7 Undiscovered Serial Acquirers

We love serial acquirers.

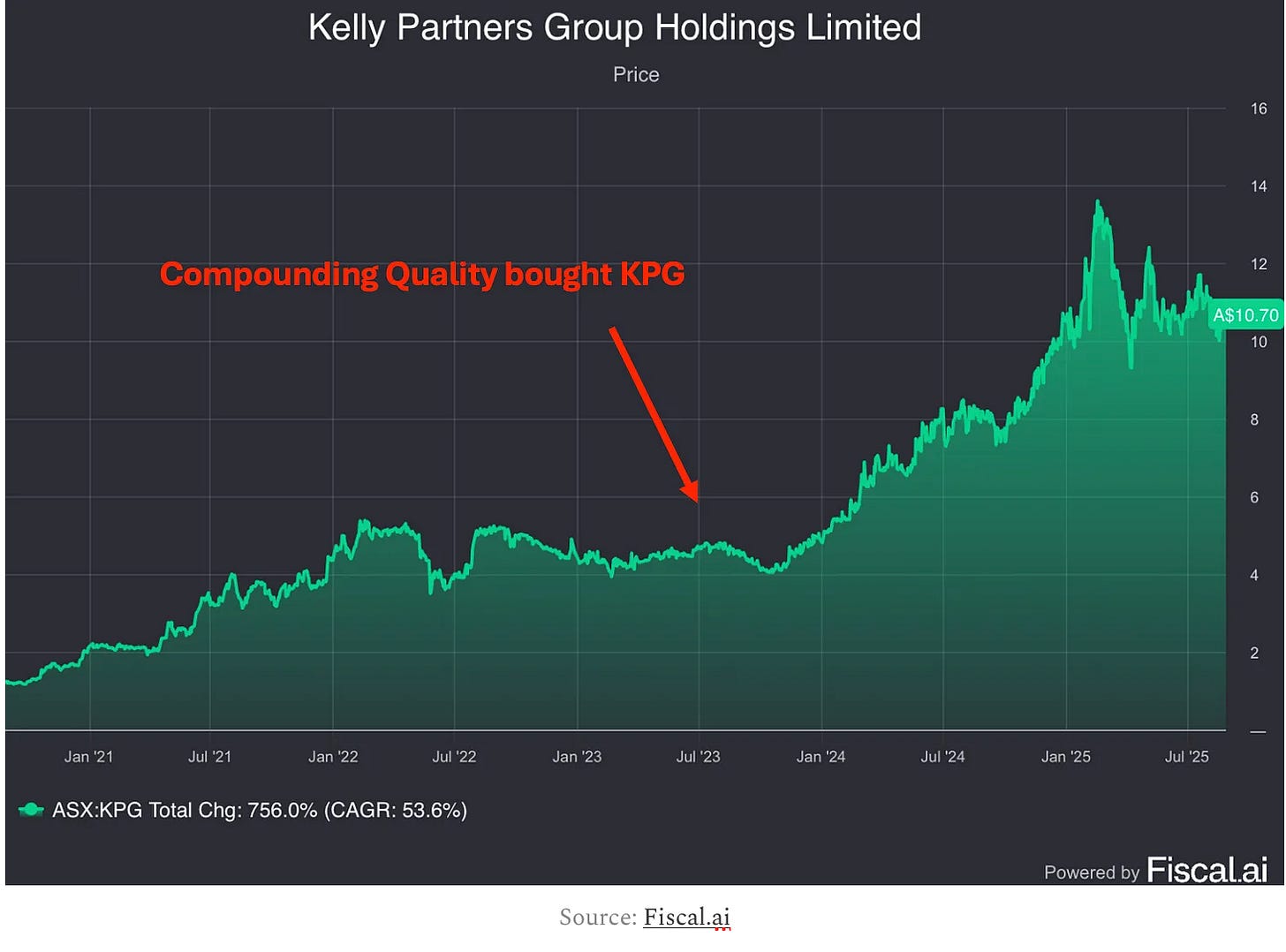

The best performing stock in Our Portfolio? Serial acquirer Kelly Partners Group.

Let’s look at 7 high-quality serial acquirers today.

7. Kingsway Financial Services (NSY: KFS)

How does Kingsway Financial Services make money?

Kingsway operates in two segments: Extended Warranty and Kingsway Search Xcelerator (KSX). The KSX segment is using a Search approach to acquiring companies.Kingsway isn’t a typical serial acquirer. It uses a Search approach to find promising acquisitions.

Here’s the key difference:

Serial acquirers buy companies and usually keep the existing management.

Search Funds first find a talented entrepreneur who wants to run a business, and only then look for a company where that entrepreneur can take the lead.

A Search Fund solves the biggest bottleneck common serial acquirers face: finding excellent operators to run their subsidiaries.

