🔑 20 Most-owned stocks by superinvestors

On Bloomberg, you can screen for stocks which are owned by superinvestors like Warren Buffett, Terry Smith, Li Lu and Howard Marks.

Here you can find the 20 stocks that are owned the most by the best investors in the world.

Company 1: Alphabet ($GOOGL)

Everyone knows Google. The company has a (quasi-)monopoly in digital advertisements. Charlie Munger once stated that Alphabet has one of the widest moats he has ever seen.

Profit Margin: 29.5%

ROIC: 23.9%

Eearnings Yield: 5.3%

Expected yearly EPS Growth (next 3 years): 12.4%

CAGR since IPO: 22.7%

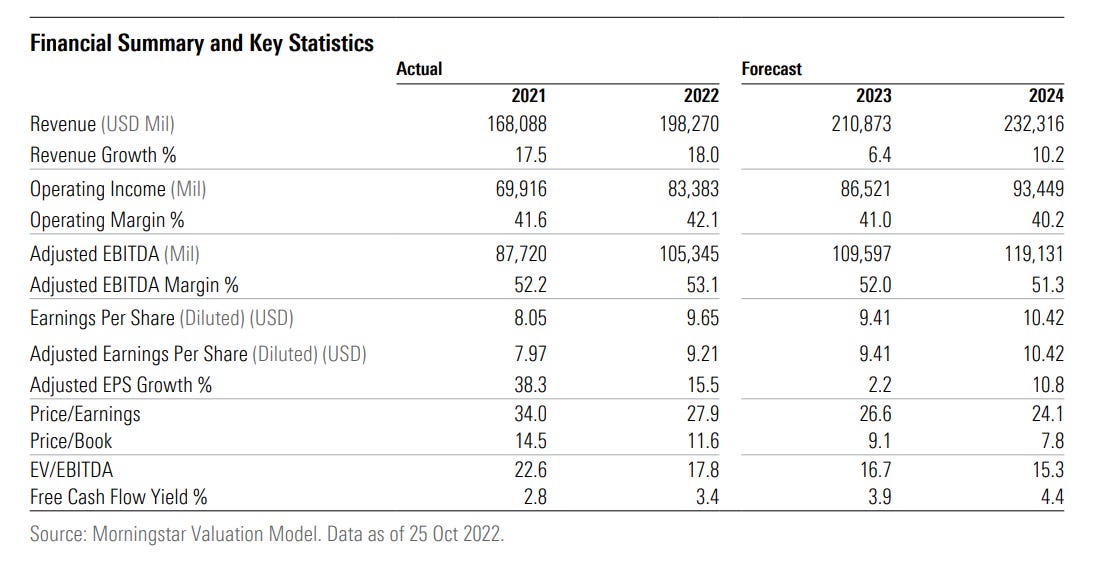

Company 2: Microsoft ($MSFT)

Microsoft operates as a software company. Word, Excel, … are all applications of Microsoft. The company is also active in cloud storage.

Profit Margin: 36.7%

ROIC: 28.1%

Earnings Yield: 4.0%

Expected yearly EPS Growth (next 3 years): 12.7%

CAGR since IPO: 22.7%

Company 3: Meta Platforms ($META)

Meta Platforms (Facebook) is a market leader in digital advertising and is investing heavily in the metaverse. The sharp decline in the stock price might offer opportunities.

