By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s become a little bit wiser today.

August 2025

The S&P 500 increased by 1.9% in August.

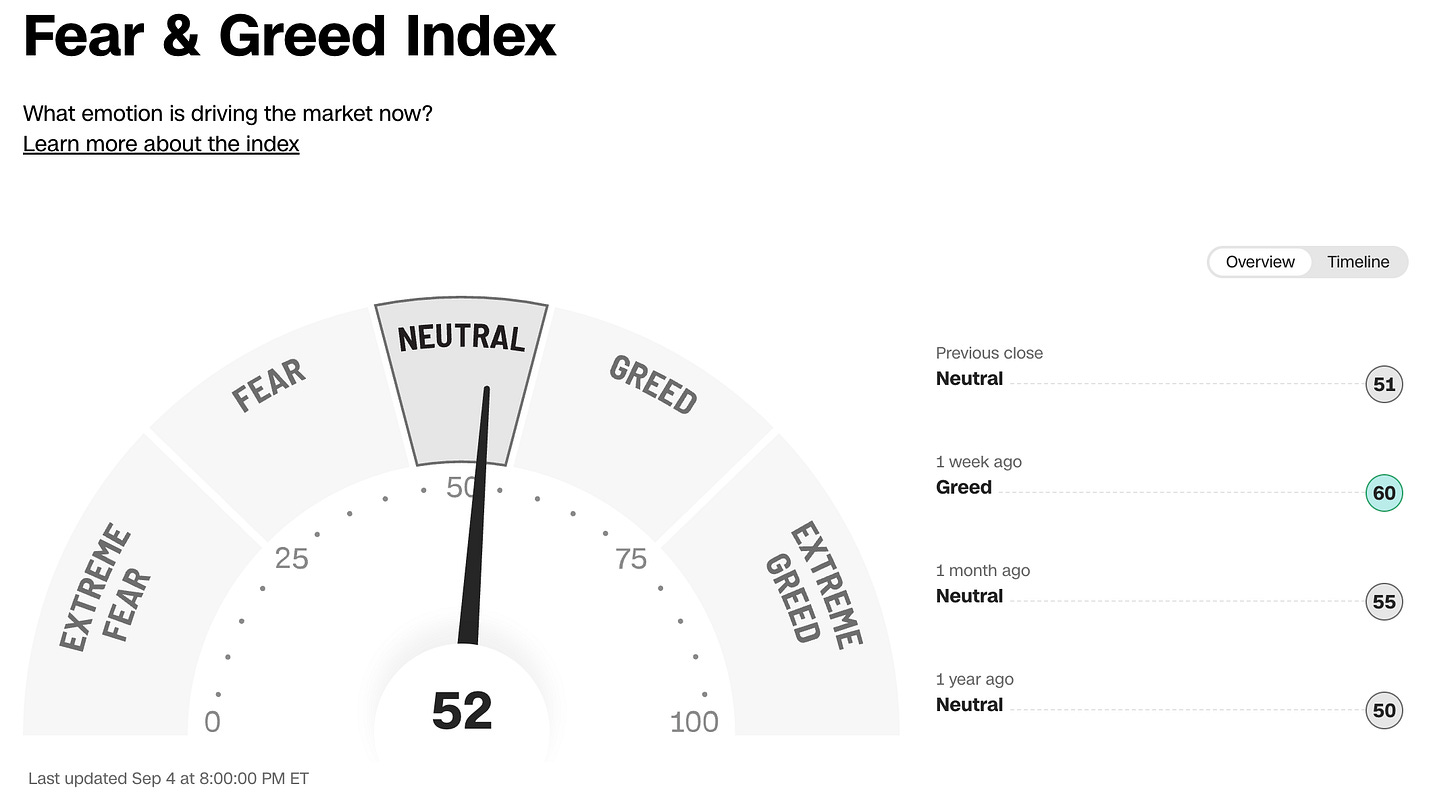

Investors are “Neutral” today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

