26 Dividend Stocks for 2026

Hi Partner 👋

Investing is one of the most wonderful things in the world.

The ‘best‘ way to do it? It depends on your financial goals.

At Compounding Quality, we talk about three main paths:

Getting Rich: Small quality companies that are growing very quickly

Staying Rich: Established quality stocks that are still growing attractively

Living Rich: Quality companies paying an attractive dividend

Today, we’re focusing on Living Rich.

The goal of Living Rich is simple: build a portfolio that generates enough dividend income to cover your expenses.

When you can do that, you’ve achieved financial freedom.

26 Dividend Stocks for 2026

TJ Terwilliger recently put together a list of 26 stocks for 2026 for Compounding Dividends.

These companies:

Generate healthy consistent cash flows

Distribute cash to shareholders via dividends

We want to share this research with you.

Let’s dive into the list.

26. Penske Automotive Group ($PAG)

How the company makes money:

Penske is one of the world’s largest automotive retailers and a leading international transportation services company. They operate hundreds of retail dealerships across the US and UK, alongside a significant commercial truck segment and a large stake in Penske Transportation Solutions.Why It’s Interesting

Local Monopolies: Dealerships are protected by state laws that limit competition, creating a regional monopoly.

The Service Department: While car sales can be cyclical, the service and parts departments provide high-margin, recurring revenue.

Rising Complexity: As vehicles become more complex, owners are less likely to DIY, driving more business back to specialized dealer service centers.

Dividend Yield

Current Yield: 3.3%

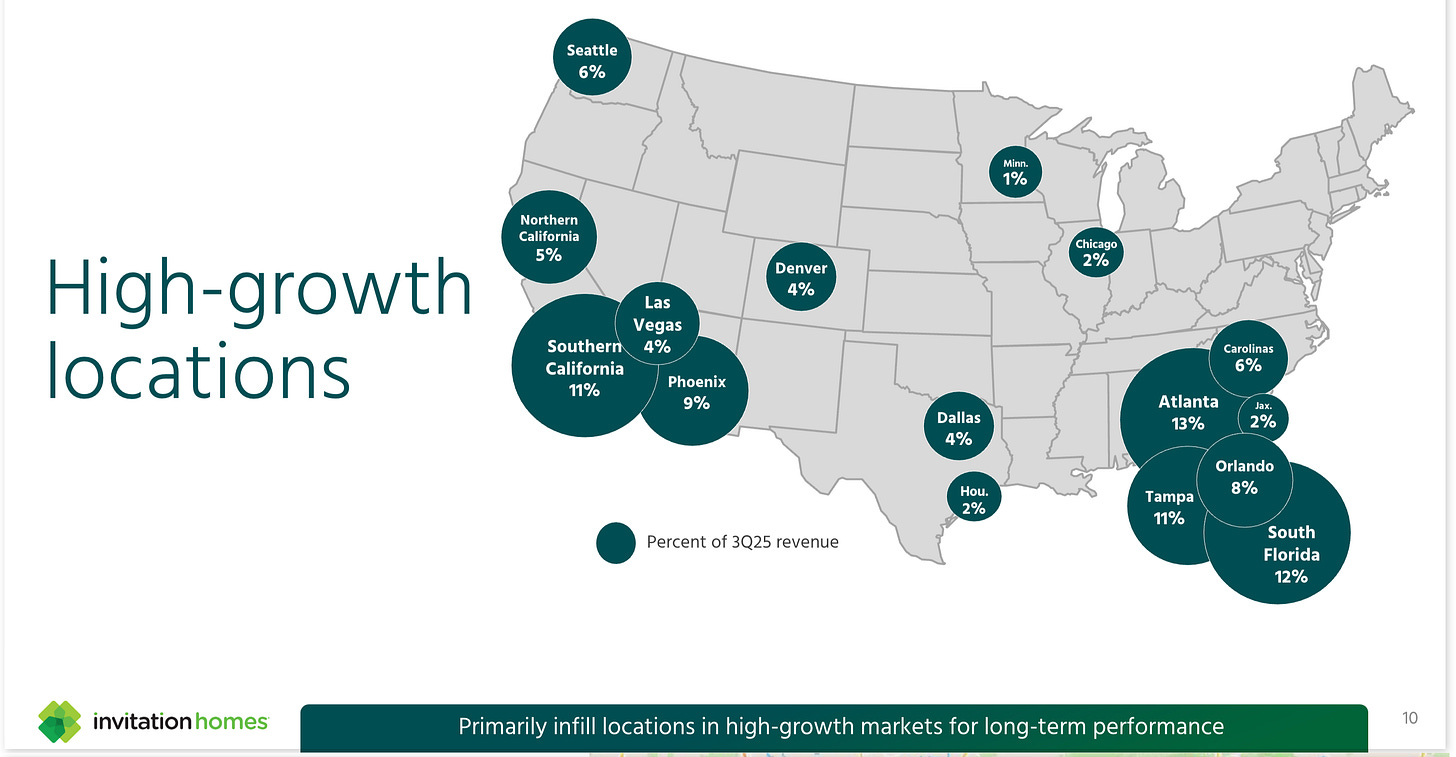

25. Invitation Homes ($INVH)

How the company makes money:

Invitation Homes is the premier single-family home leasing company in the United States. They own and manage a massive portfolio of high-quality homes in areas with strong job growth and great schools.Why It’s Interesting

The Rent vs. Buy Gap: With US home prices and mortgage rates high, renting a single-family home has become a more affordable and flexible alternative in many places.

Economies of scale: Invitation’s size means lower cost for maintenance and management, that a “mom-and-pop” landlord simply cannot match.

Valuation: Despite strong occupancy rates near 97%, the stock is offering a higher dividend yield than the historical average.

Dividend Yield

Current Yield: 4.4%

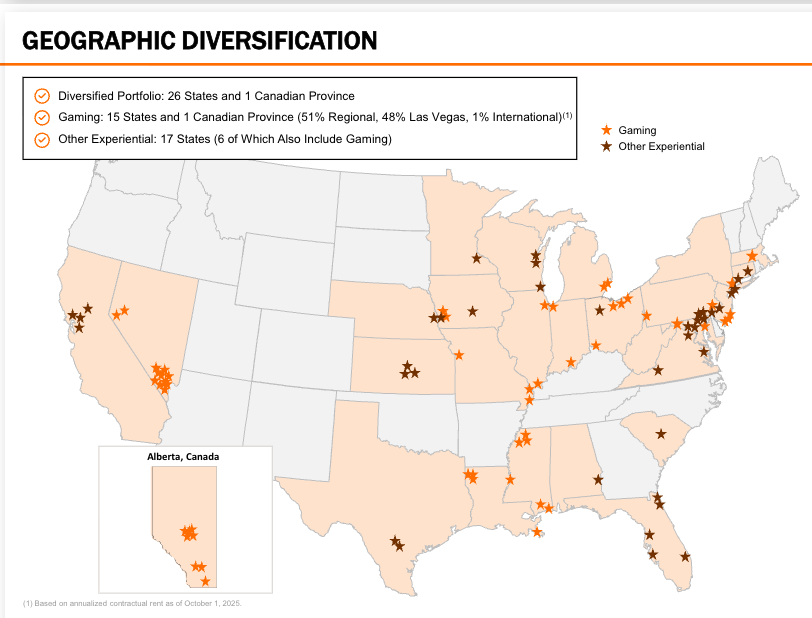

24. VICI Properties ($VICI)

How the company makes money:

VICI is a real estate investment trust (REIT) that owns one of the largest portfolios of market-leading gaming, hospitality, and entertainment destinations, including the iconic Caesars Palace.Why It’s Interesting

Triple-Net Leases: VICI uses triple-net leases, meaning the tenant pays for taxes, insurance, and maintenance. Their tenants paid 100% of their rent throughout the COVID-19 lockdowns.

