🏆 15 Lessons from Jeff Bezos

Jeff Bezos is one of the richest men in the world having built a fortune of $130 billion (!). Since 1997, Amazon’s stock increased with more than 1551x (!).

We have read all his annual letters. 15 great (investment) lessons can be found here.

Lesson 1: It’s all about the long term

When you think on the long term, you have a BIG advantage compared to those who don’t.

Bezos was willing to make investment decisions in light of long-term market leadership rather than short-term profitability or Wall Street reactions.

Lesson 2: A competitive advantage is essential

Online selling is a scale business characterized by high fixed costs and relatively low variable costs.

This gives Amazon a huge competitive advantage as it is very hard for smaller e-commerce companies to compete with them. It’s one of the key reasons why Amazon is so successful.

Lesson 3: Be OBSESSED by your customers

Customer obsession is the core of Amazon’s success.

Amazon has always had the objective to build the earth’s most customer-centric company.

Bezos believes that constantly lowering prices and maximizing value for customers will result in a larger dollar amount of free cash flow for Amazon over time.

Lesson 4: Focus on organic revenue growth

Topline growth is the most preferred source of growth.

Only invest in companies which manage to grow their revenue organically at an attractive rate. Over the past 15 years, Amazon grew its revenue with 26% (!) per year.

Lesson 5: Good investing and good business are synonymous

When you invest in good businesses, great investment results will follow eventually.

Lesson 6: free cash flow is king

Earnings don’t determine the value of a company, the present value of future cash flows does.

In his annual letters, Bezos stated multiple times that free cash flow is Amazon’s key financial metric.

Lesson 7: Advertising is the price you pay for having an unremarkable product or service

When you have a great company, the product will sell itself.

You want to invest in companies that produce products or services customers LOVE.

Lesson 8: Culture is everything

In the short term, valuation is the most important mover for the stock price.

In the long term, free cash flow growth and the culture of the company is.

Lesson 9: Be cash-favored and capital efficient

Bezos stated that Amazon is fortunate to benefit from a business model that is cash-favored and capital efficient. They don’t need physical stores nor do they need a lot of inventory.

A low capital intensity is key for quality companies as this allows them to grow exponentially when they reinvest in themselves.

Lesson 10: Improve every single day

Every annual letter, Bezos mentions it’s still Day 1 for Amazon.

Operational excellence means delivering continuous improvement in customer experience, driving productivity, and margin efficiency. This should be the goal for every company.

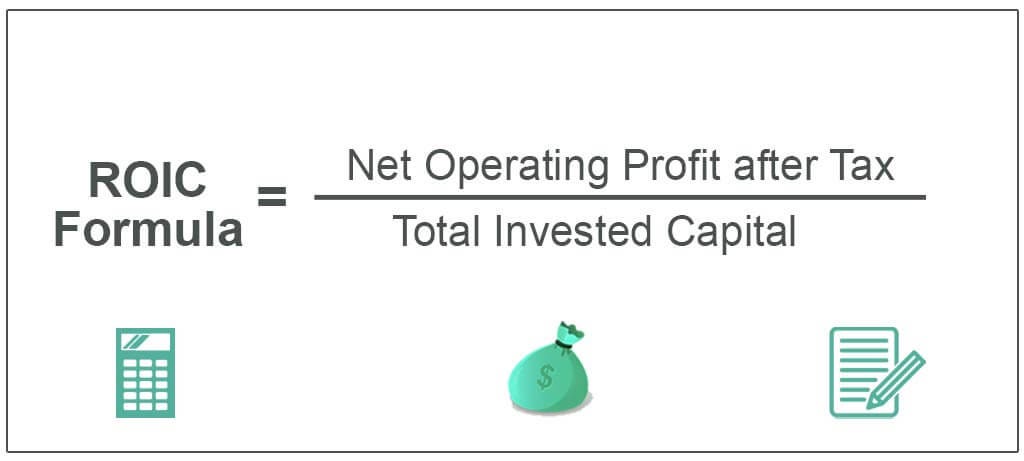

Lesson 11: Focus on Return on Invested Capital (ROIC)

Bezos has always had the long-standing objective of building the best, most profitable, highest return on capital long-term franchise.

The ROIC is THE most important metric for quality investors. The higher, the better.

Lesson 12: Don’t focus on the stock price

Bezos stated that they don’t celebrate a 10% increase in the stock price as much as they celebrate excellent customer experience.

In the end, the fundamentals of the company is all what matters.

Lesson 13: Secular trends are your friend

Treat external trends as your friend.

If you fight them, you’re probably fighting the future. Embrace them and you’ll do great.

Lesson 14: Don’t be afraid to fail

Failures are crucial to become successful.

Plant seeds daily. Good companies should reinvent themselves every single day.

Lesson 15: Invest in durable companies

A great business has four characteristics: customers love it, it can grow to very large size, has strong returns on capital and it’s durable in time with the potential to endure for decades.

When you find a company that ticks all boxes, don’t just swipe right, get married.

All shareholder letters of Jeff Bezos

If you want to learn more, here you can find all shareholders letters of Amazon mapped in 1 PDF:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.