Hi Friend 👋

A new era is arriving for Compounding Quality.

Starting from the 1st of October, only ⭐ Founding Subscribers ⭐ will get access to the Portfolio.

The price will be $1,200.

However, everyone who subscribes within the next 36 hours will get it for the regular rate.

This means you get a discount of $700.

Did you know investors can learn from Winnie the Pooh?

In the movie, he said:

"They say nothing is impossible, but I do nothing every day."

Doing nothing is almost always the best choice in investing.

The best investor is a dead investor and the first rule of compounding is never to interrupt it unnecessarily.

Performance

Since Compounding Quality launched on the 1st of October 2023, the Portfolio compounded at a CAGR of 24.4%:

A stock portfolio is like a bar of soap. The more you handle it, the smaller it gets.

We tend to keep the companies in Our Portfolio for a long time.

To outperform the market, all you need is a few large winners.

Out of 10 stocks:

Two stocks will give most of the returns

Six stocks will perform in line with the market

Two stocks will underperform

Company Fundamentals

Here are the company fundamentals compared to the S&P 500:

The Portfolio outperforms the S&P 500 on almost every metric:

Stronger balance sheet

Lower capital intensity

Better capital allocation

Higher profitability

Better growth and outlook

The S&P 500 and our portfolio have similar forward PEs.

However, based on the PEG Ratio Our Portfolio is valued cheaper because they have more growth potential.

These better quality metrics and similar valuation levels make us confident we can beat the market in the long term.

Our Portfolio

We invest in three buckets:

Owner-Operator Stocks (71.2% of the Portfolio): Quality stocks still led by their founder or founding family

Monopolies/Oligopolies (13.2% of the Portfolio): Quality stocks where a few companies dominate the entire industry

Cannibal Stocks (15.6% of the Portfolio): Quality stocks that are heavily buying back their own shares at cheap valuation levels

Valuation

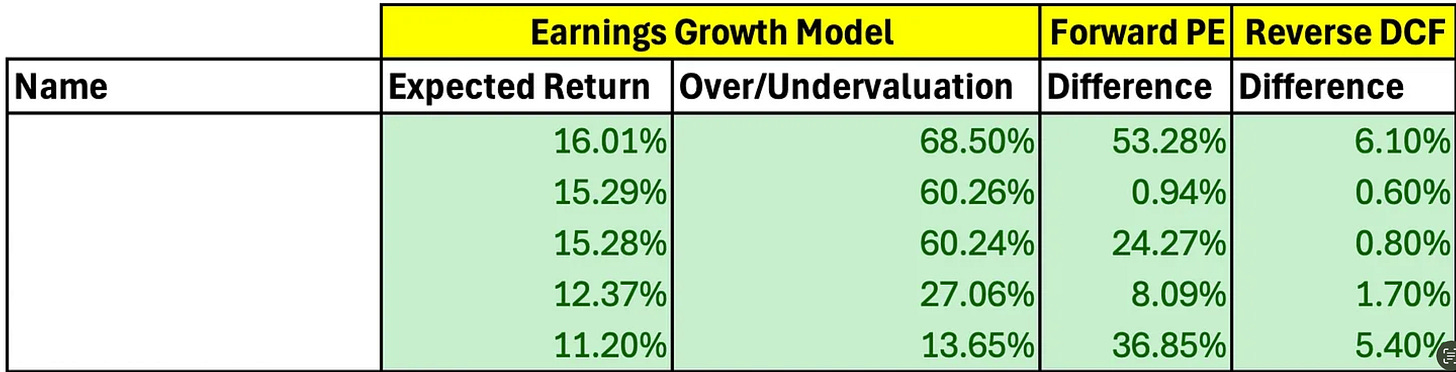

As you may know, we use 3 valuation methods:

Compare the current Forward PE with its 10-year Historical Average

Earnings Growth Model (and Fair Value)

For each company, we calculate the Fair Value (Buy-Below Price).

This is the price where the expected yearly return is 10% based on our Earnings Growth Model.

We see the company as undervalued if the stock price trades below its Fair Value.

Reverse DCF

Five companies in Our Portfolio are undervalued on all valuation methods:

Buys in the Investable Universe

Currently, there are 18 stocks to buy right now in our Investable Universe.

Click on the picture to expand:

As you see, all names have been scratched out in this article.

That’s because you are a free reader of Compounding Quality.

Partners can read this article and take a look at all the stocks mentioned.

Starting from the 1st of October, the price will increase to $1,200 forever.

Take an annual plan for $499 today and get upgraded to the Founding Subscription for free:

Everything In Life Compounds

Pieter