Profit Margin: 33.4%

ROIC: 19.3%

Earnings Yield: 9.3%

Expected yearly EPS Growth (next 3 years): 7.8%

CAGR since IPO: 12.3%

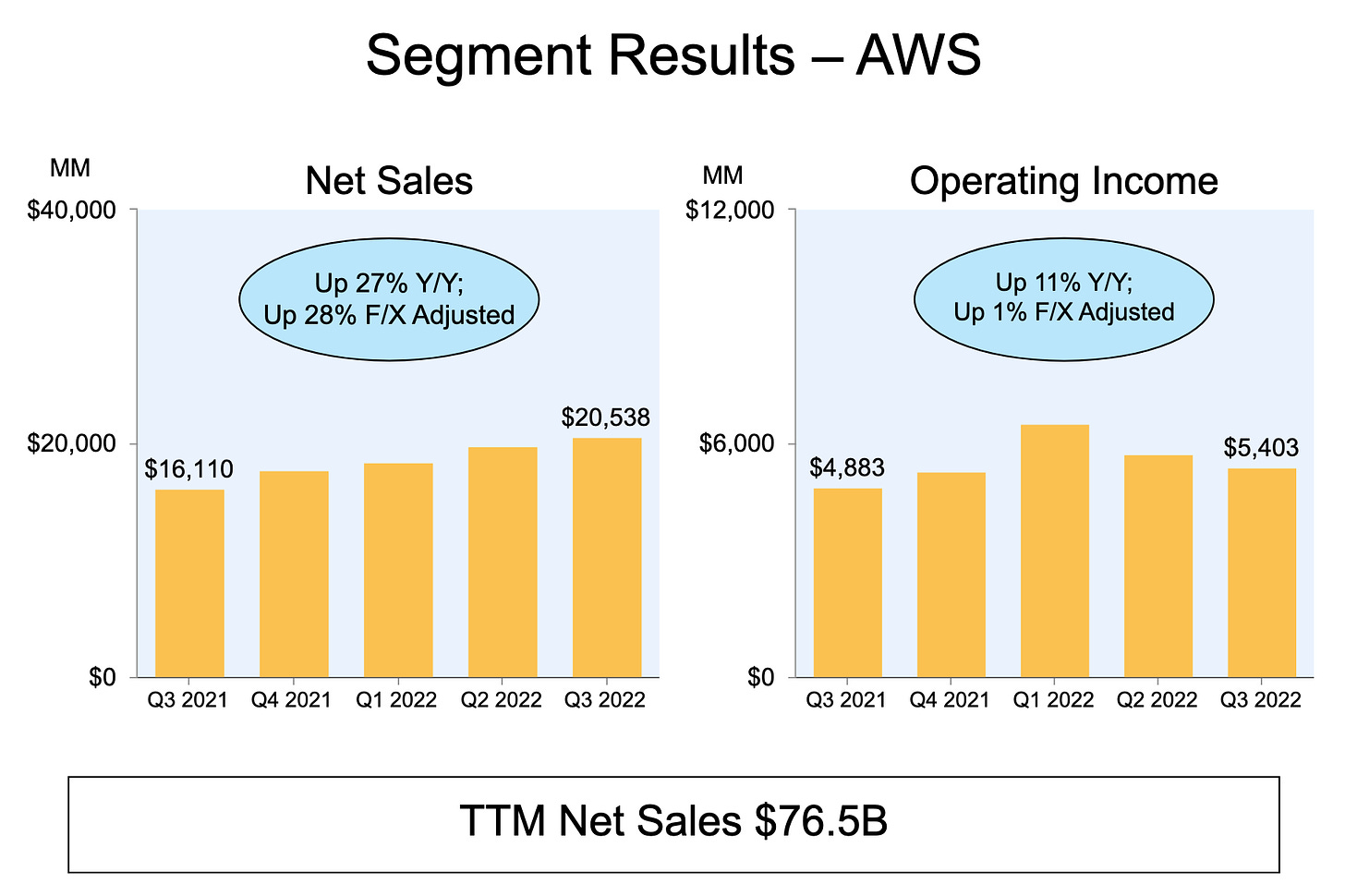

Company 4: Amazon ($AMZN)

Amazon is the worldwide market leader in e-commerce. Furthermore, Amazon also operates a cloud platform offering services globally through AWS.

Profit Margin: 7.1%

ROIC: 4.9%

Earnings Yield: 1.5%

Expected yearly EPS Growth (next 3 years): 65.9%

CAGR since IPO: 32.1%

Company 5: Visa ($V)

Together with Mastercard, Visa dominates the market for digital payments. Electronic payments are in a strong secular trend, giving a tailwind to Visa.

Profit margin: 51.0%

ROIC: 24.4%

Earnings yield: 3.9%

Expected EPS growth (next 3 years): 22.8%

CAGR since IPO: 22.8%

Company 6: Berkshire Hathaway ($BRK.B)

Berkshire Hathaway is the conglomerate of Warren Buffett, probably the best investor in the world. Apple accounts for more than 40% of Berkshire’s listed investments.

