🏆 15 Quality stocks you should know

Walt Disney once said that you can feel quality.

Quality is the result of doing all the little things well, and with heart and soul.

In this article you’ll find 15 quality stocks you should know.

1. Visa ($V)

Everyone knows this company. Visa is a great quality business with a wide economic moat and incredible profit margins. The secular trends toward electronic payments gives Visa a lot of tailwinds.

FCF Margin: 61.0%

ROIC: 28.2%

FCF Yield: 3.8%

Exp. FCF Growth (3 yr): 15.6%

CAGR since IPO: 23.0%

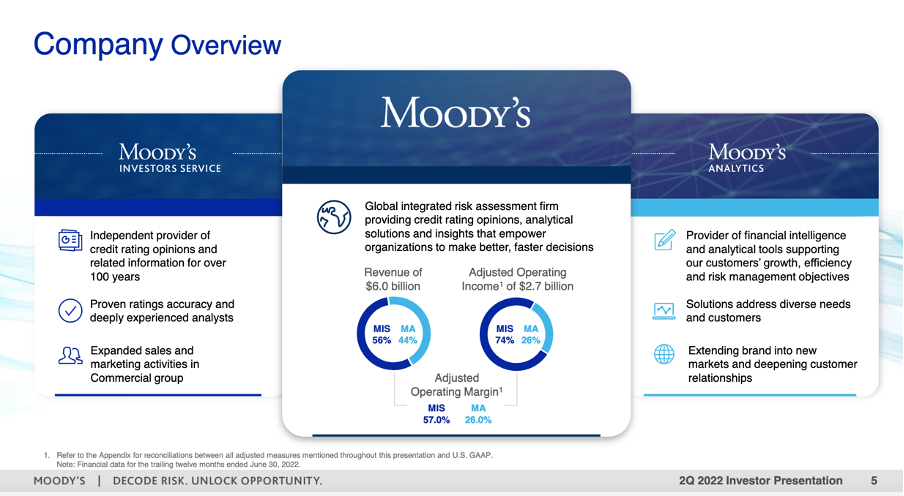

2. Moody’s ($MCO)

Moody’s is a credit rating company. S&P Global, Moody’s and Fitch dominate the credit rating market. They were the market leaders in 1980, are the market leaders today, and probably will still be in 30 years from now.

FCF Margin: 21.8%

ROIC: 15.0%

FCF Yield: 2.4%

Exp. FCF Growth (3 yr): 18.0%

CAGR since IPO: 15.7%

3. Adobe ($ADBE)

Adobe is a true compounding stock active in computer software products and technologies. Adobe’s products allow users to express and use information across all print and electronic media.

FCF Margin: 42.0%

ROIC: 25.7%

FCF Yield: 3.4%

Exp. FCF Growth (3 yr): 23.2%

CAGR since IPO: 19.0%

4. Alphabet ($GOOGL)

Everyone knows Google. The company has a (quasi-)monopoly in digital advertisements. Charlie Munger once stated that Alphabet has one of the widest moats he has ever seen.

FCF Margin: 21.2%

ROIC: 20.9%

FCF Yield: 4.3%

Exp. FCF Growth (3 yr): 19.0%

CAGR since IPO: 23.8%

5. Microsoft ($MSFT)

Everyone knows Microsoft and you will probably use it daily. Microsoft has a very wide moat in software applications, cloud storage, and advanced security solutions.

FCF Margin: 32.9%

ROIC: 26.2%

FCF Yield: 2.4%

Exp. FCF Growth (3 yr): 10.5%

CAGR since IPO: 23.7%

6. Amazon ($AMZN)

Amazon is a leading online retailer and one of the greatest e-commerce companies in the world. Furthermore they also have Amazon Web Services (AWS), providing on-demand cloud computing platforms and APIs.

