By monthly tradition, you’ll get an update on our Best Buys of the month.

Where are the markets today? And what are our favorite stocks?

Let’s explore everything today.

January 2025

In January, the S&P 500 increased by 3.2%.

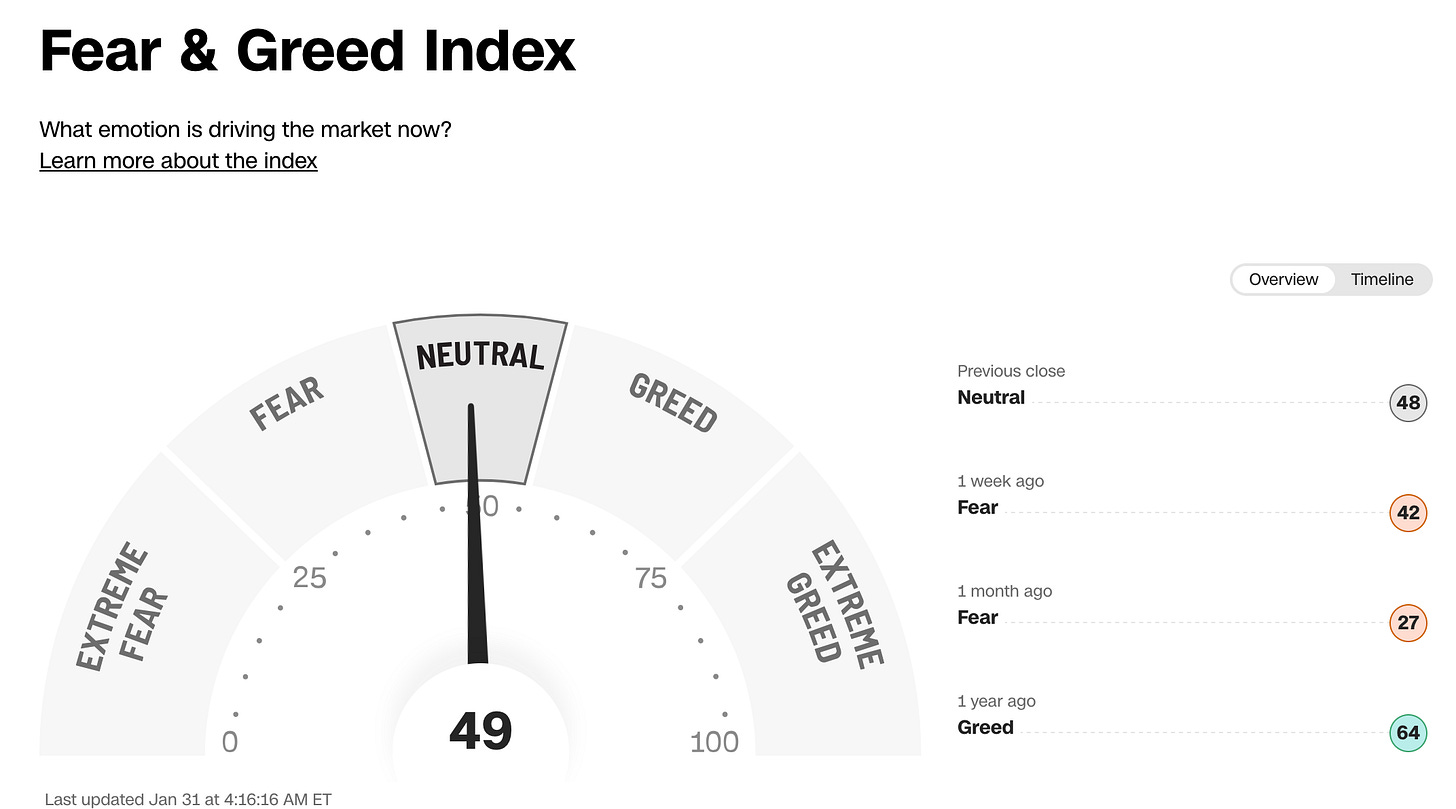

The Fear & Greed Index indicates that we are currently in ‘Neutral’ Mode.

