I am buying 4 stocks

The magic of compounding

What a journey it has been so far.

I never could have dreamed of writing for over 1 million investors and combining my two passions full-time: teaching and investing.

Compounding Quality is currently invested in 16 high-quality stocks.

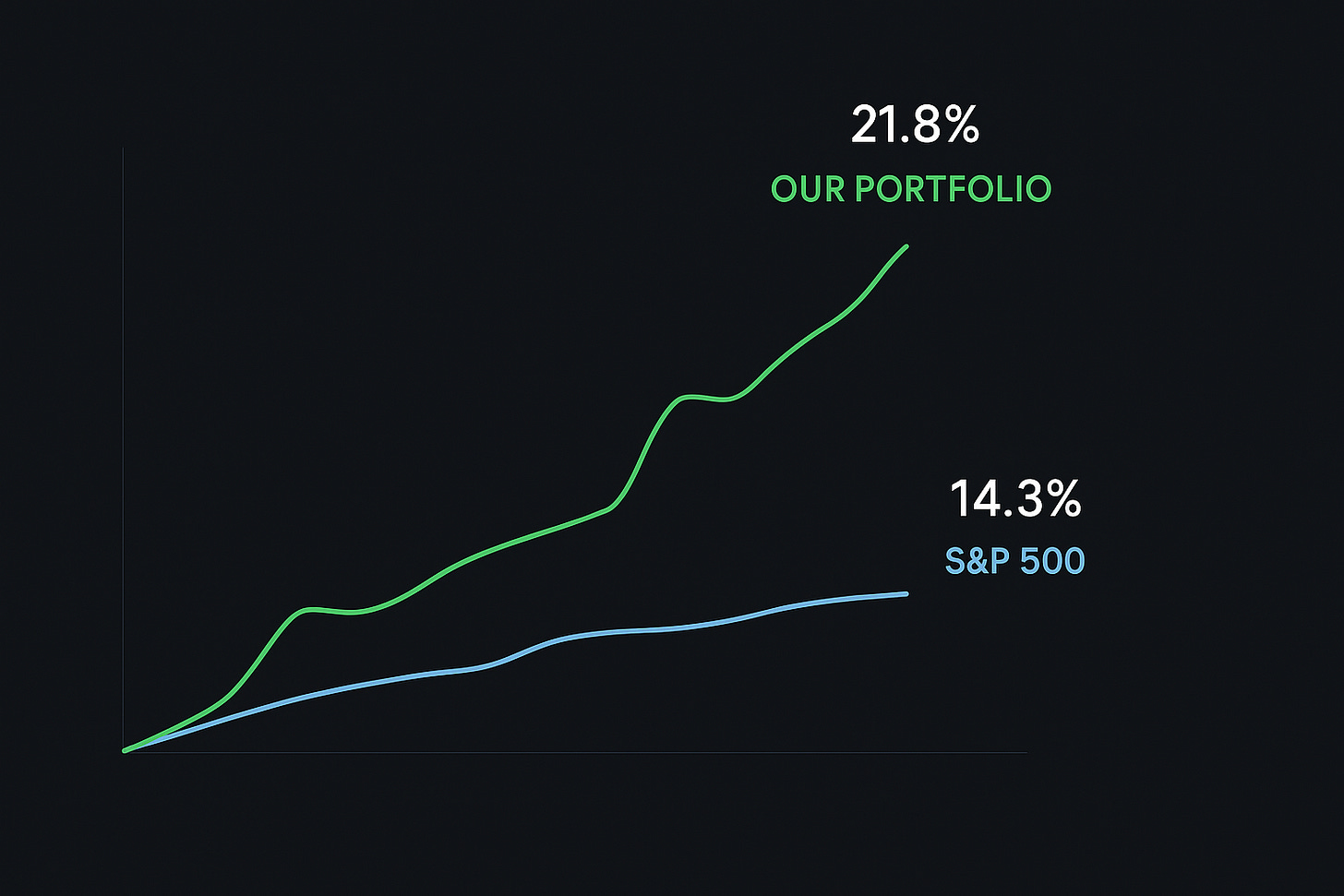

The performance (CAGR) looks as follows:

I am firmly convinced that investing is the most effective way to build wealth for you and your family.

As Warren Buffett said: If you don't find a way to make money while you sleep, you will work until you die.

So far, Our Portfolio has generated $229,193 in profits for us:

As of now, we will use Dollar-Cost Averaging to keep adding to Our Portfolio. This means we will add to new and existing positions every single month.

Why is this so important?

Just look at this example.

Currently, Our Portfolio has a value of $1.25 million.

If we invest for 30 years at a return of 12% per year and never add to Our Portfolio again, we get the following:

$37.5 million is not bad at all. Or is this an understatement?!

But things can get even better…. What if we continue to add to the Portfolio?

If we add $2,000 every month, we end up with $43.2 million

If we add $5,000 every month, we end up with $51.9 million

If we add $10,000 every month, we end up with $66.4 million

…

Please note that I don’t take any (potential) capital gain taxes into account. The reason for this is that tax rules vary from country to country.

Not convinced yet? Warren Buffett comes to the rescue once again:

Buffett has been a net buyer of stocks every single year since he was 11 years old. That’s 83 (!) years.

When Buffett was born on August 30, 1930, the Dow Jones was trading at 240 points. Today, the Dow Jones trades at 42,200 points.

This means a $10,000 investment turned into $1.8 million.

The key lesson? It’s never a great idea to bet against the stock market.

Portfolio overview

Tomorrow we will add to four positions.

Here are the companies in Our Portfolio right now (and why):