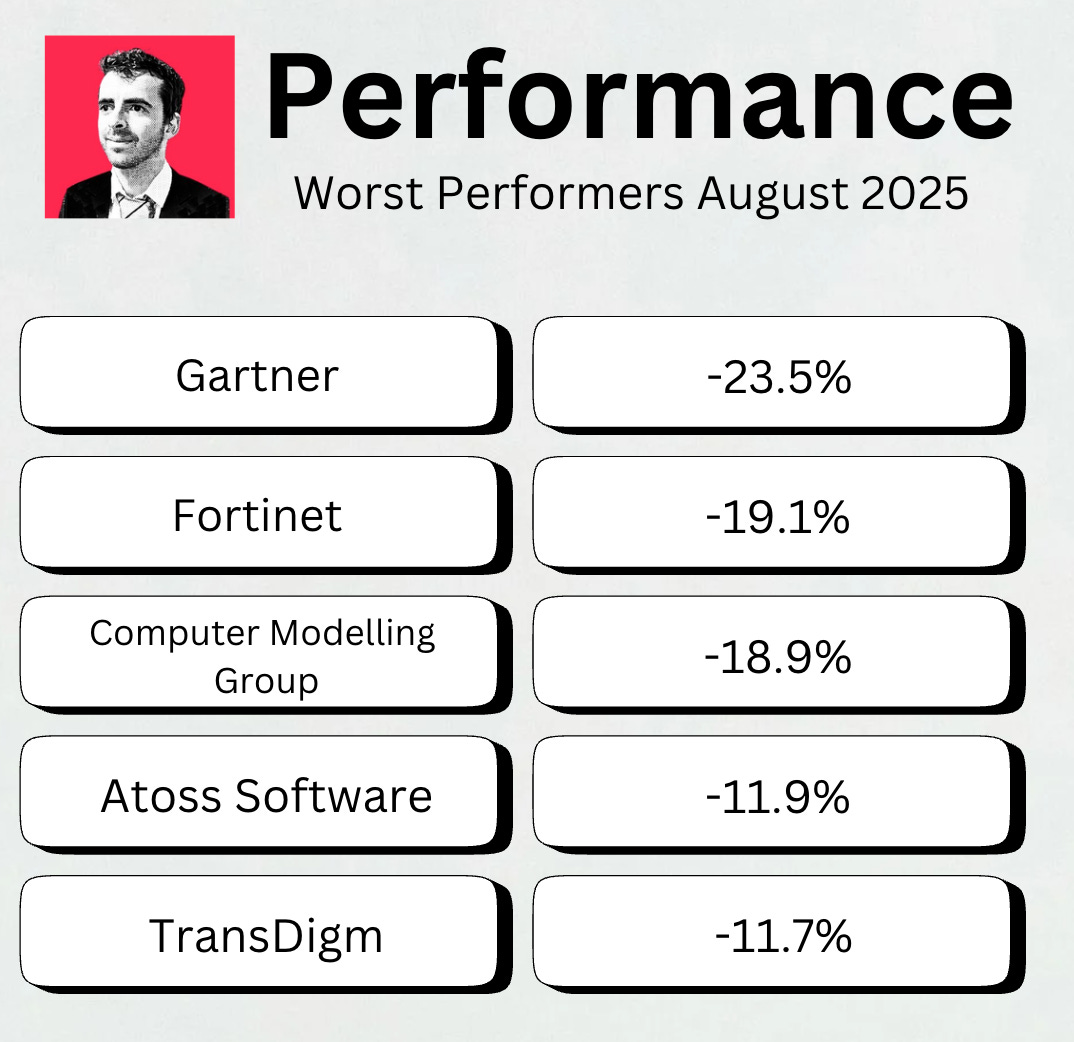

Worst performers

The cheaper we can buy great companies, the better.

Here are the worst performers of the past month:

Gartner ($IT) is trading at its lowest valuation in four years:

Best performers

Here are the best performers of August:

Arista Networks is back on the list. Since April, the stock has doubled.

