180 Interesting Cannibal Stocks

An interesting niche

Have you ever heard of Cannibal Stocks?

These are companies that consistently buy back their own shares.

Today I’m sharing a list of 180 (!) interesting cannibal stocks with you.

Cannibal Stocks

Cannibal stocks?

Today's article is an article shared by TJ, who writes Compounding Dividends. He explains you why share buybacks are so interesting + a list of 180 (!) cannibal stocks.Cannibal stocks return capital to shareholders by buying back their own shares.

The interesting thing?

Buybacks increase your ownership of the company.

An easy way to understand this is to think about sharing a pizza.

The more people there are, the smaller each slice is.

Buybacks reduce the number of slices, making your slice bigger.

How many shares you own doesn’t change, but how much of the company you own does.

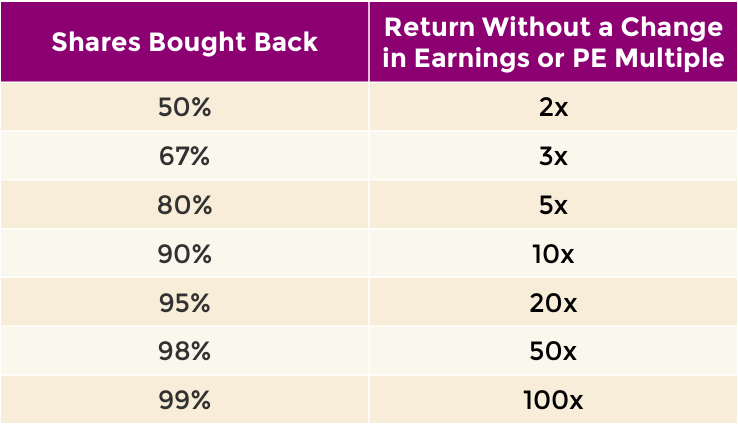

If you own a business that earns $10 per share and the company buys back 50% of its outstanding shares, EPS will increase from $10 to $20.

If everything else remains equal, the stock should double.

The chart below shows how different levels of buybacks affect returns:

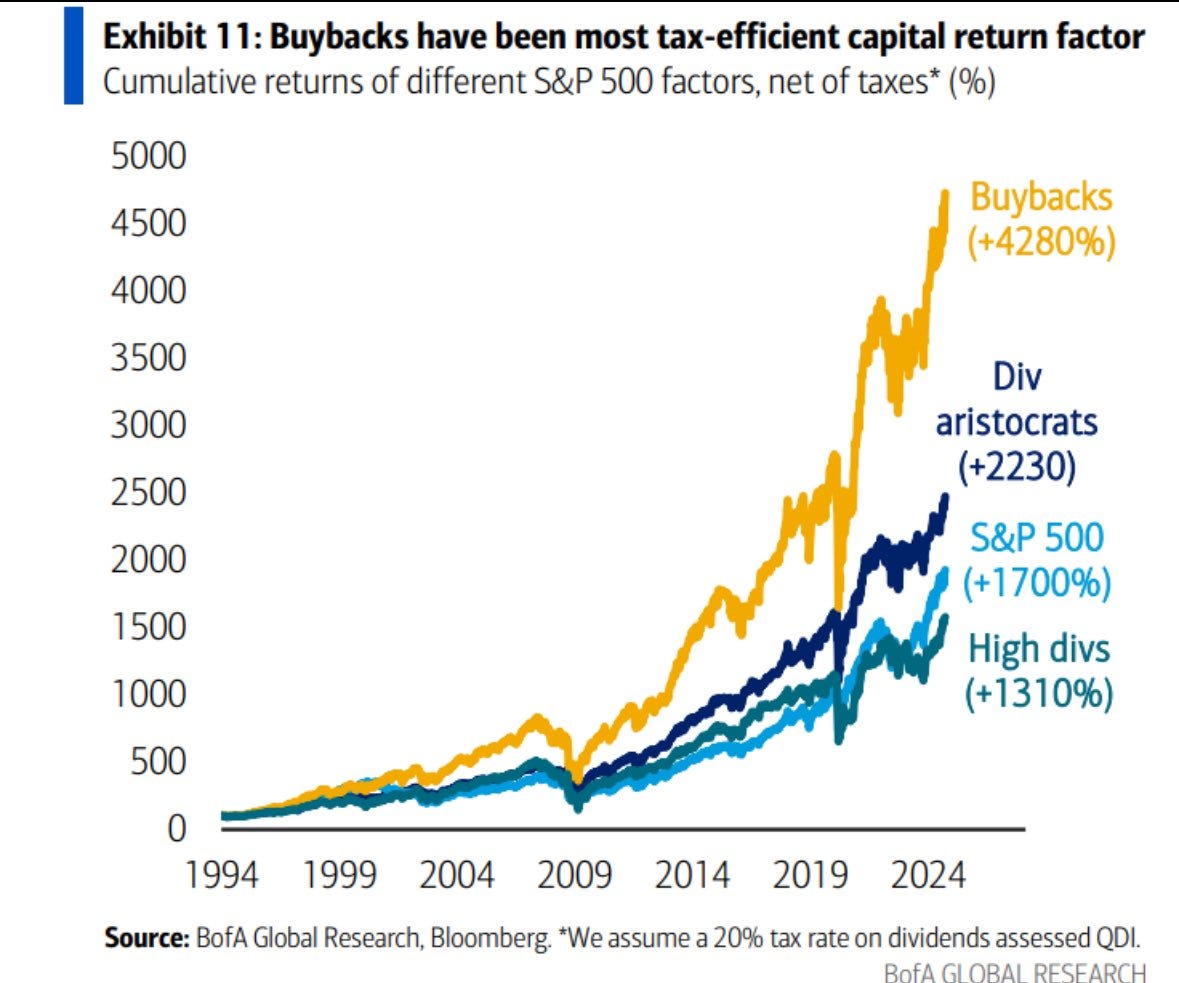

In addition to generating attractive returns, buybacks are often more interesting than dividends as they are more tax efficient.