Profit margin: /

ROIC: /

Earnings yield: /

Expected EPS growth (next 3 years): /

CAGR since IPO: 22.3%

Company 7: Bank of America($BAC)

Bank of America Corporation is a financial holding company offering different products and services like saving accounts, mortgages and wealth management.

Profit margin: 35.8%

ROIC: 3.2%

Earnings yield: 8.6%

Expected earnings growth (next 3 years): 7.1%

CAGR since IPO: 10.6%

Company 8: Mastercard ($MA)

Just like Visa, Mastercard is a beautiful company. Mastercard has a huge competitive advantage, high profit margins and a healthy balance sheet.

Profit margin: 46.0%

ROIC: 49.3%

Earnings yield: 3.1%

Expected EPS growth (next 3 years): 13.4%

CAGR since IPO: 31.0%

Company 9: Wells Fargo($WFC)

Wells Fargo & Company operates as a diversified financial services company (banking, insurances, mortgages, credit cards, …).

Profit margin: 27.5%

ROIC: 4.2%

Earnings yield: 8.4%

Expected EPS growth (next 3 years): 15.9%

CAGR since IPO: 13.7%

Company 10: UnitedHealth Group($UNH)

UnitedHealth Group owns and manages organized health systems. It’s the largest health insurer by revenue in the US.

Profit margin: 6.0%

ROIC: 16.9%

Earnings yield: 4.2%

Expected EPS growth (next 3 years): 11.4%

CAGR since IPO: 22.9%

Company 11: Johnson & Johnson($JNJ)

Johnson & Johnson manufactures health care products and provides related services. Johnson & Johnson has increased its dividend for more than 50 consecutive years.

Profit margin: 22.3%

ROIC: 18.0%

Earnings yield: 5.7%

Expected EPS growth (next 3 years): 8.6%

CAGR since IPO: 13.4%

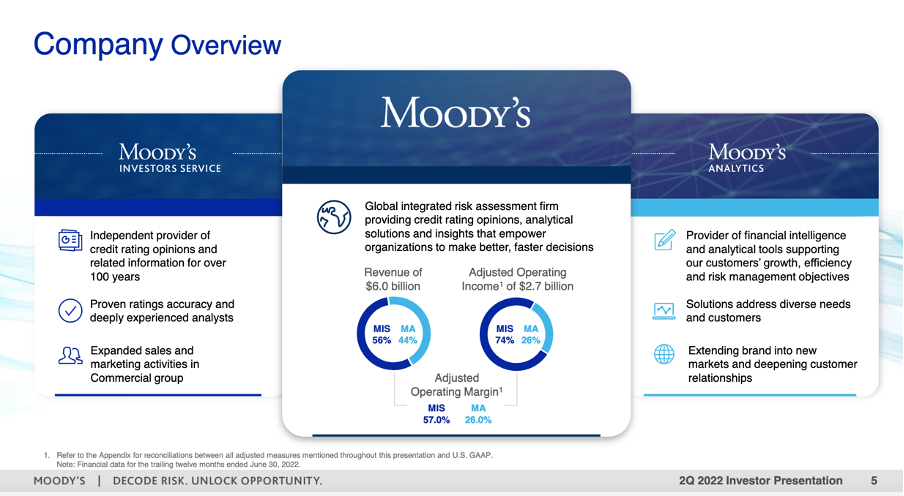

Company 12: Moody’s ($MCO)

Moody’s is a credit rating company. S&P Global, Moody’s and Fitch dominate the credit rating market. They were the market leaders in 1980, and probably will still be in 30 years from now.

