Hi Friend 👋

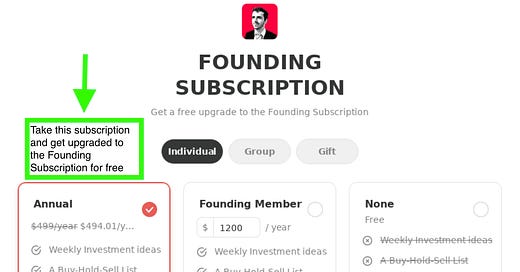

A new era is arriving for Compounding Quality.

Starting from next week, only ⭐ Founding Subscribers ⭐ will get access to the Portfolio.

The price will be $1,200.

However, everyone who subscribes this week will get it for the regular rate.

This means you get a discount of $700!

In the early 1900s, Jesse Livermore was among the wealthiest people in the world.

He made a fortune by using leverage to bet on stock market movements.

In 1929, he made $100 million from the Wall Street Crash in just one year!

But that same leverage also increased his losses, and he went broke several times.

As Charlie Munger once said: There are only three ways a smart person can go broke: liquor, ladies, and leverage.

The key lesson here?

Avoid leverage.

When you want to stay rich, invest in established quality stocks.

10 Staying Rich Stocks

When we are talking about quality stocks, there are 3 options you can use:

Getting Rich: Quality stocks with plenty of growth potential

Staying Rich: Established quality stocks that are still growing attractively

Living Rich: Great companies that are paying an attractive dividend

Today we will dive into the Staying Rich part.

Which 10 stocks would you like to own if you are in the ‘Staying Rich’ camp?

PS Did you miss the Getting Rich part? You can find 10 Getting Rich stocks here.