Critical Real Estate: You can’t move a casino. The deep integration of these properties into the tenant’s business makes VICI’s cash flow incredibly durable.

High Yield: VICI is getting close to a 6% yield, and it should be able to keep raising the dividend - their leases often have annual rent escalators tied to inflation.

Dividend Yield

Current Yield: 6.4%

23. Darden Restaurants ($DRI)

How the company makes money:

Darden is the owner of some of the most recognizable names in casual dining, including Olive Garden, LongHorn Steakhouse, and the recently acquired Ruth’s Chris Steak House.Why It’s Interesting

Market Share: While many smaller restaurant chains are struggling with rising costs, Darden’s scale allows them to negotiate better prices on everything from shrimp to steak.

Operational Excellence: Management has a “brilliant with the basics” philosophy that has led to consistent same-restaurant sales growth.

Brand Power: Flagship brands like Olive Garden have massive customer loyalty and a value proposition that’s continuing to do well, even in a tighter economy.

Dividend Yield

Current Yield: 2.9%

22. Mondelēz International ($MDLZ)

How the company makes money:

Mondelēz is a global snacking giant with a portfolio that includes brands like Oreo, Cadbury, and Milka. They operate in over 150 countries, focusing heavily on biscuits and chocolate.Why It’s Interesting

Local First Strategy: Unlike other conglomerates that centralize everything, Mondelēz allows local managers to tailor products and marketing to specific regional tastes.

Snack-Sized Moat: People don’t stop buying Oreos during a recession. The low price point and high brand loyalty make their revenue streams relatively stable.

Emerging Market Tailwinds: They have a massive footprint in developing markets where rising middle-class incomes are driving increased snack consumption.

Dividend Yield

Current Yield: 3.5%

21. H&R Block ($HRB)

How the company makes money:

H&R Block provides tax preparation services through a vast network of physical offices and digital software. They also offer financial products like the Spruce mobile banking app.Why It’s Interesting

Tax Complexity: As tax codes become more complex with new deductions and credits, the need for H&R Block’s expert assisted services keeps growing.

Buybacks: Management is aggressive with capital allocation; they have bought back nearly 47% of shares outstanding since 2016.

SaaS Revenue: Their acquisition of Wave (small business accounting) provides a high-growth SaaS revenue stream to complement the seasonal tax business.

Dividend Yield

Current Yield: 3.9%

20. Mullen Group ($MTL)

How the company makes money:

Mullen Group is one of Canada’s largest logistics and trucking providers. They provide a wide range of services, including “less-than-truckload,” specialized hauling, and oilfield services.

Why It’s Interesting

Dividend Yield: Mullen is offering a 5% yield that’s well-covered by steady cash flow.

Capital Allocation: Management is known for being patient, only making acquisitions when valuations are attractive and the balance sheet is pristine.

Essential Service: No matter the economic climate, food, medicine, and industrial supplies still need to be moved.

Dividend Yield

Current Yield: 5.1%

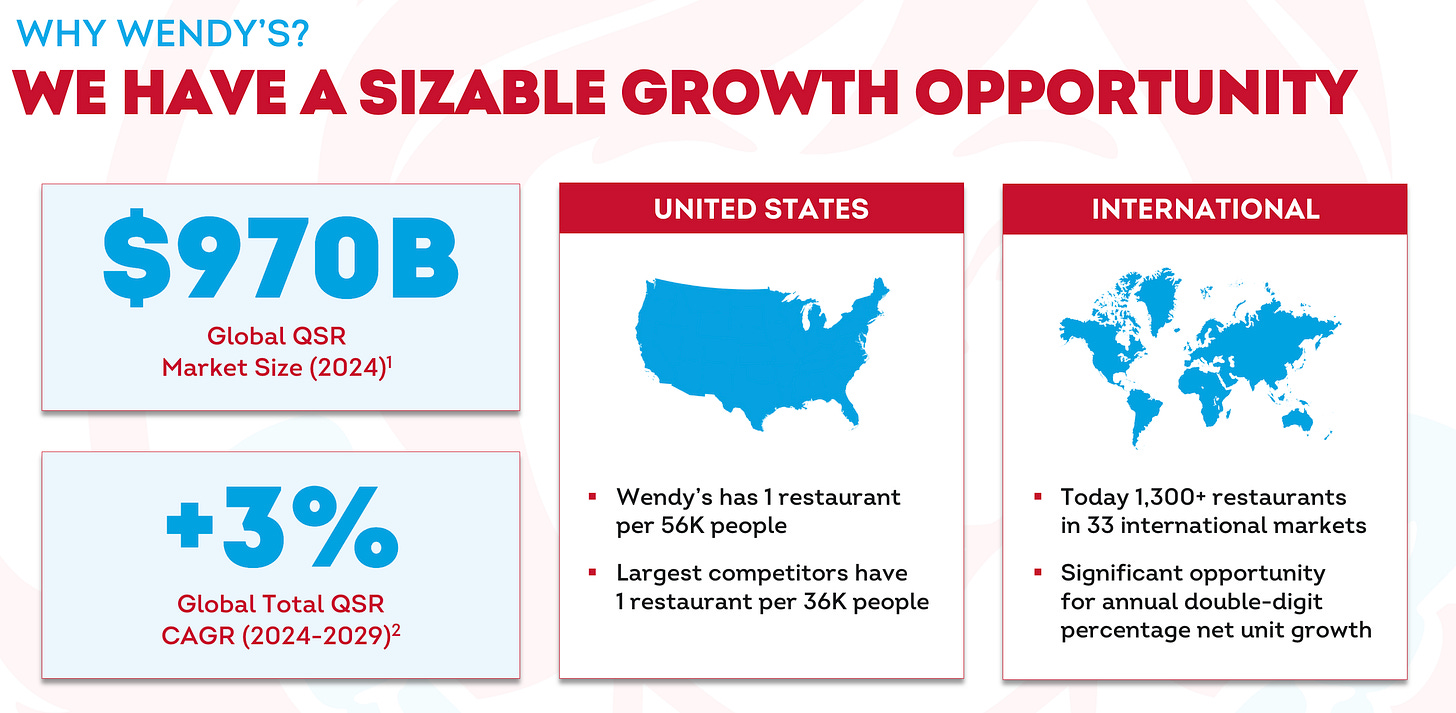

19. Wendy’s ($WEN)

How the company makes money:

Wendy’s is the world’s third-largest quick-service hamburger company. The vast majority of its thousands of locations are operated by franchisees, creating a high-margin royalty model.Why It’s Interesting

International Growth: While domestic growth is steady, Wendy’s is seeing significant international expansion, which provides a long-term runway for earnings.