Profit margin: 35.6%

ROIC: 17.3%

Earnings yield: 2.9%

Expected EPS growth (next 3 years): 9.4%

CAGR since IPO: 14.8%

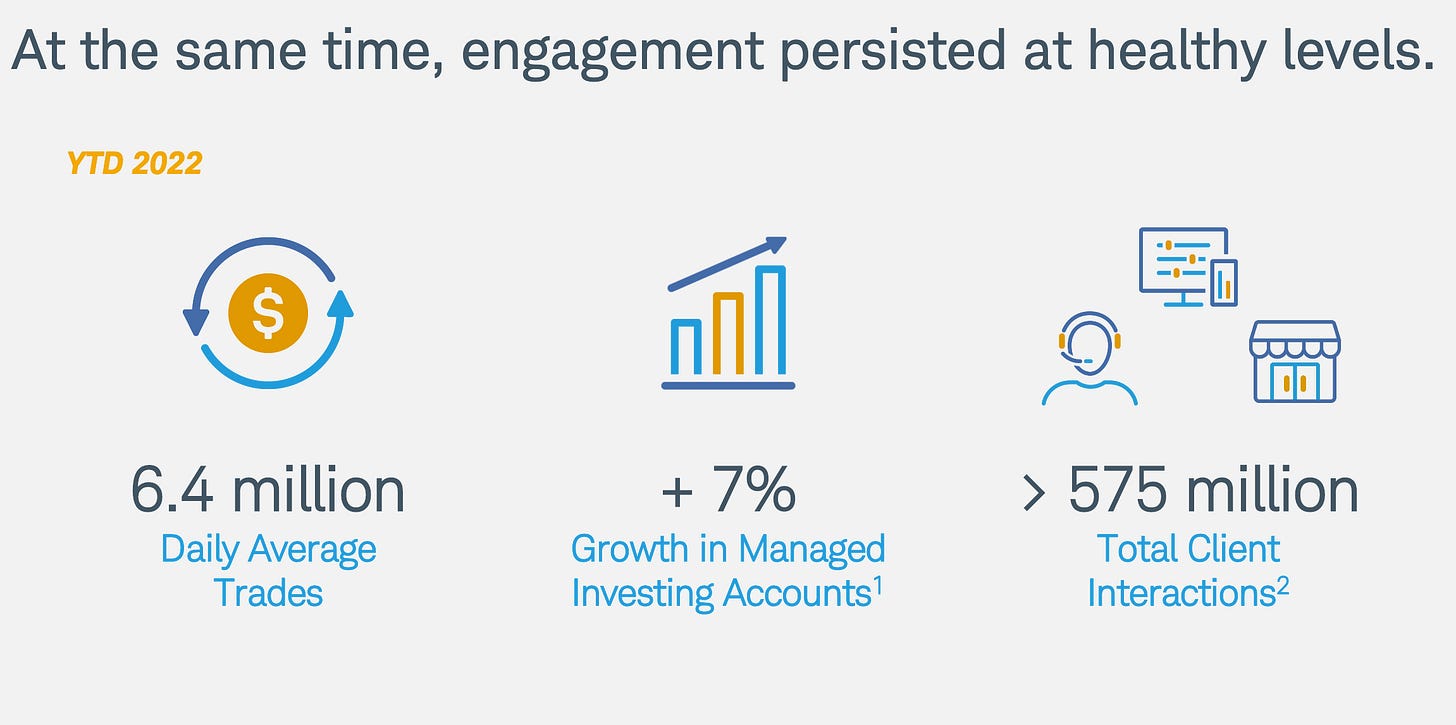

Company 13: Charles Schwab ($CHW)

The Charles Schwab Corporation is a financial services company providing wealth and asset management services.

Profit margin: 30.8%

ROIC: 9.8%

Earnings yield: 4.9%

Expected EPS growth (next 3 years): 17.1%

CAGR since IPO: 17.8%

Company 14: Walt Disney ($DIS)

The Walt Disney Company operates as an entertainment and media enterprise company. Walt Disney is mainly active in the media and theme parks.

Profit margin: 3.8%

ROIC: 2.8%

Earnings yield: 4.5%

Expected EPS growth (next 3 years): 41.8%

CAGR since IPO: 11.1%

Company 15: JP Morgan ($JPM)

JPMorgan Chase & Co is the largest bank in the United States providing global financial services and retail banking.