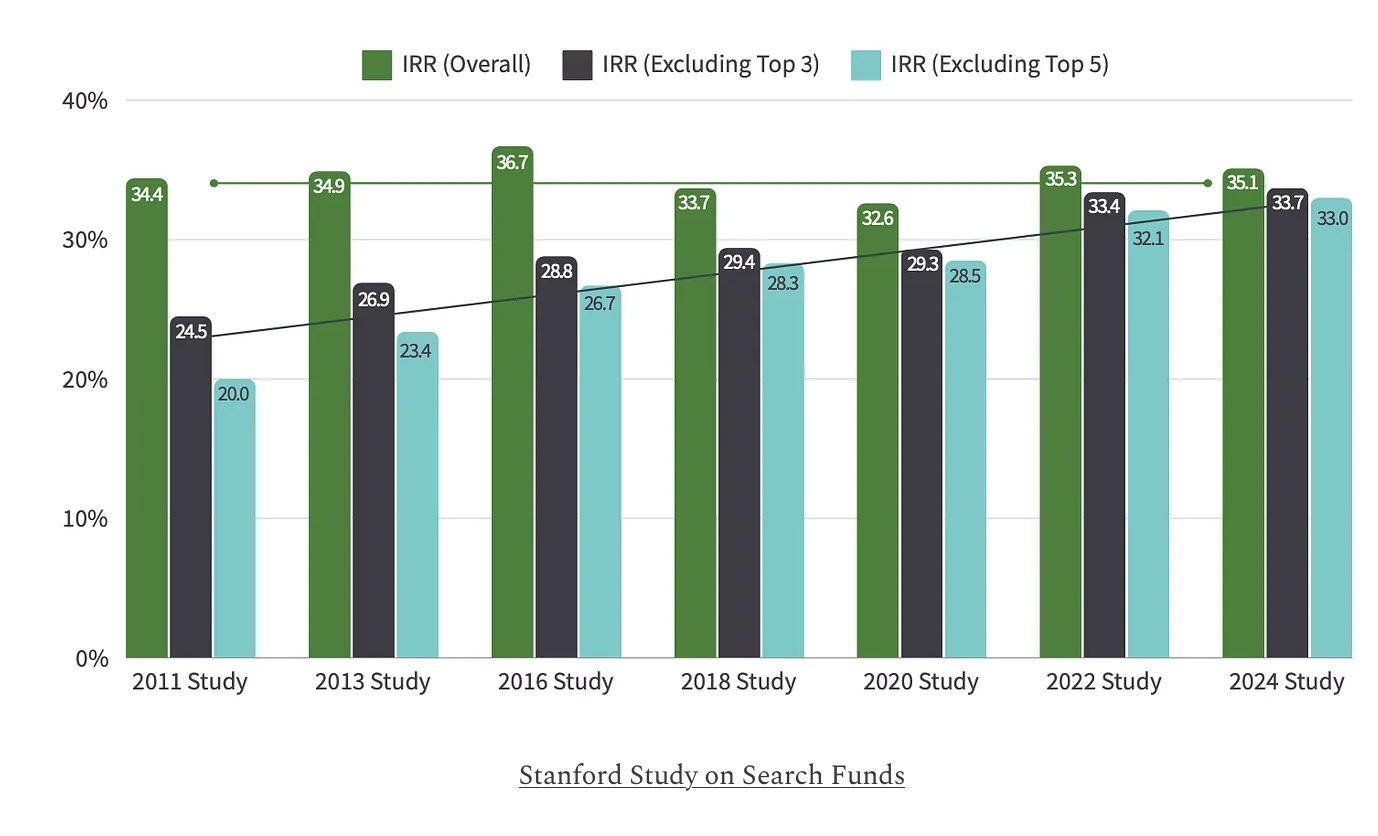

A deep study by Stanford found that 681 Search Funds had an average return of 35.1% (!) since 1984:

Why Kingsway is interesting:

Search Funds are one of the best investment vehicles

Kingsway is the only public U.S. company using the Search model

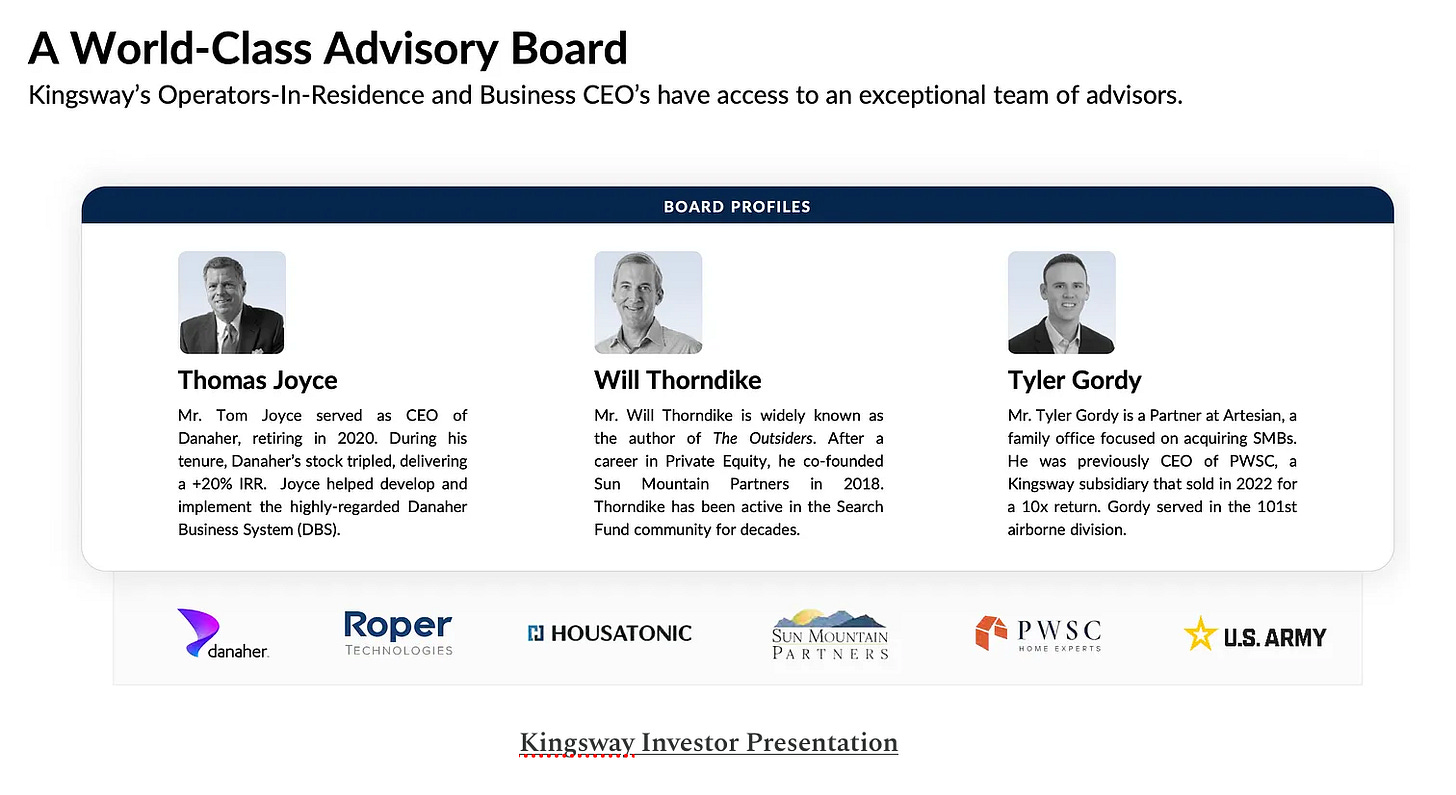

They have a world-class advisory board:

6. Teqnion (OMX: TEQ)

How does Teqnion make money?

Teqnion is building a diversified group of boring, industrial companies. They currently own 36 companies.Johan Steene runs his company exactly the way we want: honest communication, strict financial discipline, a strong emphasis on capital allocation …

And you can take running quite literally. Every morning he runs to the Teqnion HQ, and every evening he runs back home.

He lives 10km from the Teqnion HQ. But for Johan, 10km is the warm-up of the warm-up.

He is one of the best ultrarunners in the world. He even set a world record by running 283 miles in 67 hours.

That’s the equivalent of almost 11 marathons in less than three days.

Why Teqnion is interesting:

Johan Steene (CEO) and Daniel Zhang (Deputy CEO) are high-integrity people

The company has an excellent shareholder base with Chris Mayer (100-baggers) and Daniel Ek (Founder of Spotify)

