💰 5 Lessons From 'The Psychology of Money'

Morgan Housel

Looking for serious investors

Do you want to become a better investor in 2026? We are looking for a few investors who want to step up their game. Sounds like something for you? Apply here.The Psychology of Money is one of my favorite books on personal finance ever.

Most books explain how to make money, this one teaches you how to think about money.

Let’s dive into its most important lessons today.

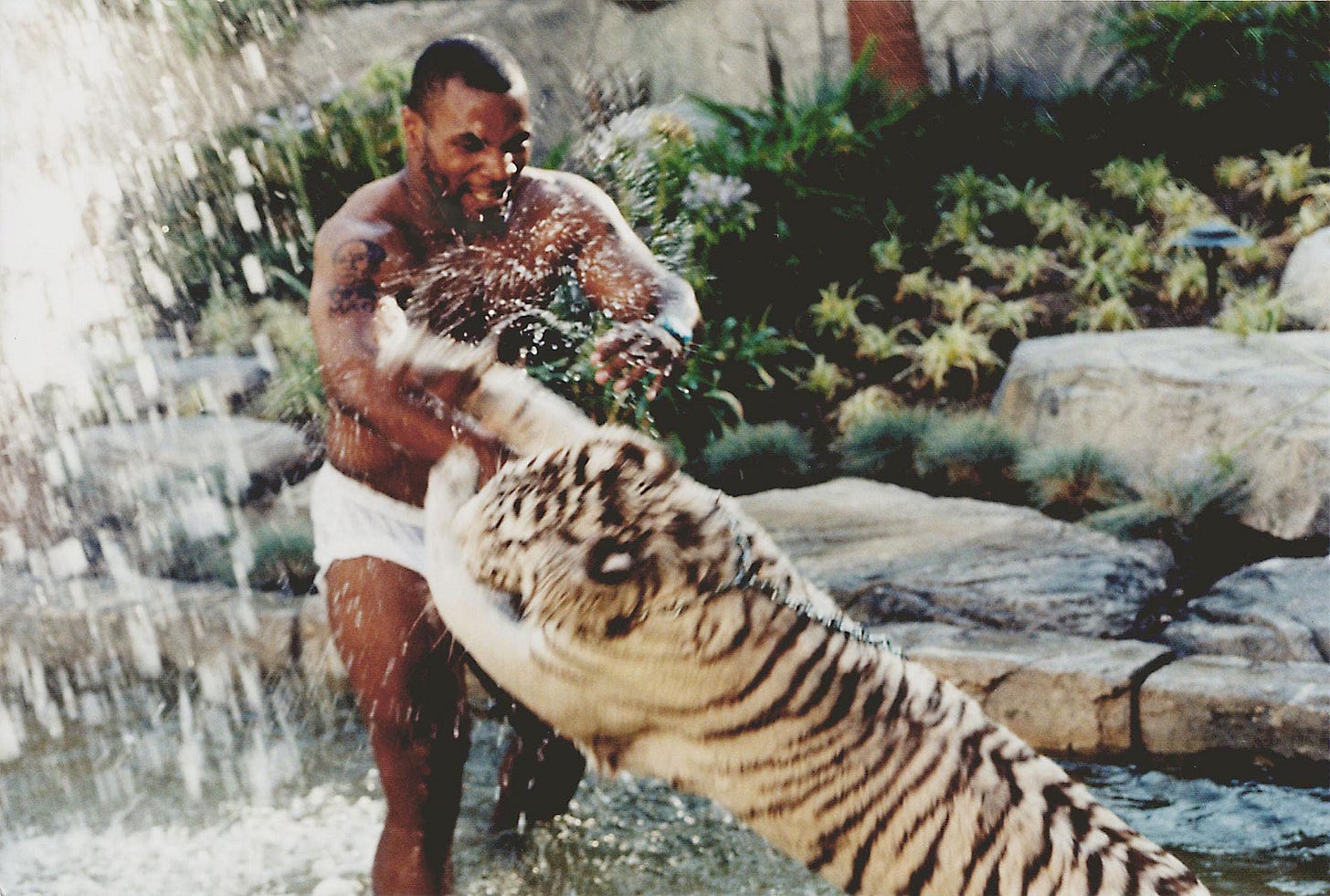

Mike Tyson earned more than $300 million during his boxing career.

He bought huge houses, cars, and threw crazy parties.

He even had three Bengal tigers that cost about $200,000 per year to feed and care for.

He seemed on top of the world, but in the end, he went bankrupt.

Tyson later said that the real fight wasn’t in the ring, it was in his head.

The money wasn’t the problem. His behavior was.

The Psychology of Money is all about how you think and act with money.

These 5 lessons from the book will help you to avoid ending up like Mike Tyson.

1. No one’s crazy

"Everyone forms money beliefs based on their own life experiences, not objective truth."People make financial decisions based on their own unique history.

