The Berkshire Hathaway weekend was amazing.

Warren Buffett's announcement of his ‘retirement’ was emotional.

Let’s discuss everything you need to know today.

TV Show

Last Tuesday, I was a guest on the Belgian TV Show ‘De Afspraak’.

Why? To talk about Warren Buffett, of course.

Dutch-speaking Partners can rewatch the episode here:

Law of large numbers

What is the key challenge of Berkshire Hathaway?

The law of large numbers.

It’s much easier for a company with $5 million in revenue to 10x its sales than for Apple, which already generates $400 billion in yearly revenue.

That’s why Buffett says that anyone who says size doesn’t hurt performance is selling.

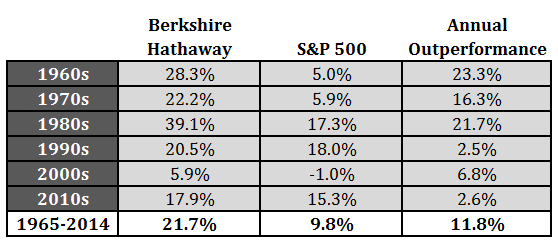

As you can see in the table, that’s why the outperformance of Berkshire Hathaway gradually decreased over the years:

Today, Berkshire Hathaway sits on a massive cash position of $347 billion.

There are two main reasons for this:

Warren Buffett thinks the market is overvalued right now

He can’t find enough attractive investment opportunities that move the needle for Berkshire

Finding new investment opportunities will be the key challenge for Greg Abel, Warren Buffett’s successor.

Today, Berkshire Hathaway has over $1 trillion (!) in assets.

It can be seen as the Titanic. The boat is so large that it’s hard to change direction (I don’t think Berkshire Hathaway will sink, though).

Last weekend, Jason Zweig wrote an excellent piece called ‘Why There Will Never Be Another Warren Buffett’. I would highly recommend you read it.

Tariffs

Another important takeaway from the meeting?

Buffett is not pleased (at all) with the import tariffs. He mentioned other countries could interpret it as an act of war.

Nobody wins in a trade war. It makes no sense for a country like the United States to produce goods like shoes (which are now produced for $2-$3 in Vietnam).

Import tariffs lead to the following:

Higher inflation

A higher unemployment rate

Many goods will become more expensive

Would you invest in Berkshire?

A lot of people ask me whether I would invest in Berkshire today.

The answer? I think Berkshire is amazing.

Over the past 5 years, Berkshire Hathaway returned +190% versus 90% for the S&P 500.

I think Berkshire Hathaway is still an amazing investment.

But I also think that their large size hurts their performance.

You should see Berkshire Hathaway as a holding company that will probably slightly outperform the S&P 500 in the long term.

The great thing about Berkshire Hathaway is that it provides diversification opportunities:

When the stock market goes up, Berkshire will lag the S&P 500

When the stock market goes down, Berkshire will outperform

"We will continue to underperform in strong bull markets and outperform in bear markets." - Warren Buffett3 Stocks Buffett Would Love

I returned from Omaha with a lot of interesting investment ideas.

Let’s discuss three of them.

3. Markel ($MKL)

How does Markel make money?

Markel makes money by selling insurance policies, investing the premiums, and earning returns on those investments.Markel hosted their annual Markel lunch on Sunday.

Simon Wilson, the head of insurance since March 2025, made a strong impression.

He was also very honest about the recent underperformance versus competitors.

Wilson seems transparent and very focused. It’s exactly what we want to see.

He managed to bring down the combined ratio from 90.4% in 2022 to under 80% for the Markel International subsidiary.

The combined ratio is a key number for insurance companies. The lower this ratio, the better.

You can calculate the combined ratio by taking the sum of all expenses and incurred losses and dividing this number by the total premiums an insurance company receives.

Combined ratio > 100%: The insurance company makes a loss

Combined ratio < 100%: The insurance company makes a profit

The fact that Wilson brought down the combined ratio of the international subsidiary by over 10% is an amazing achievement.

A tremendous amount of shareholder value would be created if Wilson could do something similar for Markel’s global operations.

A picture of Tom Gayner (CEO Markel) and me taken in 2023 during the Berkshire weekend:

By the way, you can rewatch the recording of Markel from last weekend here:

2. Dillard’s ($DDS)

How does the company make money?

Dillard's makes money by selling clothing, cosmetics, and home goods in its department stores and online.Dillard’s is an idea I got from my friend Todd Lechtenberger. He is the CEO of Amalfi Investments.

Dillard’s is not your classical Quality Play.

The positive? They have a healthy Net Cash Position, an ROIC of 40.7%, and a Free Cash Flow Margin of 9.2%.

On the other hand, the company has not been growing at attractive rates recently.

The main reason for investing in Dillard’s? A cheap valuation in combination with heavy share buybacks.

Dillard’s currently trades at a FCF Yield of 14.3%. Over the past 10 years, they bought back 55.7% (!) of their outstanding shares.

That’s an average of 8.6% per year.

As Dillard’s has a dividend yield of 0.3%, this means the average shareholder yield (Dividend Yield + Buyback Yield) equals 8.9% per year.

Now let’s dive into our favorite stock idea (spoiler alert: it’s a company I already own).