10 Best Tiny Titans

How to invest in winners

🎥 Free live training on the 16th of September:

🔥 Real stories of 10x stock gains

🔍 My personal checklist for finding 100-baggers

📊 3 small-cap stocks I’m buying right now

🎁 Plus, a bonus worth over $1,000 (yours free)

👉 Save your seat now and claim your bonus gift before spots run out.Small companies outperform the market.

And it gets even better if you only select high-quality small-cap companies.

Let’s share the 10 best-performing examples of the past 10 years.

Tiny Titans

Tiny Titans will launch on the 16th of September for people who are on the waitlist.

Make sure you put yourself on the waitlist here if you haven’t done it yet.

To celebrate, there will be a 🎉 Big Launch Party.

Here’s what you can expect:

🎁 A special gift worth over $1,000

📈 Plenty of examples

⭐ My favorite small-cap stocks right now

10 Best Performing Small Caps

Now let’s dive into the list.

The list is based on the 10-year performance. Companies will be sorted from 10 to 1.

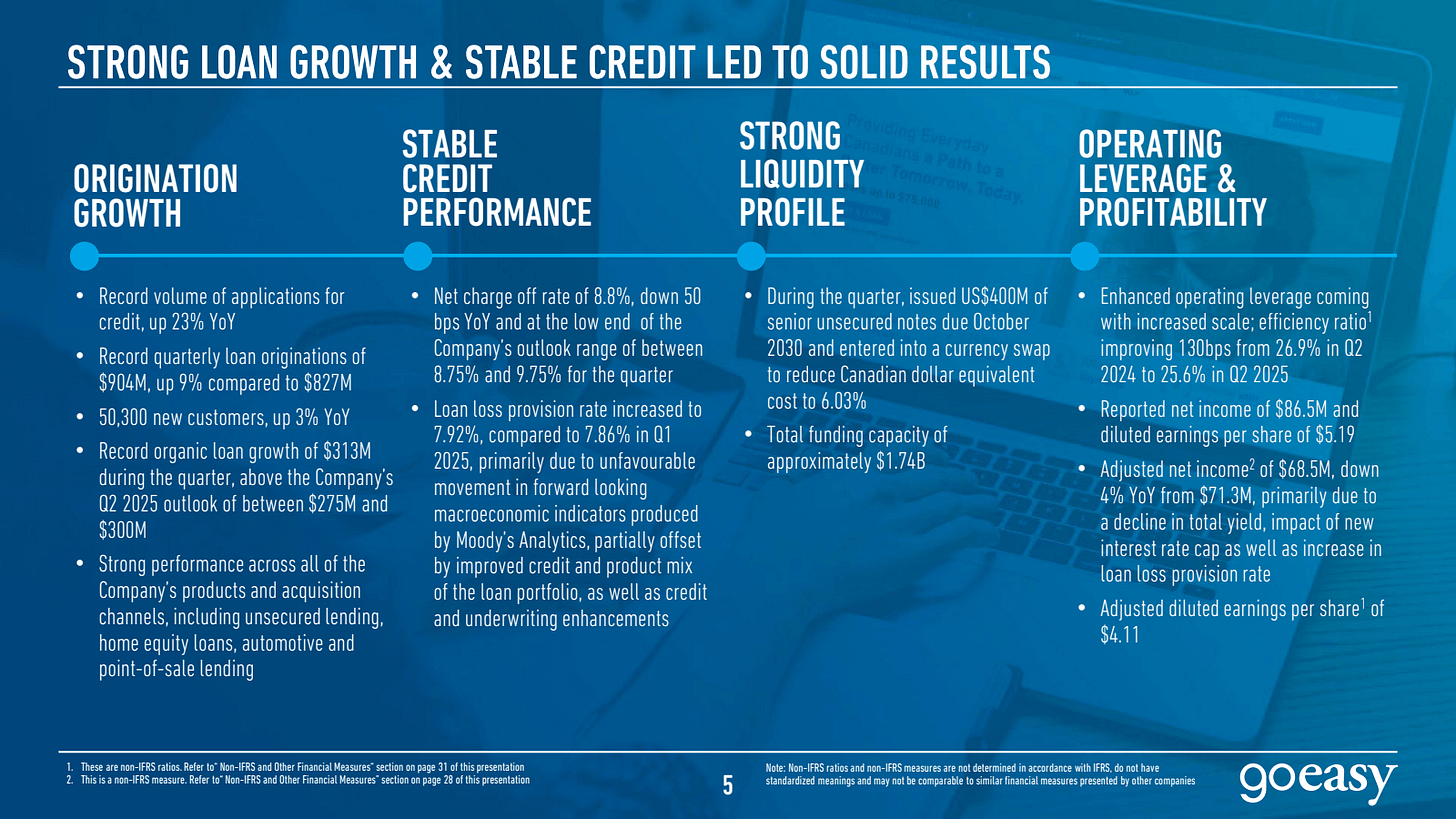

10. Goeasy (+1,272% return in 10 years)

How does the company make money?

Goeasy ($GSY) is a Canadian company that gives loans to people who can’t always borrow from banks. They also rent and sell furniture, electronics, and appliances. They make money from the interest on loans and rental payments.Goeasy is the Kinsale Capital of banking.

Their clients are borrowers who can’t go to classic banks due to low credit scores.

These clients are riskier than traditional clients, but Goeasy charges a significantly higher interest rate because of the increased risk.

Besides that, they also own EasyHome, a rent-to-own business.

Customers can get furniture, appliances, or electronics without paying the full price upfront.

They pay in small monthly amounts, often at higher rates, just like the banking side of the business.

9. Napco Security Technologies (+1,323% return in 10 years)

How does the company make money?

Napco Security Technologies ($NSSC) makes locks, alarms, and security systems. Their products protect schools, offices, and homes. They make money when people and companies buy and install their equipment.In general, there are three security verticals:

Alarms & connectivity

Locking

Access Control

Napco Security Technologies is the only brand that operates in all of them. Customers are offered the full package.

And that’s not everything.

There are a couple of other things I like about the company:

