🏆 20 Quality stocks trading at their 52-week low

On Bloomberg, you can screen for stocks which are owned by superinvestors like Warren Buffett, Terry Smith, Li Lu and Howard Marks.

In this article you can find 20 stocks owned by superinvestors which are trading near there 52-week low.

Company 1: Estée Lauder ($EL)

Estée Lauder manufactures and markets a wide range of skin care, makeup, fragrance, and hair care products.

FCF Margin: 11.3%

ROCE: 29.9%

FCF Yield: 3.2%

Expected yearly FCF Growth (3 yr): 10.1%

CAGR since IPO: 13.5%

Company 2: Equifax ($EFX)

Equifax is a consumer credit reporting agency active in information management, transaction processing and direct marketing.

FCF Margin: 17.6%

ROCE: 55.8%

FCF Yield: 3.1%

Expected yearly FCF Growth (3 yr): 13.7%

CAGR since IPO: 12.4%

Company 3: Nestle ($NESN)

Nestle is a multinational packaged food company that manufactures and markets a wide range of food products.

FCF Margin: 10.3%

ROCE: 87.8%

FCF Yield: 3.3%

Expected yearly FCF Growth (3 yr): 1.5%

CAGR since IPO: 10.6%

Company 4: Intercontinental Exchange ($ICE)

ICE operates global commodity and financial products marketplaces (electronic energy markets and soft commodities).

FCF Margin: 37.4%

ROCE: 61.5%

FCF Yield: 5.5%

Expected yearly FCF Growth (3 yr): 10.8%

CAGR since IPO: 19.2%

Company 5: American Tower ($AMT)

American Tower is a REIT that owns, operates, and develops wireless communications and broadcast towers in the United States.

FCF Margin: 36.8%

ROCE: 4.8%

FCF Yield: 3.6%

Expected yearly FCF Growth (3 yr): 0.5%

CAGR since IPO: 11.0%

Company 6: Meta Platforms ($META)

Meta Platforms (Facebook) is a market leader in digital advertising and is investing heavily in the Metaverse.

FCF Margin: 33.2%

ROCE: 22.7%

FCF Yield: 5.3%

Expected yearly FCF Growth (3 yr): 5.0%

CAGR since IPO: 12.3%

Company 7: Domino's Pizza ($DPZ)

Domino's Pizza operates a network of company-owned and franchise Domino's Pizza stores.

FCF Margin: 12.9%

ROCE: 70.3%

FCF Yield: 3.7%

Expected yearly FCF Growth (3 yr): 9.7%

CAGR since IPO: 23.5%

Company 8: Constellation Software ($CSU)

Constellation Software is a serial acquirer acquiring vertical market software companies to help them support their growth.

FCF Margin: 23.9%

ROCE: 24.0%

FCF Yield: 3.5%

Expected yearly FCF Growth (3 yr): /

CAGR since IPO: 35.0%

Company 9: Philip Morris ($PM)

Philip Morris is a leading international tobacco company.

FCF Margin: 35.7%

ROCE: 48.1%

FCF Yield: 6.9%

Expected yearly FCF Growth (3 yr): 3.5%

CAGR since IPO: 8.9%

Company 10: Mastercard ($MA)

Mastercard provides financial transaction processing services for credit and debit cards.

FCF margin: 48.0%

ROCE: 188.5%

FCF yield: 3.2%

Expected FCF growth (3 yr): 15.8%

CAGR since IPO: 31.0%

Company 11: Canadian Pacific Railway ($CP)

Canadian Pacific Railway is a Class 1 transcontinental railway, providing freight and intermodal services over a network in Canada and the US.

FCF Margin: 13.5%

ROCE: 15.6%

FCF Yield: 3.9%

Expected yearly FCF Growth (3 yr): 17.4%

CAGR since IPO: 16.3%

Company 12: Coca-Cola ($KO)

Coca-Cola manufactures, markets, and distributes soft drink concentrates and syrups.