We all make money choices based on where we grew up, how the economy felt, what our parents did, and even what inflation was like when we were kids.

So something that looks “crazy” to you may be totally logical to someone else.

An example?

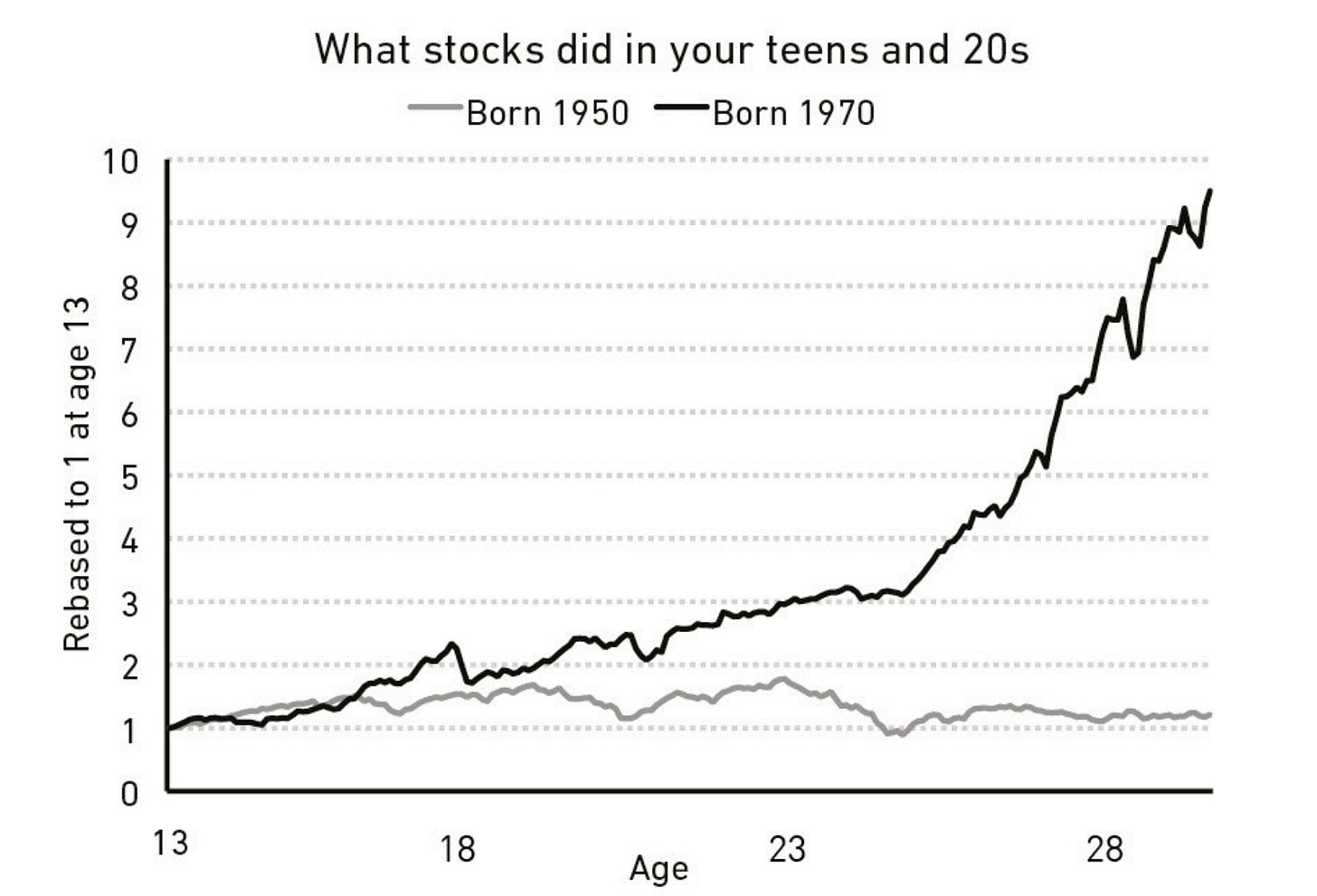

How the market performed during your teens and 20s.

If you were born in 1970, the S&P 500 increased almost 10-fold

If you were born in 1950, the market went nowhere

Same country, same market…

… but two completely different experiences.

The result?

The investor born in 1970 will naturally believe “the stock market always works, invest and you’ll get rich.”

The investor born in 1950 will easily believe that “stocks are risky and unreliable, you can’t count on them.”

Neither investor is crazy.

2. When is enough enough?

"If you don’t know what “enough” is, you’ll make decisions that destroy everything."Chasing more money, more status, or more returns, can push you into terrible choices.

No amount of money can satisfy someone who doesn’t know what “enough” is.

Rajat Gupta grew up poor, but became CEO of McKinsey and a top businessman.

By 2008 he was worth around $100 million.

He had more than enough money to happily live for the rest of his life.

But surrounded by billionaires, he started comparing himself to them.