FCF Margin: -3.3%

ROIC: 4.2%

FCF Yield: 1.3%

Exp. FCF Growth (3 yr): /

CAGR since IPO: 33.0%

7. Equifax ($EFX)

Equifax ($EFX) Equifax is a consumer credit reporting agency active in information management, transaction processing and direct marketing.

FCF Margin: 2.6%

ROIC: 7.2%

FCF Yield: 2.7%

Exp. FCF Growth (3 yr): 25.1%

CAGR since IPO: 13.7%

8. Zoetis ($ZTS)

Zoetis is active in the market for animal health medicines and vaccines. More and more people are treating their pets as a full family member, and Zoetis fully benefits from this.

FCF Margin: 16.4%

ROIC: 19.2%

FCF Yield: 2.2%

Exp. FCF Growth (3 yr): 11.6%

CAGR since IPO: 20.7%

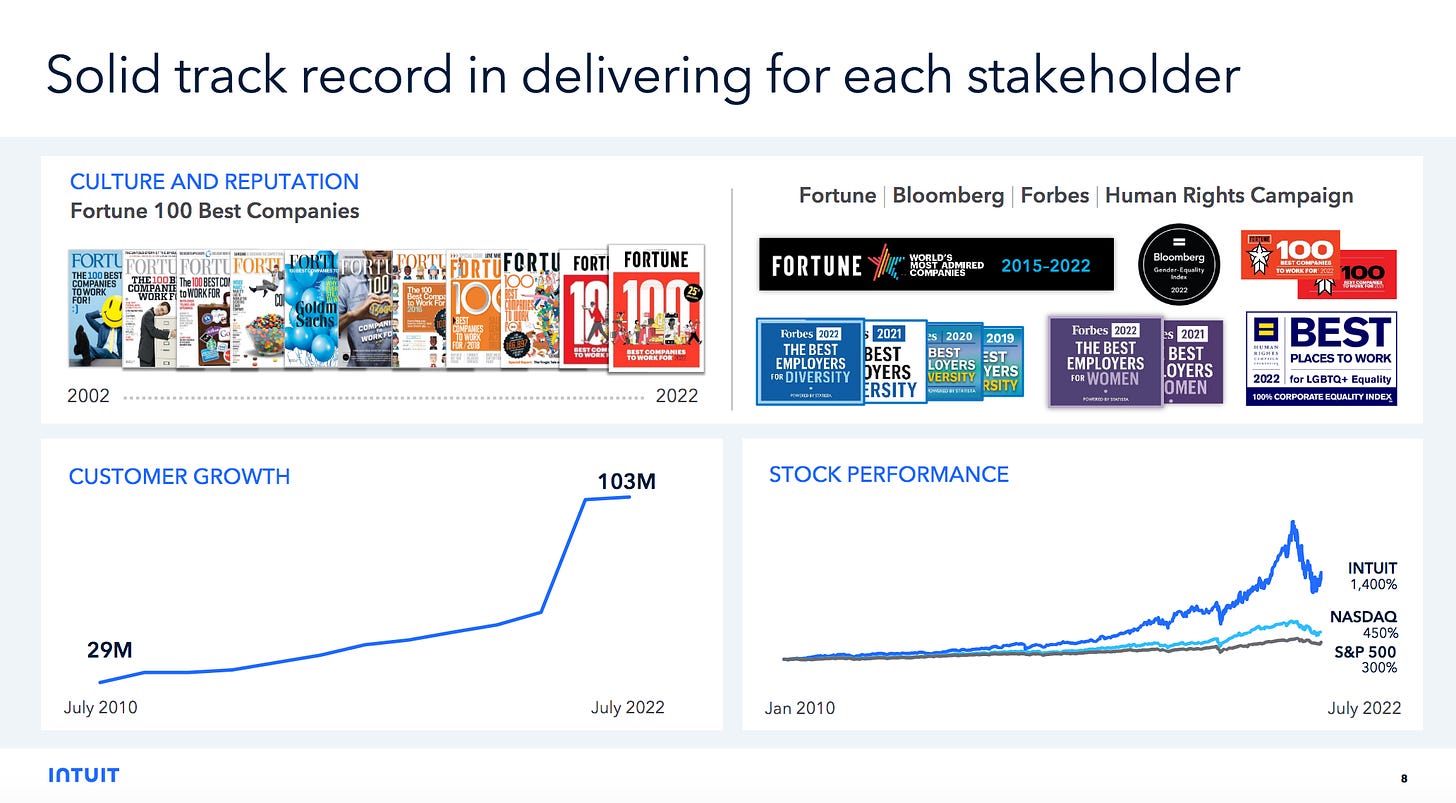

9. Intuit ($INTU)

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Intuit controls the majority of U.S. market share for small-business accounting and DIY tax-filing software.

FCF Margin: 28.8%

ROIC: 9.3%

FCF Yield: 3.3%

Exp. FCF Growth (3 yr): 32.4%

CAGR since IPO: 19.0%

10. Verisk ($VRSK)

Verisk is a data analytics provider offering decision support and risk-management solutions to the financial industry. The company's predictive analytics are used in among others rating applications, underwriting, claims, catastrophe and weather risk assessment.

FCF Margin: 31.4%

ROIC: 17.2%

FCF Yield: 2.6%

Exp. FCF Growth (3 yr): 12.5%

CAGR since IPO: 18.7%

11. Mastercard ($MA)

Mastercard provides financial transaction processing services for credit and debit cards. Together with Visa, Mastercard dominates this attractive market. Mastercard operates in over 200 countries.

FCF Margin: 48.4%

ROIC: 47.8%

FCF Yield: 2.9%

Exp. FCF Growth (3 yr): 16.5%

CAGR since IPO: 31.6%

12. S&P Global ($SPGI)

S&P Global provides clients with financial information services (credit ratings, benchmarks, and analytics) in the capital and commodity markets. S&P Ratings is the largest credit rating agency in the world. The firm's other segments include Market Intelligence, Indexes, and Platts.

FCF Margin: 22.5%

ROIC: 6.1%

