By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s get a little bit wiser today.

January 2026

The S&P 500 was up 1.3% in January

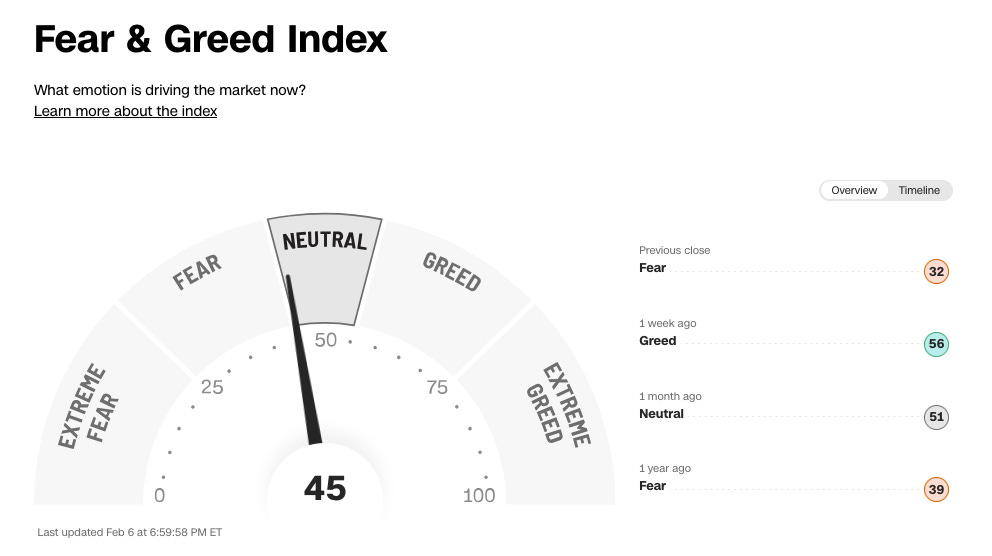

Investors are ‘Neutral’ today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

