10 Secrets about 100-Baggers

Why small caps win

Are you ready? Join me on a 🎥 free webinar on Tuesday the 16th of September.

📈 Real examples of 10x stocks

🔑 My secrets to identify 100-baggers

🏆 3 Small caps to buy today

🎁 A special gift people would pay > $1,000 for

✨ And much more!

The best part? It's free.

Register here to secure your spot (and 🎁 special gift).Small caps tend to outperform the market.

Why? The market is way less efficient in this space.

Let’s teach you 10 reasons why small caps are so interesting.

🎉 Big Launch Party

The largest returns?

Those are generated by investing in small caps.

Just imagine you invested in one of these companies:

✅ Pool Corporation ($POOL) rose from $0.92 in 1995 to $307 today.

✅ Constellation Software ($CSU) is up nearly 30,000% since 2006.

✅ Watsco ($WSO) grew from $3 in 1985 to $454 today.

✅ Medpace ($MEDP) has climbed 1,000% since 2016.

It only takes one big winner like this.

Next Tuesday, I’m sharing all my secrets in a 🎥 free webinar.

What makes it even better?

✨ It’s free

🎁 You’ll get a special gift people would pay > $1,000 for

Make sure you don’t miss it. Register here and secure your free gift:

10 Secrets about 100-Baggers

Now let’s give you a sneak peek of what we’ll talk about in the webinar already.

Here are 10 secrets about 100-baggers.