Profit margin: 39.7%

ROIC: 3.9%

Earnings yield: 8.7%

Expected EPS growth (next 3 years): 3.8%

CAGR since IPO: 12.0%

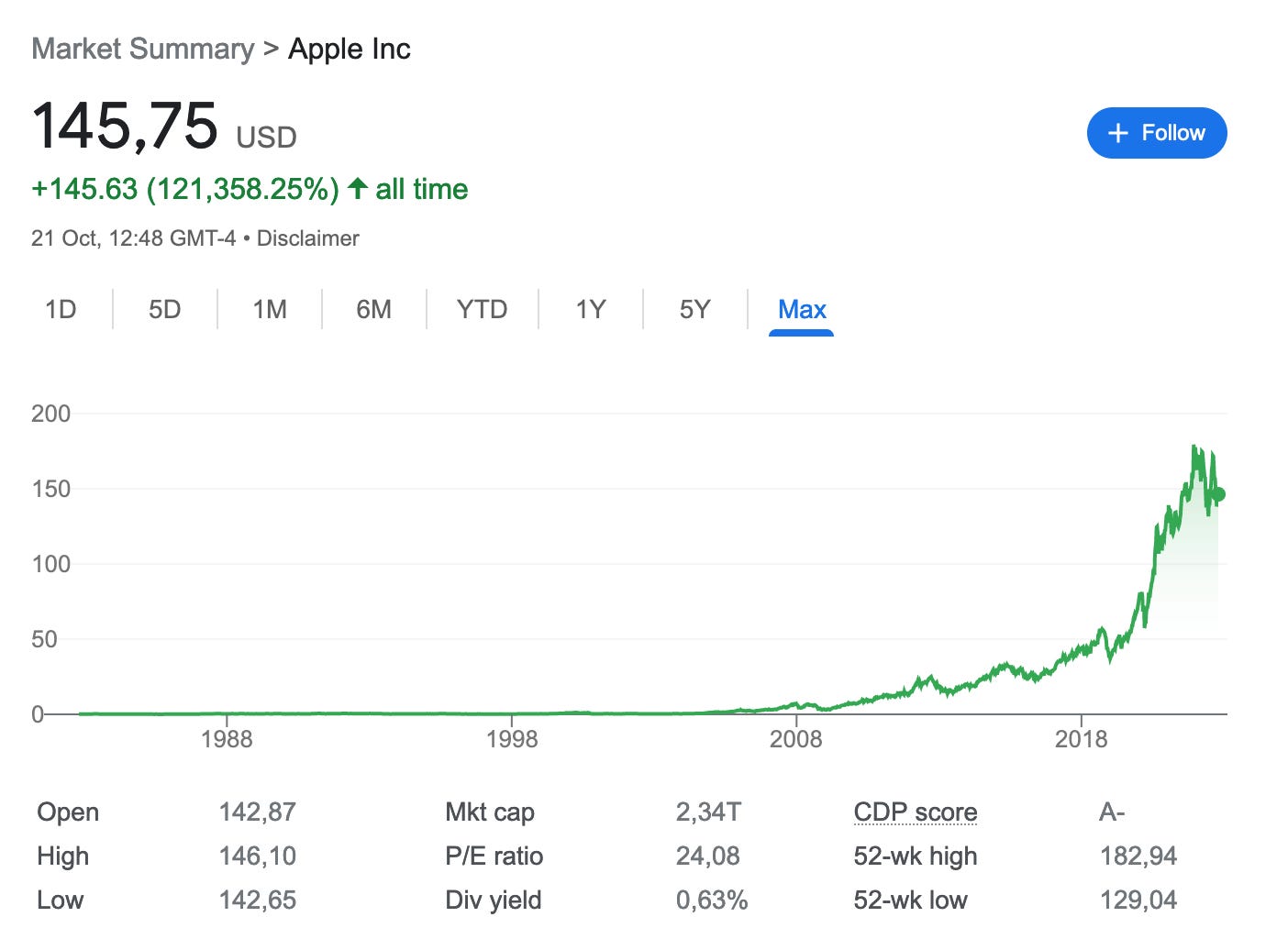

Company 16: Apple ($AAPL)

Apple is the largest company in the world which manufactures, and markets smartphones, personal computers and tablets. 18% of all new phones sold are iPhones.