Shareholder Yield: Between a high dividend yield and consistent buybacks, the company is focused on returning cash to owners.

Technology: Their heavy investment in mobile ordering and loyalty programs is increasing how often customers buy, and average ticket sizes.

Dividend Yield

Current Yield: 6.6%

18. Argan SA ($ARG.PA)

How the company makes money:

Argan is a French real estate company specializing in the development and leasing of premium logistics warehouses (the backbone of e-commerce).Why It’s Interesting

European E-commerce Play: As online shopping continues to grow in Europe, the demand for high-spec, modern warehouses will grow along with it.

Yield & Safety: Argan currently has a very attractive yield with a conservative payout ratio.

Inflation Protected: Most of their leases include indexation clauses, meaning rents rise automatically with inflation.

Dividend Yield

Current Yield: 5.1%

17. Unite Group PLC ($UTG)

How the company makes money:

Unite Group is the UK’s largest owner, manager, and developer of purpose-built student accommodation. They partner with top-tier universities to provide housing for over 70,000 students.Why It’s Interesting

Supply-Demand Gap: There is a chronic shortage of high-quality student housing in the UK, leading to high occupancy rates and reliable rent growth.

Recession Resistant: Higher education enrollment tends to stay steady or even increase during economic downturns as people head back to school to retrain.

Institutional Quality: Unite Group has a solid balance sheet and a dominant brand in the student housing sector.

Dividend Yield

Current Yield: 6.6%

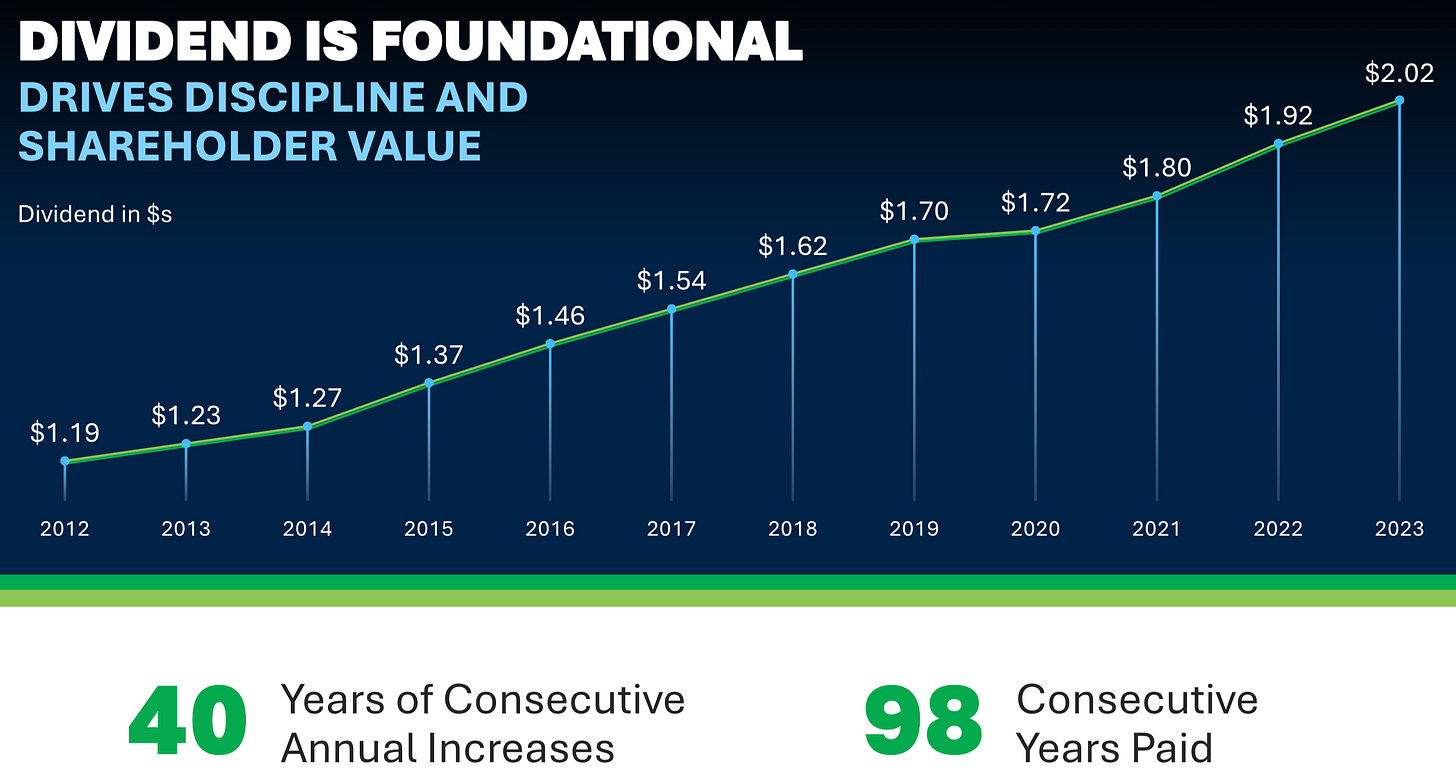

16. Sonoco Products ($SON)

How the company makes money:

Sonoco is a global provider of consumer, industrial, and healthcare packaging. They have recently pivoted aggressively toward metal packaging through major acquisitions.Why It’s Interesting

Metal Packaging: The acquisitions of Ball Metalpack and Eviosys have turned Sonoco into a global leader in metal food cans - a highly stable, competitively advantaged industry.

Inflation Protection: Most of their sales are under long-term contracts with price escalators, allowing them to pass on rising raw material costs to customers.

Decades of Dividends: Sonoco has been paying dividends continuously for almost 100 years, showing a deep commitment to its owners.

