Are you ready for 2025?

Great things happen to those who prepare.

Here are 10 interesting stock ideas to kickstart the new year.

10. Visa/Mastercard ($V/$MA)

Company Profile

Visa and Mastercard dominate the global digital payment industry.

These companies operate networks that facilitate electronic transactions between consumers and businesses worldwide.

Instead of issuing cards, they partner with banks, earning fees for every transaction processed through their systems.

Investment Rationale

A very profitable duopoly dominating the industry

One of the strongest network effects in the world

The US Digital Payment Market is expected to grow at a CAGR of 21.1% (!) per year until 2030

9. Ameriprise Financial ($AMP)

Company Profile

Ameriprise Financial provides wealth management, financial planning, and insurance services.

Their primary focus is helping individuals and institutions manage investments for long-term growth.

Investment Rationale

Cannibal stock (buyback yield of up to 9%)

Excellent management and capital allocation strategy

CAGR since IPO in 2005: 17.4%

8. Sanlorenzo ($SL)

Company Profile

Sanlorenzo designs and manufactures luxury yachts for high-net-worth individuals.

The Italian company combines traditional craftsmanship with cutting-edge design, creating some of the most sought-after yachts in the world.

Sanlorenzo’s clientele appreciates exclusivity, and the company limits production to maintain its premium brand positioning.

Investment Rationale

The luxury market is very attractive

CAGR since IPO in 2019: 16.6%

Amazing growth: 5-year EPS CAGR: 45.2%

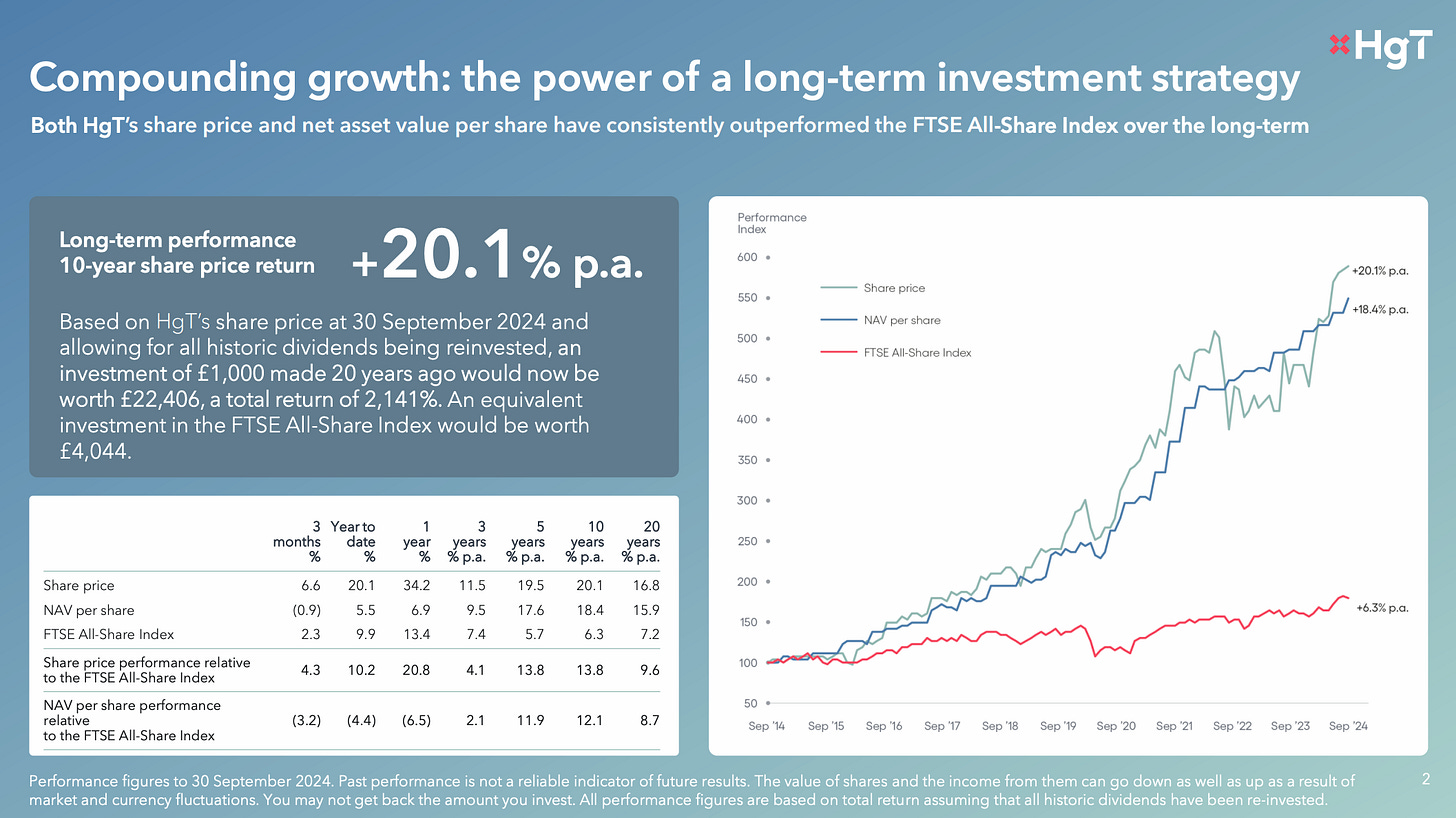

7. HG Capital Trust ($HGT)

Company Profile

HG Capital Trust is a listed private equity vehicle that invests in software and tech-enabled businesses.

The trust focuses on sectors like SaaS (Software as a Service), healthcare IT, and business services.

Their active ownership model helps portfolio companies scale effectively.

Investment Rationale

Revenue and EBITDA of HGT’s top 20 companies have grown by 20–30% per year

HgT is a leading investor in unlisted software and services companies

In the very long term, Private Equity performs even better than stocks

6. Medpace ($MEDP)

Company Profile

Medpace is a clinical contract research organization (CRO) that partners with pharmaceutical and biotech companies to run clinical trials.

With expertise in niche therapeutic areas, Medpace helps efficiently market new drugs and treatments.

Investment Rationale

Clinical Research Organizations (CROs) are very profitable

August Troendle founded the company in 1992 and he's still the CEO today

Long-term estimated EPS-Growth: 15.2%

5. Topicus ($TOI)

Company Profile

Topicus is a serial acquirer of Vertical Market Software (VMS) businesses. It’s a spin-off from Constellation Software, one of the best compounders in the world.

A VMS business creates software designed to solve industries' unique needs. As a result, it usually dominates a niche market because its products are hard to replace.

Investment Rationale

Moat based on switching costs

Mark Leonard (one of the best capital allocators) is on the board of Topicus

Still a long runway ahead

4. Kinsale Capital ($KNSL)

Company Profile

Kinsale Capital is a specialty insurer focused on excess and surplus lines.

The company takes on risks that standard insurers avoid, leveraging its deep expertise and efficient underwriting process.

Investment Rationale

The company wants to double its market share in the next few years

Founder Michael Kehoe is an excellent CEO

Strong growth figures - 10-year Revenue CAGR: 38.1%

Now let’s dive into the top 3.