In this series, we will give a weekly recap in less than 5 minutes. We would like to welcome the more than 500 subscribers who joined our Substack since last week. If you are reading this and are not subscribed yet, feel free to do this via the button hereunder:

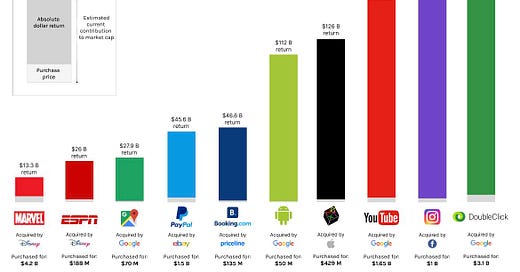

🏰 The greatest acquisitions of all time

In some cases, acquisitions can create a lot of value over time. Here are the top 10 acquisitions of all time according to 10kreader.com:

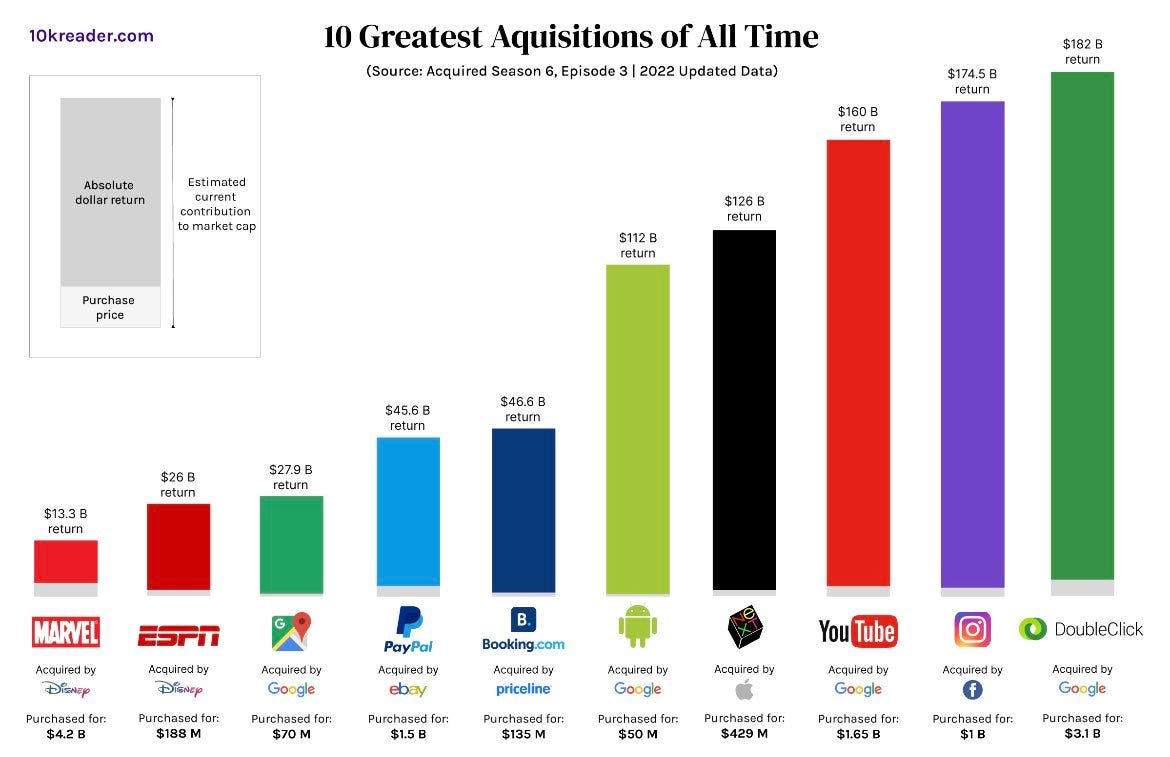

🏰 Signs we reached the top and bottom of the market cycle:

Mr. Market (the stock market) goes through periods of severe pessimism and extreme euphoria. Do you want to know where we are in the market cycle? Take a look at the table below:

🏰 One simple investment quote

Investing is a marathon, not a sprint. Think on the long term and you already have a BIG advantage compared to other investors.

"Checking your stocks daily is like putting up a webcam in the forest to see if the trees are growing."

🏰 Reading inspiration

Warren Buffett is one of the best investors in the history of humankind.