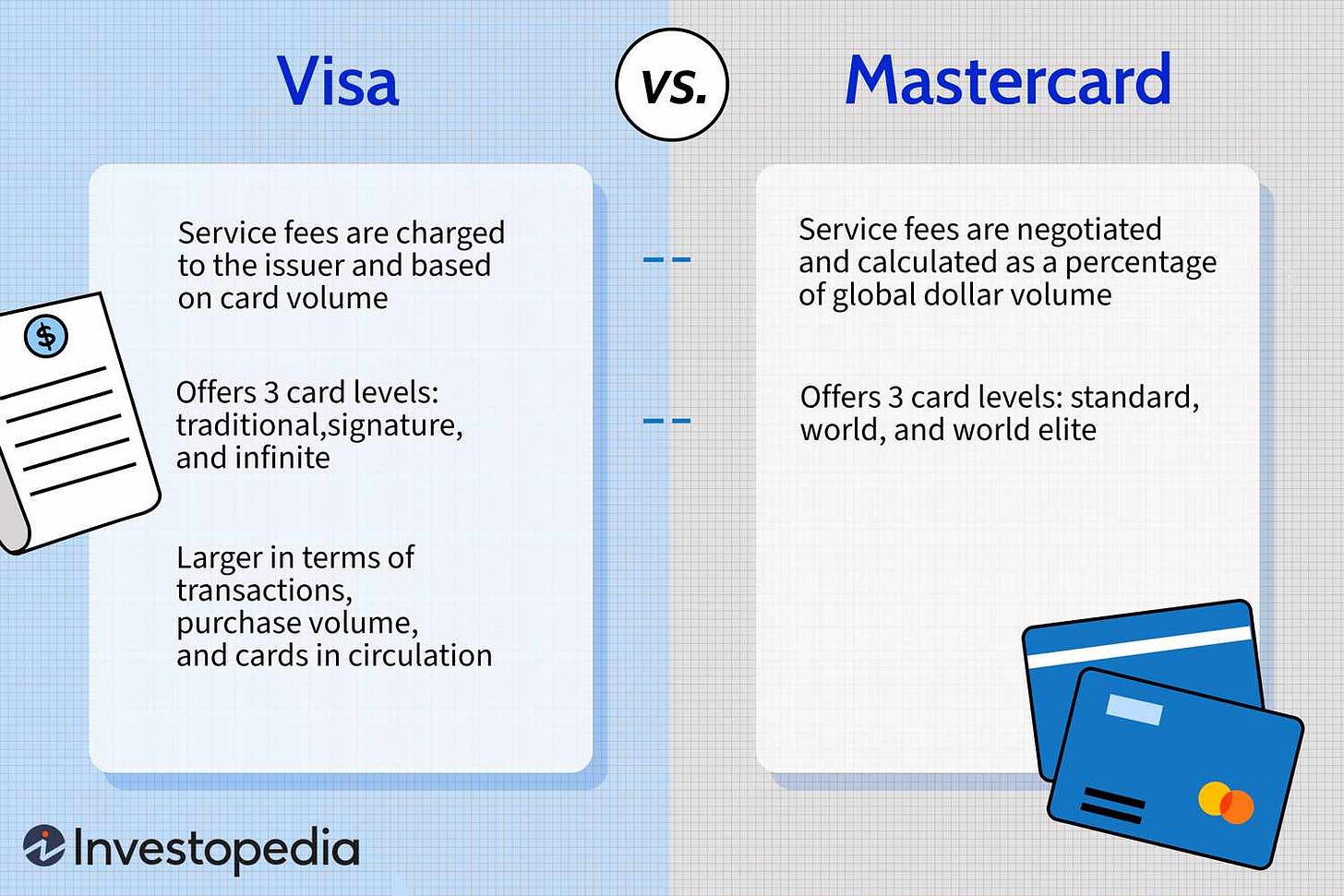

10. Mastercard/Visa (MA/V)

Company Profile

Mastercard and Visa are companies that process payments.

They help transfer money between banks and merchants when people use credit or debit cards.

Both companies offer a network connecting millions of merchants and cardholders worldwide. They make it easier for people to pay for goods and services, both in-person and online.

Fundamentals

Net Profit Margin: Mastercard: 46.5% 🆚 Visa: 54.7%

ROIC: Mastercard: 42.1% 🆚 Visa: 25.8%

Forward PE: Mastercard: 31.5x 🆚 Visa: 26.0x

Long-Term EPS Growth: Mastercard: 16.4% 🆚 Visa: 12.8%

9. Automatic Data Processing (ADP.O)

Company Profile

Automatic Data Processing (ADP) provides businesses with payroll and HR services. They handle tasks like processing employee salaries, managing benefits, and ensuring tax compliance.

ADP offers software and solutions to streamline these processes and reduce administrative work. Their services help businesses manage their workforce more efficiently.

Additionally, ADP provides insights and data analytics to support better HR decisions and planning.

Fundamentals

Net Profit Margin: 19.5%

ROIC: 7.9%

Forward PE: 27.5x

Long-Term EPS Growth: 9.7%

8. Danaher/Thermo Fisher (DHR/TMO)

Company Profile

Danaher and Thermo Fisher are companies that make scientific and medical equipment. They provide tools and services for research, diagnostics, and healthcare.

Both companies help scientists and doctors with advanced technology for experiments and tests. They support innovation in medicine and science.

Additionally, Danaher and Thermo Fisher offer products for laboratory management, ensuring efficient and accurate results in various fields.

Fundamentals

Net Profit Margin: Danaher: 17.8% 🆚 Thermo Fisher: 14.7%

ROIC: Danaher: 6.4% 🆚 Thermo Fisher: 8.1%

Forward PE: Danaher: 32.9x 🆚 Thermo Fisher: 26.8x

Long-Term EPS Growth: Danaher: 7.8% 🆚 Thermo Fisher: 9.4%

7. Old Dominion Freight (ODFL.O)

Company Profile

Old Dominion Freight Line provides freight shipping services. They transport goods across the country using trucks.

The company specializes in less-than-truckload (LTL) shipping, meaning they handle smaller shipments that don’t fill an entire truck. They focus on timely and reliable delivery.

Old Dominion Freight Line offers services for various industries, ensuring efficient and safe transport of cargo.

Fundamentals

Net Profit Margin: 21.4%

ROIC: 27.6%

Forward PE: 32.8x

Long-Term EPS Growth: 3.0%

6. S&P Global/Moody’s (SPGI.K/MCO)

Company Profile

S&P Global and Moody's are companies that rate the creditworthiness of businesses and governments. They assess how likely these entities are to repay their debts.

Both companies provide credit ratings that help investors make informed decisions. Their ratings influence interest rates and investment choices.

Additionally, S&P Global and Moody's offer financial research, analysis, and data to support the global financial markets.

Fundamentals

Net Profit Margin: S&P Global: 25.0% 🆚 Moody’s: 28.3%

ROIC: S&P Global: 7.0% 🆚 Moody’s: 16.6%

Forward PE: S&P Global: 34.1x 🆚 Moody’s: 41.4x

Long-Term EPS Growth: S&P Global: 13.7% 🆚 Moody’s: 15.3%

The top 5 Staying Rich stocks are only made available to Partners of Compounding Quality.

Become a Partner to get access right away and discover the most interesting stocks in our Portfolio right now.

🚨 $700 discount

A new era is arriving for Compounding Quality.

Starting from next week, only ⭐ Founding Subscribers ⭐ will get access to the Portfolio.

The price will be $1,200.

However, everyone who subscribes this week will get it for the regular rate.

This means you get a discount of $700!

Here’s everything you’ll get:

✍️ Three articles per week (Tuesdays, Thursdays & Sundays)

📚 Full access to our entire library of data-driven articles

📈 An insight in our Portfolio full of quality stocks

🔎 Full investment cases about interesting companies

📊 Access to the Community

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data