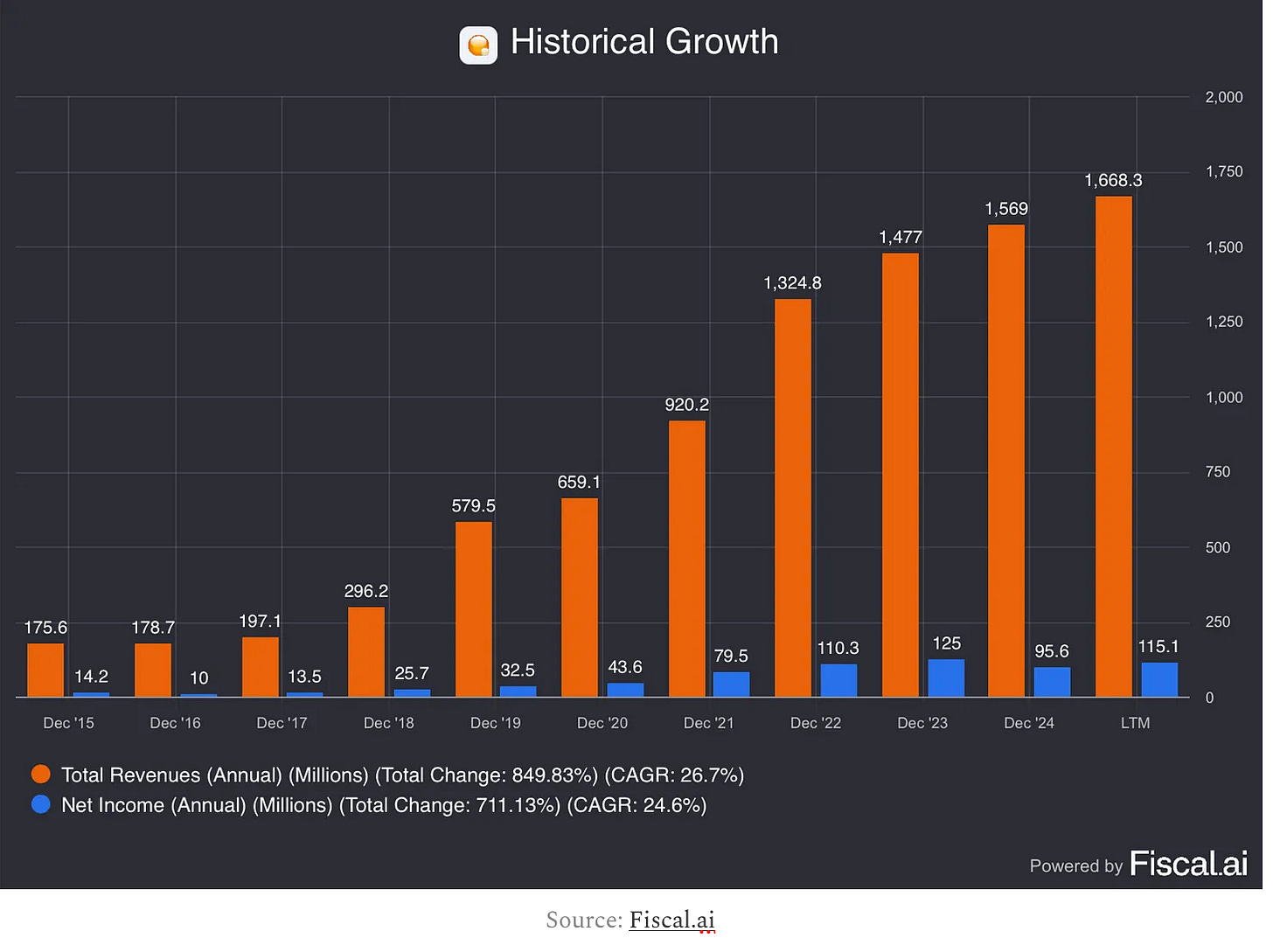

Impressive historical growth:

5. Diploma PLC (LSE: DPLM)

How does Diploma make money?

Diploma makes money by selling essential, high-margin components for industries like aerospace, medical, and industrial machinery. They grow profits through organic sales and by acquiring small specialist businesses with recurring revenue.The easiest way for a company to get on my radar? Mention “Quality Compoundingy.”

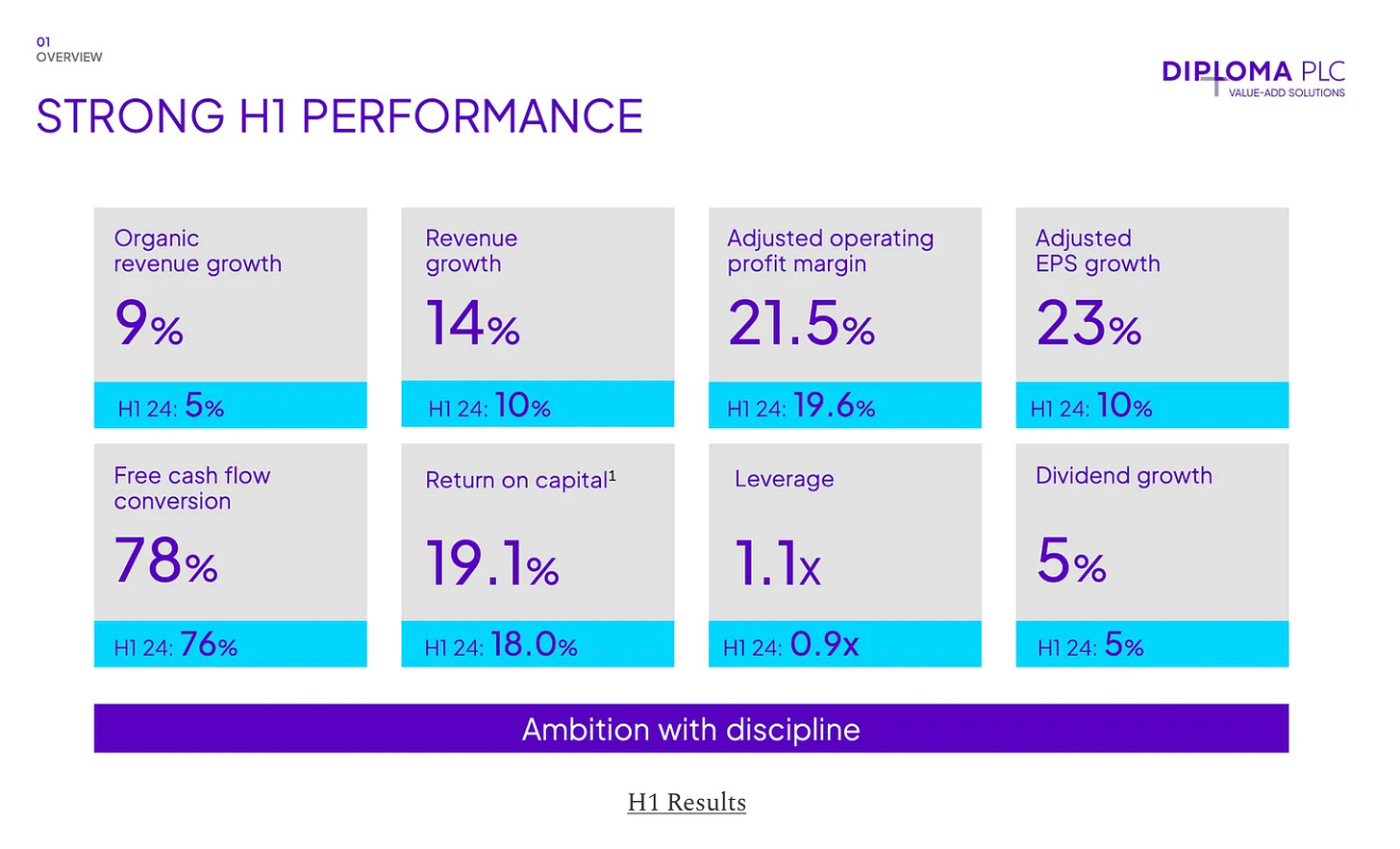

But more importantly, Diploma doesn’t just talk about it, they deliver.