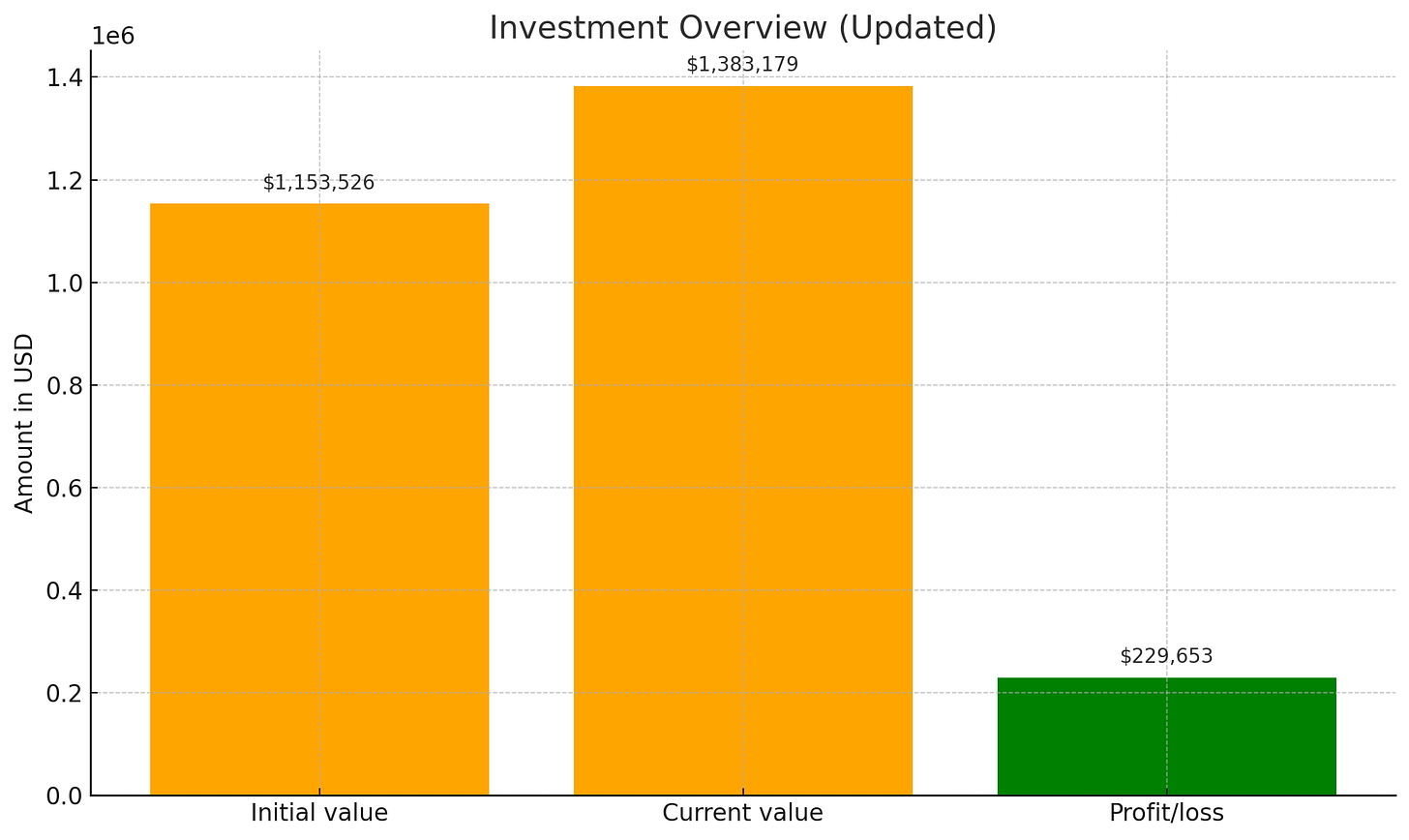

Performance

Here’s what the performance of Our Portfolio looks like.

So far, Our Portfolio has achieved an average yearly return of 19.4%.

A phenomenal result. I don’t expect this trend to continue. A return of 12% per year, on average, would already be remarkable.

I use Interactive Brokers to execute all my transactions. Discover more about Interactive Brokers here.

Spotlight: Scottish Mortgage Investment Trust ($SMT.L)

How does the company make money?

