🏰 10 Financial Ratios

The essentials

Understanding financial ratios is like having a GPS for your investments.

Without them, you’re just guessing.

These 10 Financial Ratios will help you make smarter investment decisions.

Balance Sheet Ratios

10. Debt/Equity Ratio

The Debt/Equity Ratio compares how much money a company borrows (debt) to how much money its owners have invested (equity).

Interpretation

It shows how a company is financed.

A lower ratio often indicates the company uses less leverage.

I prefer a Debt/Equity Ratio lower than 80%.

Examples

Companies with a Debt/Equity below 80%:

Cintas Corporation: 66%

IDEXX Laboratories: 62%

Microsoft: 34%

9. Net Debt/Free Cash Flow (FCF)

Wondering how many years it would take for a company to pay off its debt entirely? The Net Debt/Free Cash Flow calculates this.Net Debt/Free Cash Flow (FCF) = Net Debt / Free Cash Flow

Interpretation

A lower number means the company can handle its debt easily, which makes it less likely to run into trouble.

I look for companies with a Net Debt/Free Cash Flow below 4x.

This means the company should be able to pay off its debt in less than four years when they decide to use all free cash flow to pay down debt.

Examples

Companies with a Net Debt/Free Cash Flow below 4x:

Qualys: -2.4x (Net Cash Position)

Zoetis: 2.2x

Visa: 0.4x

Capital Intensity

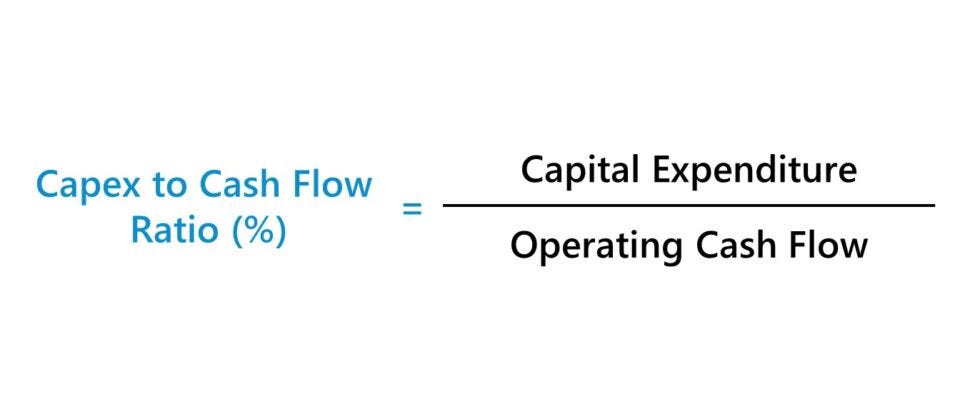

8. CAPEX/Cash From Operations

The CAPEX/Cash From Operations gives an indication about the capital intensity of a company.

The ratio shows how much of the Operational Cash Flow is used for Capital Expenditures (CAPEX).

CAPEX refers to the money a company spends to buy, maintain, or improve its long-term assets like buildings, machinery, or equipment.

Interpretation

The less capital a company needs for its regular business activities, the more money it has for things such as paying down debt and dividends.

I prefer this metric to be lower than 25%.

Examples

Companies with a CAPEX/Cash From Operations below 25%:

KKR & Co: 1.5%

Apple: 8.0%

S&P Global: 2.6%

Capital Allocation

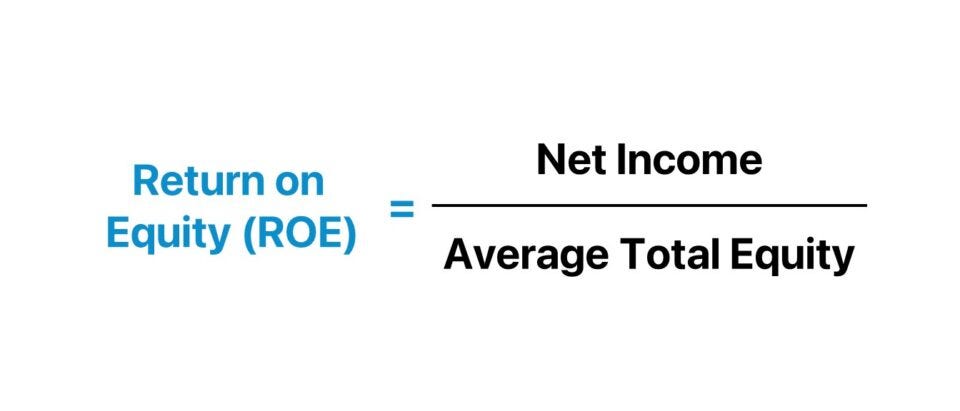

7. Return on Equity (ROE)

ROE (Return on Equity) shows how well a company turns the money from its shareholders (equity) into profits.

