Analyze Stocks

Knowing how to analyze a stock is crucial to make good investment decisions.

The best investors in the world use a strict and rational framework.

In this article, I’ll teach you how you can analyze stocks yourself.

15-Step approach

Compounding Quality always uses the same 15-step approach to analyze a company.

On each question, each company gets a score out of 10.

The higher the total score, the better.

In today’s article, we’ll use Garmin as an example.

1. Do I understand the business model?

How does the company make money?

Do I understand the products/services the company sells?

If the business profile doesn’t look attractive to you or you don’t understand it properly, you can stop looking into the company right away.

The more simple and attractive the business model, the better.

"Know your circle of competence, and stick with it. The size of that circle is not very important; knowing its boundaries, however, is vital." - Warren Buffett

The business model of Garmin is easy to understand and I use their products myself.

That’s why Garmin gets a score of 8/10 on this metric.

2. Is management capable?

You want to invest in companies which are led by great managers.

Preferably, the founder or his family is still active within the business.

Look at the track record of management and visit websites like Glassdoor to determine whether employees are happy to work for the company.

Min Kao, co-founder of Garmin, is still active as Chairman within the company and insiders own roughly 32% of Garmin.

Furthermore, the company gets a good score on Glassdoor:

As a result, Garmin gets a score of 8.5/10 for its management capabilities.

3. Does the company have a sustainable competitive advantage?

A moat or sustainable competitive advantage is essential.

Companies with a moat are usually characterized by the following:

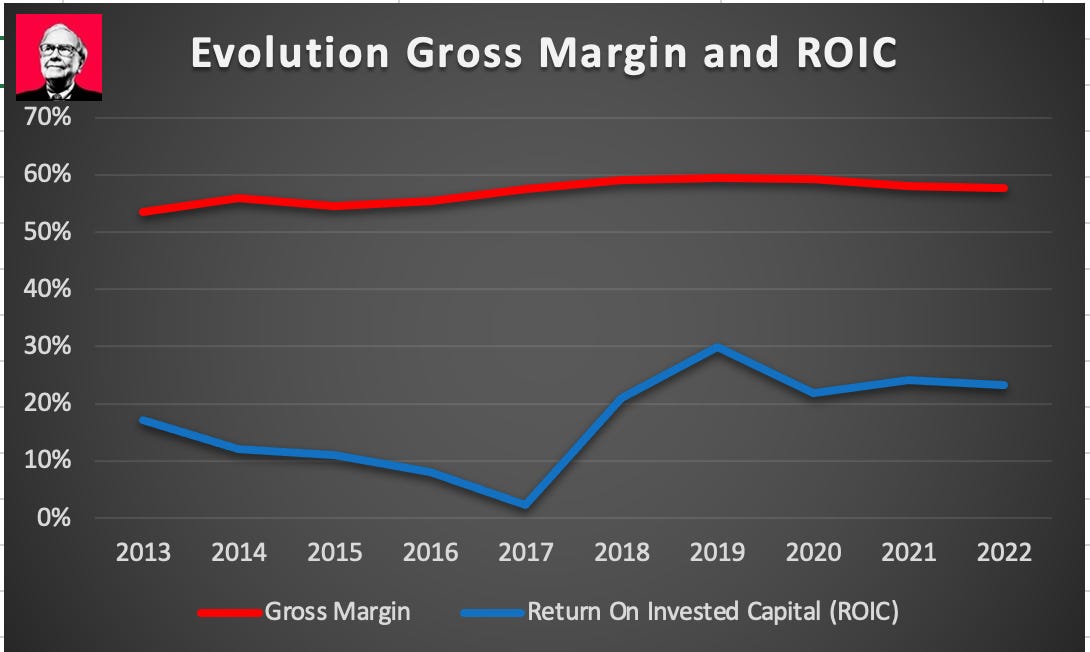

High and consistent Gross Margin

High and consistent ROIC

Garmin’s gross margin and ROIC are currently equal to 57.8% and 17.6% respectively. This indicates that Garmin has a sustainable competitive advantage.

We give Garmin a score of 8 out of 10 on this metric.

4. Is the company active in an attractive industry?

Ideally, we want to invest in companies which only have a few competitors and high barriers to entry.

The less competition, the better.

“Over the years, Buffett followed his philosophy of buying into industries with little competition. If he can’t buy a monopoly, he’ll buy a duopoly. And if he can’t buy a duopoly, he’ll settle for an oligopoly.” - The Myth of Capitalism (Book)

Garmin is active in a competitive market, especially in the market for Fitness Products.

Its main competitors for Fitness Products are among others Amazon, Apple, Bryton and FitBit.

That’s why we give Garmin a score of 5/10 on this metric.

5. What are the main risks for the company?

Disruption is the worst enemy of every quality investor.

When you invest in a quality stock which is losing its moat, you’ll end up with horrible investment results.

That’s why you should always identify the main risks a company faces before investing in it.

For Garmin, the main risks are the competitive environment and the fact that they heavily rely on Global Positioning Systems for their products. These Global Positioning Systems aren’t owned by Garmin.

Garmin gets a score of 5.5/10 on this metric.

6. Does the company have a sound balance sheet?

You want to invest in companies that are in good financial shape.

A healthy balance sheet allows companies to be flexible and capitalize on opportunities.

As you can see in the picture above, Garmin has had a net cash position every single year since 2002.

This means that the company has more cash than debt on its balance sheet. A positive sign.

Garmin gets a score of 9/10 for its balance sheet.