That pushed him to pass insider information from Goldman Sachs board meetings to hedge fund manager Raj Rajaratnam.

Gupta was convicted of insider trading, sent to prison, and lost his career and reputation.

Even extraordinary success doesn’t mean much if you don’t know when to stop.

3. Wealth is what you don’t see

“Wealth is the nice cars not purchased… the diamonds not bought… the first-class upgrade declined.”People often think a hard workout burns lots of calories, but research shows we burn a lot less than we think.

After exercising, many people treat themselves with snacks or big meals, and end up eating more calories than they burned.

They feel like they deserve it because they “worked for it.”

Money works the same way: a big paycheck can make you feel like you’ve earned the right to spend a lot.

But wealth comes from resisting that feeling and keeping more of what you make.

This kind of discipline isn’t exciting.

It’s what builds a bigger and bigger advantage over time.

4. Nothing is free

"Everything has a price, but not all prices appear on labels."Everything in finance has a hidden price.

Big returns, long bull markets, and life-changing wealth always come at a price.

That’s usually paid in stress, volatility, and uncertainty.

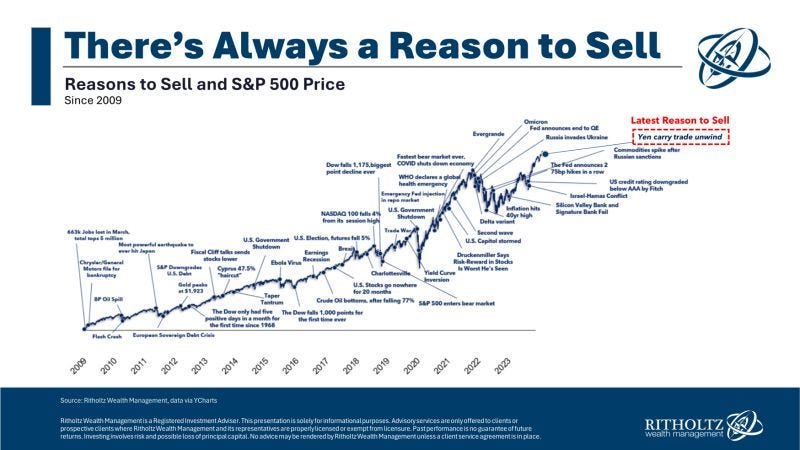

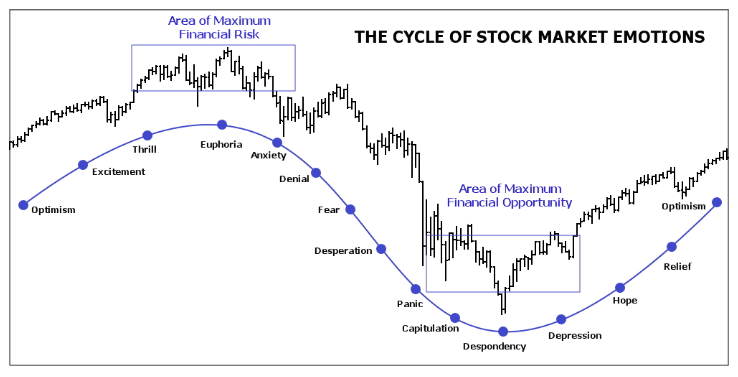

Just look at the stock market.

The long-term return of around 10% a year sounds amazing, but the real cost is living through crashes, corrections, and years that feel like failure.

Most people want the return but don’t want to pay the emotional price.

So they panic, sell too early, or jump into the next trend just before it collapses.

This is why so many investors struggle.

The people who build wealth aren’t the smartest, they’re the ones who accept that volatility is the price of admission.

5. Freedom is the best dividend you’ll get

The highest form of wealth is the ability to wake up every

morning and say, “I can do whatever I want today.”Many believe that money itself brings happiness, but happiness comes from the control money gives you over your own time.

Think of someone stuck in a high-paying job they hate.

The salary looks amazing on paper, but their days are packed with stress and pressure.

Now compare that to someone earning less but decides when they work, where they work, and who they work with.

Which person would you rather be?

The real dividend from wealth is the ability to live life on your own terms.

Conclusion

That’s it for today.

Here are the five most important lessons from The Psychology of Money by Morgan Housel:

Stop judging others’ decisions, everyone is shaped by personal experiences you cannot see

Define what ‘enough’ is for you, otherwise you’ll never be satisfied

Real wealth comes from what you keep, not what you spend

Every reward comes with a cost, understand what it is so you know if you’re willing to pay it

Money gives you control over your time, which is the deepest form of freedom

Everything in life compounds

Pieter (Compounding Quality)

PS I am looking for a few interested investors who want to step up their investment game. You can apply here if you think it’s something for you.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Brilliant: "The people who build wealth aren’t the smartest, they’re the ones who accept that volatility is the price of admission."

"There is always a reason to sell" - Say that to someone whose investing life was from 1930 to 1950 or 1965-82..