200 High-Yield Dividend Stocks

Grab the watchlist

In investing, there are multiple roads that lead to Rome.

We prefer quality stocks, but other investors prefer companies with a very high dividend yield.

In today’s article, you receive a list of 200 (!) high yield companies.

High-Yield Companies

What are high-yield companies?

High-yield dividend companies are firms that pay out a large portion of their profits as dividends, giving investors higher-than-average income compared to most stocks.Today’s article will focus on High-Yield Companies.

Some of these companies have a dividend yield of over 10%.

They could be interesting because they generate passive income for you.

The higher the dividend yield, the less you need to invest to receive $500 in dividends:

In general, there are three reasons why these kind of companies might be interesting:

They perform well on the stock market

High yield ≠ high payout ratio

They allow you to retire comfortably

1. They perform well on the stock market

Companies with a high dividend yield outperform the S&P 500:

2. High yield ≠ high payout ratio

One thing people often say about High-Yield Companies?

“They pay too much in dividends.”But guess what? That’s not always true.

You should look at the payout ratio to determine whether the high dividend yield is sustainable.

3. They allow you to retire comfortably

The beautiful thing about High-Yield Companies is that they’ll reliably provide you income.

This allows you to retire comfortably.

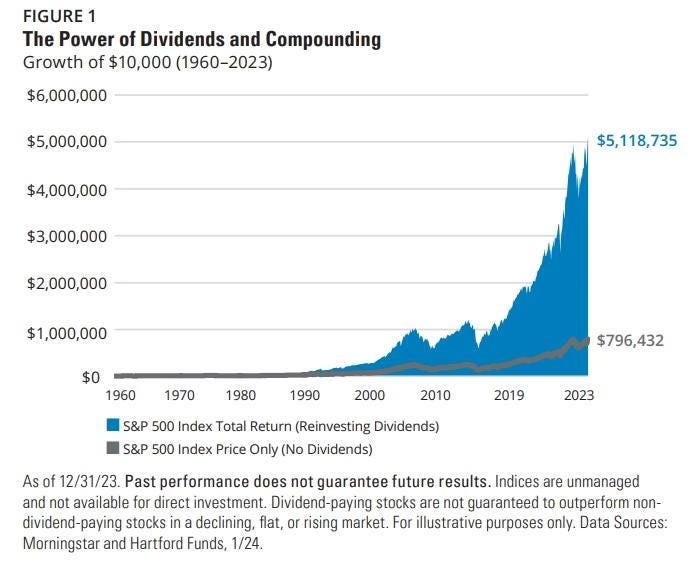

But until you retire, you can reinvest your dividends.

This fuels compounding over time.

An example: Altria ($MO)

Do you know Altria?

It’s the best performing stocks over the past 100 years.

Altria makes money by selling cigarettes and smokeless tobacco.

Marlboro is its flagship brand in the U.S.

A $1 investment in Altria in 1925 is worth over $2.6 million (!) today.

Altria’s Recent Performance

Buying Altria in 1925 would’ve been great. But let’s be honest… we weren’t investing back then.

So… what if you bought it 20 years ago?

You would have compounded your money by 14% (!) per year.

If you invested $10,000 twenty years ago, you would receive over $11,000 in yearly dividends today.

High Dividend Yield Watchlist

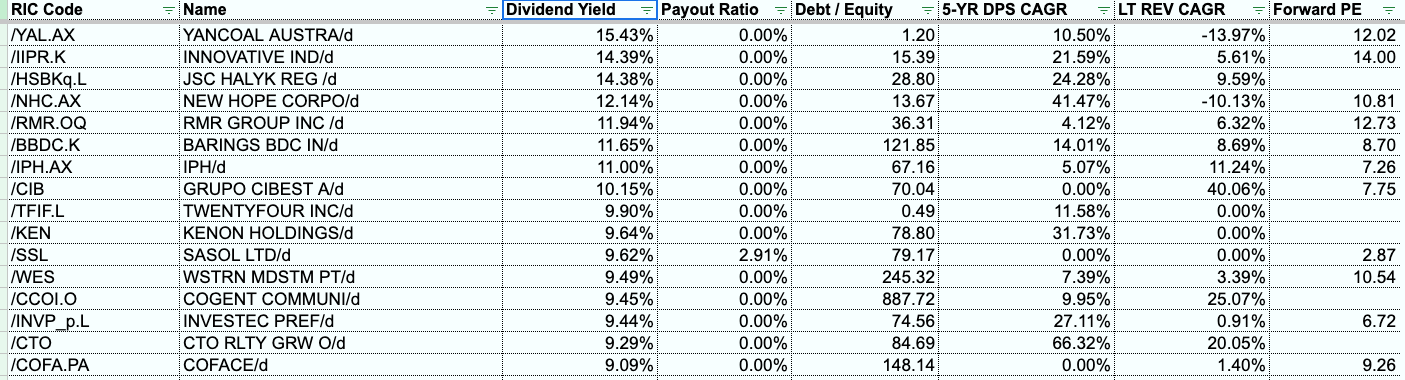

We are looking for companies that meet these criteria:

Dividend yield higher than 3.75%

Dividend growth over the last 5 years above 3.75% per year

Revenue growth above 3% per year

Over 190 companies matched these criteria.

Here are some highlights:

Highest dividend yield:

1. Yancoal Australia (15.4%)

2. Innovative Industrial Properties (14.4%)

3. Jsc Halyk Savings Bk Of Kazakhstan (14.4%)

You can download the entire list here:

Everything In Life Compounds

Pieter

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

![High-Yield Topics for MRCP Part 1 [Highly Recommended] High-Yield Topics for MRCP Part 1 [Highly Recommended]](https://substackcdn.com/image/fetch/$s_!OXYE!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff1559558-3062-4d94-bc75-bfae1e53eb23_1024x440.jpeg)

Loved this compendium. One suggestion: tag a ‘safety subset’ (FCF payout ≤70, net debt/EBITDA ≤3, IG credit). Also, adding shareholder yield would highlight total-return candidates, not just big coupons. Happy to help draft a template if useful.

Outstanding resource for dividend investors! The Altria example is a perfect illustration of the power of long-term dividend compounding - that 10% CAGR total return over 20 years demonstrates exactly why quality matters alongside yield. The 200+ stock watchlist is incredibly valuable, though I agree with the comment above about verifying the payout ratios. One additional metric worth considering for this list would be dividend growth consistency - companies that have raised dividends for 10+ consecutive years tend to have more sustainable business models. The combination of 5%+ yield, stable earnings, and reasonable payout ratios is the sweet spot. Great work aggregating this data!