A Look Into The Portfolio

Times on the stock market are very interesting.

Quality is struggling while everything related to AI and momentum seems to skyrocket.

A dangerous thing if you ask me. Let’s show you why we are set for outperformance.

Is the market overheated?

Everything related to AI and momentum seems to do very well on the stock market nowadays.

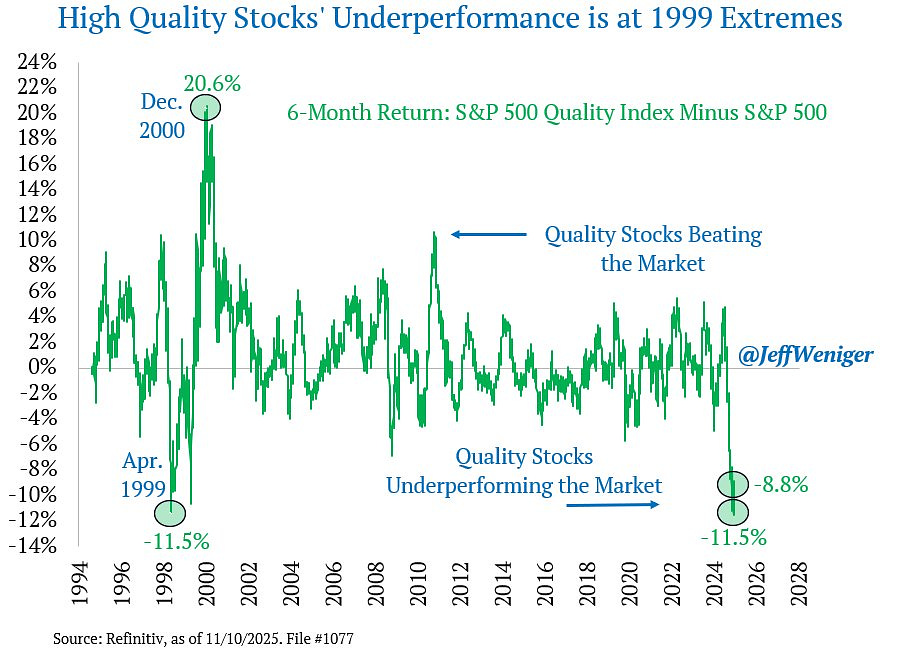

It has been since 1999 (!) that High-Quality stocks underperformed the market so hard:

This is dangerous if you ask me. We are receiving some clear warning signs.

Just look at this tweet from Tobias Carlisle:

The S&P 500 is valued so rich that we should statistically expect negative returns for the index.

The good news? If we exclude Big Tech stocks, the valuation levels already look way more reasonable:

I think these two quotes are very relevant today:

"Everyone is a genius in a bull market.” - Mark Cuban

“In bear markets, stocks return to their rightful owners.” - J.P. MorganOver the past few years, it has basically been impossible to outperform the S&P 500 if you didn’t own any Big Tech.

Nvidia has a weight of 8% in the index today.

It almost never happened that one company had such a large weight in the S&P 500.

This trend can’t continue if you ask me.

Over the next few years, I expect active stock selection to become way more important again:

You should pick companies with a healthy balance sheet

A high profitability

Great capital allocation skills

…

I think we are very well positioned with Our Portfolio for the next decade.

Let me show you why.

Our Portfolio

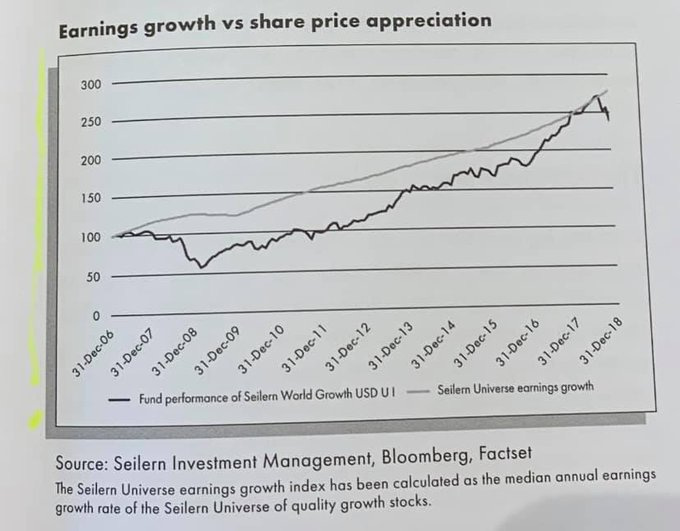

In the long term, stock prices always follow the evolution of the intrinsic value of a company.