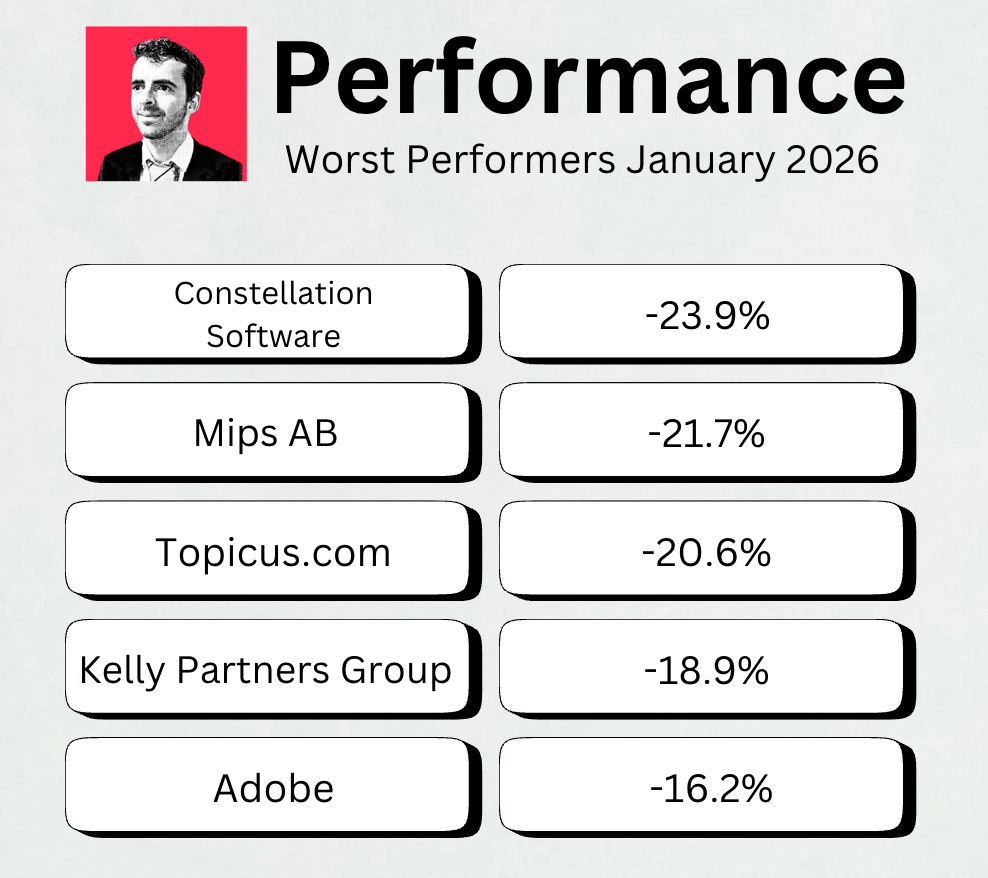

Worst performers

The cheaper we can buy great companies, the better.

Here are the worst performers of the past month:

Do you know what Constellation Software, Topicus.com, and Adobe are have in common?

They’re all software companies.

I think the market offers great opportunities in this segment today.

Best performers

These stocks did well over the past month:

Now let’s dive into a very interesting topic:

Should investors in software companies be worried about AI? Or is it a gift?

The impact of AI on software companies

"In the short run, the stock market is a voting machine, but in the long run, it is a weighing machine."

- Benjamin GrahamRight now, the market is terrified about Artificial Intelligence for software companies.

The narrative is simple:

“AI will replace traditional software. Why pay for a Salesforce or Adobe subscription when a lean AI agent can do it for free?”This fear has caused the stock price of many software companies to drop.