1. Go where competition is weak

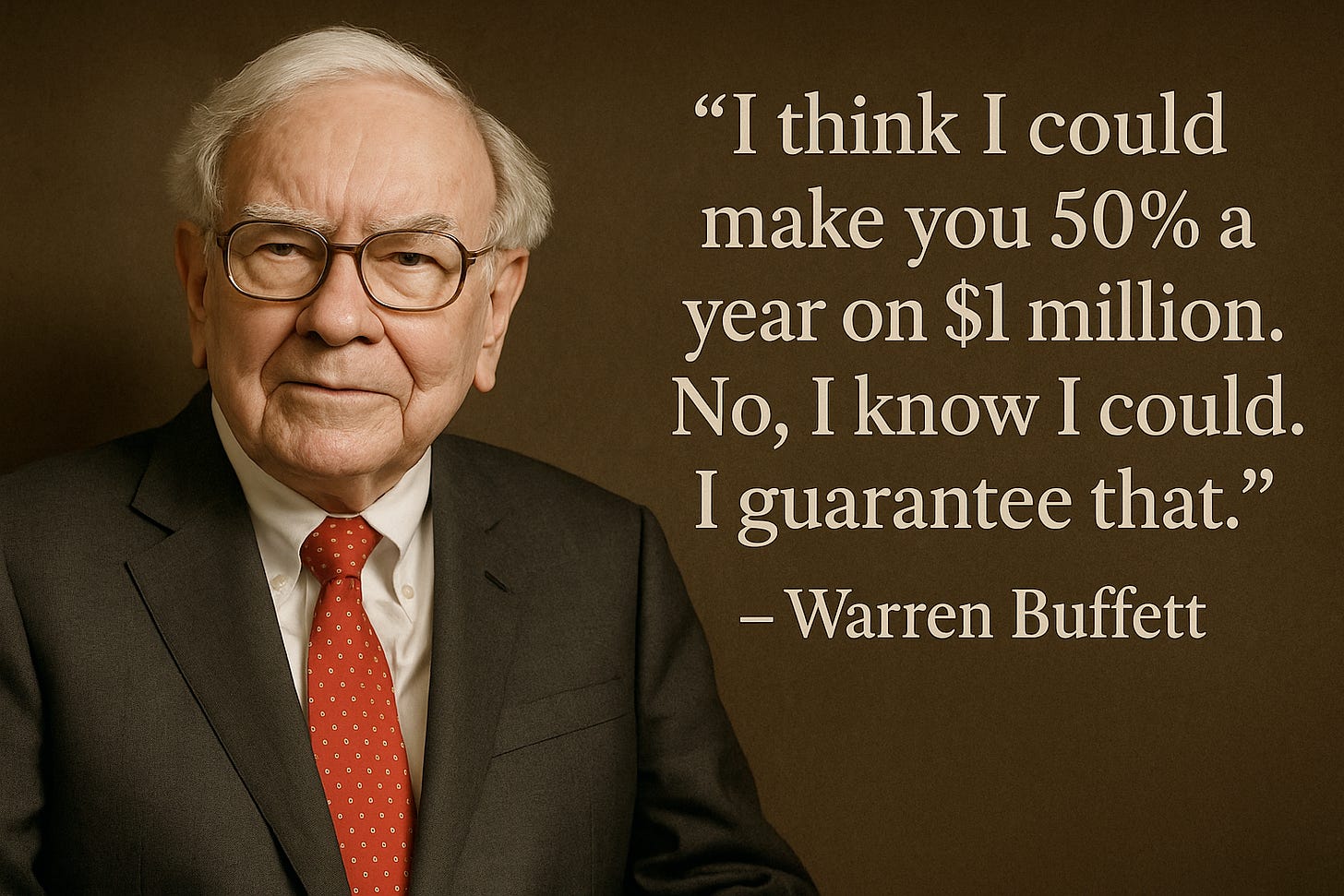

Warren Buffett said that size hurts performance.

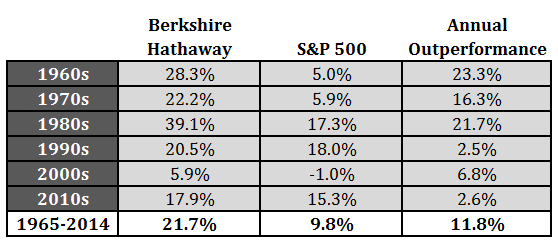

You also see this in the numbers of some of the best investors in the world.

They massively outperform the market at the beginning of their career.

But their outperformance starts to decrease once they start to manage more money.

The reason for this? The market is way less efficient in the small-cap space.

"To outperform the market, go where competition is weak." - Warren BuffettAs you can see, Berkshire Hathaway’s outperformance decreased as they became larger and larger:

The lesson you can draw from this? Invest in small caps.

2. Let your winners run

The most important thing for you as an investor?

Cut your losses and let your winners run.