Dividend Yield

Current Yield: 4.9%

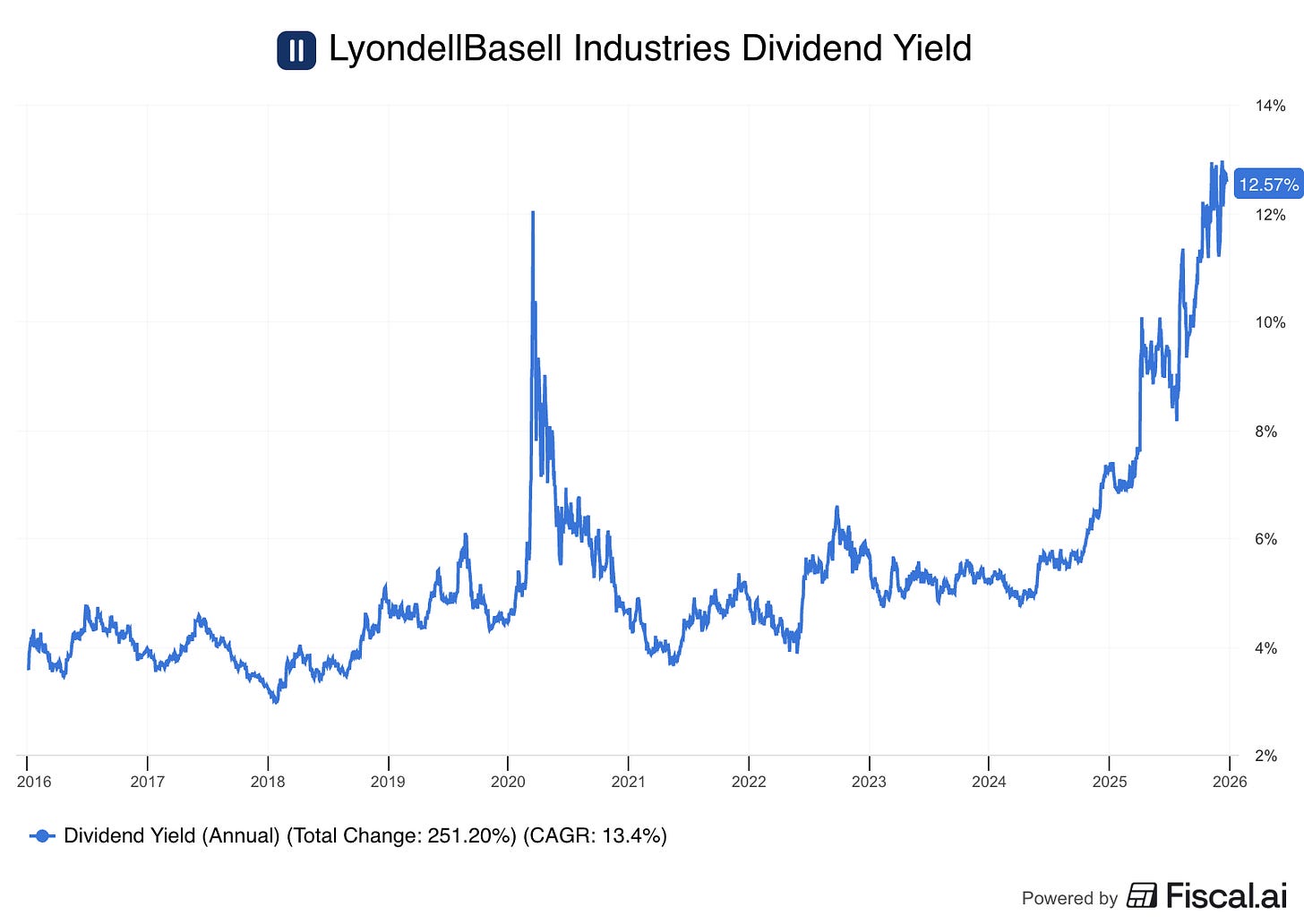

15. LyondellBasell ($LYB)

How the company makes money:

LyondellBasell is one of the world’s largest plastics, chemicals, and refining companies. They are a global leader in the production of polypropylene and polyethylene.

Why It’s Interesting

Cost Advantage: Because they operate heavily in the US, they have access to low-cost natural gas (feedstock), giving them a massive cost advantage over European and Asian competitors.

Deep Value: The stock has recently traded at some of its lowest valuations in years, paired with a dividend yield that is near historical highs.

Cash Improvement Plan: Management is currently executing a plan to unlock over $1 billion in incremental cash flow by the end of 2026.