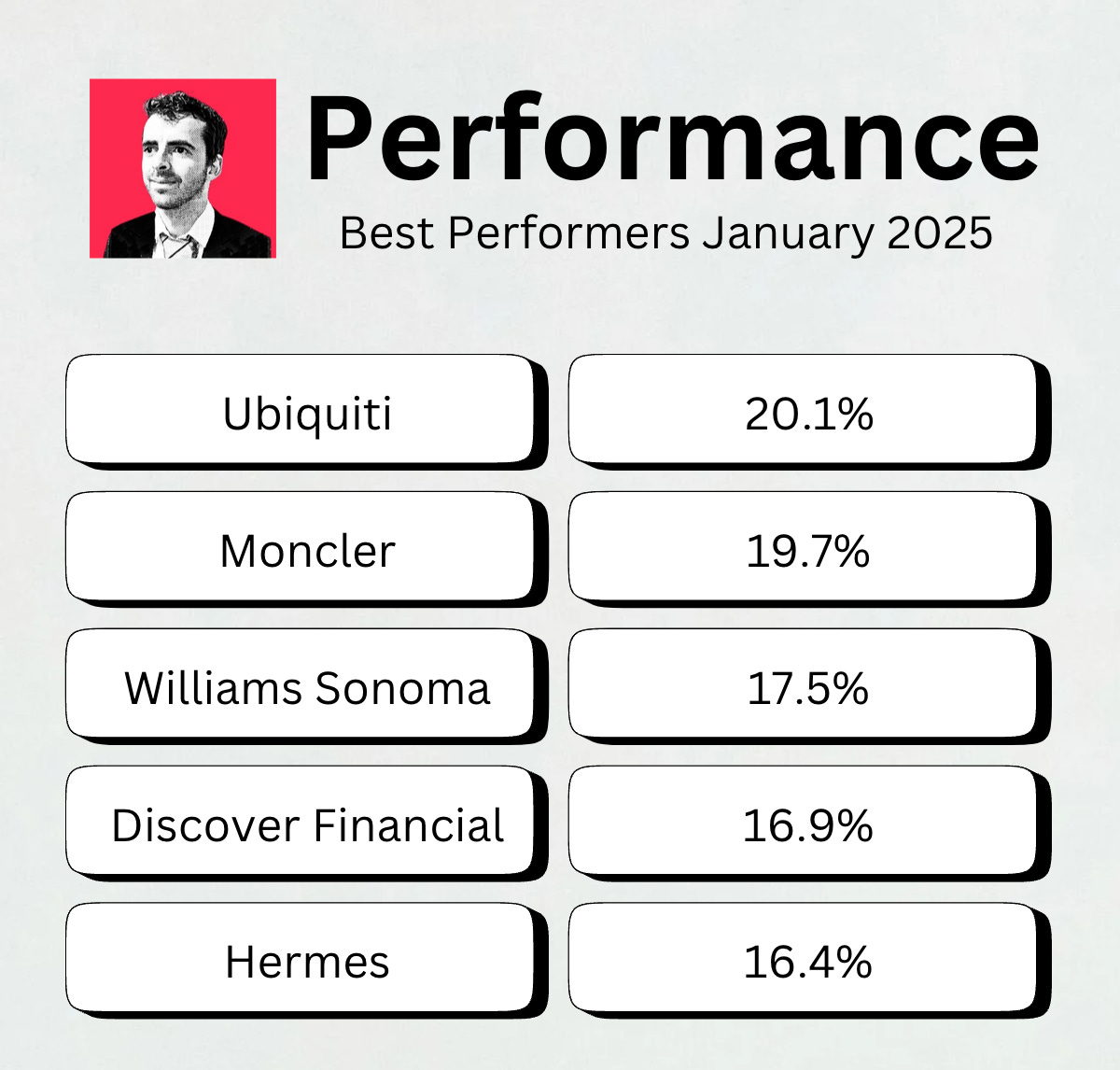

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

Best Performers

Spotlight: Computer Modelling Group ($CMG)

Computer Modelling Group (CMG) is a Canadian software company that makes simulation tools for the oil and gas industry.