Scottish Mortgage is an investment trust. It makes money for shareholders by investing in a concentrated portfolio of what its managers believe are the most exceptional public and private growth companies in the world. The goal is long-term capital growth.For years, Scottish Mortgage has been a favorite among investors seeking to own the future (growth stocks).

Their approach? Simple. But powerful.

Find game-changing growth companies and hold them for years.A quality investor sits tight and lets his investment compound over time.

That’s exactly what Scottish Mortgage Trust does.

Their portfolio gives you access to the world’s most disruptive companies. Even the ones that regular investors can’t buy.

If you invest in Scottish Mortgage Trust, you invest in companies like SpaceX from Elon Musk.

There are three main reasons why Scottish Mortgage Trust might be interesting:

Private market access: You get a piece of fast-growing private companies before they go public

Examples: SpaceX and ByteDance

High-conviction picks: Scottish Mortgage Trust invests in its best ideas only. No diversifying just to match a benchmark

Long-term mindset: While others chase quarterly numbers, Scottish Mortgage thinks in decades

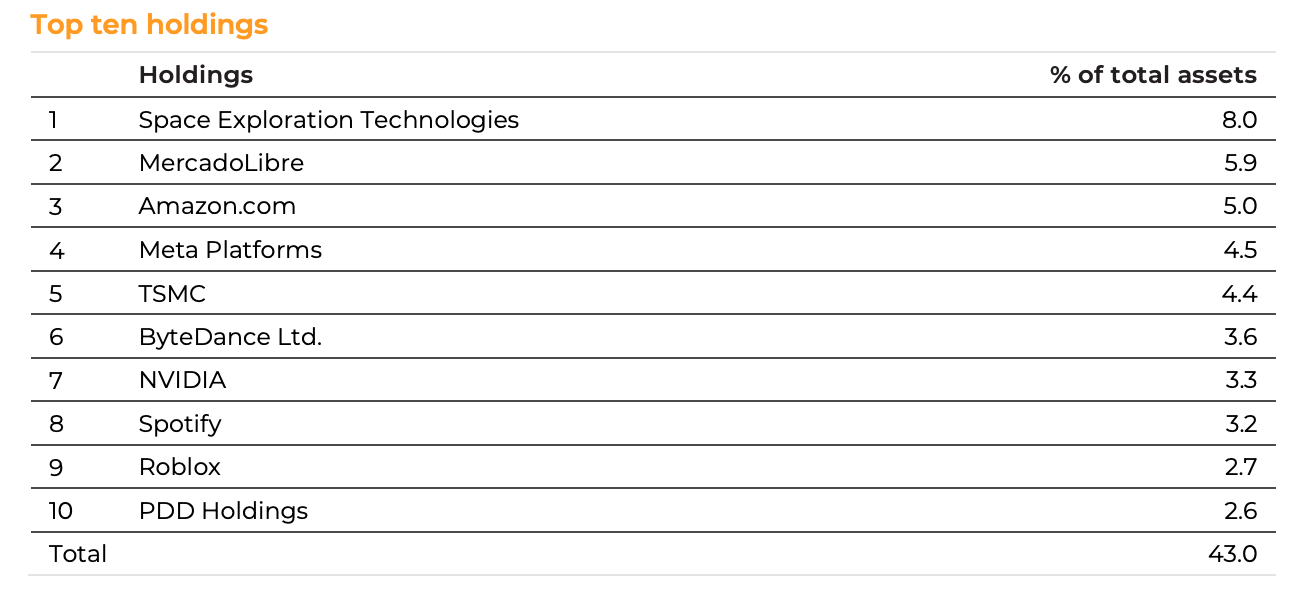

Here are their top 10 convictions:

