10 Top Stocks 2025

Your Favorite Stocks

The Compounding Quality community is amazing.

You can find endless investment ideas.

In this article, you find the Top 10 Stocks for 2025 of Our Partners.

Over the years, many of you have expressed interest in this, so I’m exploring the idea of launching an investment fund grounded in the principles I’ve consistently shared with you.

To better understand your interest and potential involvement, I’ve put together a quick survey.

Curious to learn more? Complete the survey to stay informed about the next steps (minimal entry amount: $250,000).Top Pick Partners Last Year

10. Melexis ($MELE)

Company Profile

Melexis makes small, smart chips that are used in machines. A large portion of these chips are supplied to the automotive industry.

The more cars produced, the more components Melexis can sell, and the more money they make.

For instance, think of sensors that measure how fast your car is driving.

The interesting part? Way more chips are needed in an electric car compared to a traditional car.

This means Melexis will benefit from the electrification of our vehicle fleet.

Investment Rationale

Tailwinds from the electric vehicle revolution

Excellent capital allocation (ROIC: 34.9%)

Moat based on high switching costs

9. Dino Polska ($DNP)

Dino Polska operates a chain of grocery stores across Poland. The stores focus on providing fresh food, household products, and everyday essentials.

Dino stores are located in smaller towns and rural areas, making shopping convenient for local communities.

Their business model emphasizes affordability and high-quality products.

The company continues to expand, opening new stores to reach more customers across the country.