Over the past 15 years, EPS grew at a CAGR of 16%. In other words, Diploma’s intrinsic value grew 9.3x during this period.

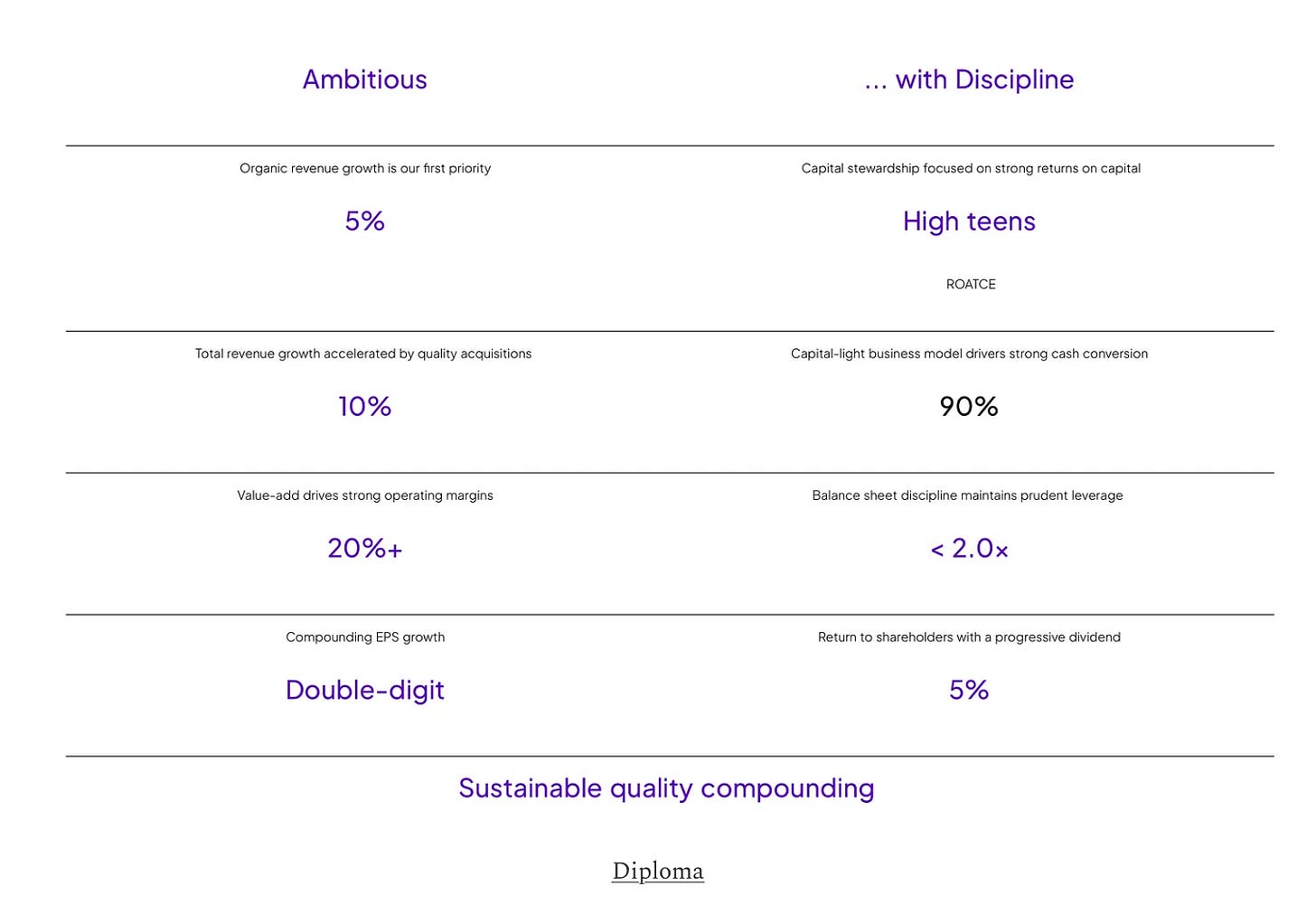

And they have no plans to slow down:

Why Diploma is interesting:

The company delivers long-term quality compounding (or is ‘Compounding Quality’?)

EPS grew at a CAGR of 16% over the past 15 years

The company has strong fundamentals and a high Return on Invested Capital

4. Vitalhub (TOR: VHI)

How does Vitalhub make money?

