🏆 15 Quality stocks with skin in the game

Are you looking for investment inspiration?

In this article, you’ll find 15 quality stocks with skin in the game.

This means the company is run by their founders and/or in which a controlling family owns a significant share.

Company 1: Copart ($CPRT)

Copart provides vehicle suppliers, primarily insurance companies, with a variety of services to process and sell salvage vehicles through auctions.

Profit Margin: 31.1%

ROIC: 23.5%

Earnings Yield: 4.0%

Expected yearly EPS Growth (next 3 years): 11.0%

CAGR since IPO: 20.2%

Company 2: Arista Networks ($ANET)

Arista Networks provides cloud networking solutions for data-centers and computer environments.

Profit Margin: 28.5%

ROIC: 29.4%

Earnings Yield: 4.2%

Expected yearly EPS Growth (next 3 years): 20.6%

CAGR since IPO: 33.1%

Company 3: LVMH ($MC)

LVMH is a diversified luxury goods group. The Company produces and sells wine, cognac, perfumes, cosmetics, luggage, watches, and jewelry.

Profit Margin: 18.7%

ROIC: 15.7%

Earnings Yield: 4.4%

Expected yearly EPS Growth (next 3 years): 9.2%

CAGR since IPO: 13.6%

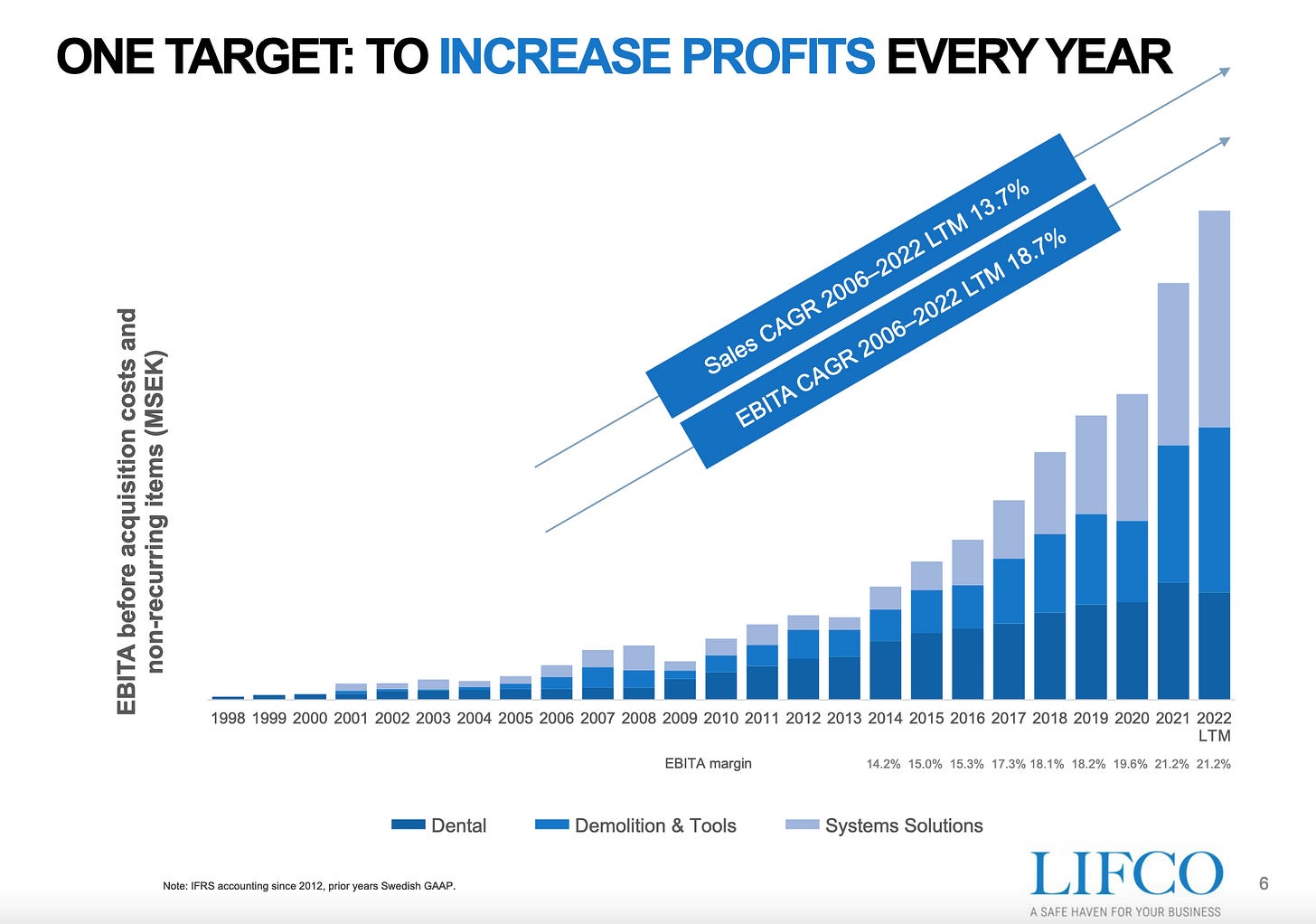

Company 4: Lifco ($LIFCO-B)