Investment Rationale

Dino Polska can still double in size in Poland

The company reinvests almost all free cash flow in organic growth

Poland has one of the fastest-growing economies in the world

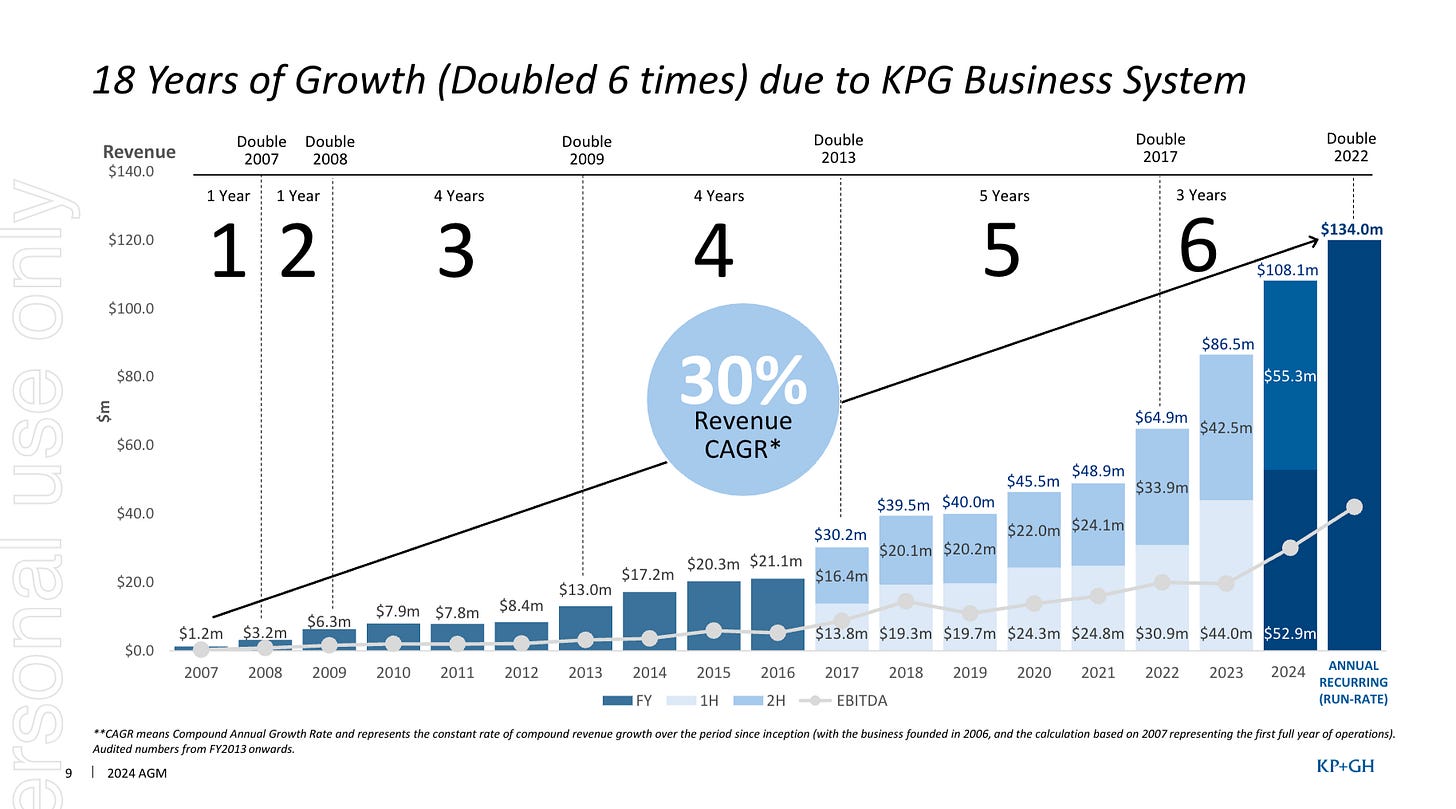

8. Kelly Partners ($KPG)

Company Profile

Kelly Partners Group is an Australian company that helps small and medium-sized businesses manage their finances.

They offer services like accounting, tax advice, and business planning to help these companies grow and succeed.

Investment Rationale

Brett Kelly is an excellent CEO and a ‘Buffett-freak'

Scalable business model with a disciplined M&A strategy

Doubled its revenue every three since its IPO

7. TransMedics ($TMDX)

TransMedics develops systems for organ transplantation, like hearts, lungs, and livers.

Instead of keeping organs on ice, their devices keep them warm and functioning outside the body.

TransMedics' technology allows doctors to better assess organs before transplantation. This improves the chances of success and saves more lives.

The company works with hospitals worldwide to make transplants safer and more effective.

Investment Rationale

Transmedics has a moat based on its innovation and know-how

The company is very profitable (Gross Margin: 59.3%)

Amazing growth figures (5-year Revenue CAGR: 80.2%)

6. Alphabet ($GOOGL)

Company Profile

Alphabet, the parent company of Google, dominates the online search and digital advertising markets.

Every time you search on Google or watch a YouTube video, the ads you see help Google make money.

They also earn revenue from subscriptions like Google Workspace, offering devices like phones and smart home gadgets, cloud services, …

Investment Rationale

Unparalleled scale in digital advertising

Google has a quasi-monopoly in the search engine market

Long-term estimated EPS-Growth: 16.5%

5. Topicus ($TOI)

Company Profile

Topicus acquires specialized software companies tailored to meet the specific needs of particular industries.

This focus allows them to dominate niche markets, as their products are often difficult to replace. 70% of Topicus's revenue is recurring in nature.

The company is a spin-off from Constellation Software, a top-performing stock over the past two decades.

Investment Rationale

High switching costs create a durable moat

Constellation Software still owns 30.4% of the company

Strong growth figures (5-year Revenue CAGR: 25.9%)

4. ASML ($ASML)

Company Profile

ASML is a company that makes super advanced machines for creating computer chips that power things like phones, laptops, and video games.

These machines use light to draw incredibly small patterns on silicon, which is how chips are made.

ASML is the only company in the world making a special kind of machine called EUV (extreme ultraviolet) lithography.

This technology helps create the fastest and most powerful chips for things like AI and smartphones.

Investment Rationale

Monopoly in the semiconductor supply chain

Benefits from a secular trend in Artificial Intelligence (AI)

Outstanding profitability: 5-year average Gross Margin of 49.8%

Now let’s dive into the top 3.

Spoiler alert: two of these three stocks are Key Convictions of Our Portfolio.

In other words: I would buy them right now.