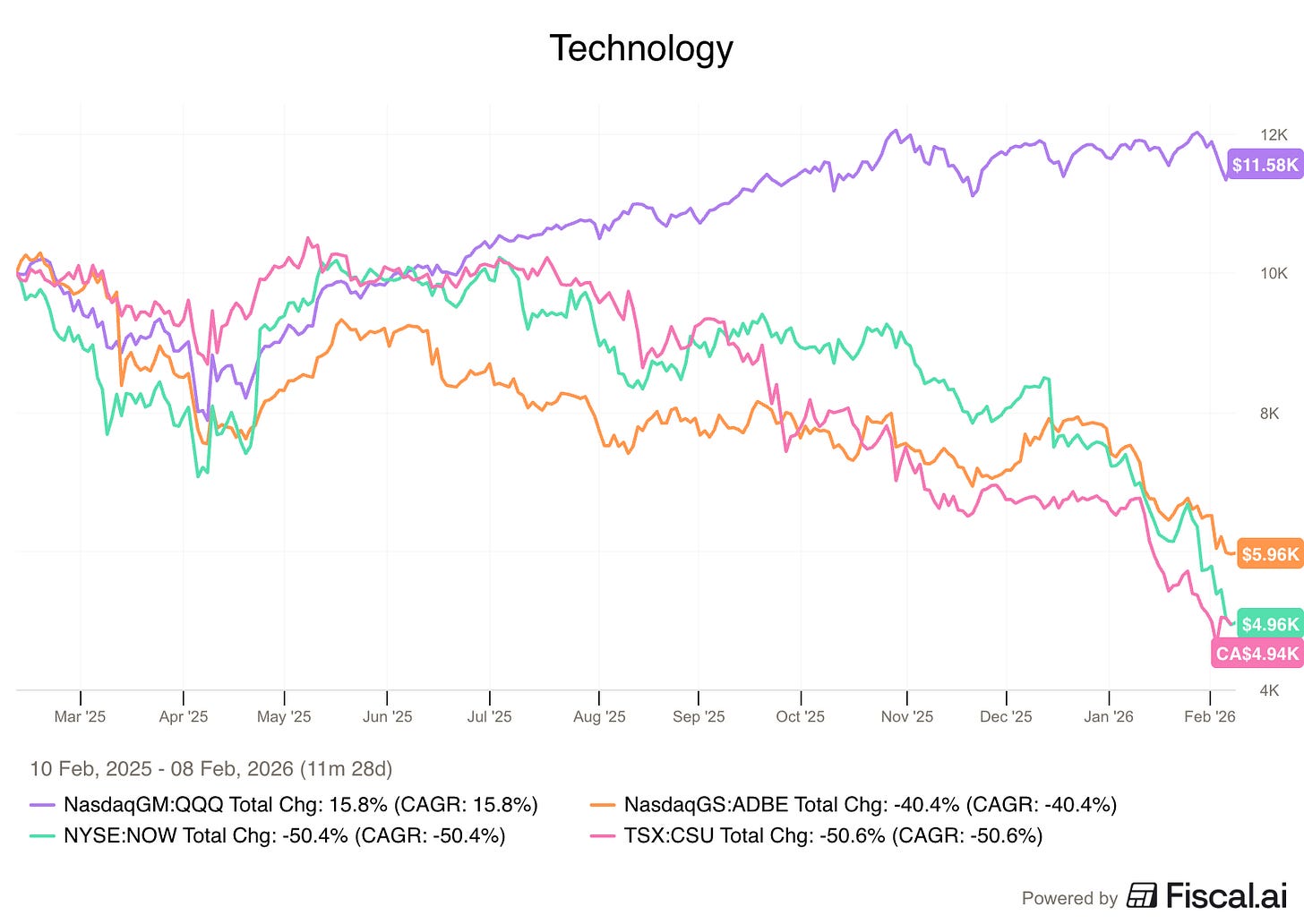

The Nasdaq 100 is flirting with record highs…

… while software companies like ServiceNow, Adobe, and Constellation Software are trading at levels we haven’t seen in years.

Two Sides of Disruption

AI will certainly disrupt some software companies.

If a company’s only value is completing a basic task (like simple data entry or basic reporting), it might be in trouble.

But for most Quality Stocks, AI is not a threat, it’s a tool that can make them better.

Quality Always Wins

A Quality Company has a moat that AI cannot easily disrupt.

Proprietary Data: AI is only as good as the data it trains on. Companies like ADP and Intuit have decades of specialized, private data that competitors don’t.

High Switching Costs: Replacing a critical system is incredibly painful for large businesses. Most CFOs won’t risk their entire operation to save a few dollars.

Operating Leverage: Quality companies are using AI in their own products, making their products better and cheaper.

