7 Future Compounding Machines

Serial Acquirers

Serial Acquirers can be amazing investments.

Just look at Constellation Software. They returned +25.000% to shareholders since 2006.

Let’s dive into 7 undiscovered serial acquirers today.

Serial Acquirers

Last month, we wrote an article about serial acquirers. Two topics were covered:

Why serial acquirers outperform the market

5 interesting examples

In case you missed it, you can read it here.

It became clear that you love serial acquirers:

For that reason, let’s look at 7 undiscovered serial acquirers today.

7. LeMaitre Vascular (NDQ: LMAT)

How does LeMaitre Vascular make money?

LeMaitre Vascular makes tools that help doctors fix blood vessels. These are the tubes that carry blood in your body. Their product portfolio includes over 100 devices, spanning vascular grafts, stents, angioplasty balloons, patches, and surgical instruments.LeMaitre is a specialist. They apply a roll-up strategy in a niche, fragmented market.

Their market enjoys some structural growth trends:

Aging global population: older people have more problems with blood vessels

Need for precise tools: surgeons prefer to use small tools (LeMaitre’s specialty)

Increased demand from emerging markets: more people in developing countries are getting access to hospitals

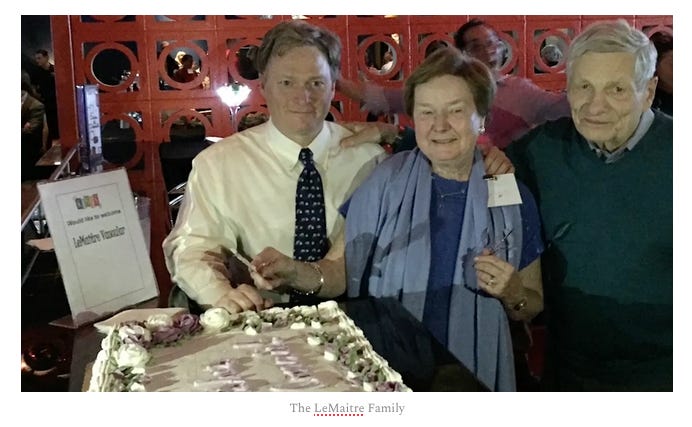

LeMaitre is also a textbook example of an Owner-Operator. George D. LeMaitre was a vascular surgeon and founded the company in 1983.

Today, his son George W. LeMaitre is the CEO and Chairman and still owns 8.4%.

Why LeMaitre is interesting:

The company benefits from structural growth trends

It’s a textbook example of an Owner-Operator

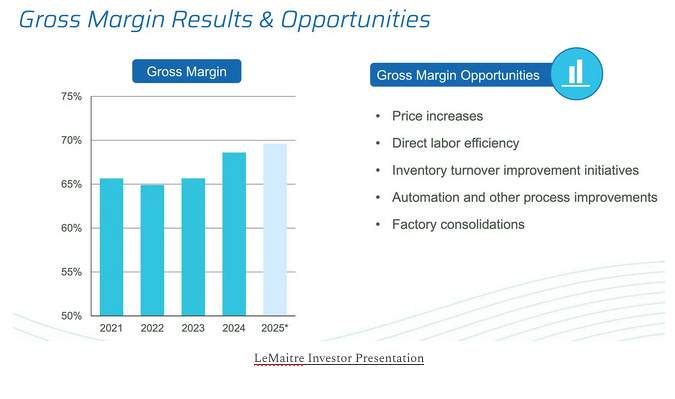

LeMaitre possesses pricing power:

6. Computer Modelling Group (TSX: CMG)

How does Computer Modelling Group make money?

CMG makes simulation software that helps petroleum engineers understand how oil & gas flow underground. However, Pramod Jain (CEO) is transitioning the company into a serial acquirer of high-quality software companies.Behind every Warren Buffett, there is a Charlie Munger: someone who is less known but equally important in the success story.

Although he lives like a ghost, most investors know the Warren Buffett of Constellation Software: Mark Leonard.