FCF Yield: 3.3%

Exp. FCF Growth (3 yr): 15.5%

CAGR since IPO: 14.2%

13. Estée Lauder ($EL)

Estee Lauder is the world leader in the global prestige beauty market. The company manufactures and markets a wide range of skin care, makeup, fragrance, and hair care products.

FCF Margin: 11.3%

ROIC: 7.4%

FCF Yield: 1.5%

Exp. FCF Growth (3 yr): 21.9%

CAGR since IPO: 13.1%

14. Verisign ($VRSN)

Verisign is the sole authorized registry for several generic top-level domains, including the widely utilized .com and .net top-level domains. The company operates critical internet infrastructure to support the domain name system.

FCF Margin: 56.4%

ROIC: 176.2%

FCF Yield: 3.6%

Exp. FCF Growth (3 yr): 10.1%

CAGR since IPO: 15.8%

15. Thermo Fisher ($TMO)

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments: analytical technologies, specialty diagnostic products, life science solutions, and lab products and services.

FCF Margin: 15.4%

ROIC: 8.5%

FCF Yield: 3.4%

Exp. FCF Growth (3 yr): 23.6%

CAGR since IPO: 13.1%

Overview

Here’s an overview of all companies mentioned:

The end

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

With CAGRs this high, how can we expect to generate similar returns into the future? That would require either inflated prices or astronomical market caps in real dollars or some combination of both...I’m curious what your thoughts are on realistic projections considering the productivity growth of many of these companies was largely based on conquering new territory quickly. Not saying these won’t be profitable in the future, by and large they most likely will, but as an author who wants to fully educate their audience on these types of opportunities I’d like to see some honest caveats for these companies.

Thanks for all the sharings! This is extremely valuable for me and the well-being of my family. Do you see the reason of the quick decrease of the ROIC for @SPGI and even @EL compared to previous year. How do you understand these two ROIC decreases and are they somehow alarming?