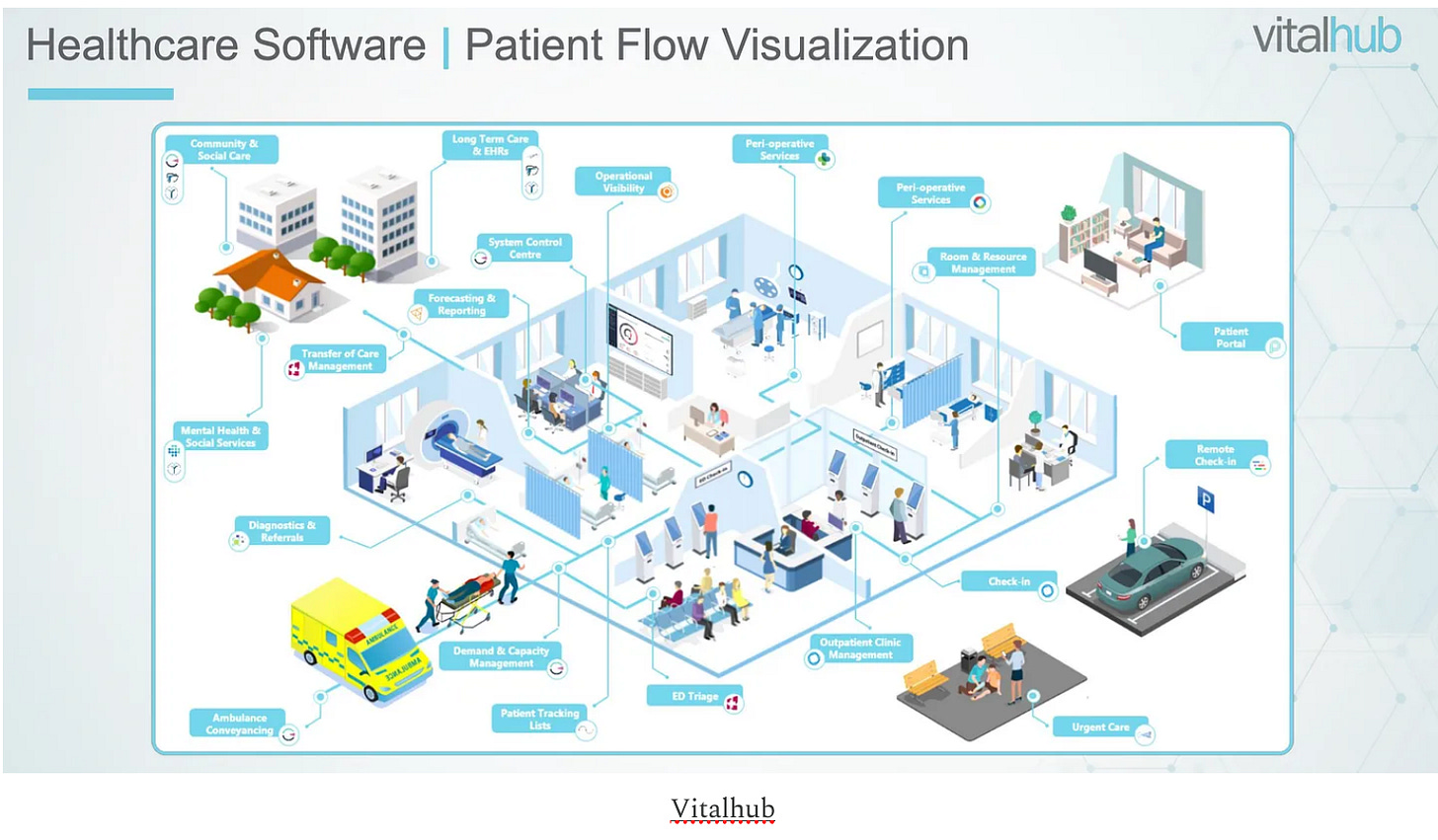

Vitalhub develops software solutions for healthcare institutions. They primarily focus on tools that support Patient Flow Visualization (see visual below). To support organic growth, Vitalhub has already completed 22 acquisitions. With over 400 potential acquisition targets in the pipeline, their runway for growth is still substantial.Vitalhub sells software to government-funded or government-owned healthcare organizations.

That’s exactly what makes the company so interesting.

Regardless of the state of the economy, governments continue to invest in healthcare. And once they pick a software provider, they rarely switch.

As CEO, Dan Matlow says:

“We are all government-funded, which is probably as recession-proof as you can get as a software business.”Switching costs are also high. Nobody wants to change a platform that everyone already knows… just to save a little money.