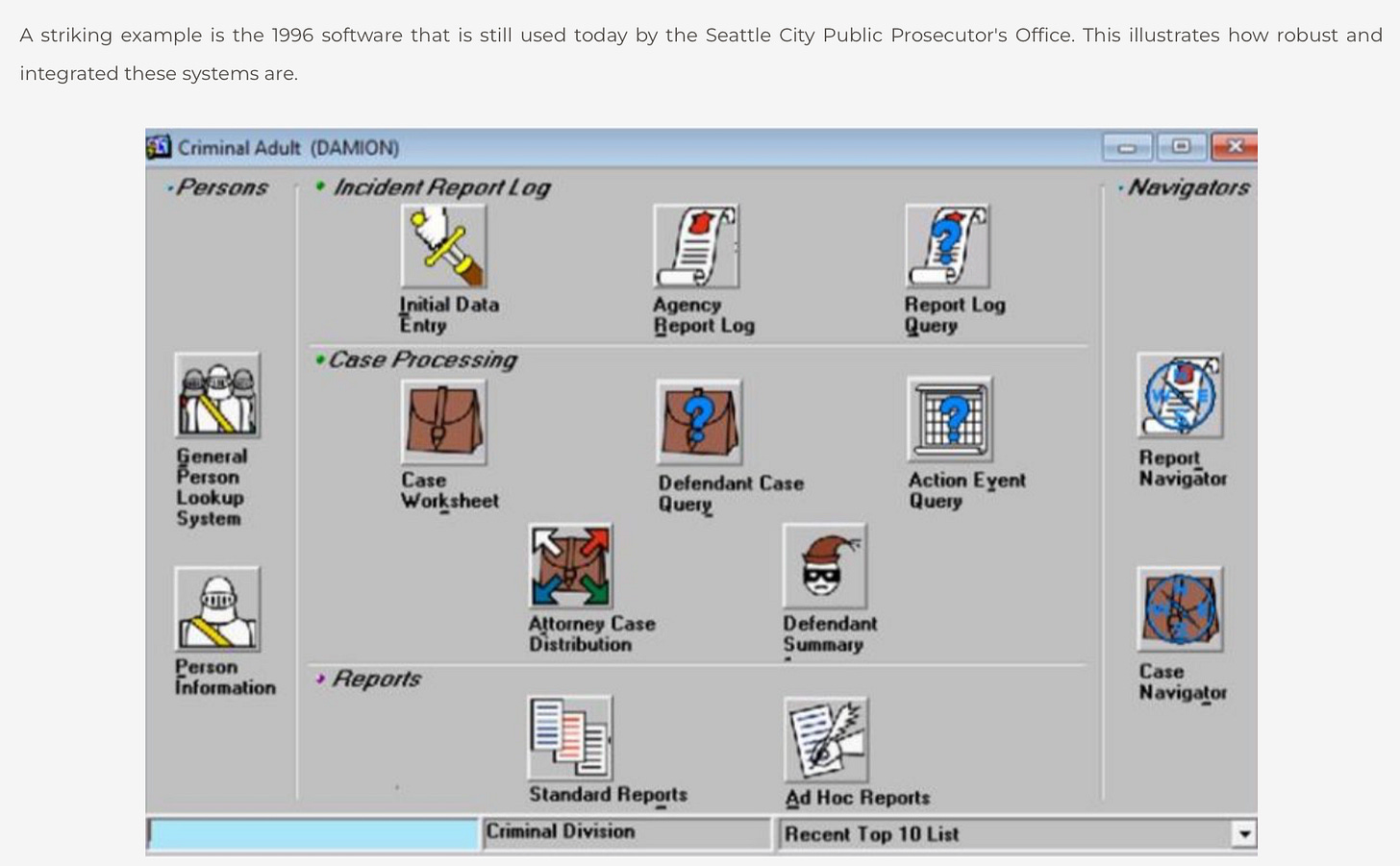

Want proof that software can be very difficult to replace?

Software from 30 years ago is still being used in some places!

Below is an example of a tool from Constellation Software:

Opportunities in Software?

Charlie Munger used to tell us that the big money is in the waiting.

When a narrative like “AI will disrupt every software company” takes over, the market panics.

This creates an interesting opportunity to buy companies with high ROIC, strong free cash flow, and dominant market positions at a significant discount to their intrinsic value.