You don’t believe me? Just look at this chart:

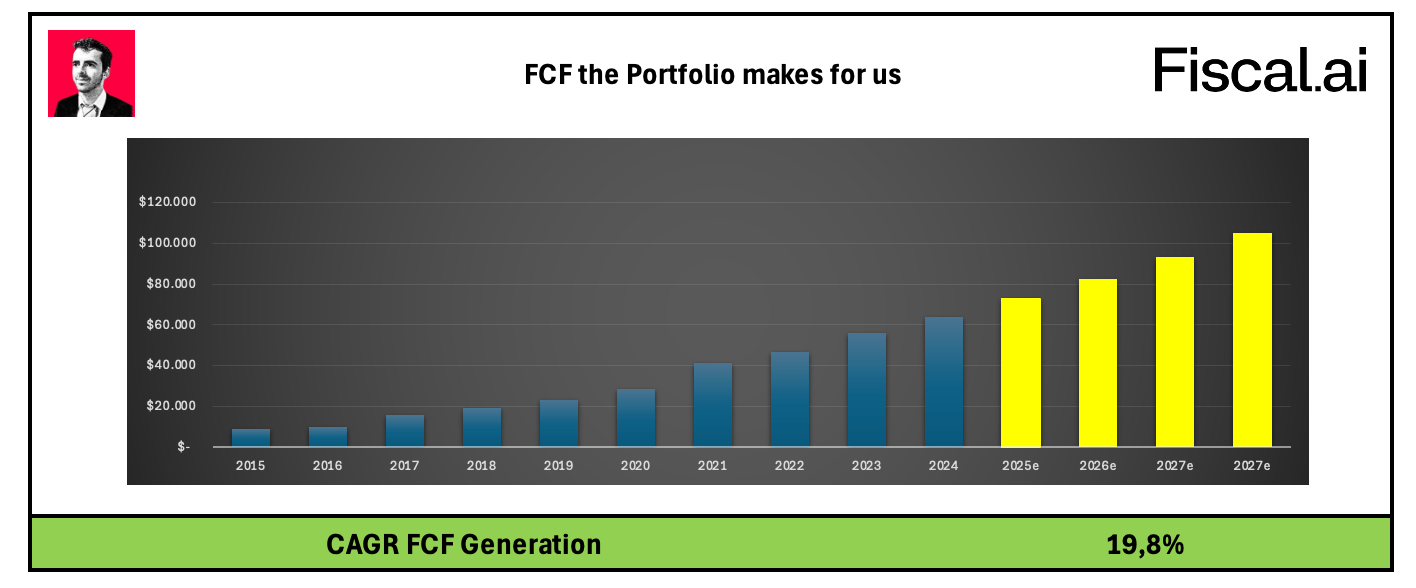

If we look at the evolution of the intrinsic value of Our Portfolio, the situation looks as follows:

Our companies have grown their value on average by +19.7% per year since 2015.

Not bad! The stock prices should follow too.

If you compare it with the S&P 500, you see our companies created way more shareholder value:

The interesting part? I expect our companies to grow their intrinsic value by +10.8% in 2025.

But the stock prices didn’t follow this year.

As a result, our companies became cheaper.

Today Our Portfolio trades at a FCF Yield of 5.4%.

This is the cheapest it has ever been over the past decade!

It means that for every $100,000 we invest, $5,400 in pure cash is generated.

As Our Portfolio is worth $1.35 million… We generate $72.900 in cash per year.

Every. Single. Year.

And the best part? This number keeps going up.

I expect this number to exceed $100,000 by 2027:

It beautifully shows that we are making money while we sleep.

The ultimate goal? Let Our Portfolio generate $1 in Free Cash Flow per minute for us.

This would result in:

$60 per hour

$1.440 per day

$10.080 per week

$43.200 per month

$525.600 per year

It’s not a question IF we will achieve this.

It’s a question WHEN we will achieve this.

At a FCF Yield of 5%, we would need a Portfolio of $10.5 million to reach our goal.

How long would it take us under the following assumptions?

Our Portfolio is currently worth $1.35 million

We add $50,000 every single month

We achieve a return of 12% per year

In this case, it would take us less than 8 years.

This is something to look forward to. Generating $1 in Free Cash Flow per minute is a big deal (> $500,000 per year).

The future truly looks bright, Partner!

Expectations for the future

You are now aware of the fact that we’re invested in amazing companies.

Companies that will become stronger and stronger over the next few years.

In fact, it’s the only thing that matters.

If you know this, you shouldn’t worry about market fluctuations.

The next question you should ask yourself:

What will the future bring for our companies?Let’s take a look: