Hi Friend 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you my favorite stocks.

July 2024

In July, the S&P 500 increased by 0.9%.

The Fear & Greed Index indicates that we are currently in ‘Neutral’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

The cheaper we can buy great companies, the more we like it.

Worst performers

Best Performers

It’s great to see that Our Latest Buy is in the Best Performing List of the month:

Visa

A company that is becoming more and more interesting? Visa.

How does Visa make money?

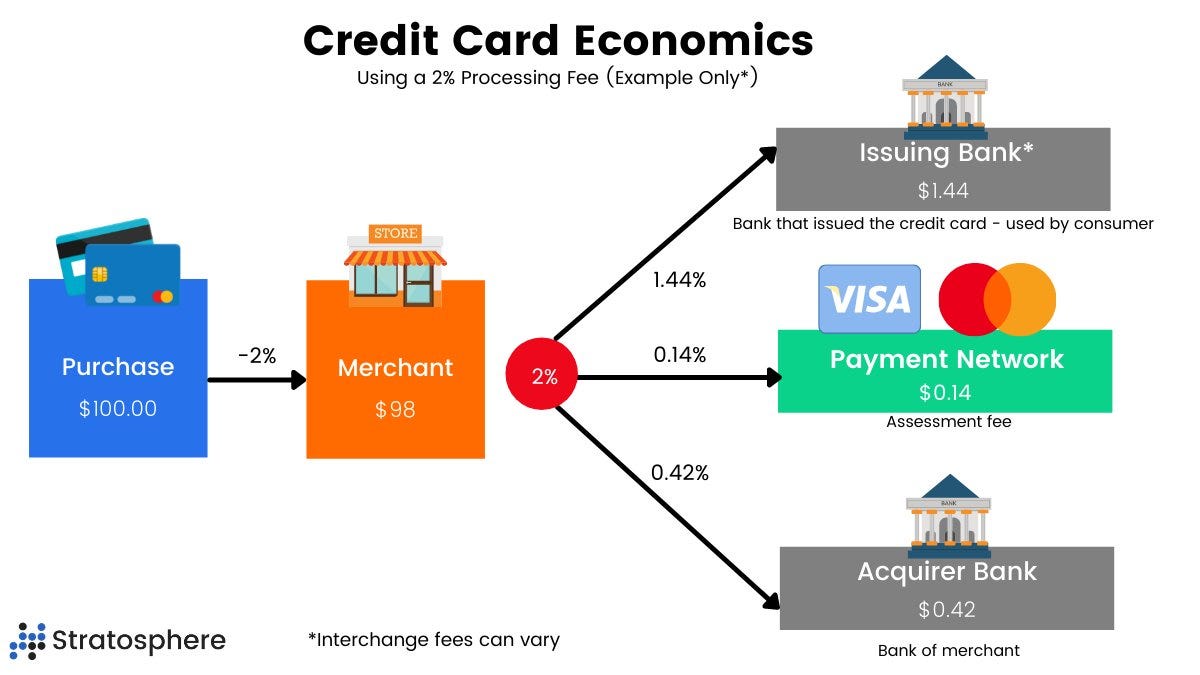

Visa is a global payments technology company. They provide electronic payment solutions through a network of branded credit and debit cards.

Just like Mastercard, Visa’s core function is to operate a payment network connecting merchants, banks, and cardholders.

When you make a purchase using Visa, the merchant pays a fee to Visa for processing the transaction.

Last year, 276 billion (!) payments and cash transactions were made via Visa’s payment network. This means Visa executed 757 million transactions per day.

Source: Finchat (Stratosphere is the former name of Finchat)

Why might Visa be interesting?

Visa is an amazing business.

They have a healthy balance sheet, are very profitable (Net Income Margin: 54.7%), are great capital allocators (ROIC: 21.2%) and the company still has plenty of growth opportunities. The consensus states that they can grow their EPS by 13% per year in the medium term.

"Mastercard and Visa's profit margins are 4x as high as the average company within the S&P 500. This means that you could halve their profit margin, and do it gain to get to the average profit margin of other companies." - Chuck Akre

Today, Visa trades at a forward PE of 24.8x versus a 5-year historical average of 33.6x.

Our Earnings Growth Model gives an expected return of 14.2% which looks attractive.

The Reverse DCF states that Visa should grow its FCF by 11.8% per year to return 10% per year to shareholders. This sounds like a realistic target.

Both Our Earnings Growth Model and Reverse DCF are explained here.

Best Buys August 2024

Now let’s dive into our favorite stocks for August 2024.

Let’s do it a bit differently than we usually do.

The companies within our Portfolio are the companies we’re the most bullish on right now.

If you ask me, there are some attractive buying opportunities within these names.

Currently, there are 5 Strong Buys.

Let’s go over them.