Richard L. Soloway has served as Founder and CEO since 1998

The company is evolving to a recurring revenue business model

Everything related to security and safety is in a clear secular trend

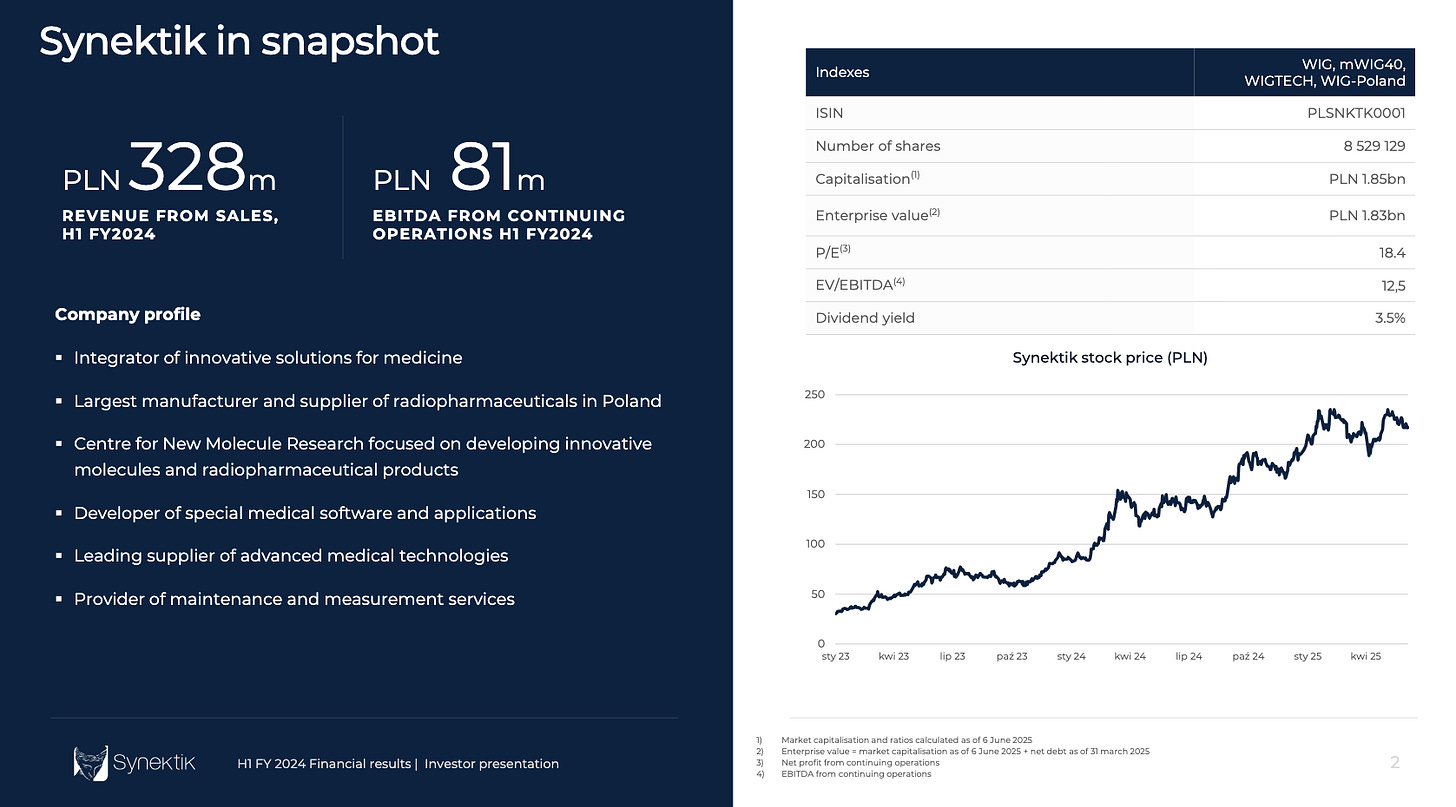

8. Synektik (+1,325% return in 10 years)

How does the company make money?

Synektik ($SNT) is a Polish healthcare company. They make and sell medical imaging systems, like scanners and cameras. They help doctors see inside the body of their patients. Synektik earns money by selling this equipment to hospitals and clinics.Synektik makes special medicines called radiopharmaceuticals. Doctors use them to find diseases like cancer inside the body.

They also build and sell high-tech medical gear. Even robots that help doctors during surgery.

One of their most important products? Da Vinci robots (Intuitive Surgical). These machines assist doctors in performing precise and minimally invasive surgeries.

Synektik has exclusive rights to distribute da Vinci robots in Poland, the Czech Republic, and Slovakia until 2030.

7. AppFolio (+1,417% return in 10 years)

How does the company make money?

AppFolio ($APPF) builds software for landlords and property managers. It helps them collect rent, manage tenants, and keep track of buildings. The company makes money through subscription fees for using its software.AppFolio is a software company that quietly powers the real estate world.

Since 2006, they’ve helped landlords and property managers do everything from collecting rent to screening tenants and managing investors. All in one smooth platform.

In a recent interview, Mark Leonard, the mastermind behind Constellation Software, said something interesting:

“There are two main companies Constellation Software could learn from: AppFolio and Veeva.”

This got my interest for sure.

AppFolio is an amazing company with high insider ownership. It ticks all the boxes of the criteria we’re looking for.

6. Alpha Group International (+1,572% return in 10 years)

How does the company make money?