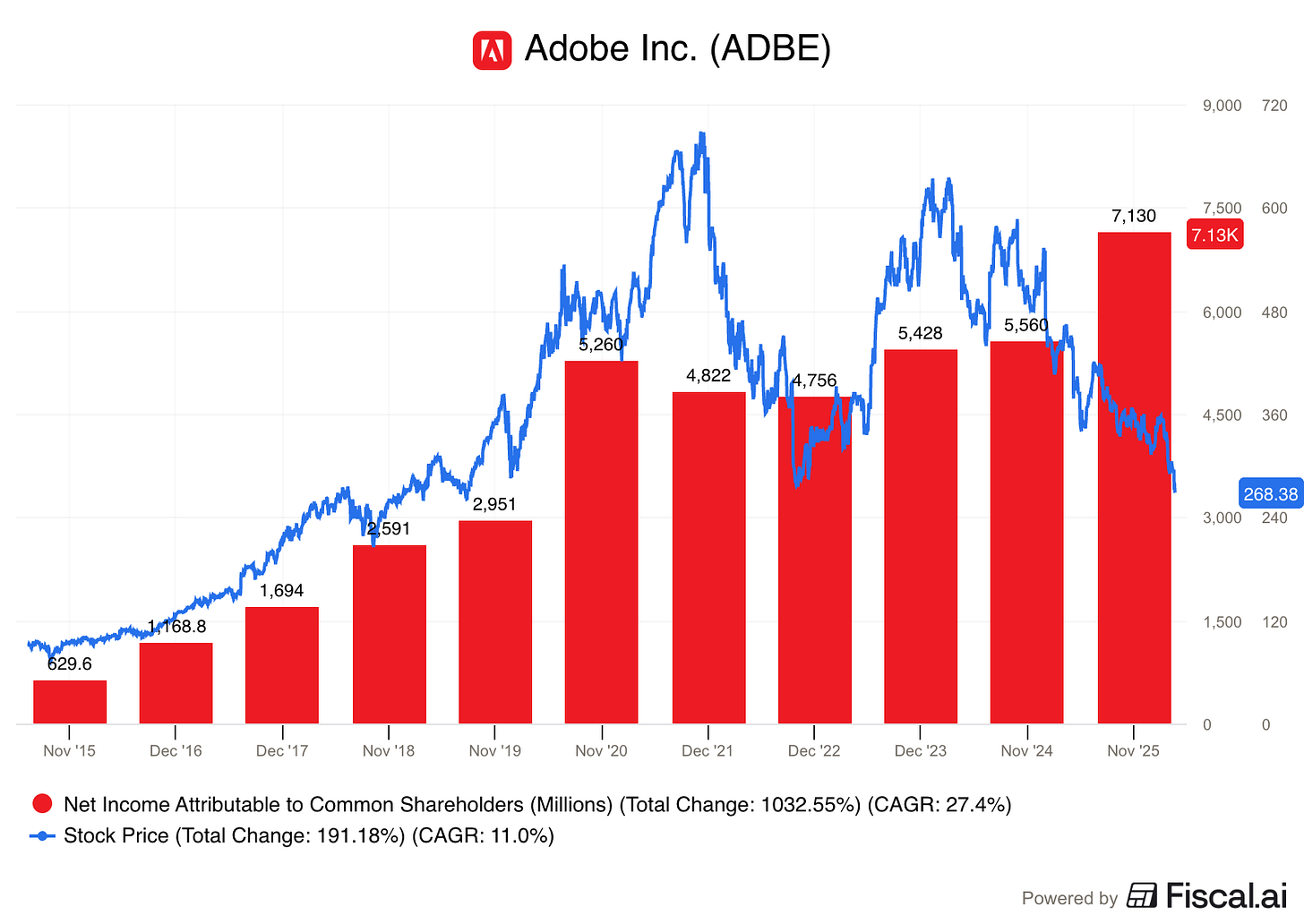

Always remember that stock prices eventually follow earnings.

We have been looking for high quality software businesses that are currently being punished by the market.

That’s why we focus solely on software companies in this Best Buys article.

Best Buys February 2026

Now, let’s dive into our five favorite stocks for February 2026.

5. Adobe ($ADBE)

How does Adobe make money?