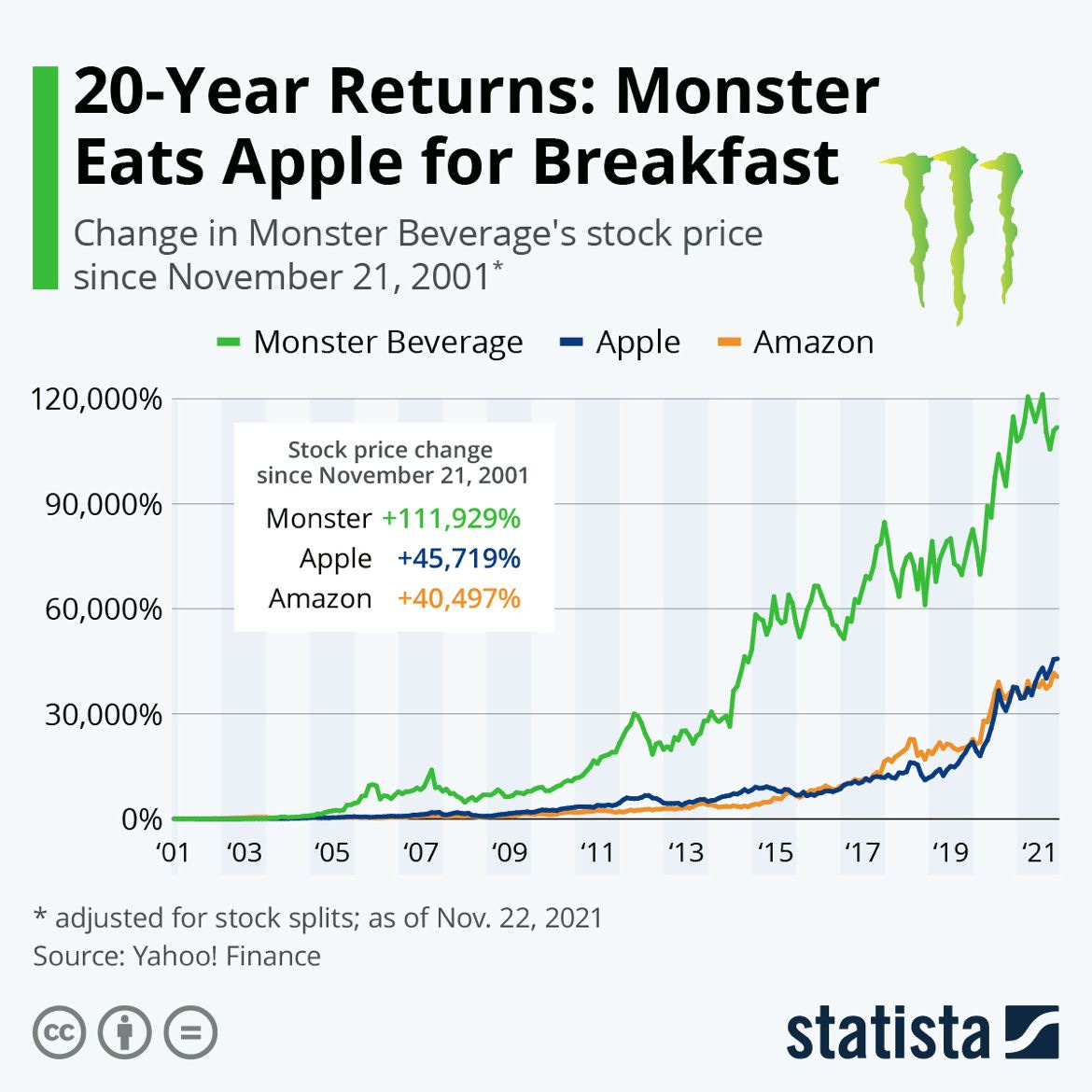

Just imagine you had owned Monster Beverage since 2001.

$1,000 would have turned into over $1 million.