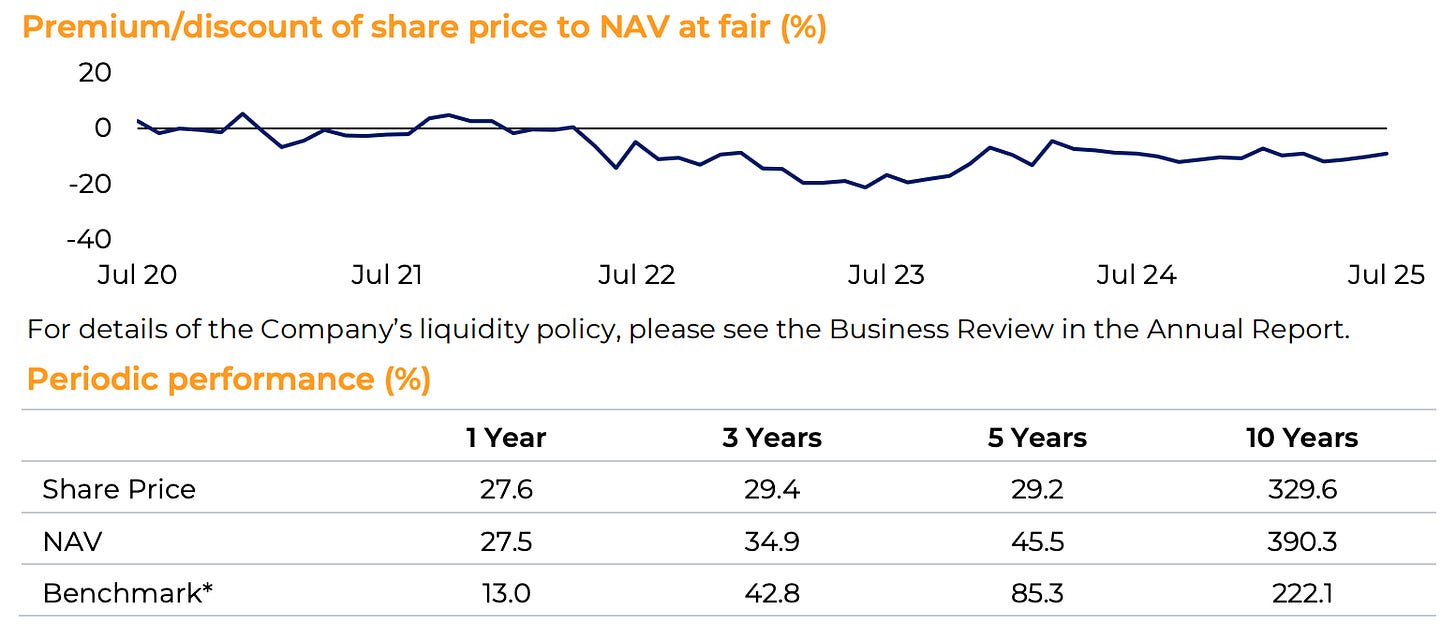

Let’s look at the key numbers for Scottish Mortgage:

Discount to NAV: -10.9% (a small premium)

% invested in Private Equity: 26.3%

10-Year NAV CAGR: 15.2%

Scottish Mortgage Trust might be a buy-and-forget stock for long-term growth.

You can look at the company’s factsheet here.

Best Buys September 2025

Now, let’s dive into our five favorite stocks for September 2025.

This month’s focus? Wide-moat compounders.

Why? As Warren Buffett said:

