10 Stocks for the Next 50 Years

Have you ever heard about the Bonsai Portfolio?

A bonsai grows slowly. But it does so consistently every single year. They can live for hundreds of years.

A Bonsai Portfolio is a long-term investment strategy where you buy great companies that grow slowly but steadily.

Recently I asked this question to Partners in the Community:

Which companies would you be proud to own for the next 50 years?Let’s dive in the top 10 picks of Our Partners.

10 Stocks for the Next 50 Years

10. ASML ($ASML)

Company Profile

ASML is one of the most important companies in the world.

They build the machines that make computer chips. These chips are the tiny brains inside your phone, laptop, and even your car.

Their machines are extremely precise and advanced. This is what makes ASML so special.

The company helps chipmakers create faster, smaller, and more powerful chips, which we all rely on every day.

Why will the company still be relevant in 50 years from now?

High profitability with plenty of reinvestment opportunities

ASML is dominating the entire market

The world will need more and more chips in the years ahead

9. LVMH ($MC)

Company Profile

LVMH is a global producer and distributor of luxury goods.

The French company is a dominant force in the luxury industry, led by Bernard Arnault. They cover a wide range of consumer products and experiences.

LVMH operates more than 5,000 stores around the world. It’s the second largest company in Europe after Hermès.

Their handbags themselves turned out to be a great investment. In 1979, a Louis Vuitton bag cost $150. By 2022, that same bag was worth $1,490.

Why will the company still be relevant in 50 years from now?

Luxury never goes out of fashion

LVMH will benefit from the growing middle class in Asia

Excellent business with a shareholder-oriented mindset

8. Investor AB ($INVE-B)

Company Profile

Investor AB is a Swedish holding company that has been around since 1916. They own major Swedish companies such as Atlas Copco, ABB, and AstraZeneca.

Why is this holding company so interesting? As an investor, you are always looking for companies with maximum returns and minimum risk.

Investor AB has both:

Creating shareholder value: Investor AB grew its intrinsic value by 12.2% per year over the past 10 years

Low risk: Healthy balance sheet and diversified portfolio

Why will the company still be relevant in 50 years from now?

Investor AB owns stable, high-quality companies

A long track record of over a century

The Wallenberg family still controls Investor AB

7. Kelly Partners Group ($KPG)

Company Profile

Kelly Partners Group is a serial acquirer in the accounting industry.

The Australian company serves private businesses and high-net-worth individuals with chartered accounting and advisory solutions.

Brett Kelly is the CEO and Founder of KPG. He is a complete Buffett-freak in the positive sense of the word.

Currently, Kelly Partners Group is heavily expanding into the United States.

Why will the company still be relevant in 50 years from now?