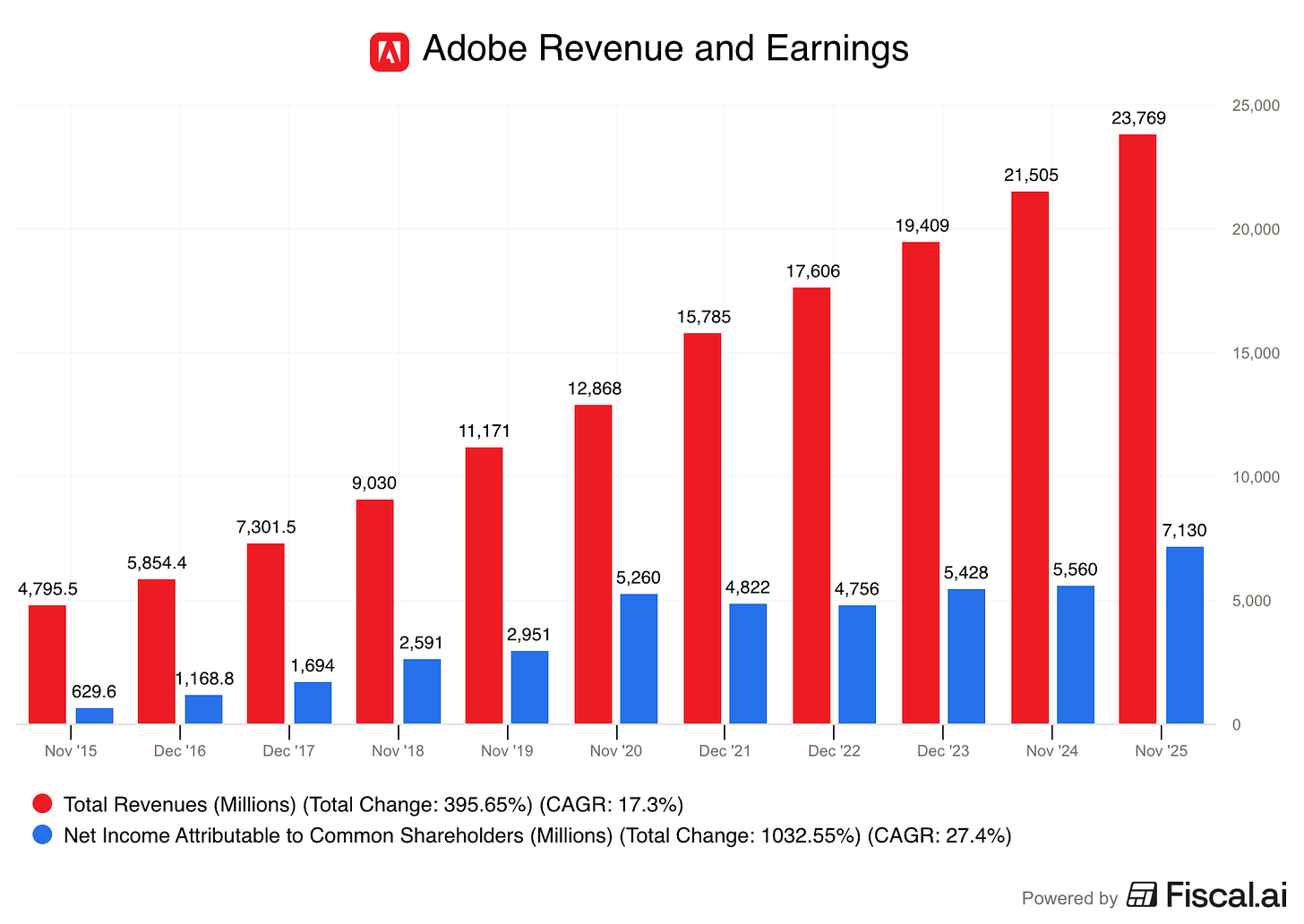

Adobe makes money primarily through a cloud-based subscription model. It is the global leader in digital creative and document software, generating the vast majority of its revenue from recurring fees for products like Photoshop, Acrobat, and the Adobe Experience Cloud.Two things keep declining with Adobe.