This image shows the cumulative returns of different factors, net of taxes.

Capital allocation choices

In general, companies have 4 capital allocation options:

Organic growth

Pay down debt

Dividends

Share buybacks

We will look at the shareholder yield in this article.

Shareholder yield = Dividend Yield + Buyback YieldAs you can see, shareholder yield performs even better than dividends alone!

One of the reasons we love Fiscal.ai?

It calculates the Shareholder Yield for you.

Here’s the shareholder yield of the company Evolution AB.

Evolution AB’s current shareholder yield equals 7.3% (!):

A Cannibal Example

🏠 NVR

NVR is a homebuilder in the United States.

Between 1993 and 2024, the company bought back more than 80% (!) of its outstanding shares.

Shares outstanding 1993: 17.9 million

Shares outstanding 2024: 2.9 million

83.8% of shares bought back

And this while the company didn’t pay any dividends.

Since 1993, the stock increased from $5.5 to $7,500. This means it’s a 1,400 bagger!

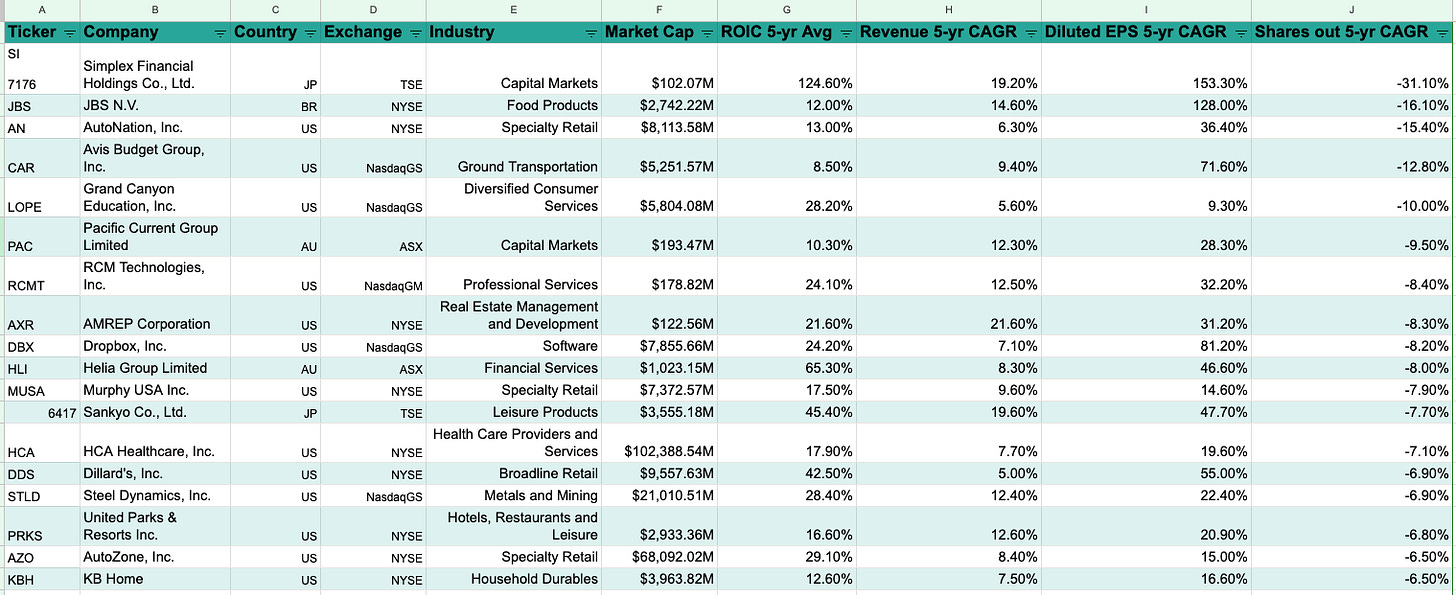

The Cannibal Universe

Are you ready to look at more than 180 companies returning capital to shareholders?

Let’s dive into the list!

You can download it for free here:

Everything In Life Compounds

Pieter

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

I love articles where you post lists like this! It inspires me to recreate the screener and then tweak it a little bit.

One change I made to the screener is the outstanding share count. What if we say the company doesn't need to buy back shares as long as they don't issue any new ones? There are some companies that issued shares way back when and kept that number steady for years, even decades!

All sorts of interesting companies appear!

A lot don't makes sense to me or appeal to me or are simply unavailable to me ... but, there is always one that sticks out! Maybe this is my "needle in the haystack".

Olympia Financial in Canada.

That's the next rabbit hole I'm going to jump down into 🐰 and research. Let's keep on learning!