Alpha Group ($ALPH) helps companies when they need to change money from one currency (like dollars) into another (like euros). They give advice and make smart plans so businesses don’t lose too much money when exchange rates move. Alpha Group is a perfect fit for the Tiny Titans Portfolio.

Almost every international company must manage foreign exchange and interest rate risks.

There’s one company that helps them deal with it. And because this risk never disappears, Alpha Group’s services are always needed.

Recently, a takeover bid was announced. The stock shot up +26% on the news.

If you want to own companies for decades, this isn’t the kind of headline you cheer for.

But it does confirm one thing: we’re looking in the right places with Tiny Titans.

5. Chapters Group (+1,611% return in 10 years)

How does the company make money?

Chapters Group ($CHG) is a German serial acquirer in Vertical Market Software. They acquire companies and own them for the long term while helping them grow. Chapters Group buys small, profitable niche businesses and… simply let them run. That’s it. No micromanagement. No drama. Just smart, quiet compounding.

This is a stock to hold for a very long time. And here’s why:

Reason 1: This model works. Constellation Software became one of the best-performing stocks of the last 20 years by doing the exact same thing.

Reason 2: The longer your time horizon, the more important great management becomes.

And Chapters Group has exactly that:

Mitch Rales is the Co-founder & Chairman of Danaher. He is an icon amongst serial acquirers. He is one of Chapters’ major shareholders

William Thorndike is the author of ‘The Outsiders’, probably the best book about capital allocation in the world. Thorndike is also a shareholder of the company

Daniel Ek is the CEO of Spotify. He is also involved because he owns shares of Chapters.

Jan-Hendrik Mohr is the CEO of Chapters Group and a value investor at heart

4. TerraVest Industries (+2,191% return in 10 years)

How does the company make money?

TerraVest Industries ($TVK) is a serial acquirer of the most boring businesses. Think about propane tanks, pressure vessels, and furnaces. TerraVest Industries is a serial acquirer in niche manufacturing markets.

They own companies in fields like energy, transportation, and industrial equipment.

Terravest helps these companies improve by providing them with resources and guidance. They look for opportunities to make these businesses more efficient and profitable.

After an acquisition, the company:

Combines operations where possible

Cut costs (like shared back-office, bulk purchasing)

Scales production to spread fixed costs over more sales

Most acquirers say synergies fail. Terravest proves the opposite in their niche.

Profits on some tanks went up +75% (!) after the improvements of Terravest.

You can read a Not So Deep Dive about the company here.