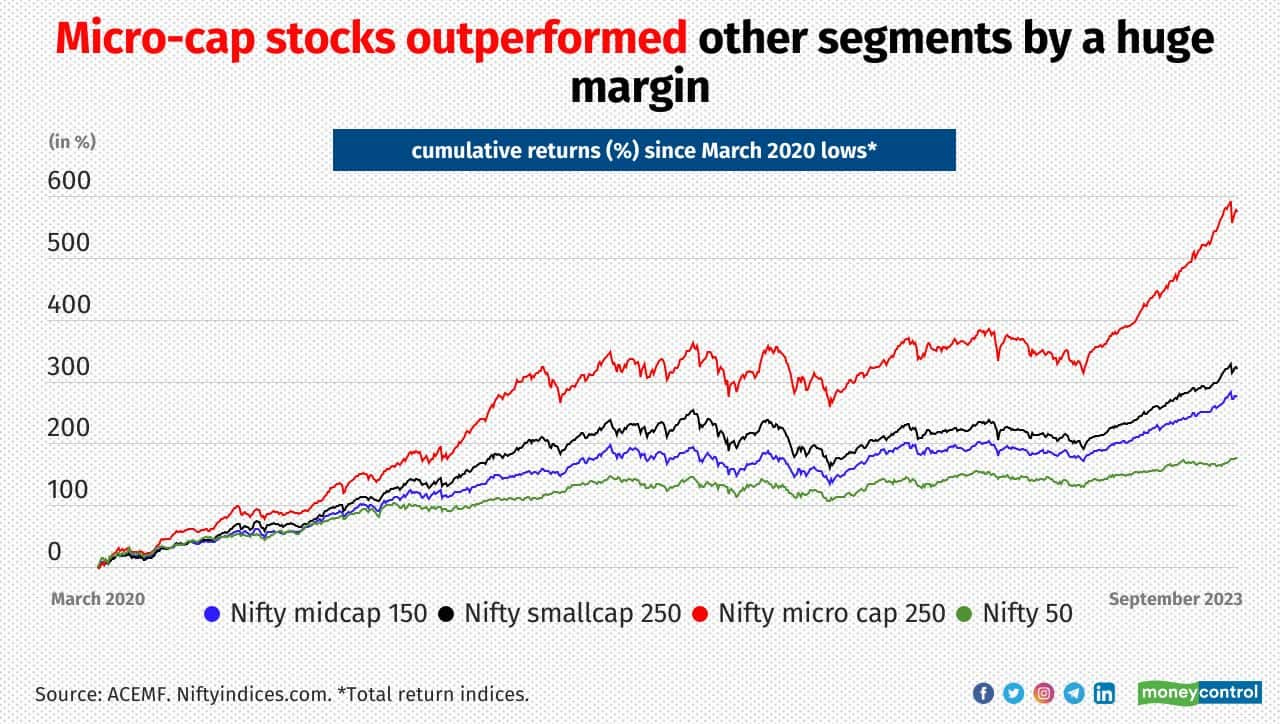

3. Small caps outperform

Small caps outperform the market.

Between 1926 and today, the 10% smallest companies outperformed large caps by 4.4% per year on average.

Imagine putting $1,000 to work in 1926. By today, you’d have:

Large caps: $8.7 million

Small caps: $430 million

The small caps made you almost 50x (!) as much money.

Please note that this example is over a period of 99 years.

That’s the magic of compounding put to work.

4. Microcaps do even better

You want to increase your performance even more?

Invest in microcaps.

Microcaps are companies with a market cap below $300 million.

If you had invested $1,000 in 1926:

Large caps: $8.7 million

Small caps: $430 million

Micro caps: $860 million

5. Quality Small-Caps

You want even better returns?

Only select quality stocks with a market cap below $3 billion.

If you had invested $1,000 in 1926:

6. It only takes one

It only takes one amazing investment to be very successful.

If you bought 10 stocks twenty years ago and 9 of them go bankrupt…

… you would still have amazing results if the 10th stock was Amazon or Apple.

A few other examples:

✅ Axon Enterprise: $1,000 turned into $307,000

✅ Intuitive Surgical: $1,000 turned into $215,000

✅ Equinix: $1,000 turned into $203,000

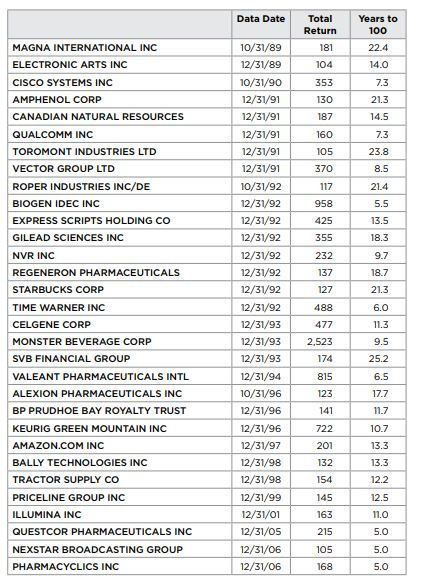

7. 100-baggers

A 100-bagger is a company that increased 100x.

Everyone would love to have such a company in their Portfolio.

These companies possess over the following characteristics:

🧢 Market cap < $3 billion: Smaller companies grow faster

💰 Healthy balance sheet: Low debt = more flexibility

👨💼 High insider ownership: Skin in the game = better decisions

📈 High profitability: We love strong profit margins

🎯 ROIC > 15%: Smart capital allocation = compounding

🚀 Revenue & EPS growth > 10%: Past and future growth matters

🚫 No share dilution: Fewer shares = more for you

♻️ Reinvestment opportunities: Keep the flywheel spinning

🏷️ Low valuation: Cheap + quality = 💥

🧠 Owner-Operators: Long-term thinking beats Wall Street

Here are some examples of 100-baggers:

8. Why these companies should outperform

Here’s why these kinds of companies should outperform…

… Just compare the fundamentals of Small-Cap Watchlist (Tiny Titans) with the S&P 500.

As you can see, the companies in this watchlist are way better companies while they trade at more or less the same valuation level.

As a reminder, you can download this watchlist here.

