📈 Are we buying Constellation Software?

CSI week part IV

Over the past few days, you received an extensive Deep Dive on Constellation Software.

But does this company deserve a spot in Your Portfolio?

Let’s figure it out today.

Deep Dive: Conclusion

So, are we buying Constellation Software?

You can summarize the entire investment case with three visuals.

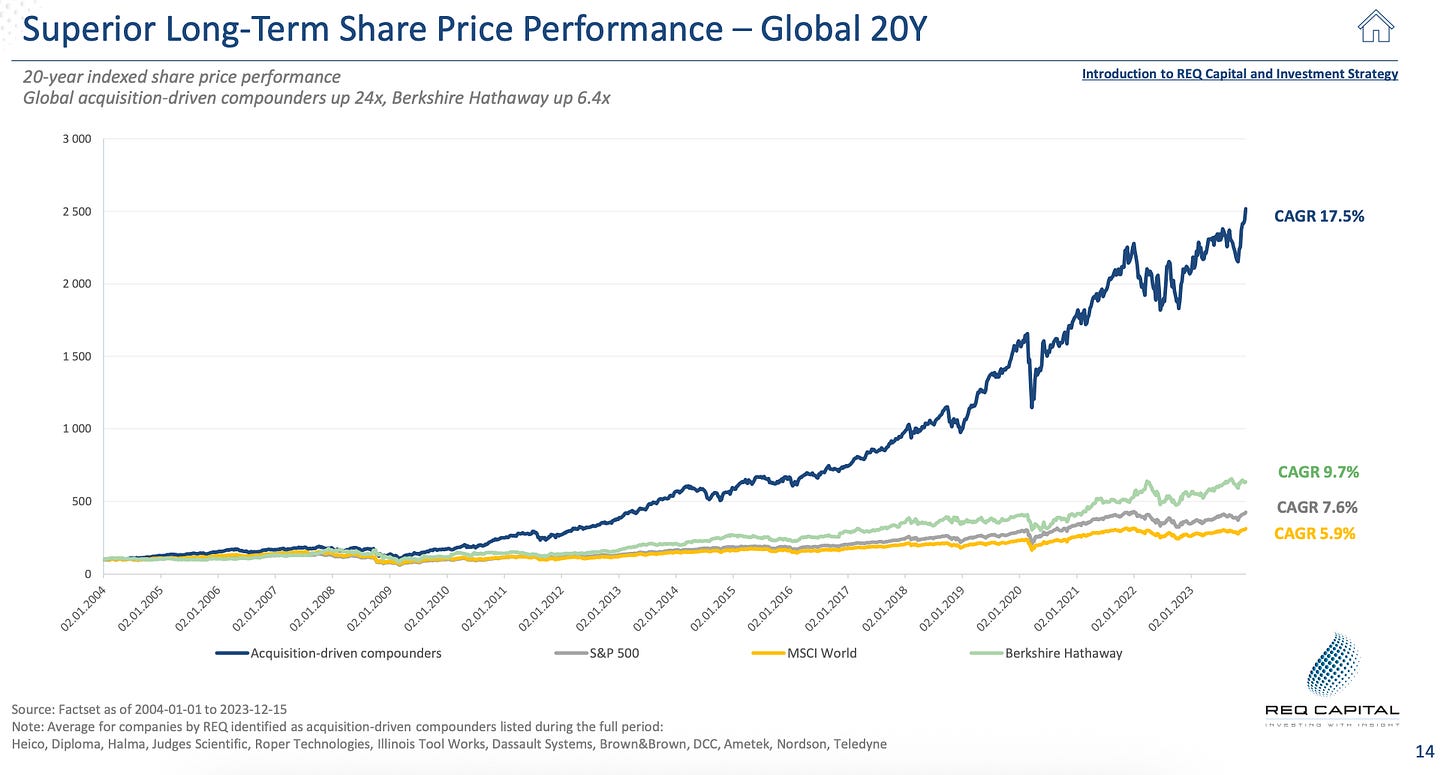

1. Serial Acquirers Outperform

Serial Acquirers outperform the broader market by a wide margin:

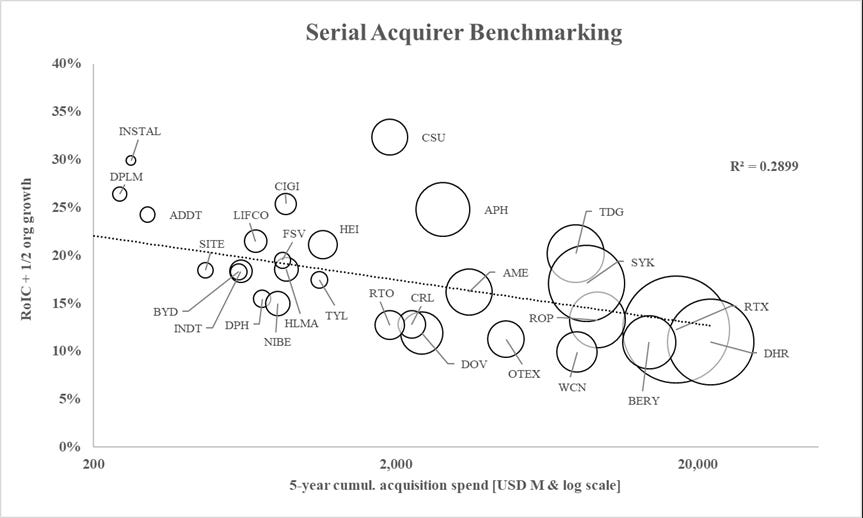

2. The best serial acquirer in the world

Constellation Software is the best Serial Acquirer in the world:

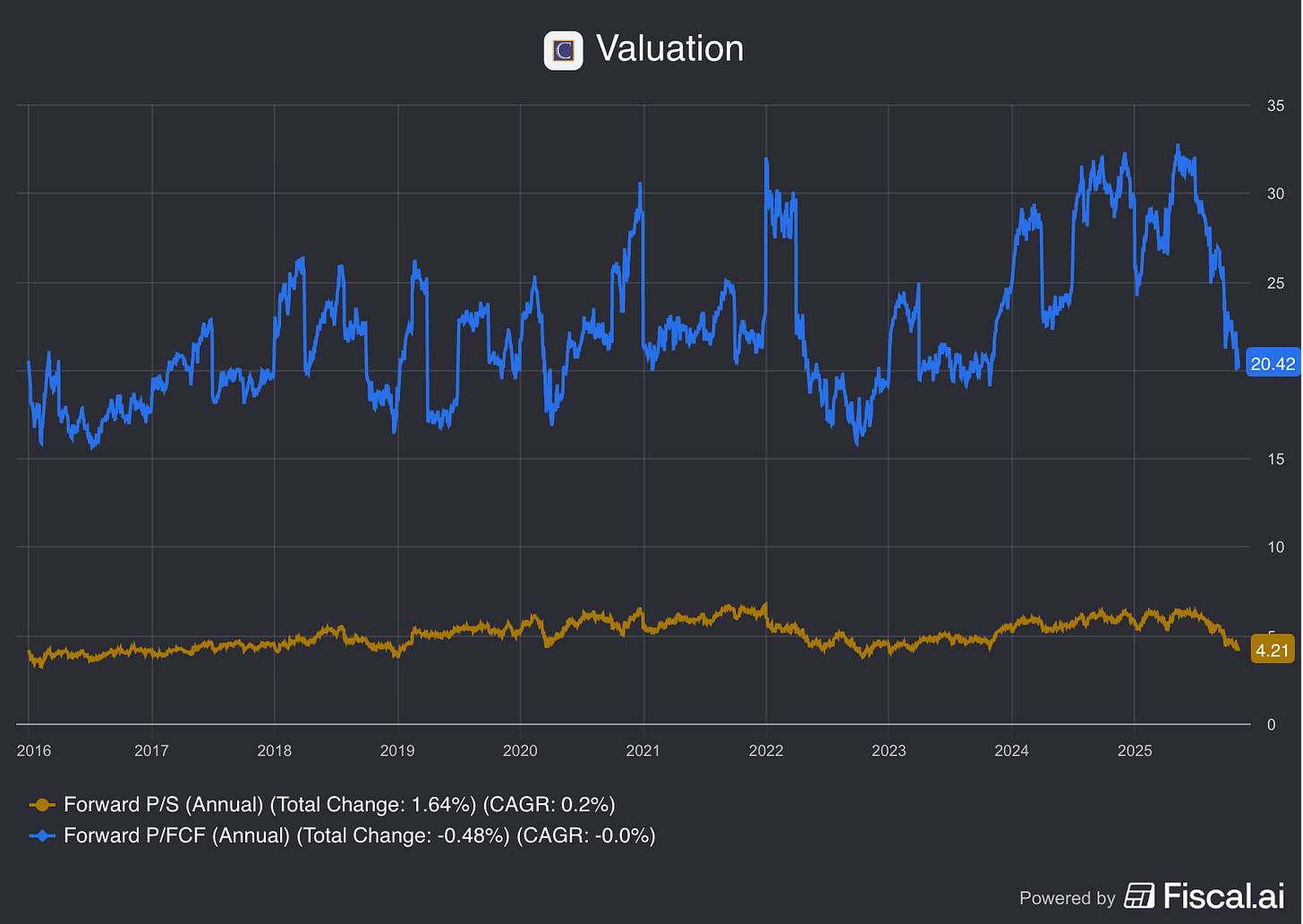

3. Reasonable valuation

Today, Constellation Software trades at a reasonable valuation level.

Conclusion investment case

We wrote a 55-page Deep Dive about Constellation Software. Let’s summarize it for you.

Just 15 years after their IPO in 2006, Constellation had already joined the 100-bagger club.

The stock has consistently compounded at +30% per year.

While many 100-baggers experience a -50% drawdown on their way (even Berkshire did three times), Constellation never had major drawdowns until today.

The stock is now down 30% from its all-time high (ATH).

Taking into account the exceptional quality of the company, it trades at a reasonable valuation.

So, you might ask yourself: why does this opportunity exist? Why did Constellation Software decline so much?

The biggest factor is the resignation of Mark Leonard as CEO.

After the announcement, the stock was down 15% intraday.

Mark Leonard, also known as “Software Santa” or the “Warren Buffett of Software”, is truly one of the best capital allocators who has ever lived on this planet.

His shareholder letters are full of insights, humility, and integrity. They are a must-read for every serious investor.

This quote beautifully shows that it’s all about discipline:

“I recently worked on a large transaction. With every day that passed, I could feel my commitment to the process growing... not because the news was getting better, just because I was spending more time on the prospect. The investment didn’t quite meet our hurdle rate. We were not able to negotiate a structure that got us an extra couple of points of IRR, and the big one got away. The difference between investing and not was tiny.” – Mark LeonardNevertheless, we believe Constellation will continue to outperform in the post Mark Leonard era.

You’re incredibly wrong if you think Constellation Software is a one-man show.

Mark Miller will replace Mark Leonard. He has been working next to Mark Leonard from day one.

You can think of him as the right hand of Mark Leonard or the “Charlie Munger of Software”.

Miller owns roughly $700 million worth of CSI shares. Interestingly, Mark Miller bought a lot of shares on the open market after Leonard’s resignation. In addition, Leonard will continue to serve on the Board. Lawrence Cunningham is also on this Board.

But keep in mind that it’s not about Miller, Leonard, or Cunningham.

Unlike other big serial acquirers or holding companies, capital allocation is even decentralized at Constellation. Mark Leonard has been preparing Constellation to run without “a big leader.” It’s all about small teams and autonomy.

Going into the financials, it’s pretty simple: Constellation checks all the boxes. The company has a healthy balance sheet, low capital intensity, high reinvestment rates, great capital allocation metrics, and strong historical growth.

Recent insider buys signal confidence in the long-term potential of this wonderful compounding machine.

But the question is..

Are we buying?

The answer is…