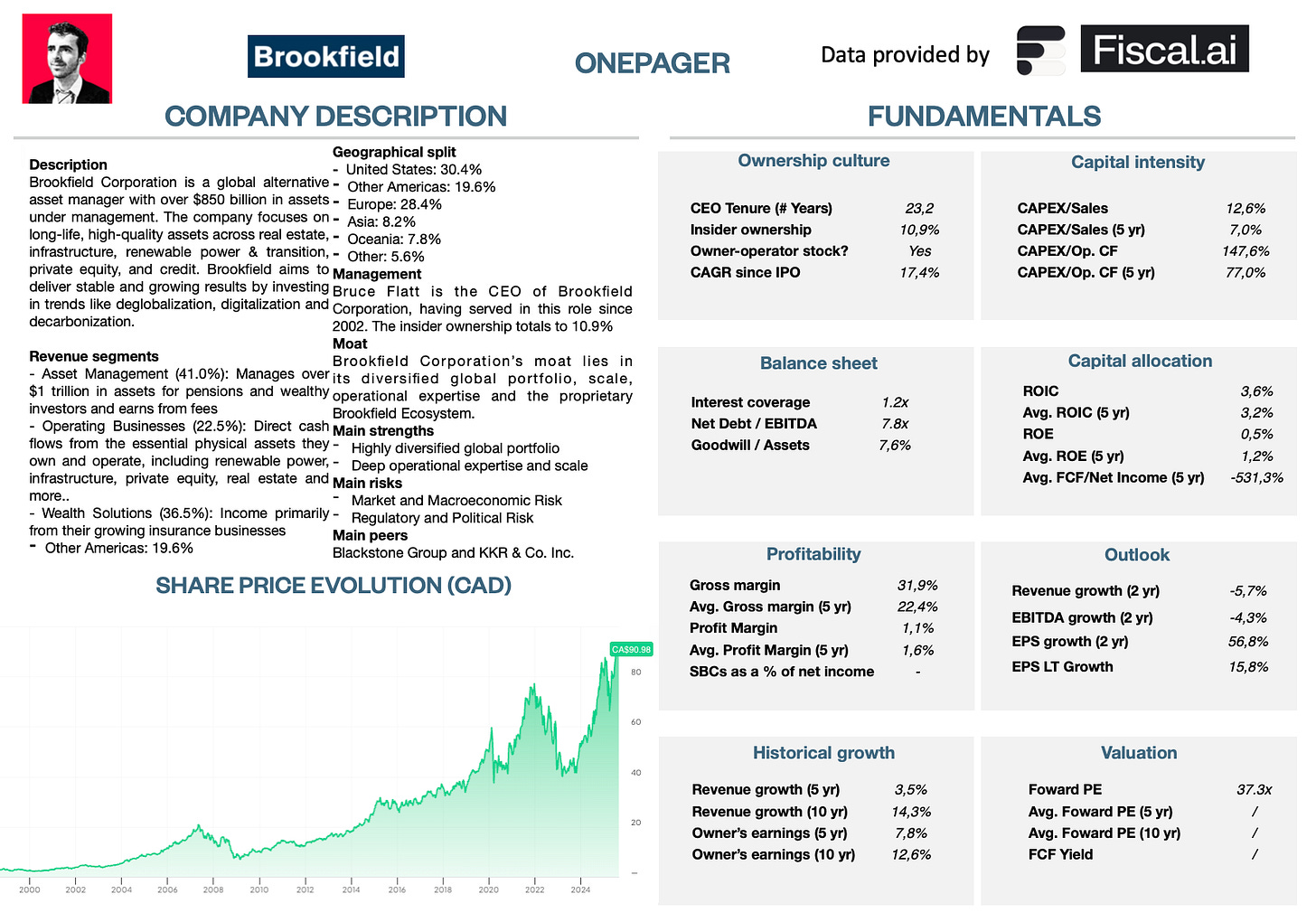

5. Brookfield Corporation ($BN)

How does the company make money?

Brookfield Corporation is a giant holding company. They manage over $1 trillion and own real-world assets like power plants, toll roads, and more. They earn fees and profits from this empire, then reinvest the cash to grow even bigger.A lot of investors see Brookfield as a way to team up with one of the best capital allocators in the world: Bruce Flatt.

Bruce Flatt is called ‘Canada’s Warren Buffett’ for a reason.

His approach?

Buy essential assets when they’re out of favor

Fix them

Hold them for the long run

Brookfield has returned +18% per year (!) for two decades.

Bruce Flatt has indicated they want to double every 5 years.

This would be attractive for long-term investors like us.