Profit Margin: 25.3%

ROIC: 48.8%

Earnings Yield: 4.1%

Expected yearly EPS Growth (next 3 years): 6.2%

CAGR since IPO: 19.5%

Company 17: Alibaba ($BABA)

Alibaba can be seen as ‘the Amazon of China’. Just like Amazon, they are also focusing heavily on the cloud.

Profit margin: 7.3%

ROIC: 0.5%

Earnings yield: 9.1%

Expected EPS growth (next 3 years): 14.0%

CAGR since IPO: 0.0%

Company 18: American Express ($AXP)

American Express Company is a global payment and travel company. The Company's principal products and services are charge and credit payment card products.

Profit margin: 18.5%

ROIC: 13.1%

Earnings yield: 6.5%

Expected EPS growth (next 3 years): 7.2%

CAGR since IPO: 10.7%

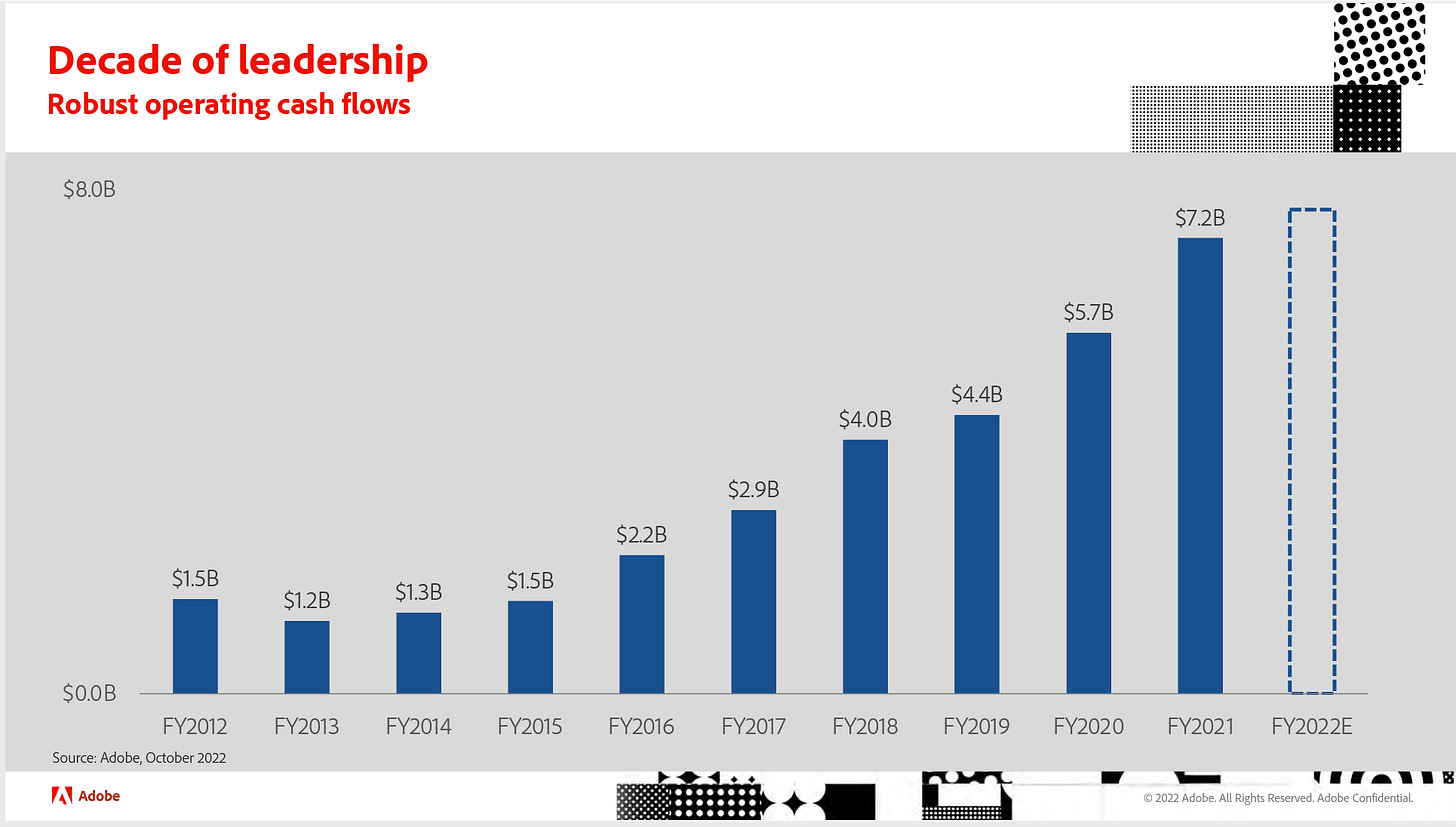

Company 19: Adobe ($ADBE)