Dividend Yield

Current Yield: 11.2%

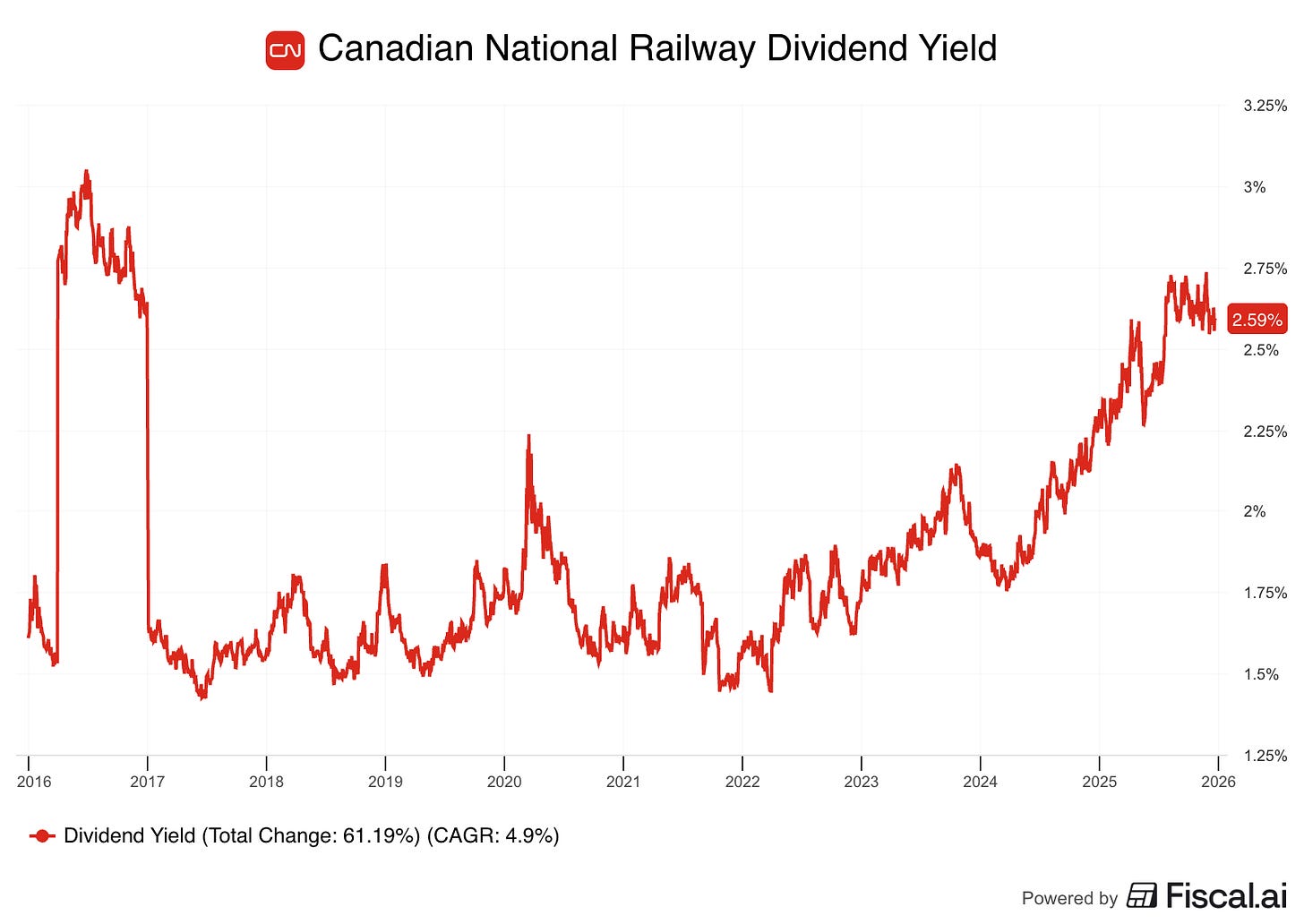

14. Canadian National Railway ($CNR)

How the company makes money:

CN Rail operates the only railroad in North America that connects the Atlantic, Pacific, and Gulf coasts.

Why It’s Interesting

The Ultimate Moat: You cannot build a new railroad. CN operates a toll booth on the North American economy with minimal competition for long-haul freight.

Valuation: After a period of higher valuation, the stock has become more attractive relative to its peers and its own historical averages.

Efficiency: CN is consistently one of the most efficient railroads in the world, generating massive free cash flow that supports a growing dividend.

Dividend Yield

Current Yield: 2.6%

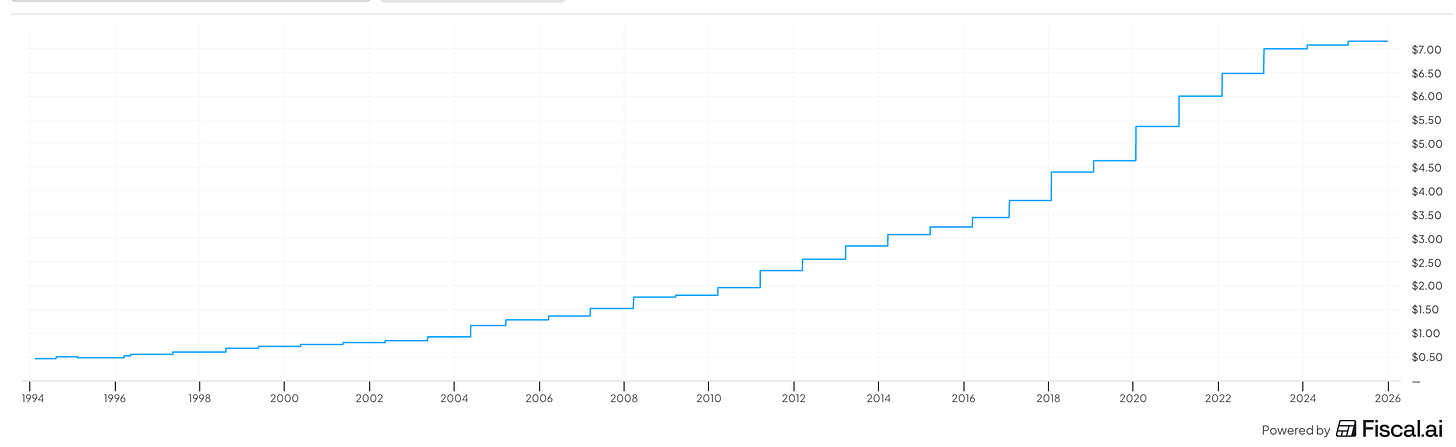

13. Canadian Tire ($CTC.A)

How the company makes money:

Canadian Tire is a legendary retail staple in Canada, operating a massive network of stores that sell everything from automotive parts to housewares and sporting goods. Beyond retail, it has a significant financial services arm and a majority stake in CT REIT.Why It’s Interesting

Shareholder-First Culture: The company is family-controlled (by the Billes family), giving management a long-term mindset. They just announced their 16th consecutive year of dividend increases.

Aggressive Buybacks: Management is a serious buyer of their own stock, with an intention to repurchase up to CAD 400 million in shares through 2026.

Triangle Loyalty: Their Triangle Rewards program is one of the strongest in Canada, giving them data on roughly 11 million active members to drive repeat business.

Dividend Yield

Current Yield: 4.1%

12. General Mills ($GIS)

How the company makes money:

General Mills is the owner of brands like Cheerios, Nature Valley, Blue Buffalo, and Betty Crocker. They are a global leader in the branded consumer foods space.Why It’s Interesting

A Leader in Every Aisle: They hold the #1 or #2 market share position in a staggering number of categories. This dominance gives them immense bargaining power with retailers.

Attractive Valuation: General Mills is trading at a low valuation and high dividend yield relative to its history.

Growth Strategy: They are heavily investing in product quality and “newness” (targeting 25% of 2026 sales from new products) to prevent consumers from switching to generic store brands.