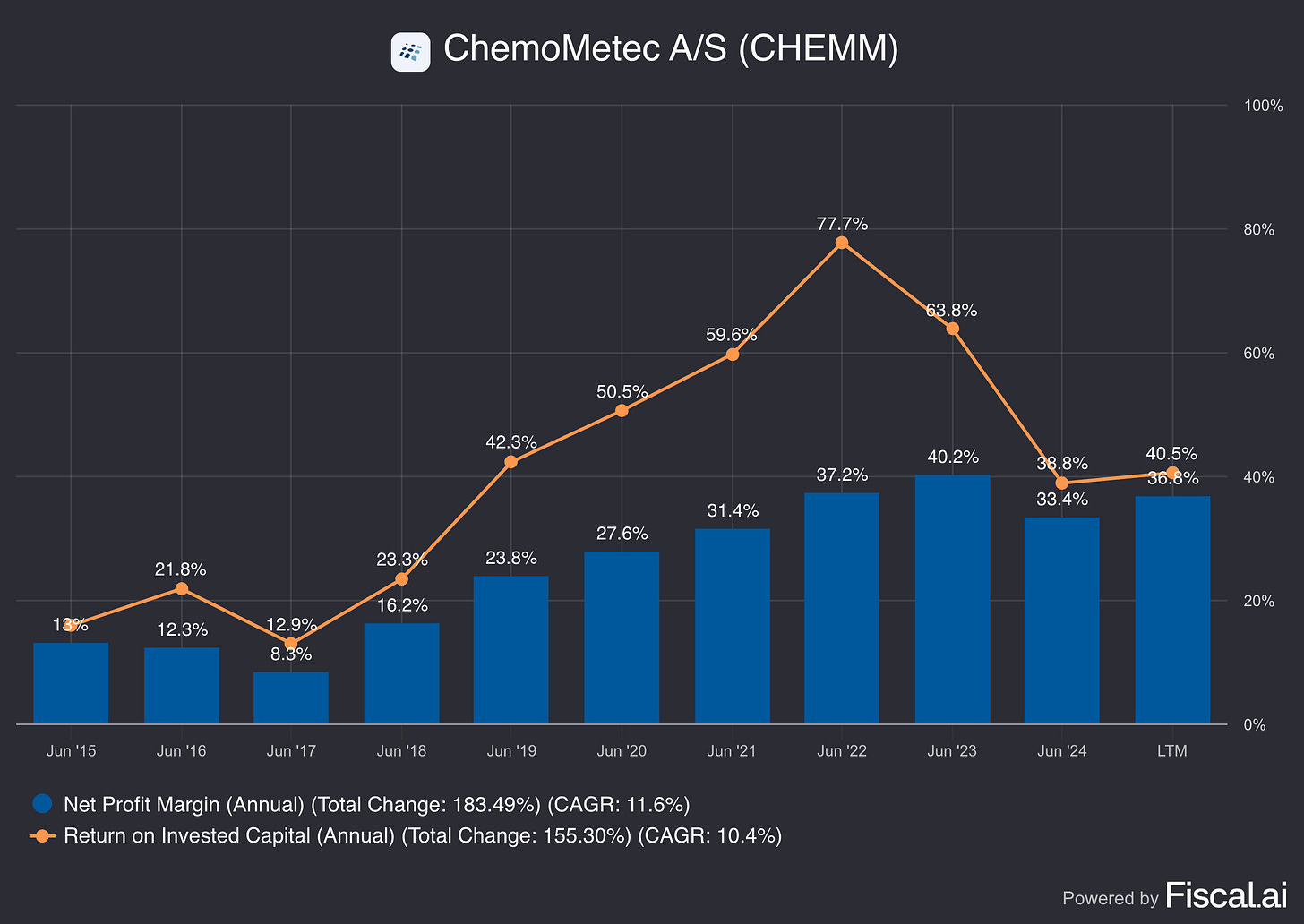

3. ChemoMetec (+2,422% return in 10 years)

How does the company make money?

ChemoMetec ($CHEMM) makes machines that count and analyze cells, often used in labs and biotech. Scientists use them for research on medicine and new treatments.ChemoMetec’s big breakthrough came with the NucleoCounter. This machine can quickly and accurately count cells.

Counting cells is super important in science. If doctors or labs don’t know the exact number of cells, the treatment can be unsafe or not work well.

It’s now a must-have tool for companies working on new cell treatments and medicines.

Why does this matter? Because these industries are growing fast, and they all need strong quality checks. That’s exactly what ChemoMetec delivers.

The company has a strong recurring revenue model:

Sell instruments (one-time revenue)

Sell consumables (recurring revenue every time labs run tests)