FCF Margin: 29.1%

ROCE: 68.7%

FCF Yield: 4.3%

Expected yearly FCF Growth (3 yr): 3.7%

CAGR since IPO: 10.9%

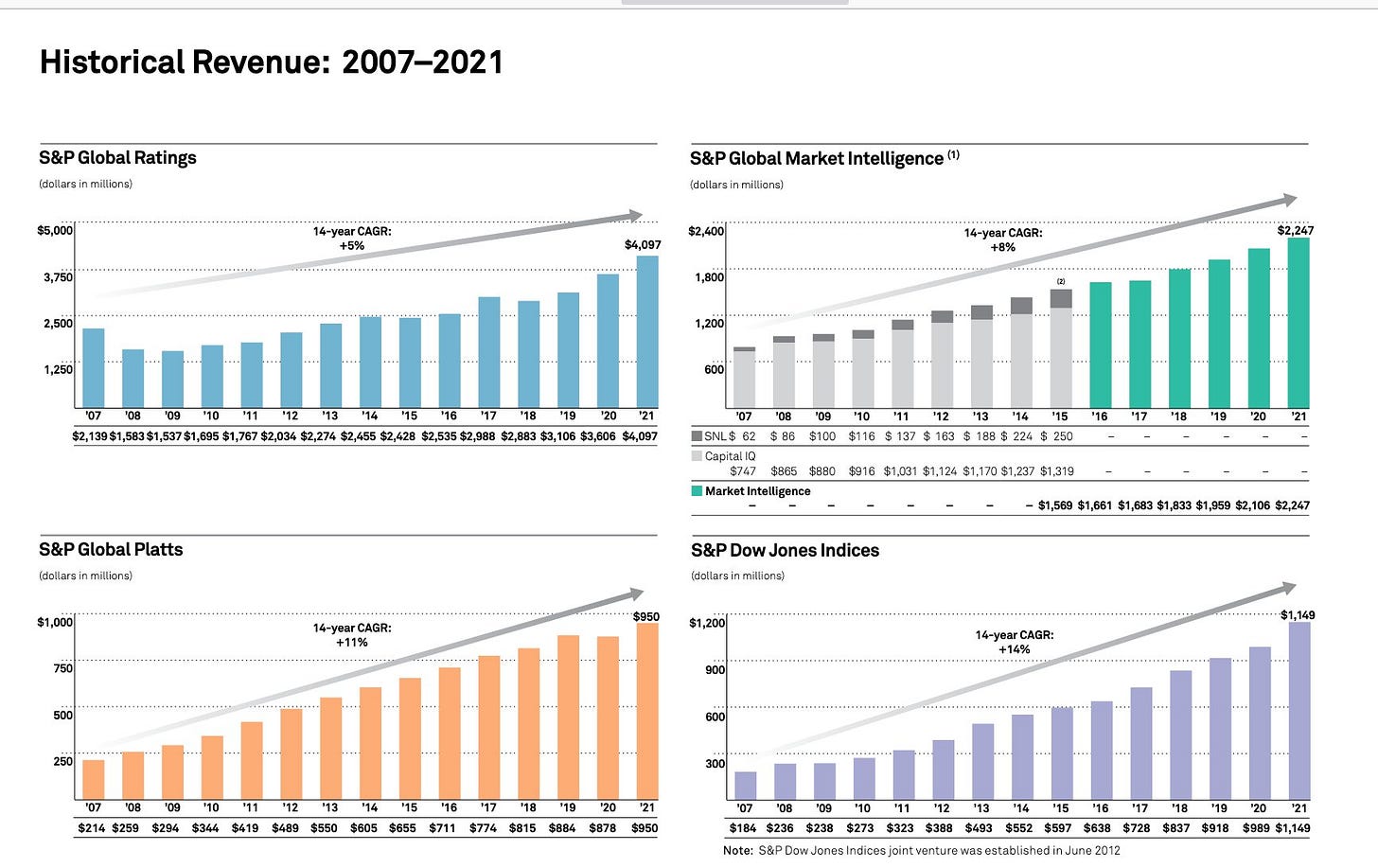

Company 13: S&P Global

S&P Global provides clients with financial information services (credit ratings, benchmarks, and analytics) in the capital and commodity markets.

FCF margin: 42.9%

ROCE: 126.3%

FCF yield: 4.4%

Expected FCF growth ( 3 yr): 16.9%

CAGR since IPO: 13.7%

Company 14: Accenture ($ACN)

Accenture PLC is a consultancy company with management and technology consulting services and solutions.