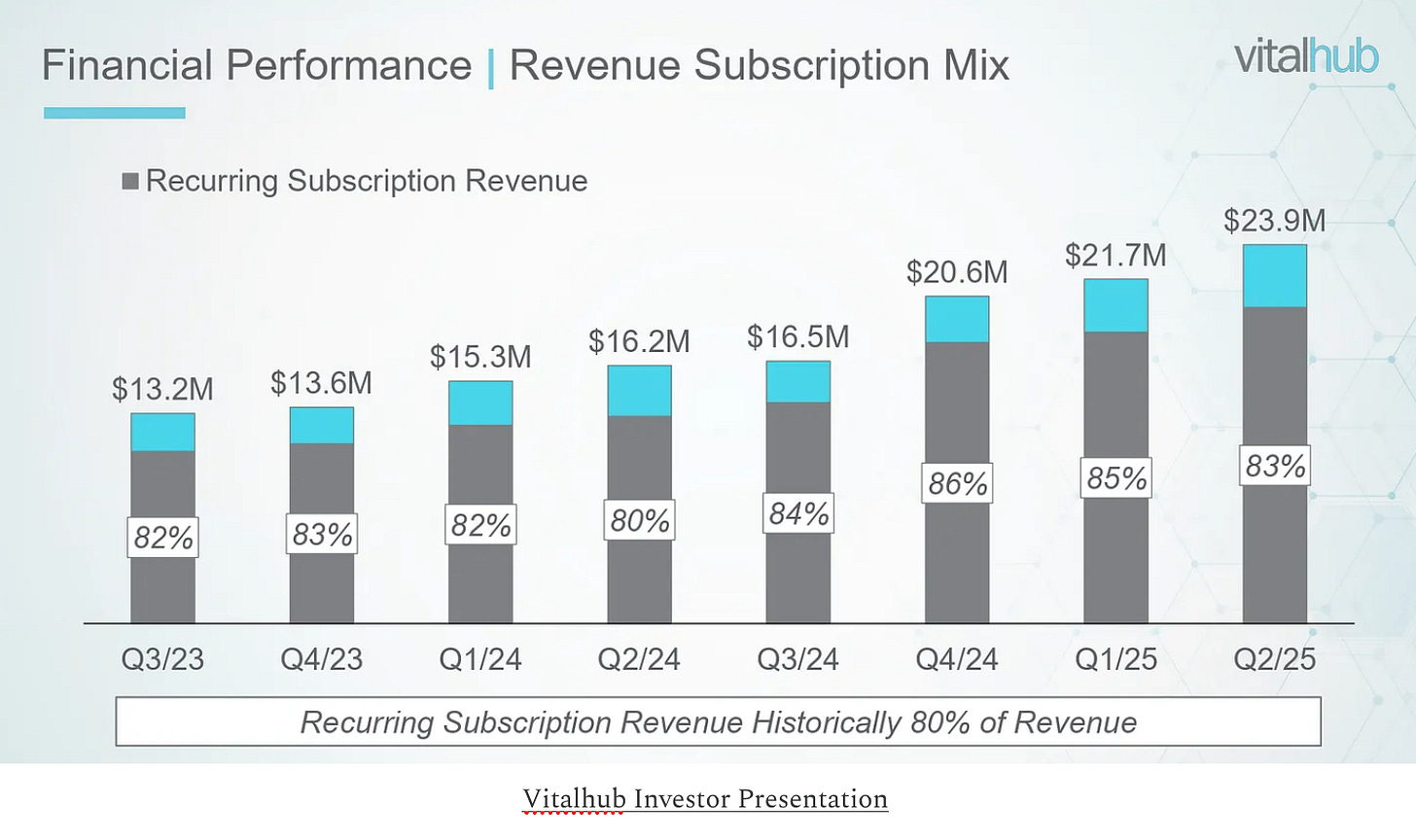

That’s why yearly churn is only 3%.

And the best part? 83% of Vitalhub’s revenue comes from subscriptions. That’s the highest quality form of recurring revenue you can get.

In addition, it’s an Owner-Operator. Dan Matlow founded Vitalhub in 2007.

Today, he is still the CEO and owns 1.4%. Total Insider Ownership stands at 12.3%.

Why Vitalhub is interesting:

It’s an Owner-Operator

Revenue quality is extremely high: 83% comes from subscriptions, and churn is low