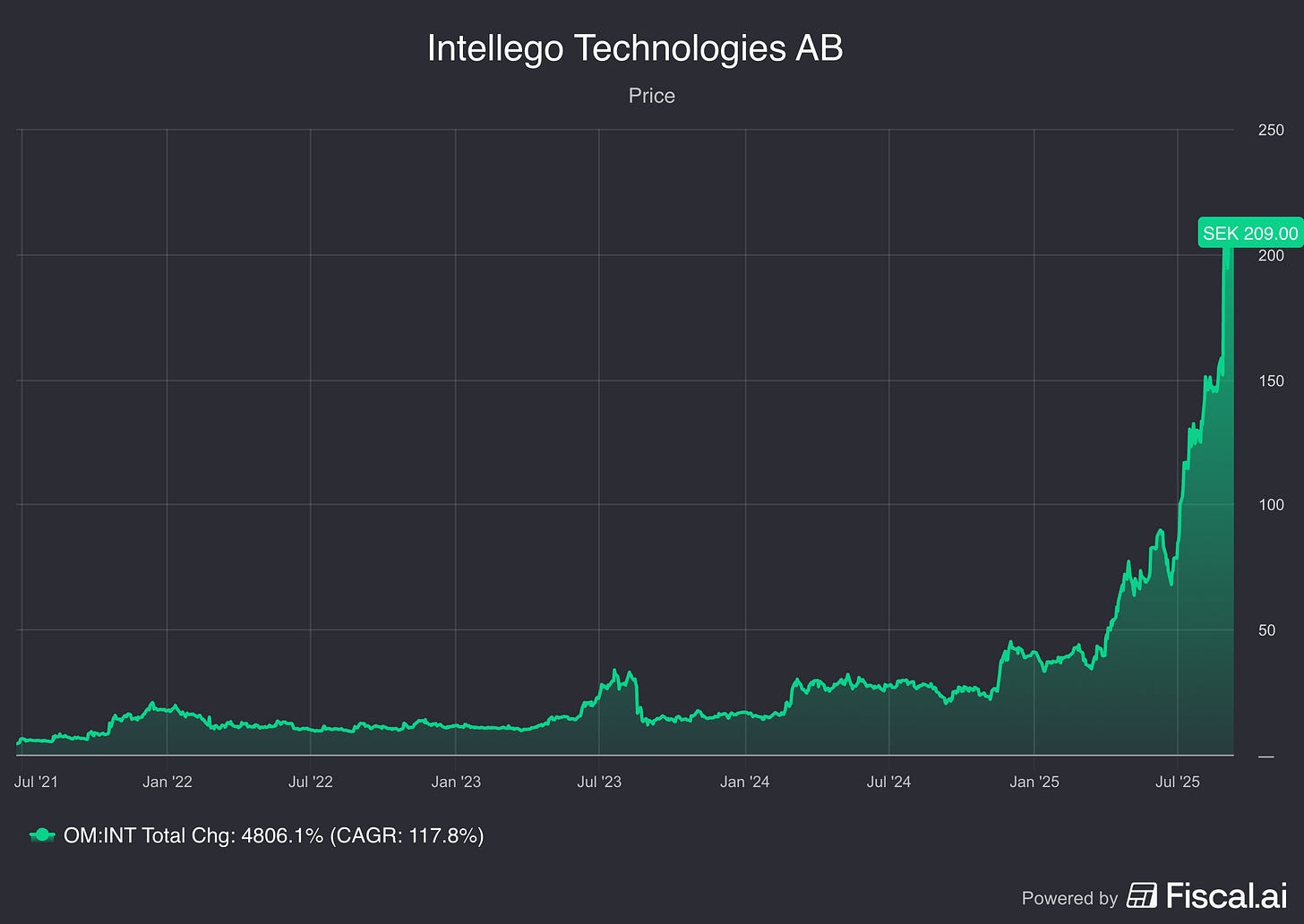

2. Intellego Technologies (+4,806% return in 10 years)

How does the company make money?

Intellego Technologies ($INT) is a Swedish company that makes special labels and sensors for UV light. These products show whether UV light (used to kill germs) is strong enough to work.Intellego Technologies increased by +355% since the beginning of the year:

So what happened? Everything.

Sales exploded. More people bought their UV-stickers. And prices went up.

Big partners like Henkel and Likang pushed global sales.

New laws (like FDA rules) boosted demand even more.

Profit margins grew by +15%

Valuation jumped. Investors got very excited.

You only need one winner like this.

With Tiny Titans we’ll try to identify the next Intellego Technologies.