But the Charlie Munger of Constellation Software? Completely under the radar…

But not for us.

The Charlie Munger of Constellation Software is Mark Miller.

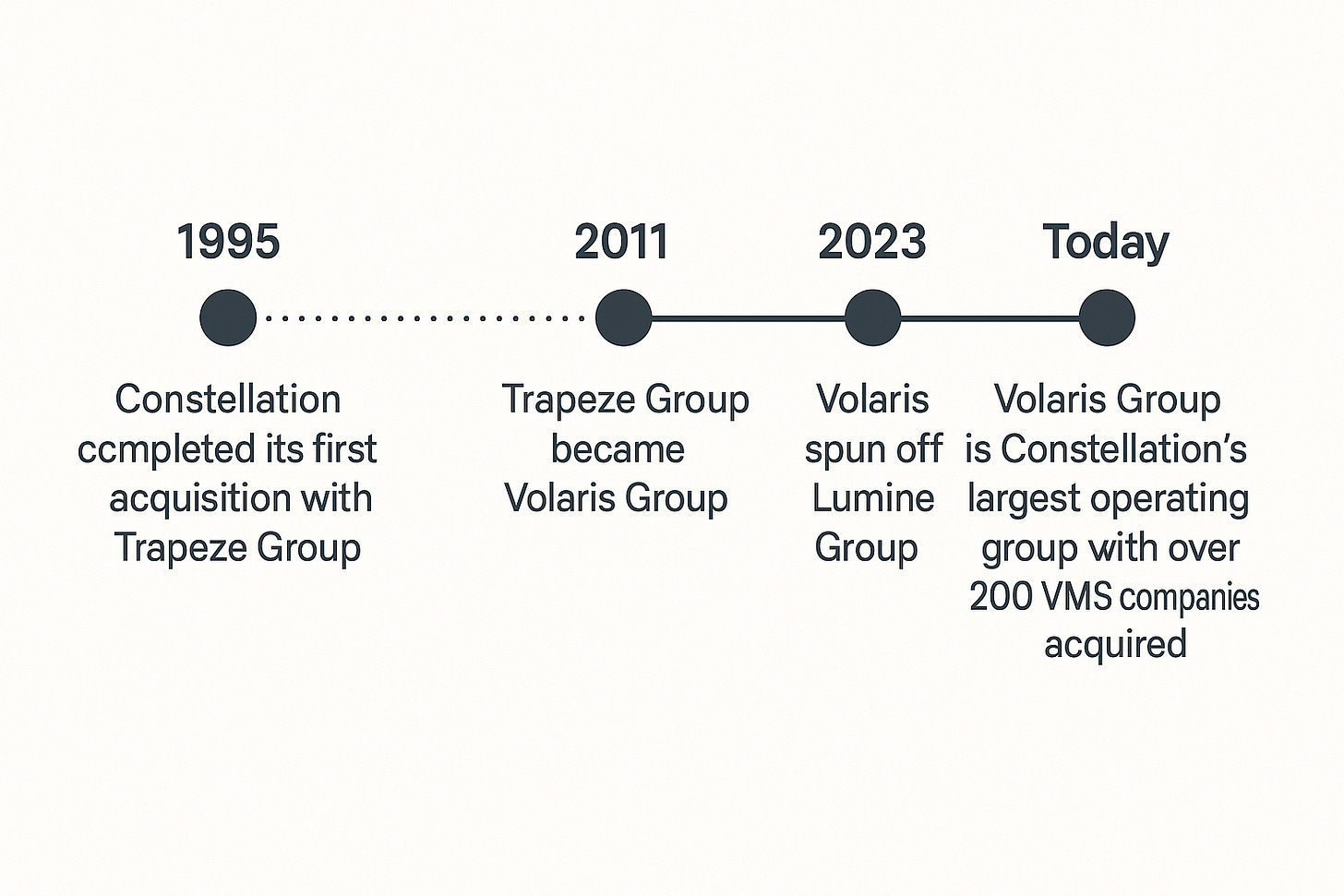

A little Constellation Software history:

The CEO of Trapeze Group / Volaris Group the entire time was Mark Miller. He is also COO of Constellation Software and Chairman of the Board at Lumine Group.