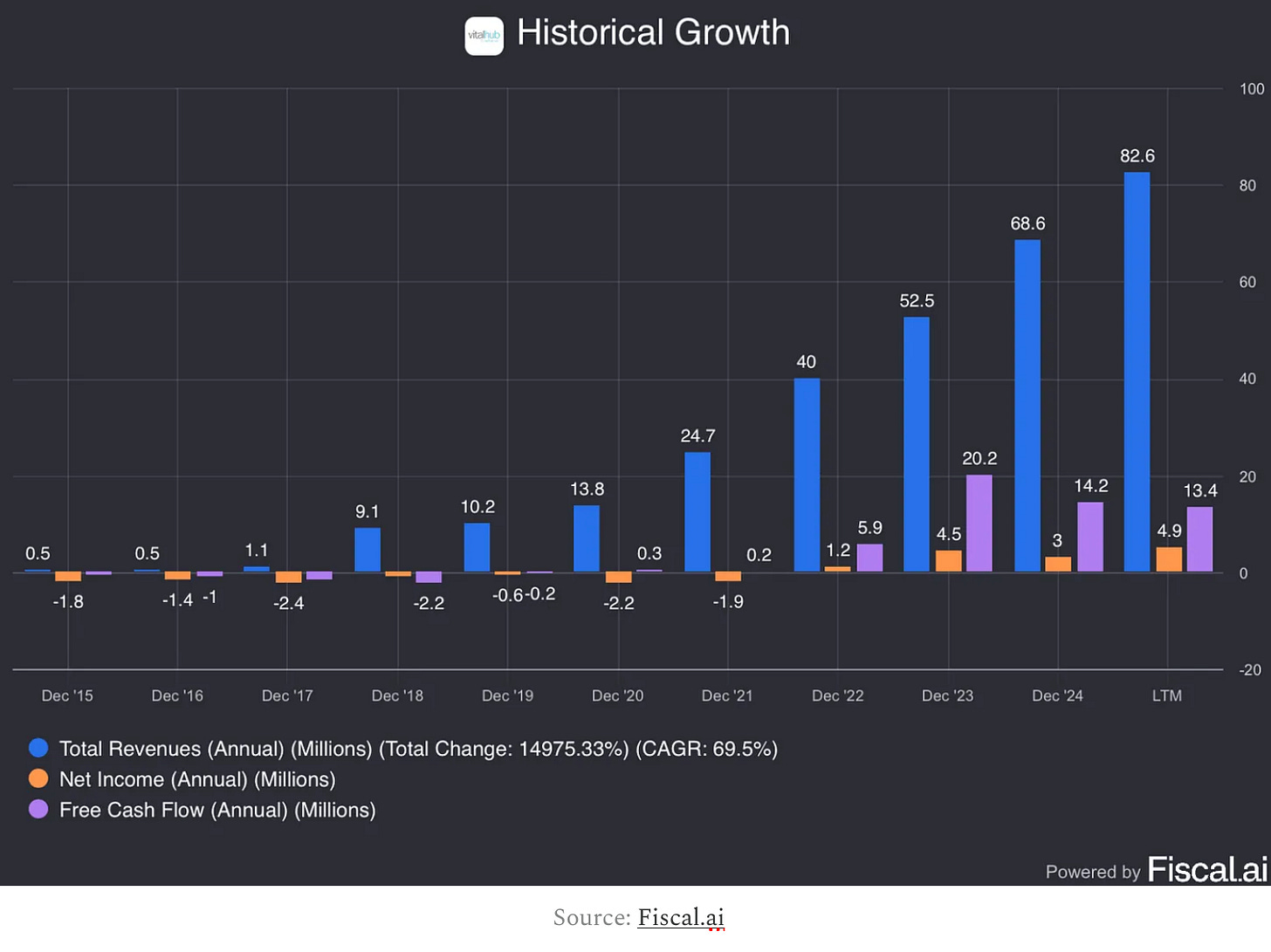

Impressive historical growth

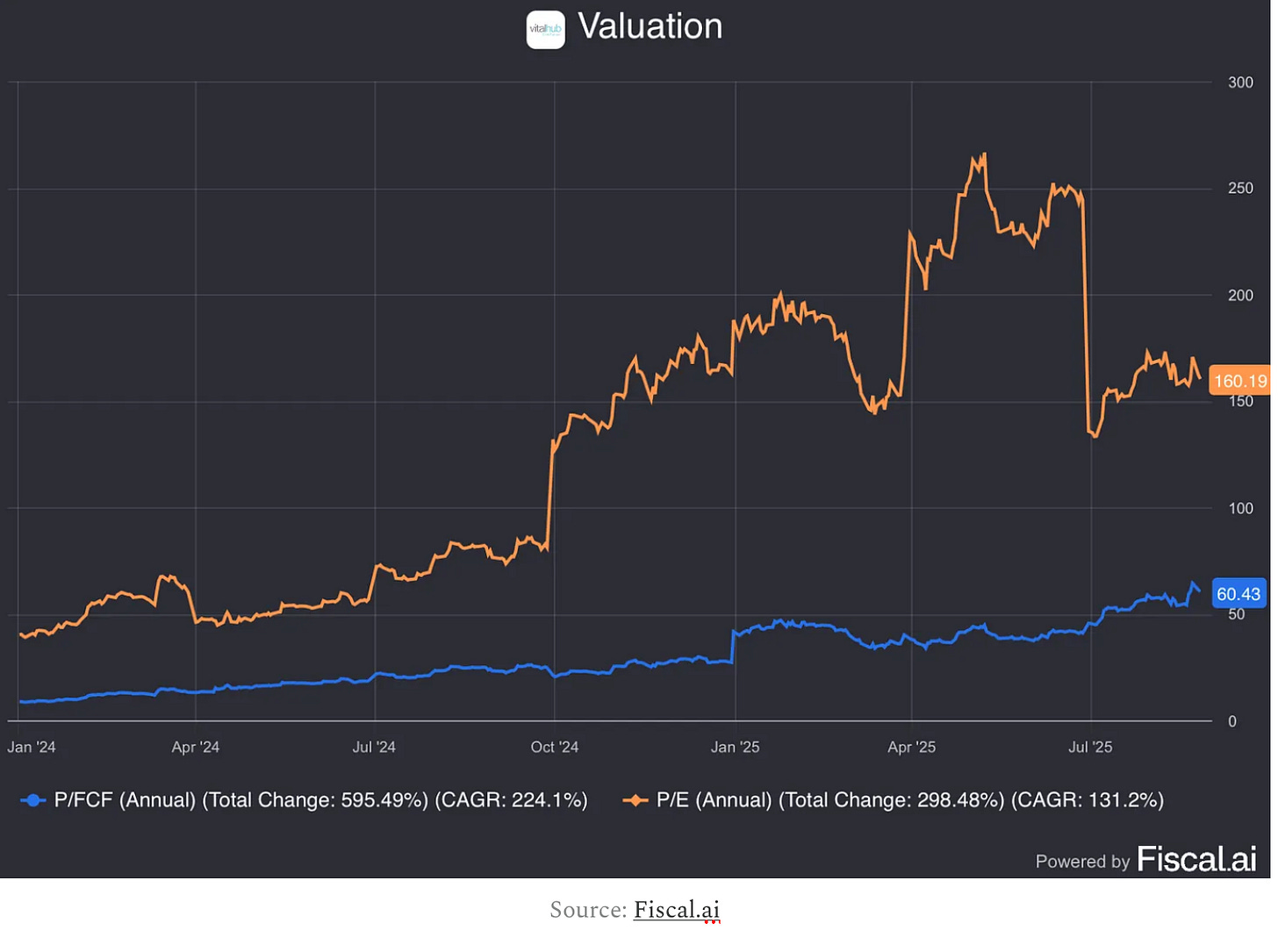

We would love to own Vitalhub. Unfortunately, the company is extremely expensive today:

Now let’s dive into the top 3.