Dividend Yield

Current Yield: 5.5%

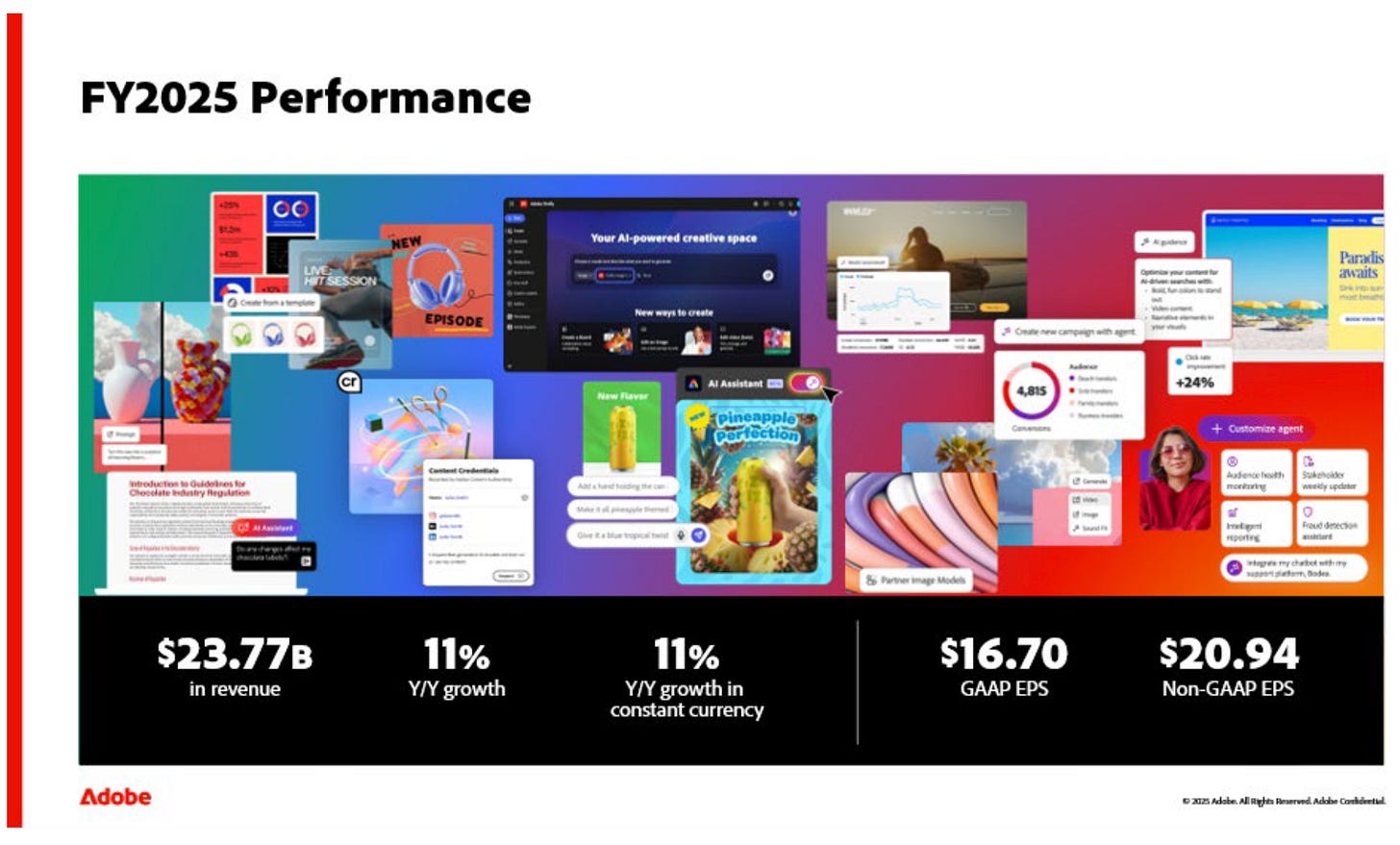

11. Adobe ($ADBE)

How the company makes money:

Adobe is the undisputed king of creative software. From Photoshop to Acrobat, their products are essential tools for the digital economy, delivered through a high-margin subscription model.Why It’s Interesting

A Serious Share Cannibal: Adobe is using its massive free cash flow to buy back shares at a historic rate, reducing their share count by over 6% in 2025 alone.

Low Valuation: After being caught up in the AI hype cycle, the stock has recently traded at a much more reasonable valuation.

AI Monetization: Their Firefly generative AI is being rapidly adopted by enterprise clients, creating a new upsell lever that is just starting to impact the bottom line.

Buyback Yield

Buyback Yield: 8.9%

10. Air Products & Chemicals ($APD)

How the company makes money:

Air Products provides essential industrial gases (like oxygen, nitrogen, and hydrogen) to customers in the electronics, energy, and healthcare sectors.

Why It’s Interesting

Necessary Products: Industrial gases are a tiny fraction of a customer’s total cost but are vital for production. This makes for long customer relationships and high switching costs.

The Long-Term Contracts: Most of their revenue is secured via 15-to-20-year “take-or-pay” contracts, creating predictable cash flows.

Hydrogen Leadership: They are currently a front-runner in the global transition to blue and green hydrogen, providing a long-term growth tailwind.

Dividend Yield

Current Yield: 2.7%

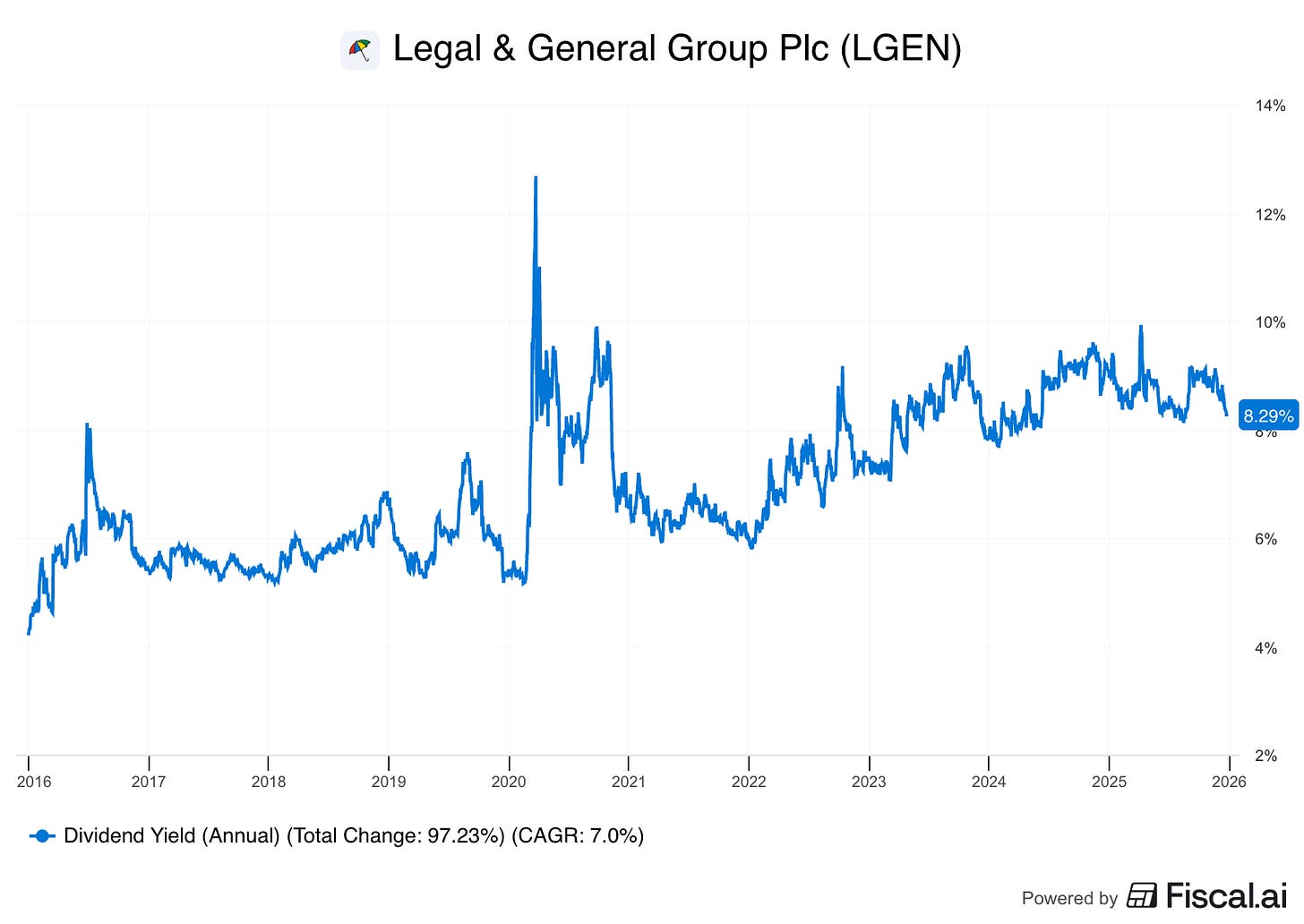

9. Legal & General ($LGEN.L)

How the company makes money:

Based in the UK, Legal & General is a financial services giant specializing in pension risk transfer, asset management, and insurance.

