42 High-Quality Stocks

How to use Finchat

Finchat is an amazing tool.

I use it to create investment cases and find interesting stocks to buy.

Today, I’ll show you how I use Finchat in an efficient way.

How to use Finchat?

I use Finchat mainly for two things:

Screen for Quality Stocks

Check the fundamentals of companies

Screen for Quality Stocks

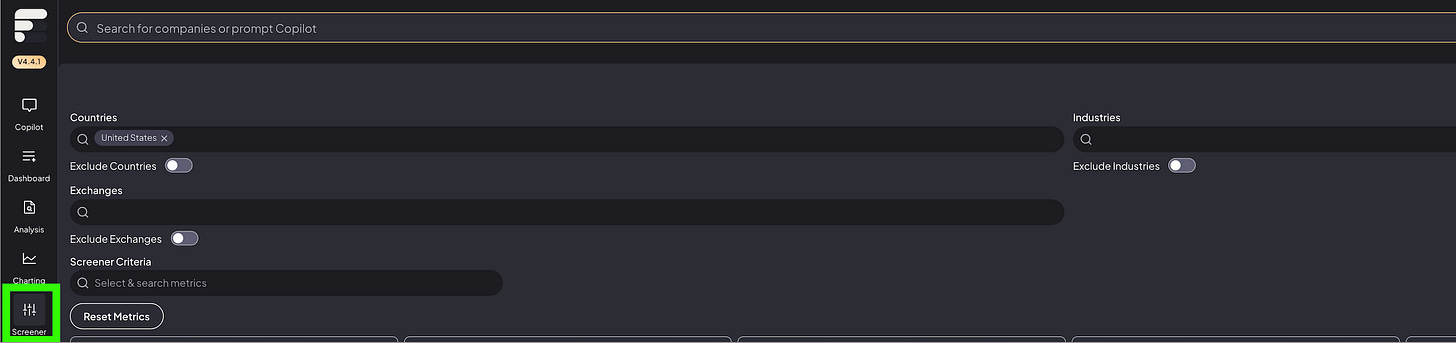

How to screen for Quality Stocks?

On the left, click on the ‘Screener’ section

Here are the criteria I use:

Revenue growth > 7% per year

EPS growth > 10% per year

FCF / Net Income > 80%

Profit Margin > 10%

ROIC > 15%

Net Debt / EBITDA < 3X

Please note the following:

We want Revenue Growth to be more than 7% per year (past and future).

We want EPS Growth to be more than 9% per year (past and future).

In Finchat, the screening criteria look like this:

I exclude China and some cyclical industries as I don’t consider them within my circle of competence.

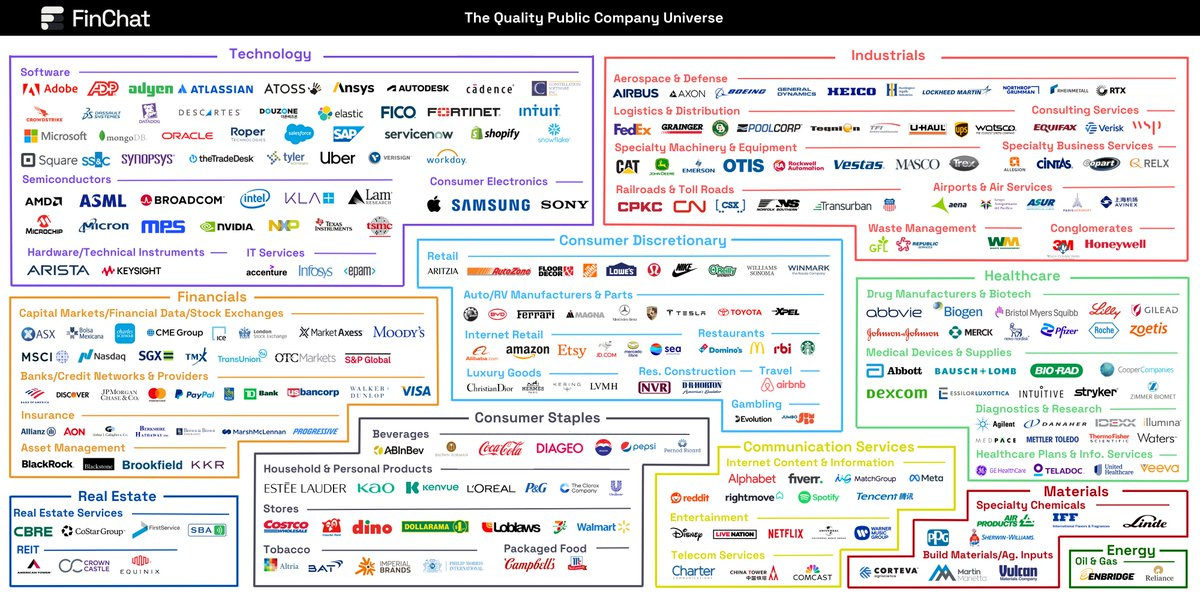

The companies that match these criteria are the following (click on the picture to expand):

As you can see, there are a lot of high-quality names in this list.

Think about Visa, Mastercard, Hermès, ASML, Adobe, Arista Networks, Fortinet, Fair Isaac, MSCI, IDEXX Laboratories, Rollins, …

You can use the output of this stock screener as a basis for future research.

Adobe, for example, seems to be trading at low valuation levels today:

Check the Fundamentals

Finchat is also an amazing tool to check the fundamentals of a company.

Let’s say we want to dig deeper into Adobe, for example.

Use the search bar and look for Adobe

When you do this, you can immediately look at the most important Fundamentals of Adobe:

A few things that stand out?

Adobe’s profitability is amazing:

Gross Margin of 89.2% and a Free Cash Flow Margin of 41.7%

They allocate capital well

ROIC: 22.7%

The company seems to look cheap

Forward P/E: 16.8x

Adobe has a healthy balance sheet

Net cash position of $873 million

Adobe grew attractively in the past

Historical Revenue and EPS Growth over the past 10 years: 17.9% and 37.9%

The future looks interesting too

The expected long-term EPS Growth equals 14.9%

One important sidenote to make for Adobe?

They pay quite a lot of Stock-Based Compensation.

Stock-Based Compensation as a percentage of Net Income equals 27.5%.

It is a cost for shareholders and should be treated accordingly.

It’s important to highlight that the Forward PE of 16.8x in Finchat looks at the Non-GAAP Earnings.

Stock-Based Compensation isn’t included as a cost in Non-GAAP Earnings (it is in GAAP Earnings).

We should deduct the Stock-Based Compensation of $1.86 billion from Adobe’s Expected Net Income of 2025 ($7.1 billion).

This brings us to an adjusted Net Income of $5.24 billion.

As the current market cap equals $150 billion, Adobe trades at an actual PE of 28.6x.

This sounds like a fair valuation level if you ask me.

Finchat

As Finchat is launching some major updates to its platform this week, they are celebrating with a discount of 25%. Finchat offers a discount only two times a year.

This discount is valid until Thursday, May 1st.

You can take advantage by using this link and going to the ‘View Plans’ section:

Everything In Life Compounds

Pieter

I have been using Finchat more and more lately. One handy feature is the ability to make your own custom formulas and ratios. For example, you can make one to calculate the percentage of SBC to FCF or Net Income. The ratio can then be applied to all ticker symbols or it can stay local the one you were looking at. Cool stuff!

I have finally taken the plunge, subscribing to Finchat today. The feeling of empowerment and emancipation that doing your own research and homework brings is really great, and one of the biggest draws to the educational component in Compounding Quality.