CMG makes oil drilling and gas extraction more efficient and more sustainable.

Their technology is primarily used for storing CO2 underground, so it is no longer released into the atmosphere.

CMG’s business model bridges the growing demand for energy with the need to address climate change.

Computer Modelling Group got on the radar of many quality investors due to the fact that Chris Mayer bought the company.

Here’s his reasoning (source: Quartr):

"One stock I bought recently is Computer Modelling Group, listed in Canada. There is a certain Constellation Software influence here. Mark Miller is chairman of the board. The largest shareholder is a Constellation board member. And the head of acquisitions is an ex-CSI guy. The CEO, Pramod Jain, gets it.

Early in 2024 they adopted CSI-style compensation, which rewards ROIC + growth and requires part of the bonus to purchase shares in the open market. I love all of this. And then you have a steady, high-return, cash-spinning, moaty software business at the core. They've got lots of room to deploy capital in a big market and grow.

One negative is the dividend. But I'd expect them to cut or do away with the dividend entirely at some point as they ramp up their M&A program. They've only done two so far. The stock sold off heavily after a soft quarter in November, which is a gift for the longer-term shareholders." - Chris MayerThe fundamentals of CMG look like this:

Debt/Equity: 0.5x

Net Profit Margin: 16.4%

ROIC: 19.3%

Forward PE: 27.7x

Expected Long-Term EPS Growth: 18%

CAGR since IPO in 2018: 13.5%

Best Buys February 2025

Now let’s dive into our favorite stocks for February 2025.

I only mention companies that can’t be found within the Portfolio today.

I love the companies within our Portfolio and I think most are still (significantly) undervalued.

5. Kainos Group ($KNOS)

How does the company make money?

Kainos is an Irish technology company that provides IT services for governments and businesses. The company specializes in cloud-based solutions and AI technologies. Artificial Intelligence is clearly a secular trend. Kainos is well-positioned to benefit from this.

After a challenging 2024, Brendan Mooney was recently reappointed as CEO. Mooney had originally led the company for 22 years (2001-2023). He holds an 8.5% equity stake in $KNOS.

In an interview with the BBC, Mooney spoke about his return: “My time away has given me a fresh perspective on Kainos. I see significant growth opportunities.”

With major clients in the public sector (such as the UK Government) and the private sector (including Netflix), Kainos can rely on stable revenues, even in economically volatile times.

Today, Kainos trades at a Forward PE of 20.8x. Compared to its historical average, this is relatively cheap.

4. Adobe ($ADBE)

How does the company make money?

Adobe is globally known for its Creative Cloud, including Photoshop, Illustrator, and PDF. Almost 95% of Adobe’s revenue comes from cloud-based subscriptions, with almost 35 million subscribers. Being the industry standard in design software, Adobe holds a very dominant position in the creative sector.

Despite strong financial performances in 2024, Adobe’s stock price experienced a 25% decline. Investors doubt Adobe can make money from AI tools such as Firefly.

In several interviews, Adobe CEO Shantanu Narayen addressed these concerns, consistently saying: “AI is an opportunity, not a threat.”

This confidence is also seen in Adobe’s financial strategy.

In March 2024 the company announced a $25 billion share buyback program through 2028, underscoring Adobe’s strong belief in its AI projects, and creating shareholder value.

When Adobe would execute on its buyback program, they would buy back 13% (!) of their outstanding shares.

Now let’s dive in the top 3.