Interpretation

A high ROE means the company is good at rewarding its owners (shareholders).

Companies with a ROE higher than 20% can be seen as great businesses.

Examples

Companies with a ROE over 20%:

Automatic Data Processing: 87.3%

Games Workshop: 62.1%

Hamilton Lane: 23.0%

6. Return on Invested Capital (ROIC)

The ROIC (Return on Invested Capital) gives an indication about how efficiently the company allocates its capital.

If the ROIC is 15%, the business generates $15 in profit for every $100 of capital investors invest in the business.

Interpretation

A high ROIC indicates the company is allocating capital efficiently.

I prefer a ROIC higher than 15%.

Examples

Companies with a ROIC over 15%:

Domino’s Pizza: 54.6%

Lululemon Athletica: 37.5%

MSCI: 26.9%

Profitability

5. Gross Margin

The Gross Margin shows how much money is left after paying for the cost of making a product (like materials and labor).

Interpretation

A higher Gross Margin means the company keeps more money from each sale to cover other expenses and make a profit.

A high and consistent Gross Margin is a great indication of pricing power.

I usually look for companies with a Gross Margin over 40%.

Examples

Companies with a Gross Margin over 40%:

Moody’s: 72.9%

Autozone: 53.1%

Alphabet: 58.1%

4. Free Cash Flow Margin (FCF Margin)

The Free Cash Flow Margin is the percentage of a company’s sales that turns into Free Cash Flow (money left after all expenses and investments).

Interpretation

The higher the FCF margin, the higher the profitability.

Look for companies with a FCF Margin over 10%.

Examples

Companies with a FCF Margin over 10%:

Moody’s: 72.9%

Autozone: 53.1%

Alphabet: 58.1%

Dividend

3. Dividend Yield

The Dividend Yield is the percentage of a company’s stock price that it pays out to shareholders as dividends each year.

Interpretation

The higher the Dividend Yield, the more the company pays out to shareholders.

Do you want to learn about dividend investing? Please check out Compounding Dividends

Examples

Companies with a high Dividend Yield:

Pfizer: 6.4%

TransDigm Group: 5.9%

The Kraft Heinz Company: 5.6%

Valuation

2. Price-to-Earnings (PE) Ratio

The PE (Price-to-Earnings) Ratio compares a company’s stock price to its earnings (profits) per share.

Interpretation

A lower PE might mean the stock is cheap, while a high P/E might suggest people expect growth in the future.

Look for companies where the current PE Ratio is lower than the average PE Ratio over the past 5 years.

Examples

Companies with a current PE Ratio lower than their historical average:

Dream Finders Homes: 7.3x (5-year historical average: 10.2x)

SDI Group: 16.1x (5-year historical average: 29.2x)

Kainos Group: 18.0x (5-year historical average: 41.6x)

1. Free Cash Flow Yield (FCF Yield)

Free Cash Flow Yield measures how much Free Cash Flow a company generates compared to its market capitalization.

Interpretation

A high FCF yield indicates the company is trading at cheap valuation levels.

Try to find companies where the current FCF Yield is higher than the average FCF Yield over the past 5 years.

Examples

Companies with a current FCF Yield higher than their historical average:

Kinsale Capital: 9.9% (5-year historical average: 7.8%)

Nike: 5.2% (5-year historical average: 2.8%)

Medpace: 4.9% (5-year historical average: 4.7%)

That’s it for today.

Did you like this? Make sure to share it with Friends & Family.

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I love these "quick-hit" or "quick-check" ratio checklists. They enable us to get a feel for the state of a company. From there we can decide to dig deeper or to pass on it. 👍

I get hung up on the denominator in the ROIC calculation. How do we define "invested capital"? This isn't something we can directly find listed on a balance sheet. The number must be calculated. It seems to be a little different for different companies, depending on their business model.

Is there a summary somewhere that collects the different ways to calculate "invested capital" for different business models?

Awesome list! Understanding FCF Yield and applying it to my own analysis has transformed the way I value companies over the years.