Lifco provides dental products, machinery and tools, sawmill equipment, contract manufacturing, vehicle interiors, and environmental technology.

Profit Margin: 13.7%

ROIC: 15.3%

Earnings Yield: 3.5%

Expected yearly EPS Growth (next 3 years): 3.6%

CAGR since IPO: 33.3%

Company 5: Evolution AB ($EVO)

Evolution operates as a gaming company. The Company develops, produces, markets and licenses fully integrated B2B live casino solutions to online casino operators.

Profit Margin: 56.7%

ROIC: 21.5%

Earnings Yield: 5.1%

Expected yearly EPS Growth (next 3 years): 14.7%

CAGR since IPO: 72.3%

Company 6: L’Oréal ($OR)

L'Oreal manufactures cosmetics. The Company offers mascara, lip gloss, foundation, eyeshadow, primer, nail polish, lipstick, face powder, blusher, and concealer, as well as skin, hair, and body care products.

Profit Margin: 14.2%

ROIC: 15.2%

Earnings Yield: 3.4%

Expected yearly EPS Growth (next 3 years): 8.6%

CAGR since IPO: 14.3%

Company 7: Nike ($NKE)

Nike designs, develops, and markets athletic footwear, apparel, equipment, and accessory products for men, women, and children.

Profit Margin: 12.9%

ROIC: 19.7%

Earnings Yield: 3.0%

Expected yearly EPS Growth (next 3 years): 9.2%

CAGR since IPO: 16.8%

Company 8: Ferrari ($RACE)

Ferrari NV designs and manufactures sports cars. The Company offers new and used vehicles, warranty programs, financial supports, and maintenance, as well as watches, apparels, earphones, caps, and other accessories.

Profit Margin: 19.5%

ROIC: 18.9%

Earnings Yield: 2.8%

Expected yearly EPS Growth (next 3 years): 11.5%

CAGR since IPO: 26.1%

Company 9: Moncler ($MONC)

Moncler S.p.A. manufactures apparel products. The Company provides sporting garments for mountaineering.

Profit Margin: 19.2%

ROIC: 17.6%

Earnings Yield: 4.4%

Expected yearly EPS Growth (next 3 years): 6.4%

CAGR since IPO: 20.1%

Company 10: Monster Beverage ($MNST)

Monster Beverage markets and distributes energy drinks. Monster Beverage serves customers worldwide.

Profit Margin: 24.9%

ROIC: 18.5%

Earnings Yield: 2.8%

Expected yearly EPS Growth (next 3 years): 16.1%

CAGR since IPO: 19.3%

Company 11: XPEL ($XPEL)

XPEL develops and manufactures automotive protection products offering window and protective film for the painted surfaces of automobiles.

Profit Margin: 12.2%

ROIC: 30.8%

Earnings yield: 2.4%

Expected EPS Growth next 3 years: 31.4%

CAGR since IPO: 25.3%

Company 12: Netease ($NTES)

NetEase operates as a leading internet technology company providing online services including content, community, communication, and commerce.

