10 Lessons from 2024

Stock market lessons

2024 has been an amazing year for investors.

The S&P 500 increased by 26.0% (so far).

Our Portfolio returned 43% since inception in October 2023.

Let’s share my 10 key learnings from the year.

1. Time In The Market > Timing The Market

Timing the market is a fool’s game.

Did you think stocks were expensive at the beginning of 2024? Not being invested would have cost you 26% in returns.

The best thing you can do?

Stay invested. Consistently add to your existing positions full of wonderful companies.

2. The Market Can Stay Irrational Longer Than You Can Stay Solvent

Everyone is a genius in a bull market.

Only when the tides go out do you discover who is swimming naked.

Watch out for chasing trends and hype stocks. Your results can be horrible when Mr. Market starts acting rational again.

"I can calculate the movement of the stars, but not the madness of men."- Sir Isaac Newton, 17203. Pay Up for Quality

Buying the second-best company in an industry because it’s cheaper than the market leader is rarely a good idea.

Buy the best companies in the world and let the magic of compounding do its work for you.

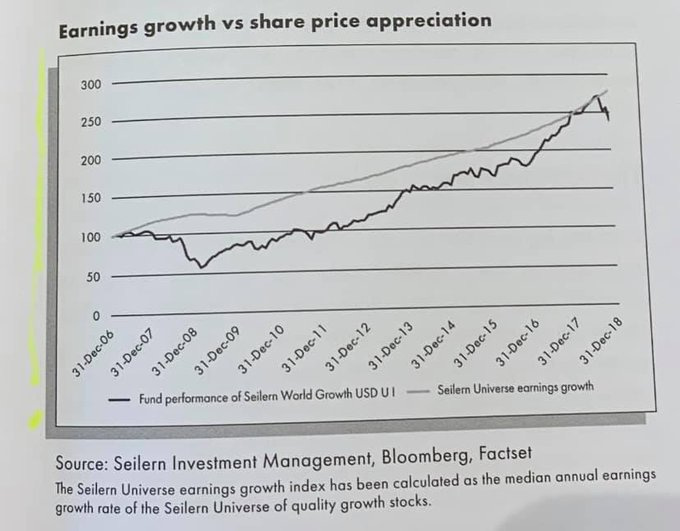

4. Stock Prices Follow Earnings Growth

In the long term, stock prices always follow the evolution of the intrinsic value.

That’s why you want to invest in companies active in a structurally growing end market.

"If you bought the S&P 500 at a P/E of 5.3x in 1917, and sold it in 1999 at a P/E of 34x, your annual return would have been 11.6%. Only 2.3% per year came from the massive increase in P/E. The rest of your return came from the companies’ earnings and reinvestments." - Terry Smith5. The Market Looks Expensive

The S&P 500 is trading at a valuation premium compared to its historical average.

J.P. Morgan States the expected return is 3-4% per year over the next 5 years at these valuation levels.

6. International Stocks Look Cheap

Since 2004, non-US stocks have never been cheaper than today compared to US stocks:

7. Value versus Growth

Value stocks have structurally underperformed growth stocks over the past few years.

It has been quite a while since value has been so cheap compared to growth.

8. Big Tech Has Never Been More Powerful

Big Tech is driving returns for the S&P 500.

The Magnificient 7 accounted for over 50% (!) of all returns since 2022.

9. Margins Are At All-Time Highs

The average Profit Margin within the S&P 500 equals 12.9%.

This is one of the highest profitability levels for the index ever.

10. Take Advantage of Mr. Market

The average return of the S&P 500 since 1980? 11-12% per year.

And this while the average intra-year decline was roughly 15%.

The key lesson?

Use volatility to your advantage.

Buy stocks when there’s blood running through the streets.

Whenever you’re ready

That’s it for today.

Whenever you’re ready, here’s how I can help you:

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data