FCF Margin: 14.3%

ROCE: 80.1%

FCF Yield: 5.2%

Expected yearly FCF Growth (3 yr): 8.9%

CAGR since IPO: 16.4%

Company 15: Ferrari ($RACE)

Ferrari designs and manufactures sports cars. This luxury company also sells watches, earphones, and so on.

FCF Margin: 21.8%

ROCE: 25.1%

FCF Yield: 1.8%

Expected yearly FCF Growth (3 yr): 11.3%

CAGR since IPO: 25.2%

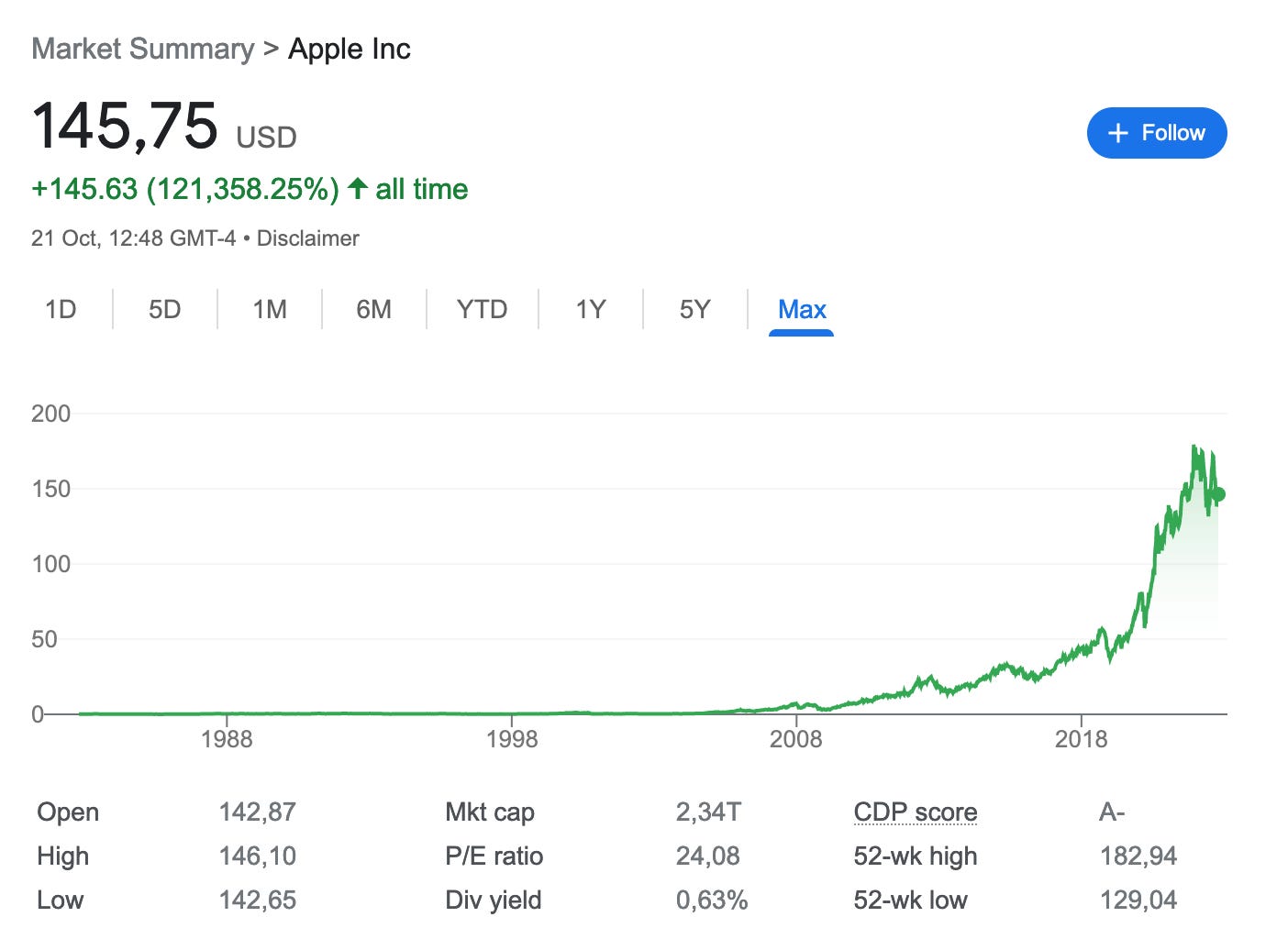

Company 16: Apple ($AAPL)

Apple is the largest company in the world which manufactures, and markets smartphones, personal computers, tablets and wearables .