Profit Margin: 19.2%

ROIC: 12.1%

Earnings Yield: 6.7%

Expected yearly EPS Growth (next 3 years): 7.9%

CAGR since IPO: 23.2%

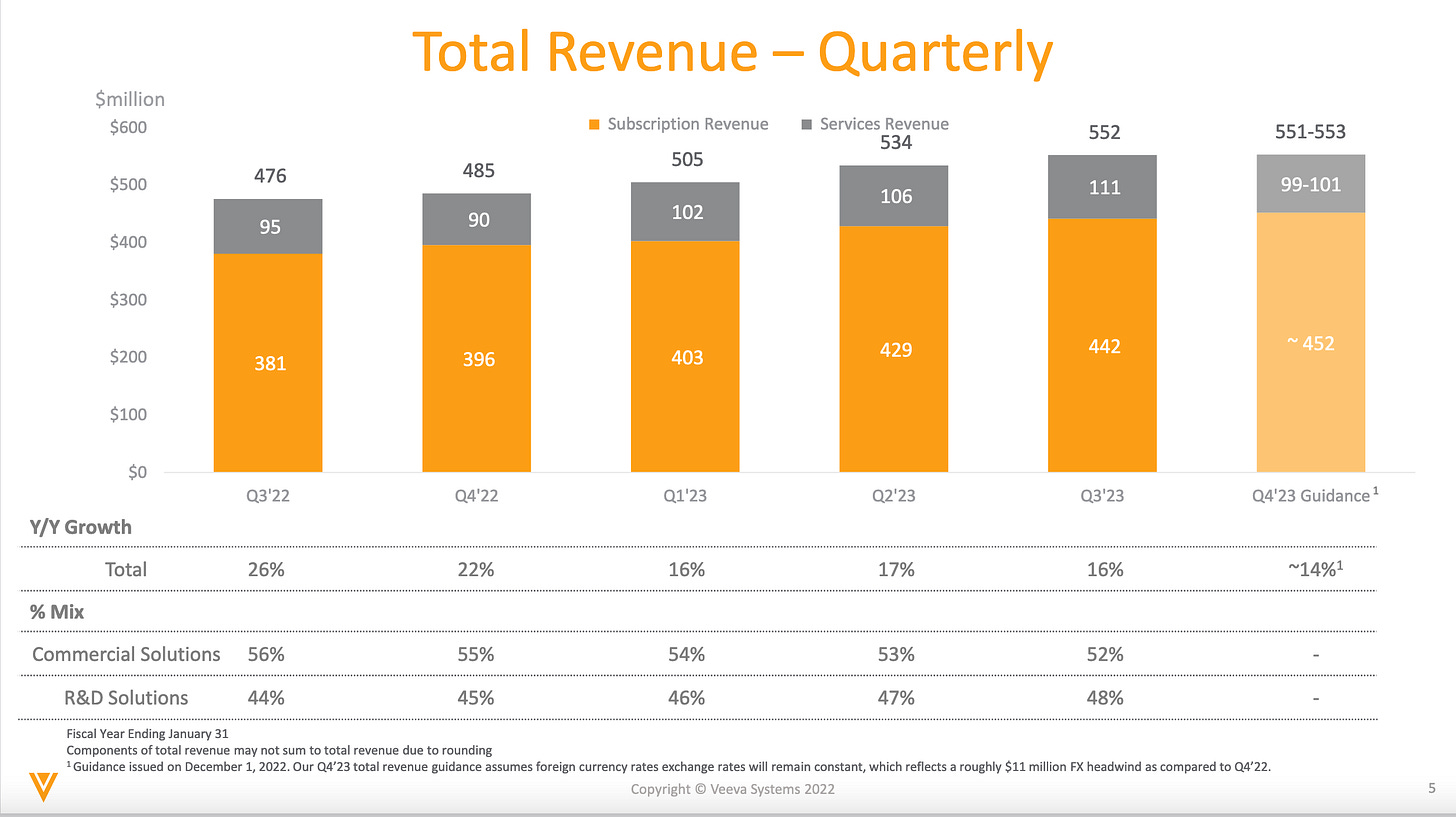

Company 13: Veeva ($VEEV)

Veeva Systems provides cloud-based software. The Company offers enterprise application, multichannel platform, customer relationship, and content management solutions.

Profit Margin: 23.1%

ROIC: 12.0%

Earnings Yield: 2.6%

Expected yearly EPS Growth (next 3 years): 31.7%

CAGR since IPO: 26.1%

Company 14: Paycom ($PAYC)

Paycom provides data analytical software products to manage the employment life cycle from recruitment to retirement.

Profit Margin: 18.6%

ROIC: 22.2%

Earnings Yield: 2.2%

Expected yearly EPS Growth (next 3 years): 28.6%

CAGR since IPO: 41.8%

Company 15: Fortinet ($FTNT)

Fortinet, Inc. provides network security solutions. The Company offers network security appliances, software, and subscription services.

Profit Margin: 18.2%

ROIC: 59.9%

Earnings Yield: 2.6%

Expected yearly EPS Growth (next 3 years): 23.7%

CAGR since IPO: 33.0%

Overview

Did you find this article interesting? Here is an overview of all companies mentioned:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 60 hours per week researching stocks.

It would be great to add, expected topline growth (next 3 years), moat levels, rationale for investing, risks: Moncler might have been a great stock but there is little evidence that the great brand effect will persist indefinitely whereas LVMH, L’Oreal offer better risk returns with solid scale effects, dominant presence, great management

Hello .... Who made the selections for this list of 15 companies ? Thank you