9. Performance watchlist

The watchlist performs really well.

The average yearly return? Almost 17% (!) since the IPO of these companies.

That’s an amazing outperformance compared to the S&P 500:

The goal of Tiny Titans? Only invest in companies that can return 15% per year.

If this would be true, these stocks should be able to double every 5 years.

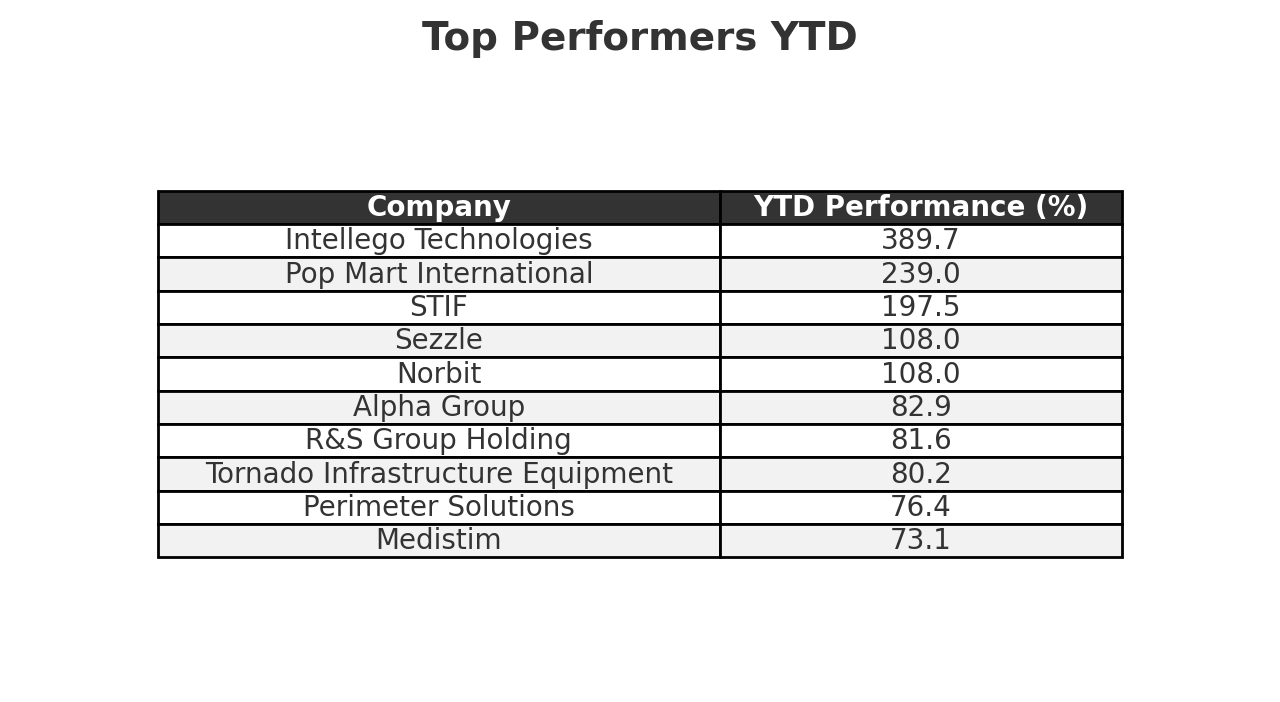

10. Best performing stocks YTD

Finally, here are the best-performing stocks on our watchlist since the beginning of the year:

You would have loved to own some of these companies, didn’t you?

Conclusion

That’s it for today.

You want to learn how to identify these kinds of companies yourself?

Attend the 🎉 Big Launch Party of Tiny Titans next Tuesday.

Who knows… it might lead you to your first 100-Bagger.

Everything in life compounds

Pieter

PS The webinar will be amazing. You can register here for free.

Thanks for the write up. For anyone interested to learn more about, what makes a company like POOL compound, I have written an article on it: https://open.substack.com/pub/latebloomr/p/beyond-the-numbers-uncovering-pool?utm_source=share&utm_medium=android&r=5bgci5

Can this be watched afterwards since I work during these hours?