FCF Margin: 25.4%

ROCE: 299.8%

FCF Yield: 4.5%

Expected yearly FCF Growth (3 yr): 4.3%

CAGR since IPO: 34.1%

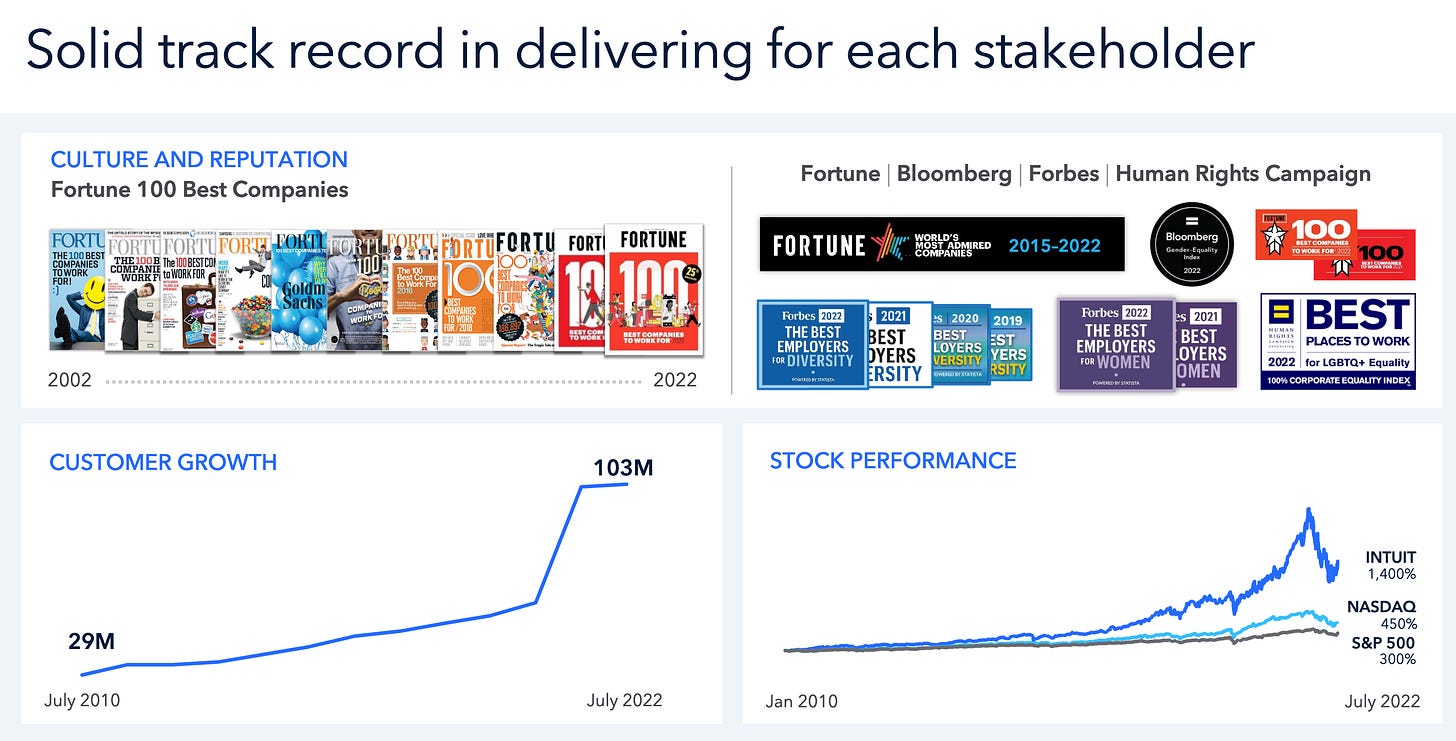

Company 17: Intuit ($INTU)

Intuit develops and markets business and financial management software solutions for mainly small and medium sized businesses.