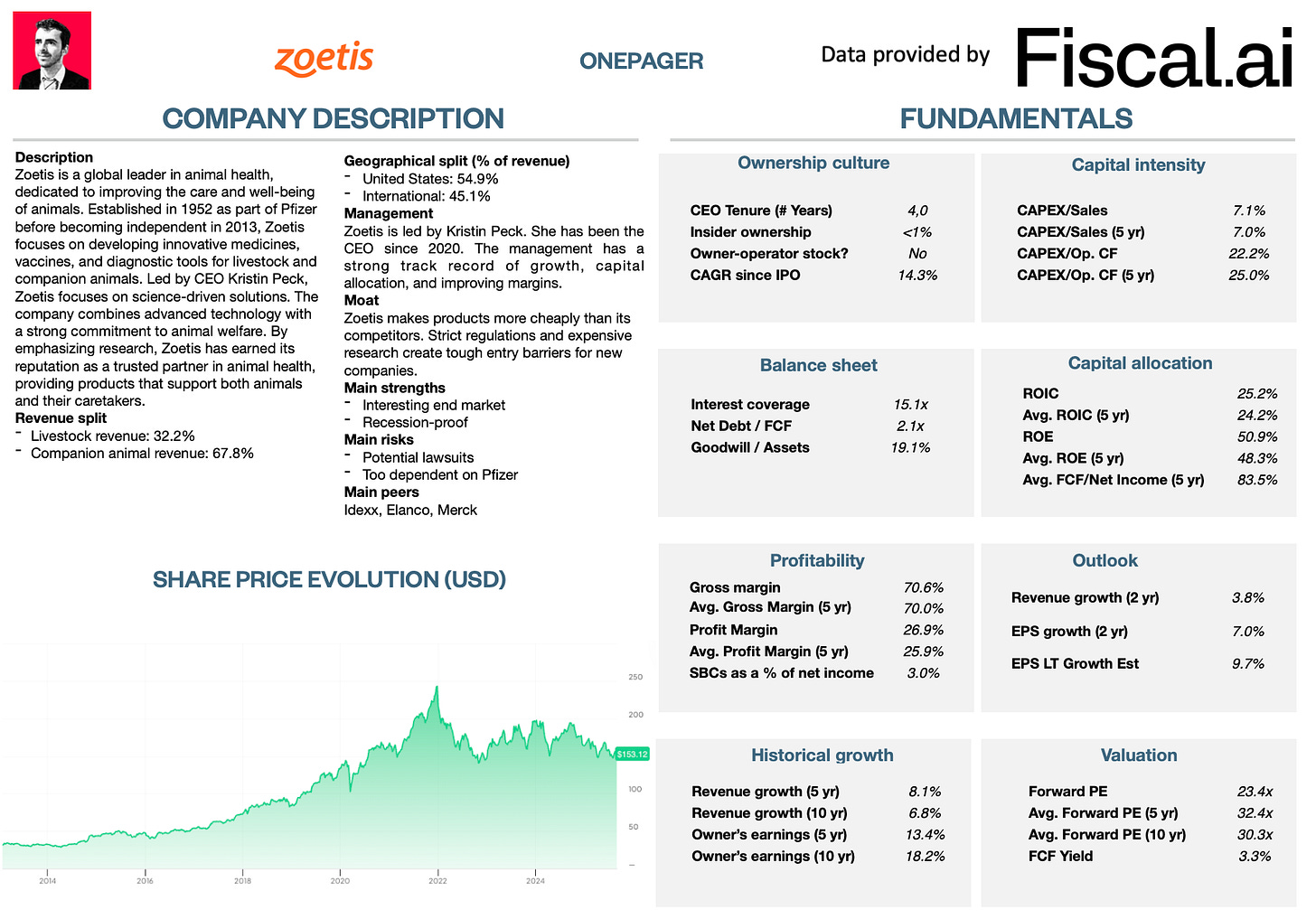

4. Zoetis ($ZTS)

How does the company make money?

Zoetis is the world’s #1 in animal health. It makes medicines, vaccines, and tests that keep animals strong. From cows, pigs, and chickens… to dogs, cats, and even horses.Zoetis is one of the highest-quality businesses in our universe.

The company focuses on two powerful trends:

People are treating pets like family and spending more on their health

Rising demand for meat worldwide, which requires healthier livestock

Zoetis is the market leader. The company benefits from scale advantages in research, production, and distribution.

And let’s not forget about innovation.

The company has a history of blockbuster drugs, all backed by strong patents. That keeps competition at bay.

You can download a full investment case here (written by Luc Kroeze).

Now let’s dive into the top 3.