Adobe is a true compounding machine active in computer software products and technologies. Adobe’s products allow users to express and use information across all print and electronic media.

Profit margin: 30.6%

ROIC: 27.0%

Earnings yield: 4.1%

Expected EPS growth (next 3 years): 20.0%

CAGR since IPO: 17.6%

Company 20: Pepsico ($PEP)

PepsiCo operates foods and beverages businesses. The Company manufactures markets and sells a variety of grain-based snacks, carbonated and non-carbonated beverages, and foods.

Profit margin: 9.6%

ROIC: 18.4%

Earnings yield: 3.7%

Expected EPS growth (next 3 years): 6.1%

CAGR since IPO: 12.0%

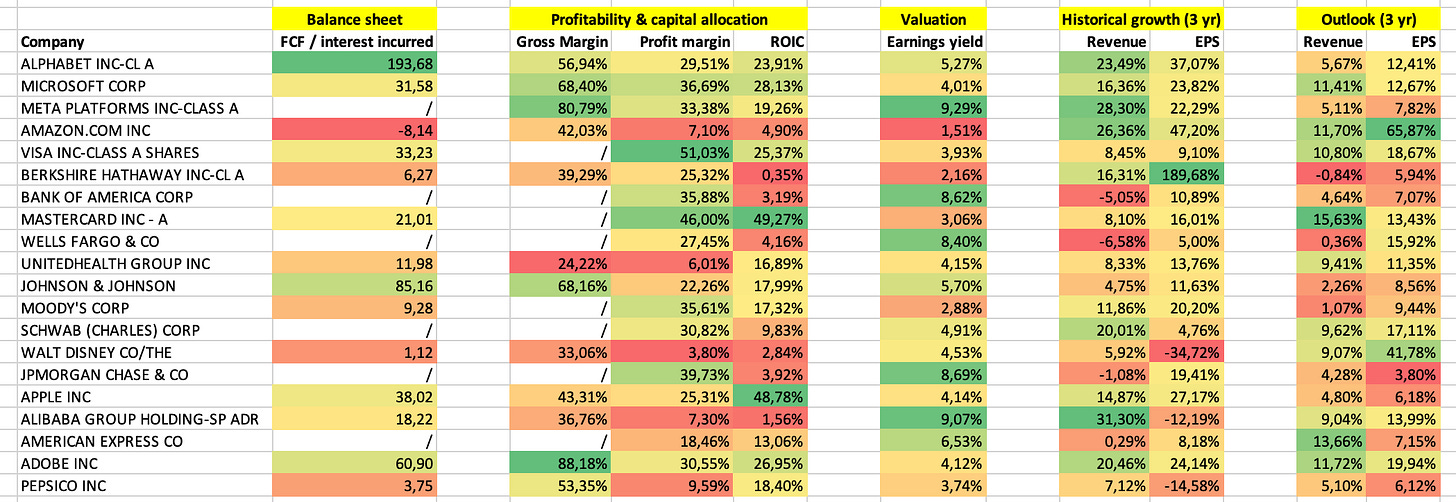

Overview

Here you can find an overview of all companies mentioned:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, Linkedin, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $200 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

Hi there, thank you so much for the great work :)

Could you let us know the source of the data in this post? (it'd be helpful if you added the data sources for future posts, as a suggestion)

I am specially interested in knowing the source of metrics such as EPS or FCF CAGR for the next 3 years.

Cheers,

Xavi

Thank you, great post and I enjoy your analysis. The summary spreadsheet with all the ratio is awesome, are you updating all the ratio manually? And can you share that spreadsheet