You can download all his shareholder letters in 1 PDF file for free. The file can be downloaded here:

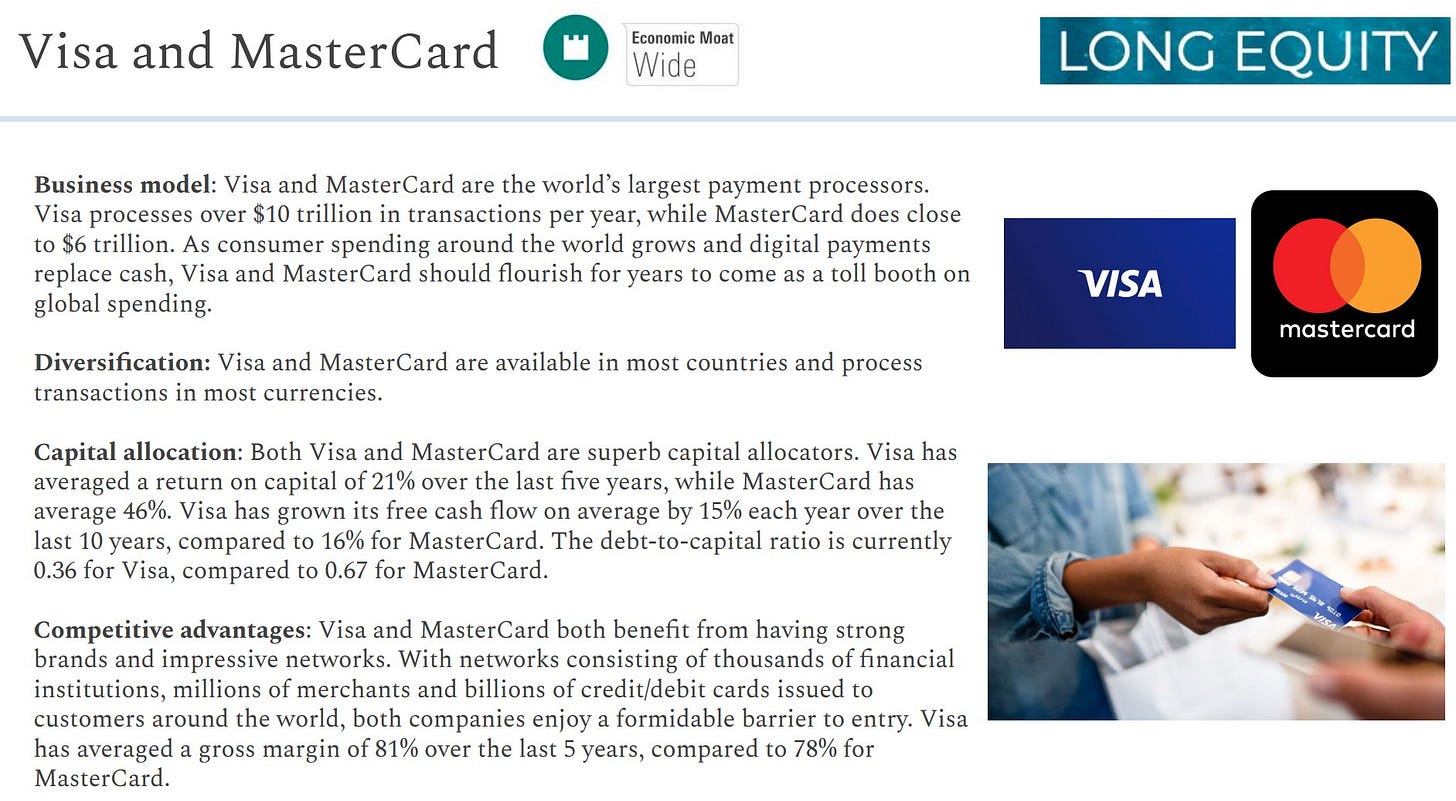

🏰 Example of a quality company

"Mastercard and Visa's profit margins are 4x as high as the average company within the S&P 500. This means that you could halve their profit margin, and do it again to get to the average profit margin of other companies. This indicates that Mastercard and Visa have a strong moat." - Chuck Akre

Source of the picture below: Long Equity

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter and Linkedin.

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $125 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

I am long overdue to visit the Archives! 😃

10kreader.com is gone. 🤷

I remember Double Click! Does that make me old? 👴

The chart from Flame University is awesome! That needs to be reposted in the Circle Community! 👍 Today is Oct 11, 2024. According to the chart I think we are two or three steps above the bottom with plenty of room before the top.

Looking back at Q2 2020 through Q4 2021, I see a lot of signs markets were running toward a top.

Number 1 - We seemed to have lots of SPACs.

Number 2 - Asset prices shot up like rockets starting Q2 in 2020.

Number 5 - A class of investor celebrities came about. Bill Ackman and Cathy Wood were all over.

Number 6 - Volume was heavy!

Number 8 - People were buying art, wine, and collectables.

Number 11 - Retail / amateur investors stuck at home with COVID stimulus money stimulated markets.

Number 12 - Everything was "cloud this", "cloud that". You could cut the euphoria with a spoon!

Then when inflation hit and rates rose, we saw our trip down to the bottom.

Number 1 - No more SPACs.

Number 4 - Multiples contracted.

Number 6 - Rates actually rose because of inflation but now we are seeing rates fall. Soft landing?

Number 9 - Nobody liked REITs.

Number 11 - Investors sold equities and bought Treasury issues.

Number 12 - Sam Bankman Fried and his cronies got busted.

Number 13 - Nobody is happy with inflation.

I'm printing that chart and hanging it! 🖼️

Google says the quote, "Checking your stocks daily is like putting up a webcam in the forest to see if the trees are growing." came from Burton Malkeil. Is that true?

" All shareholder letters Warren Buffett " is not available. can you update it?