100 Owner-Operator Stocks

Skin in the game matters.

Do you know why?

Companies with high insider ownership tend to outperform the market by a wide margin.

In today’s article, we’ll cover a list of 100 Quality Stocks with high insider ownership and we’ll discuss our 11 favorite ones.

Keep things simple

Albert Einstein once said that you should make everything as simple as possible, but not simpler.

This is also true when investing.

More than 90% of all investors underperform the market.

That’s sad and funny at the same time.

There are a lot of very simple investment strategies that outperform the market in the long term:

Quality Investing:

The MSCI World Quality Index outperformed the MSCI World Index by 3.5% per year since 1995

Value investing:

The 10% cheapest stock based on a simple price-to-earnings ratio outperformed the S&P500 by 5% per year over the past 100 years

Small cap investing:

Small cap stocks outperformed large cap stocks by 3.4% per year over the last century

Another simple strategy that managed to outperform in the past?

Investing in companies with skin in the game.

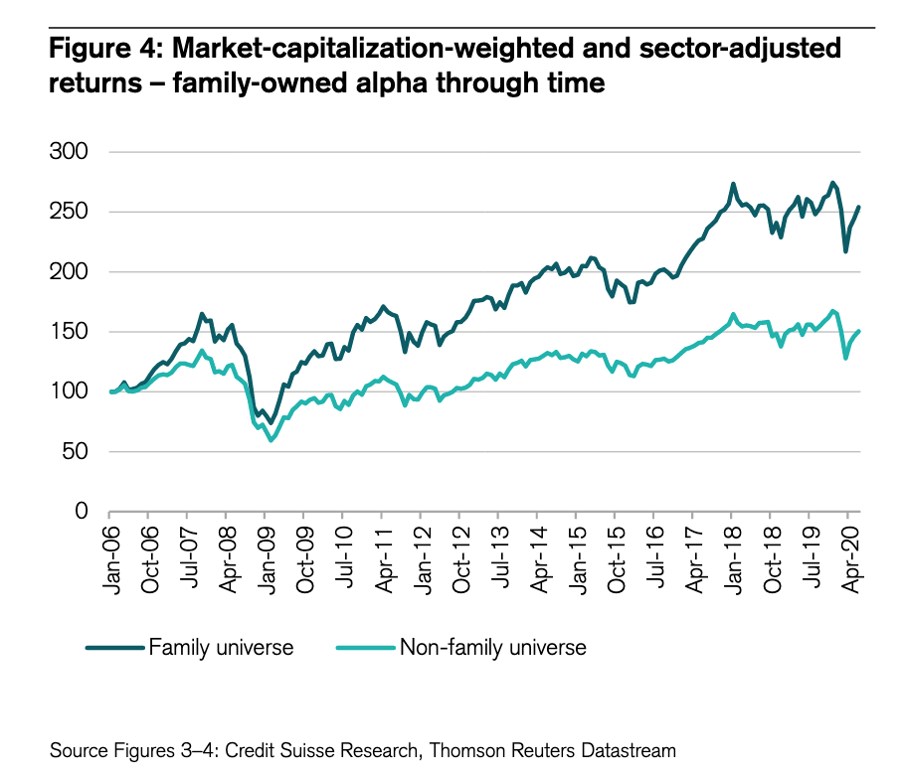

A study of Credit Suisse has shown that family-owned companies outperformed non-family-owned companies by 3.6% per year since 2006:

And guess what? If you solely invest in companies with skin in the game which have quality characteristics, you can even further improve your performance.

Why does Skin in the game matter?

The main reason why family-led businesses tend to outperform non-family companies is quite obvious: they tend to think and act like owners.

They’re not just doing it for the money. They genuinely love what they do and use a long-term mindset.

Companies with skin in the game don’t want to maximize quarterly results.

They want to make sure that the company gets bigger, stronger, and more robust so their (grand)children can continue to reap the benefits from what they’ve built over the years.

These companies dare to make decisions that might hurt results in the short term but are very good for long-term value creation.

In other words: they think in quarter decades instead of quarters.

100 Owner-Operator Stocks

Over the years, I’ve gathered an Excel with the Fundamental Data of 900 companies with skin in the game.

I’ve been building the list for a few years.

If we can believe the study of Credit Suisse, this universe should have outperformed the S&P500 by more than 3% per year.

Spoiler alert: it did.

But let’s take this one step further and trim down the list of 900 companies based on some Quality Criteria:

Great capital allocation skills

High profitability

Attractive growth

Low capital intensity

In other words: we’re trying to look for the quality companies within a list that as a whole already performed better than the index.

Compounding Quality has identified 100 companies that match these criteria.

These stocks managed to compound at 18.8% per year over the past 15 years versus 8% for the S&P 500.

Let’s dive into the full list and show you my 11 favorite ones!