Why It’s Interesting

Sustainable High Yield: The stock has a dividend yield north of 8%, supported by a massive free cash flow of £4+ billion.

Aging Demographics: As baby boomers retire, the demand for pension de-risking services is exploding, which is a market where Legal & General is a global leader.

Simplified Strategy: Management has recently pivoted to focus on their core, high-return businesses, which should lead to more consistent capital returns.

Dividend Yield

Current Yield: 8.1%

8. Extra Space Storage ($EXR)

How the company makes money:

Extra Space Storage is the largest self-storage operator in the U.S. (by store count), managing over 4,000 properties across the country.Why It’s Interesting

Capital-Light Growth: A significant portion of their business is managing stores for other owners. This generates high-margin fee income without the need to own the real estate.

Consolidation Opportunity: The self-storage industry is still highly fragmented. Extra Space uses its tech platform to identify and acquire smaller operators.

Inflation Hedge: Because storage leases are usually month-to-month, they can adjust pricing much faster than office or retail landlords when inflation rises.

Dividend Yield

Current Yield: 4.5%

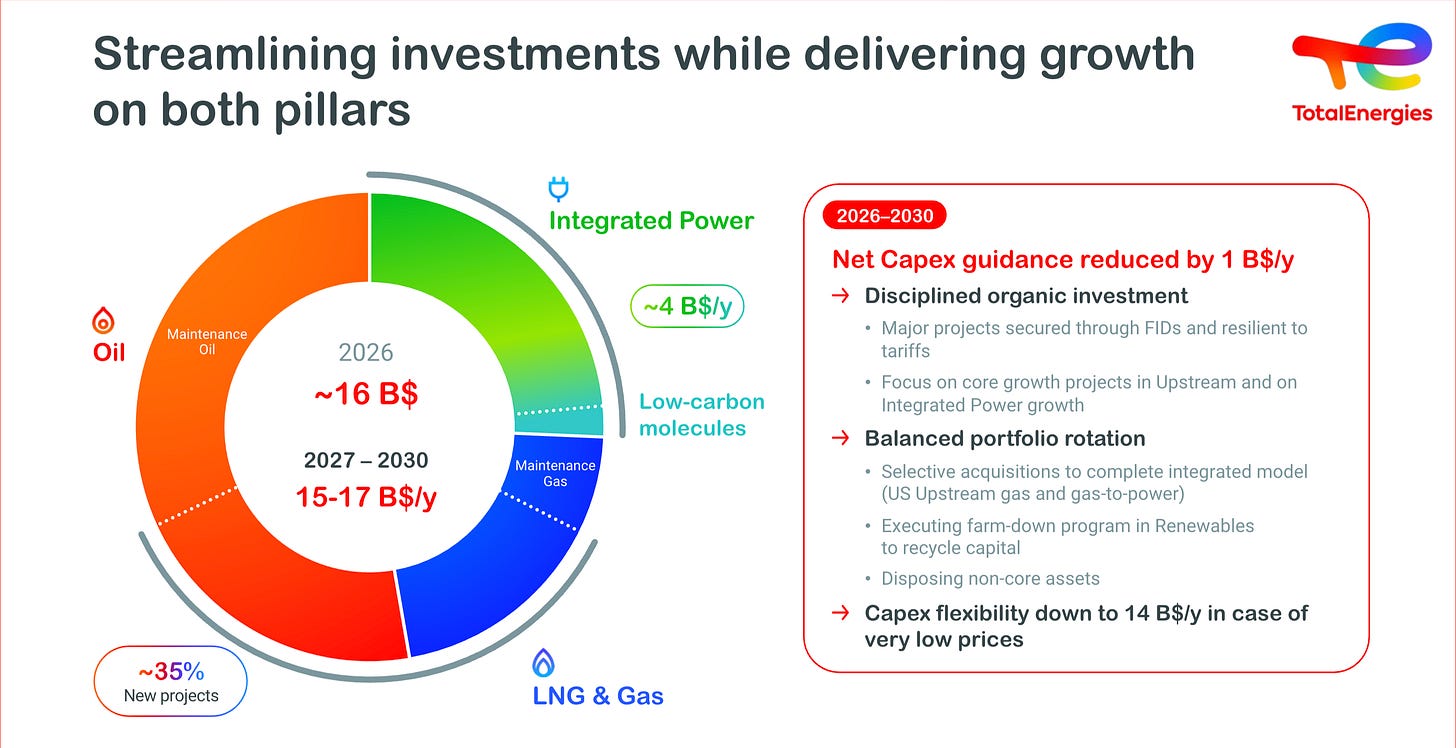

7. TotalEnergies ($TTE)

How the company makes money:

TotalEnergies is a French multi-energy giant. While they are a major oil and gas producer, they are transitioning faster than almost any other peer into renewables.Why It’s Interesting

Diversified Energy Strategy: TotalEnergies is reinvesting oil profits into a massive portfolio of wind and solar assets, aiming to be a top-5 global renewable power producer by 2030.

Low Cost Producer: Their traditional oil projects have some of the lowest production costs in the industry, allowing them to remain profitable even at low oil prices.

Valuation: Like many European energy firms, it trades at a significant discount to its U.S. peers (like Exxon or Chevron) despite having a more progressive transition plan.

