In this post, we will talk about the semi-annual letter (2022) of Fundsmith written by Terry Smith that was published today. Fundsmith is one of the best quality investment funds in the world. Since the launch in 2010, Terry managed to return 451.5% to investors compared to 243.2% for the MSCI World. This is equal to a CAGR of 15,8% compared to 11,2% for the MSCI World.

In general, Terry’s Strategy consists of three pillars:

Buy good companies

Don’t overpay

Do nothing

Despite performing very well on the long term, over the first six months of 2022 Fundsmith lost 17,8% compared to 11,3% for the MSCI World. Quality stocks suffered from significant multiple contraction due to rising interest rates over the first half of 2022.

According to Terry, the cause of the downturn in global equity markets is obvious: the upsurge in inflation and the consequent need to raise interest rates and risk a recession. Raising interest rates is now a necessity to combat the current macro-economic environment.

In general, inflation, rising interest rates and an increasingly likely recession have two obvious effects on equity investments: fundamental effects and valuation effects.

Fundamental effects

Inflation causes an increase in the cost of the ingredients, components and other inputs. In other words, the Costs of Goods Sold (COGS) increases. The best defense against inflation is to invest in companies with a high gross margin (the difference between sales and COGS). So, what you want to do, is invest in companies with high and sustainable gross profit margins.

L’Oréal is a great example. The higher the gross margin, the less impact increasing COGS have on the operating profit of a company:

In general, it is very important that you focus on the fundamentals and underlying growth of the companies within your portfolio. The decline in stock prices we see today can almost be fully attributed to multiple contraction.

For Terry Smith, revenue growth is one of the most preferred sources for value creation. The results that the companies within Fundsmith’s portfolio reported were still very good.

Fundsmith primarily invests in 3 sectors which are still growing very attractively: consumer staples, albeit with some consumer discretionary, healthcare and technology. Companies in these sectors usually have a high Return On Invested Capital (ROIC). ROIC is very important for value creation in the long term:

Valuation

At the end of June 2022, the free cash flow (FCF) yield of Fundsmith’s portfolio was equal to 3.6% compared to 2.7% at the end of 2021.

“This means that in the space of six months, the valuation of the portfolio has declined all the way back to where it was at the end of 2017. “

The strong multiple contraction in technology stocks is also very remarkable. Technology stocks in the S&P500 are now more lowly-rated than consumer staples. This while the growth prospects for technology companies are looking way better:

“The median FCF yield on the 78 technology stocks in the S&P 500 Index is 4.6% and the mean is actually 5.2%. Conversely the equivalent numbers for the 36 stocks in the consumer staples sector are 3.8% and 4.6%.”

Terry Smith is still very comfortable with his technology stocks as they are high quality with a bright growth outlook:

“Conversely the price-to-earnings ratio on most of the stocks in our portfolio that could loosely be described as ‘tech’ — Microsoft, Adobe, Alphabet, Visa, ADP, Intuit, PayPal and Meta — averages 24x, Amazon is the only outlier.”

Performance individual positions

Over the first 6 months of 2022, the five biggest detractors were PayPal, Meta Platforms (Facebook), IDEXX, Intuit and Microsoft:

On the other hand, the five biggest positive contributors over the same period were Philip Morris, Novo Nordisk, Brown-Forman, PepsiCo and Waters:

The main reason for the good performance of Novo Nordisk is the strong growth of their product Wegovy. Wegovy is a drug that was developed for diabetics but it also is the first really effective weight loss drug.

Terry Smith also talks about Meta Platforms (Facebook). Meta now trades at a FCF Yield of 8.7%, which is very cheap. At this level Facebook is either very cheap or a so-called value trap according to Terry:

“The title for the lowest-rated belongs to Meta Platforms. Meta’s stock now trades on a FCF yield of 8.7%. At this level it is either cheap or a so-called value trap. We will let you know which when we find out, but we are inclined to believe it is the former. “

Conclusion

Finally Terry Smith emphasis that’s its all about the long term. In the long *run, stock prices will follow their fundamentals (FCF per share growth) and not the other way around.

“We claim no insight into how far the headwind to valuations caused by rising interest rates will go, but we are confident that the companies in our portfolio will survive and prosper relatively well in such an environment. This has been and will continue to be our primary focus. If we get that right then our Fund will emerge with the intrinsic value of its investments maintained or enhanced. Sooner or later share prices reflect fundamentals, not the other way around.”

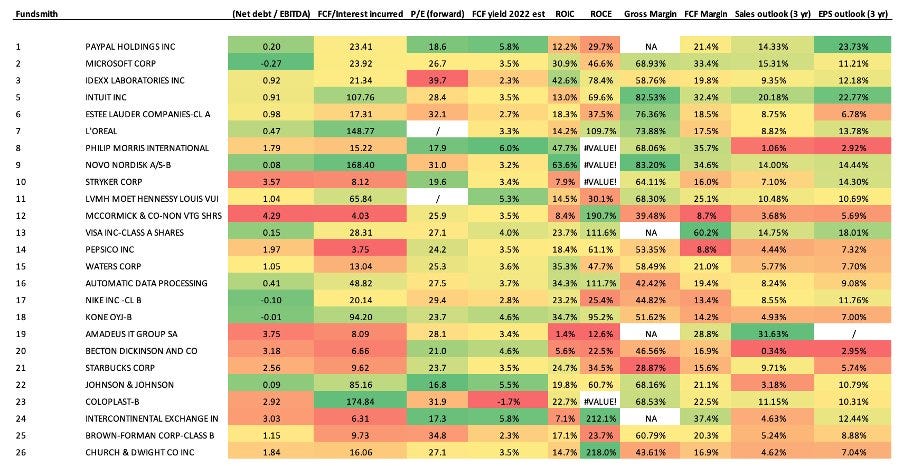

For those interested, the full portfolio of Terry Smith at the end of 2021 with some fundamental characteristics can be found here.

* Please note that data per 31/12/21 of Bloomberg were used. So new positions like Alphabet and Adobe were not included. Facebook (Meta) is also not included.

The end. The semiannual letter can be found here: https://www.fundsmith.co.uk/media/jhnc4xoi/2022-fef-semi-annual-letter.pdf.

As this is one of the first articles on this Substack, it would be highly appreciated if you could like, comment or share this content. By doing this, I know that some investors learned something from this post and we should write more in the future.

Over the next few weeks, we will also giveaway some Quality Investment Books for free to subscribers.

While Fundsmith has had great returns I think a better measure would be how much an investor who invests say €1000 every month for the last 5 years would have now. You can't time markets but there are times when you have to say this valuation is crazy.

The comparison with a Quality fund or say Invesco GARP ETF (Growth at a Reasonable Price) is not so impressive over the last few years