1. IES Holdings (+5,514.0% return in 10 years)

How does the company make money?

IES Holdings ($IESC) works in construction and energy. They install electrical systems, lighting, and internet networks in buildings. They make money by doing these projects for companies, schools, and homes.It all started in 1997 as an electrical contractor.

Today? IES Holdings is a diversified holding (what’s in a name).

IES uses a decentralized model.

Each business runs on its own... but gets the strength of the group.

Another thing I love?

Most public companies do calls, give guidance, and talk to analysts.

IES does none of that. No calls. No guidance. No analysts.

I like this for two reasons:

It keeps them under the radar.

Management ignores the short-term... and plays the long game.

Conclusion

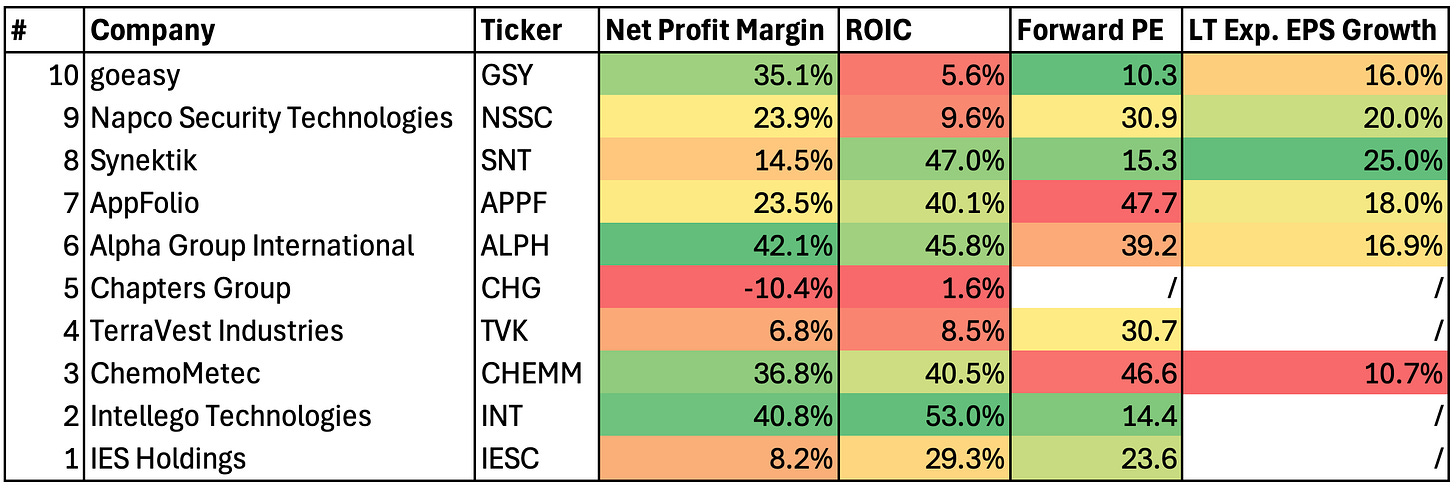

Here’s an overview of the 10 companies mentioned:

Wrapping up

That’s it for today.

You want to learn how to identify these kinds of companies yourself?

Attend the 🎉 Big Launch Party of Tiny Titans next Tuesday.

Who knows… it might lead you to your first 100-Bagger.

Everything in life compounds

Pieter

PS The webinar will be amazing. You can register here for free.

Really interesting that Mark Leonard singled out AppFolio alongside Veeva as companies Constellation could learn from. The property managment software space isn't as flashy as healthcare IT but the moat dynamics are pretty simlar. Once you get landlords and property managers onto your platform and they have all their tenant data, rent collections, and workflows built in, switching costs become massive. I'm curious how much of AppFolio's growth is coming from new customer adds versus expanding within their existing base. The insider ownership detail is encouraging too, always a good sign when managment has real skin in the game.