FCF Margin: 28.8%

ROCE: 65.4%

FCF Yield: 3.2%

Expected yearly FCF Growth (3 yr): 37.6%

CAGR since IPO: 18.4%

Company 18: TSMC ($TSM)

Taiwan Semiconductor Manufacturing Company is a crucial company in the market for semiconductors specialized in integrated circuits.

FCF Margin: 17.4%

ROCE: 27.1%

FCF Yield: 3.4%

Expected yearly FCF Growth (3 yr): 7.3%

CAGR since IPO: 15.0%

Company 19: Paypal ($PYPL)

PayPal provides a technology platform that enables digital and mobile payments on behalf of consumers and merchants.

FCF Margin: 21.4%

ROCE: 16.6%

FCF Yield: 5.8%

Expected yearly FCF Growth (3 yr): 27.2%

CAGR since IPO: 11.9%

Company 20: Alphabet ($GOOGL)

Google is a market leader in web-based search, advertisement, maps and many more.

FCF Margin: 26.0%

ROCE: 31.8%

FCF Yield: 5.1%

Expected yearly FCF Growth (3 yr): 12.0%

CAGR since IPO: 19.4%

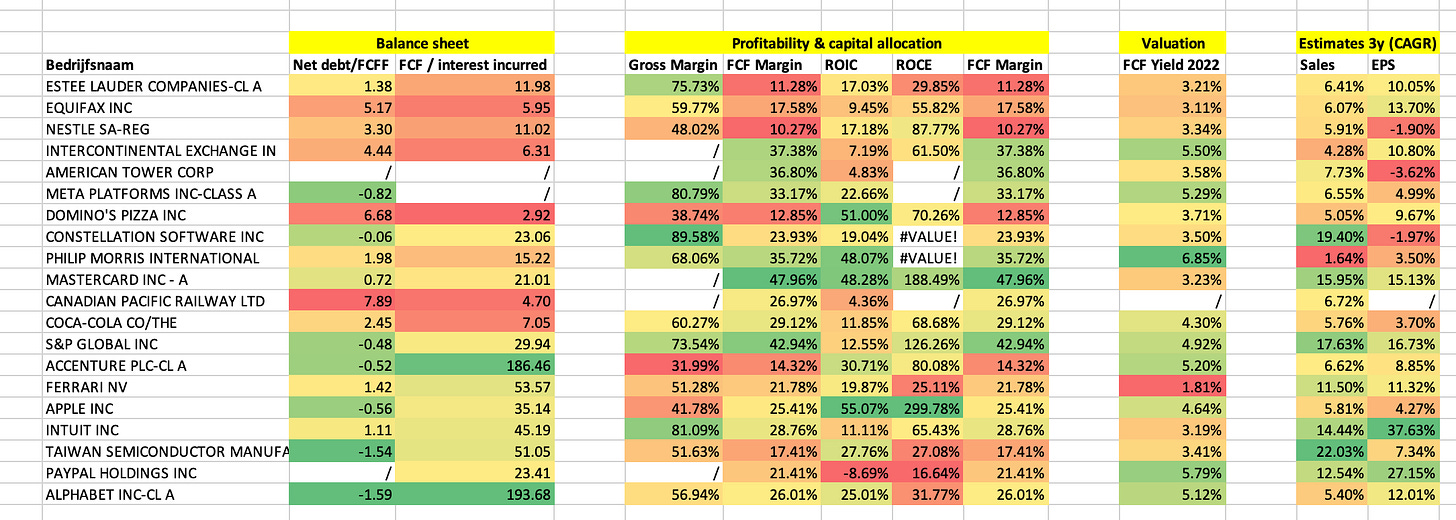

Overview of companies mentioned

Here you can find an overview of all companies mentioned:

More from us

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis. You can also follow us on Twitter, and Instagram.

If you have any questions, please email us via this button:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

this is excellent article; is there any websites apart from bloomberg terminal to source these metrics particularly ROCE? thanks

Hi CQ, good to see you, excellent info as usual thanks.

Cheers Kev