You can see him as the right hand of Mark Leonard himself.

But to simplify, we will call him the Charlie Munger of Constellation.

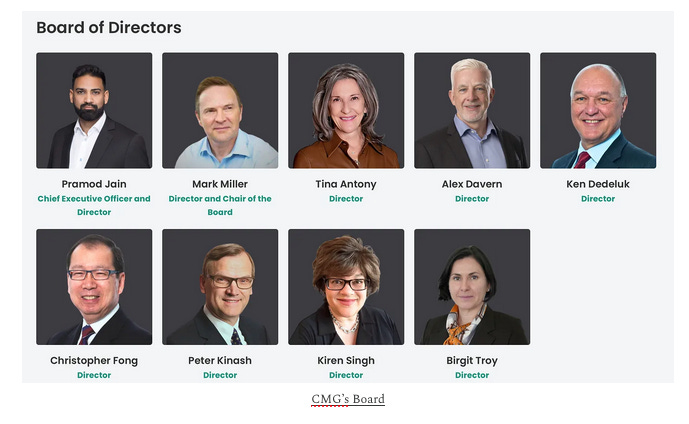

Now take a look at CMG’s board:

Found him?

Mark Miller is the Chair of the Board at Computer Modelling Group.

And the Constellation influence at CMG doesn’t end here.

Birgit Troy, a board director at CMG, was Portfolio CFO and leader of the M&A team at Lumine Group.

And then, there’s CMG’s largest shareholder: Andrew Pastor, a Constellation board member.

He owns 41.2% of CMG.

Did we find a mini Constellation Software?

Besides the Constellation operators, there’s also Pramod Jain (CEO). His shareholder letters are full of insight like this:

"A colleague recently challenged me with the question, 'What is that one word that you stand for?'

It was an easy answer for me because it is a deeply held and long-standing belief. That one word is 'compounding'. Compounding is said to be the 8th wonder of the world, and in both my personal and professional life.

I believe 'bring a 1% improved version of yourself every day and you’ll be 37 times better in a year'. Our employees know this well, as I’ve repeated it often since joining CMG. It is something I strive to do every day." - Pramod Jain, CEOWhy CMG is interesting:

Top-tier Constellation insiders are joining the company

The CEO, Pramod Jain, is a true star

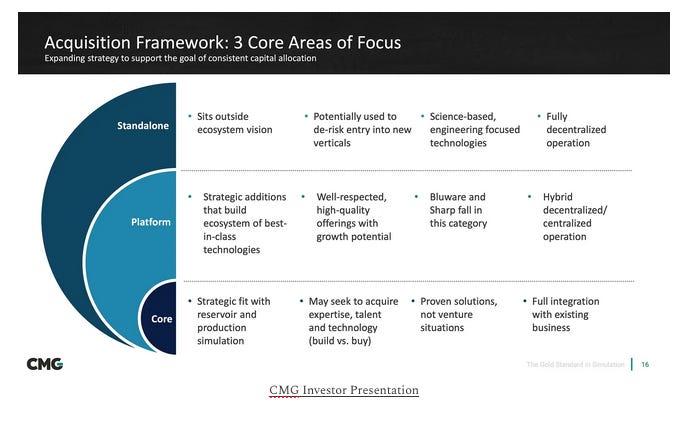

CMG wants to diversify outside the oil & gas market through acquisitions:

Quick update: Mark Miller recently left Computer Modelling Group. His replacement as Chair of the Board is Andrew Pastor.

While it’s never good to see someone as Mark Miller leave, his replacer is almost as impressive. This way, there’s also more insider ownership in the Board.

5. Fitlife Brands (NDQ: FTLF)

How does Fitlife Brands make money?

FitLife Brands develops and sells health and wellness products like supplements and sports nutrition. It makes money by selling these products through retail stores, gyms, and online channels.The main lesson I learned from reading “The Outsiders” by Thorndike?