Dividend Yield

Current Yield: 5.9%

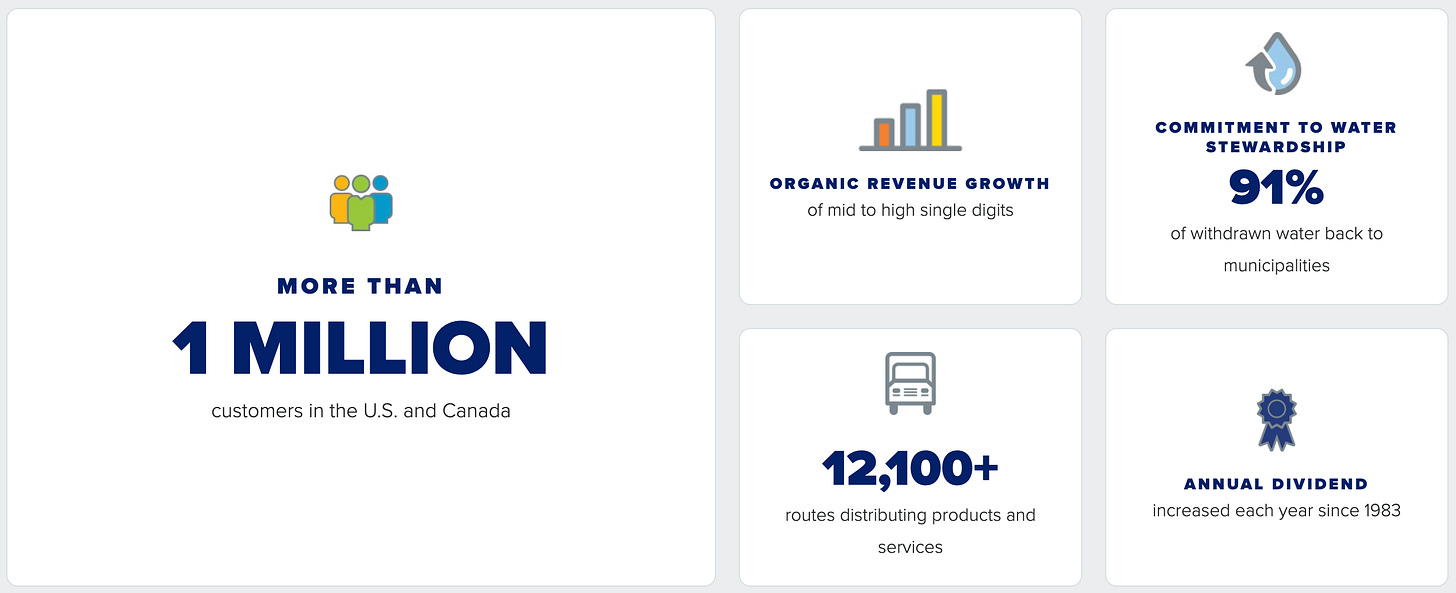

6. Cintas ($CTAS)

How the company makes money:

Cintas provides branded workwear, facility services (mats, mops), and first aid kits to over one million businesses.Why It’s Interesting

Route Density: Once a Cintas truck is already stopping at a customer’s location to drop off uniforms, it costs almost nothing to also sell them soap, mats, and fire protection.

Consistent Growth: Historically, Cintas has grown its earnings at a multiple of US GDP growth, showing incredible resilience across different economic cycles. They’ve also proposed a merger with UniFirst, which would result in a big jump in customer numbers.

Operational Excellence: They consistently operate at high margins, reflecting a culture obsessed with efficiency and customer retention.

Dividend Yield

Current Yield: 0.9%

Top 5

That’s it for today.

The Top 5 stocks are available to Partners of Compounding Dividends.

You are not a Partner yet? You can secure your spot here:

Please note there is a money-back guarantee of 90 days.

This means you can test it out risk free.

Everything in life compounds

Pieter (Compounding Quality)

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

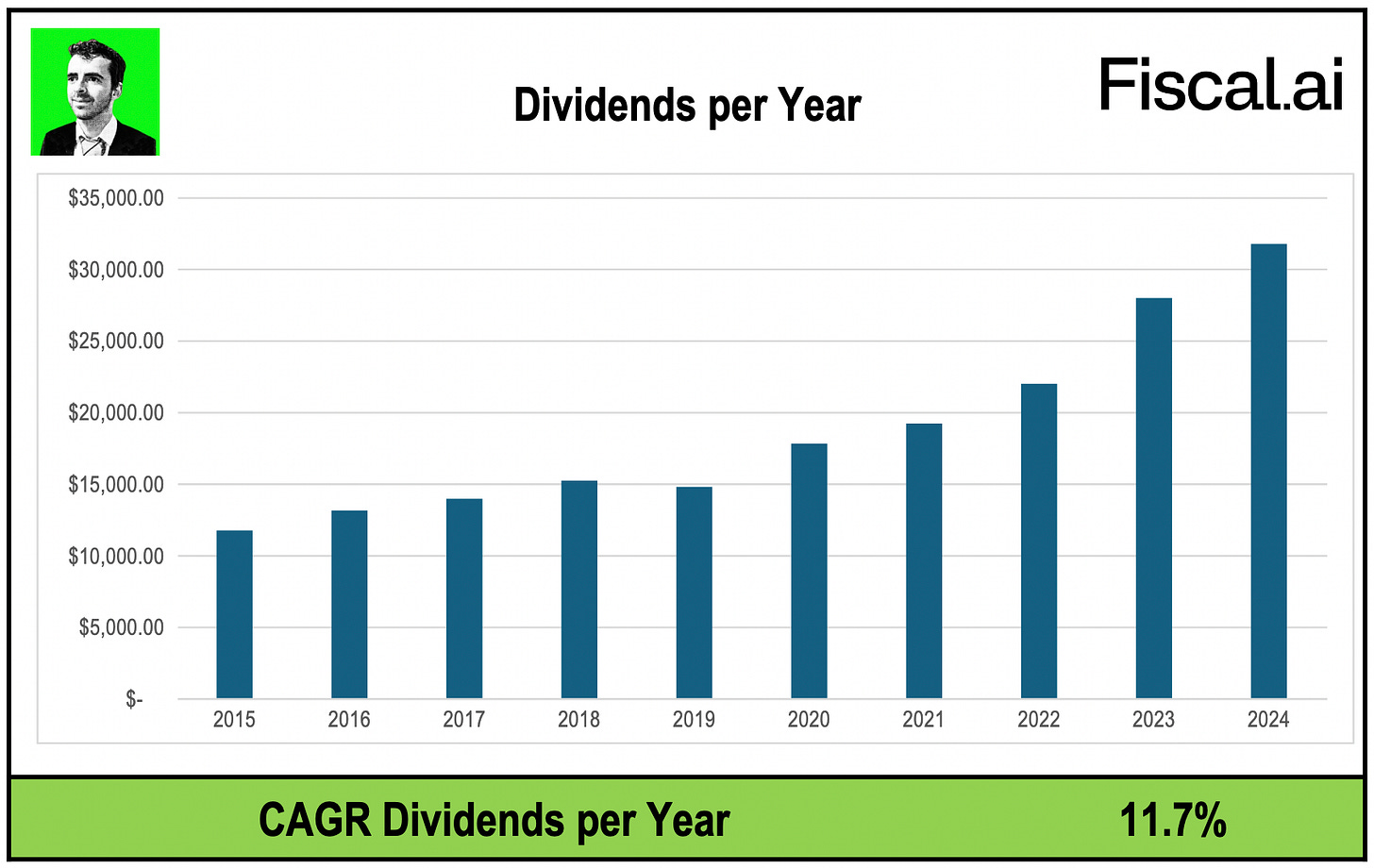

Fiscal.ai: Financial data

AWESOME