkshire Hathaway was down 50%. A reporter asked Charlie Munger whether he was worried about this. His response:

2️⃣ Compounding can be beautiful

When you become 1% better every day, you will become a learning machine. The same is applicable in the stock market. Most people overestimate what they can do in a year and underestimate what they can do in a decade.

3️⃣ One simple investment quote

Do you want to become rich in the stock market? The big money is not in the buying and the selling, but in the waiting.

"Investing is where you find a few great companies and then sit on your ass" - Charlie Munger

4️⃣ Read as much as you can

Do you know what J.K. Rowling, Jeff Bezos and Warren Buffett have in common? They became billionaires thanks to writing, selling, and reading books.

Reading is crucial to become the best possible version of yourself.

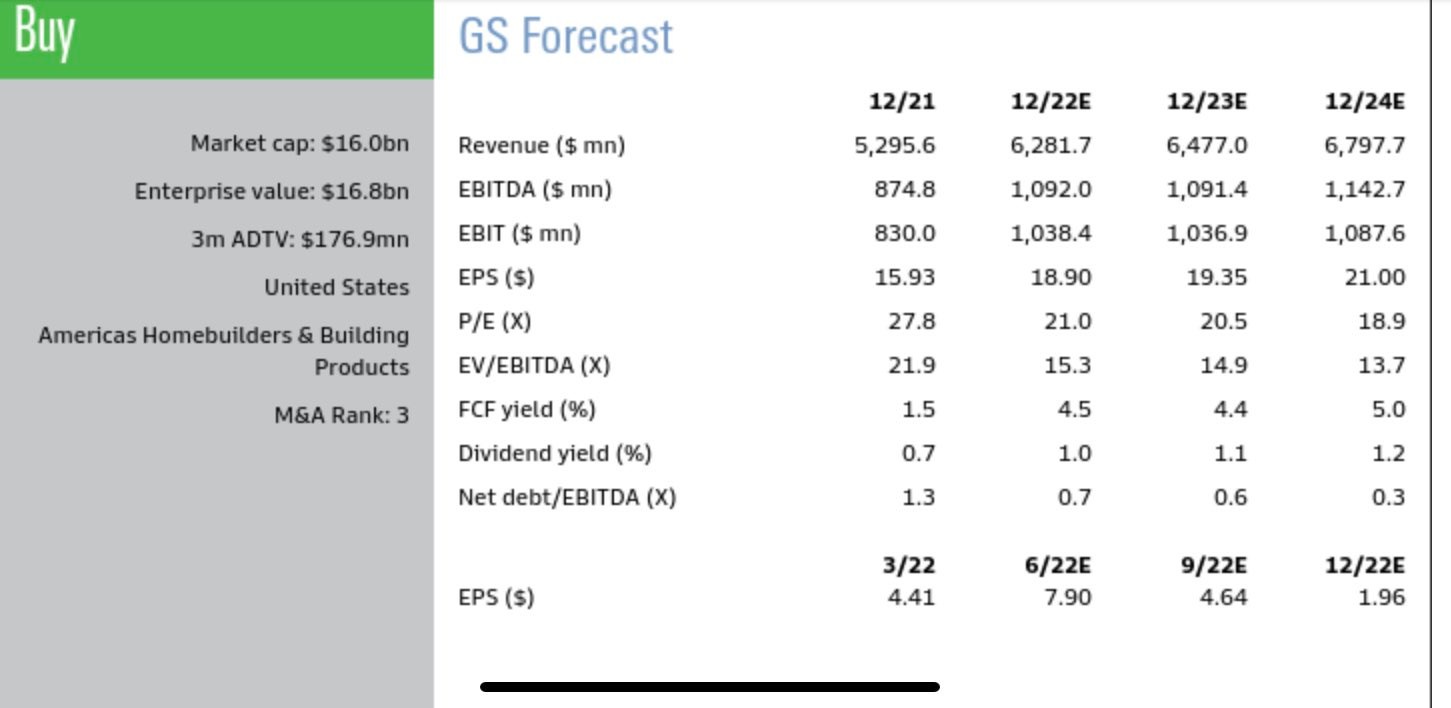

5️⃣ Example of a quality company

Pool Corporation ($POOL) is trading at it's cheapest valuation since 2010. Great company with great capital allocation:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $125 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

I would like to learn to be peaceful when my POrtfolio is down 50 percent

I decided to take a trip down "Archive Lane" to see where I left off reading past articles and where do I land?

Here, at this article, as global markets take a tumble from Donald Trump's "Tariff Tantrum". How timely! 😄

I really appreciate Lesson #1 from Mr. Munger. Everything seems to be in turmoil now and I feel surprisingly calm and chilled out. Maybe it's because I was lucky enough to start selling down 1% of my holdings a while back and built up a cash reserve. The cash allows me to go bargain hunting as if I were on a treasure hunt in a thrift store!

I found a YouTube video with the interview of Mr. Munger regarding his "zero" feeling.

https://www.youtube.com/watch?v=3WkpQ4PpId4

I hope the link works!