Wonderful things happen when a CEO thinks like an investor, not just an operator.

This is exactly why Fitlife Brands is interesting.

Dayton Judd founded Sudbury Capital Management, an investment advisory firm established in 2012.

Through this investment vehicle, he came across an undermanaged company: Fitlife Brands.

This is when Dayton Judd decided to step in and completely transform the company.

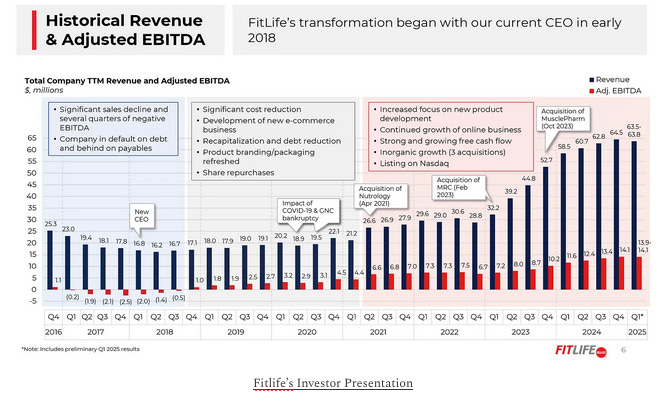

As you can see below, everything has changed at Fitlife since Judd became CEO in 2018:

Why Fitlife Brands is interesting:

Dayton Judd is a CEO with skin in the game (56.2% stake) who thinks as an investor

Impressive Growth: 5-Year EPS CAGR of 21.5%

Fitlife Brands looks cheap:

Fitlife Brands just recently closed an acquisition that will almost double its revenues. You can read the announcement here.

4. Sygnity (WSE: SGN)

How does Sygnity make money?

Sygnity is a large IT Group in Poland. Recently, it came under the Constellation Software umbrella and is now often referred to as "The Constellation of Poland". They have also pivoted into acquiring VMS companies.“Quality companies often have quality shareholders.”

If this is true, Sygnity should be a compelling opportunity.

A notable shareholder is Pinetree Capital, led by Damien Leonard, son of Mark Leonard.

Pinetree Capital ($PNP) is a publicly listed investment firm that primarily invests in early-stage software companies.

Other quality shareholders of Sygnity? Us!

We are already invested in this Polish compounder through Topicus, which owns 72.9% of Sygnity.

Why Sygnity is interesting:

They can benefit from the knowledge of Constellation Software

It’s mirroring Constellation Software’s success formula:

“ Since you are all quite familiar with Constellation and TSS … we will have a very similar approach” - Maciej Różycki, CEO Sygnity

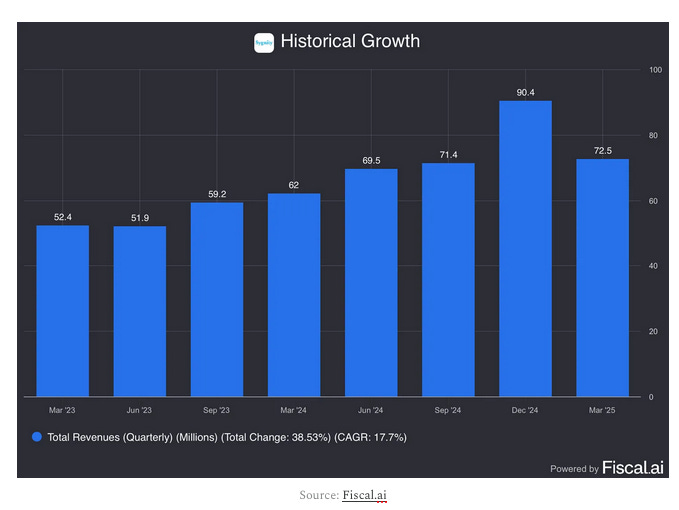

Growth has been accelerating during the last quarters:

Now let’s dive into the top 3.