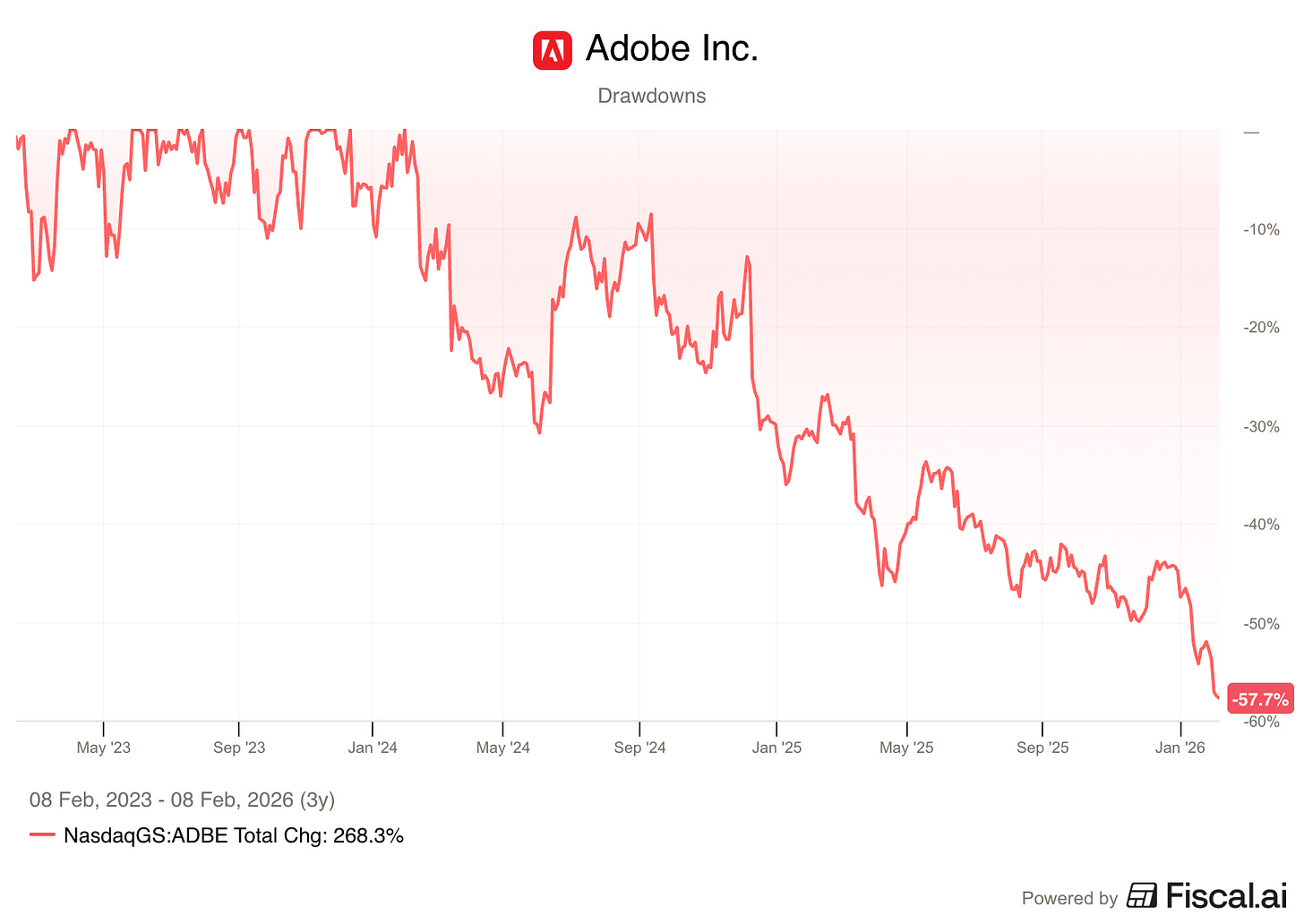

The first thing? The share price (a bad thing).