Brett Kelly still owns almost 50% of the shares

Plenty of reinvestment opportunities

The accounting industry is very attractive for serial acquirers

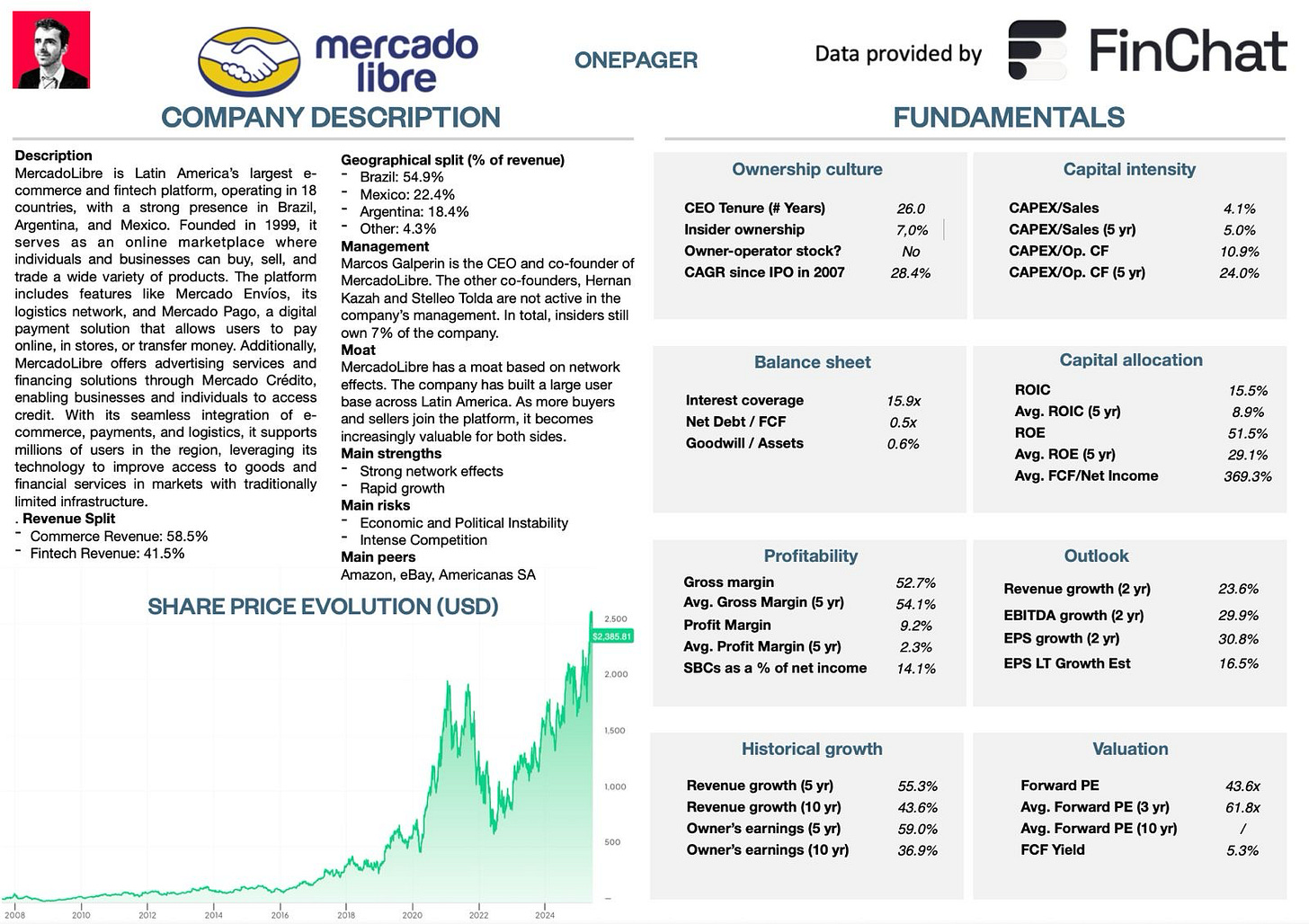

6. MercadoLibre ($MELI)

Company Profile

MercadoLibre is an online shopping platform. The business model is similar to Amazon.

They started in Latin America and now serve many countries in that region. Customers shop for electronics, clothes, toys, and more.

MercadoLibre also has a payment system called Mercado Pago, which makes it easy for people to pay online safely.

You can read our Not So Deep Dive here.

Why will the company still be relevant in 50 years from now?

Dominates the fast-growing e-commerce market in Latin America

FinTech business is scaling rapidly with high margins

Long-term estimated EPS growth: 16.5%

5. Alphabet ($GOOGL)

Company Profile

Alphabet, Google's parent company, makes money from online advertising through its search engine, YouTube, and other platforms.

They also generate revenue from cloud computing services like Google Cloud.

Alphabet invests in innovative projects and businesses through its ventures arm, like self-driving cars and life sciences.

Why will the company still be relevant in 50 years from now?

Undisputed market leader in online advertising

Insiders still have more than 50% of the voting power

Cash flow machine with very high profitability

4. Visa ($V)

Company Profile

Visa is a global payments technology company. They provide electronic payment solutions through a network of branded credit and debit cards.

Just like Mastercard, Visa’s core function is to operate a payment network connecting merchants, banks, and cardholders.

When you make a purchase using Visa, the merchant pays a fee to Visa for processing the transaction.

Last year, 276 billion (!) payments and cash transactions were made via the company’s payment network. This means Visa executed 757 million transactions per day.

Why will the company still be relevant in 50 years from now?

Visa holds a strong market share in a fast-growing industry

A very high profitability (Net Profit Margin: 52.9%)

It’s almost impossible to compete with Visa and Mastercard

Now let’s dive into the top 3.