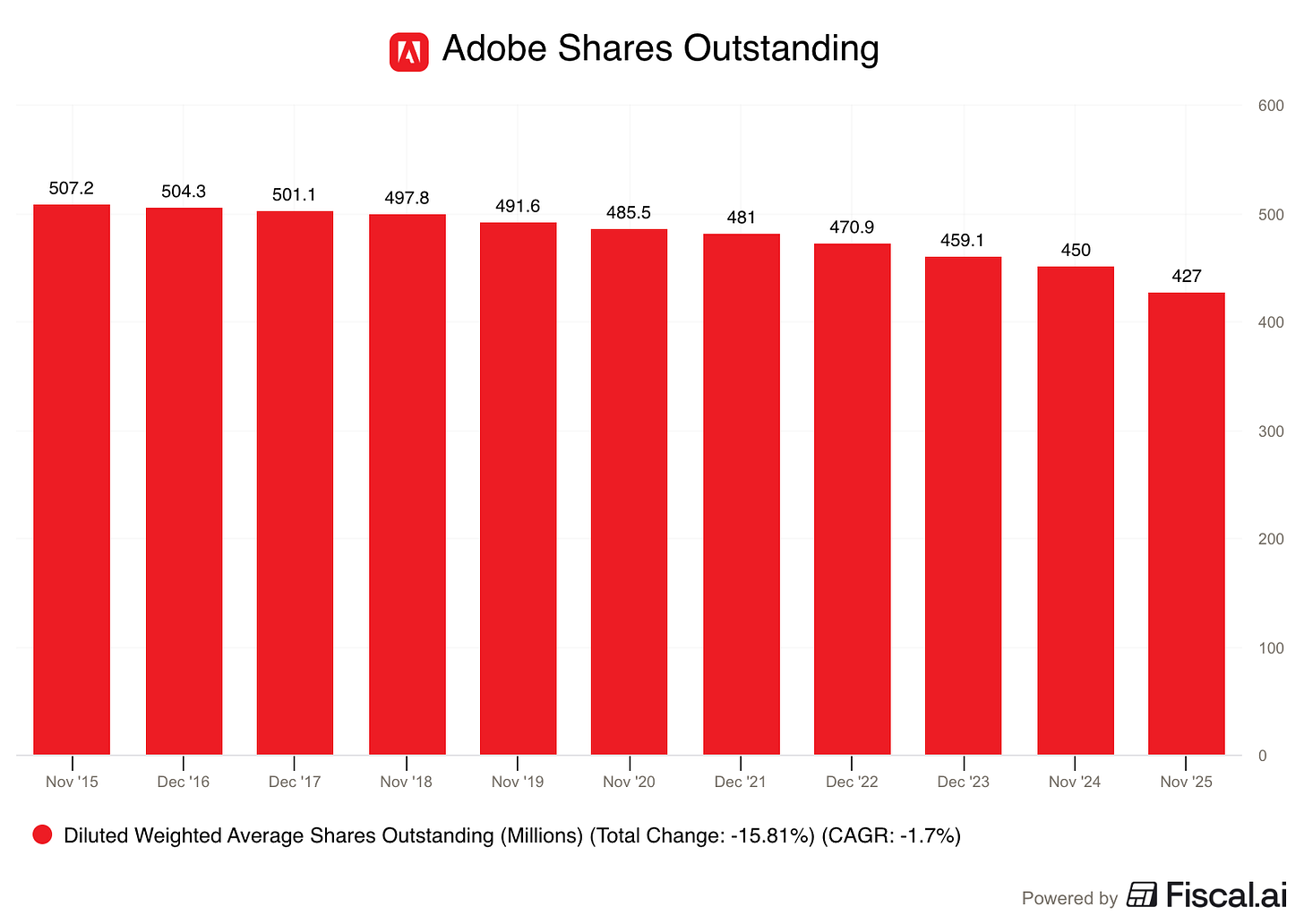

Second? The number of shares outstanding (a good thing).

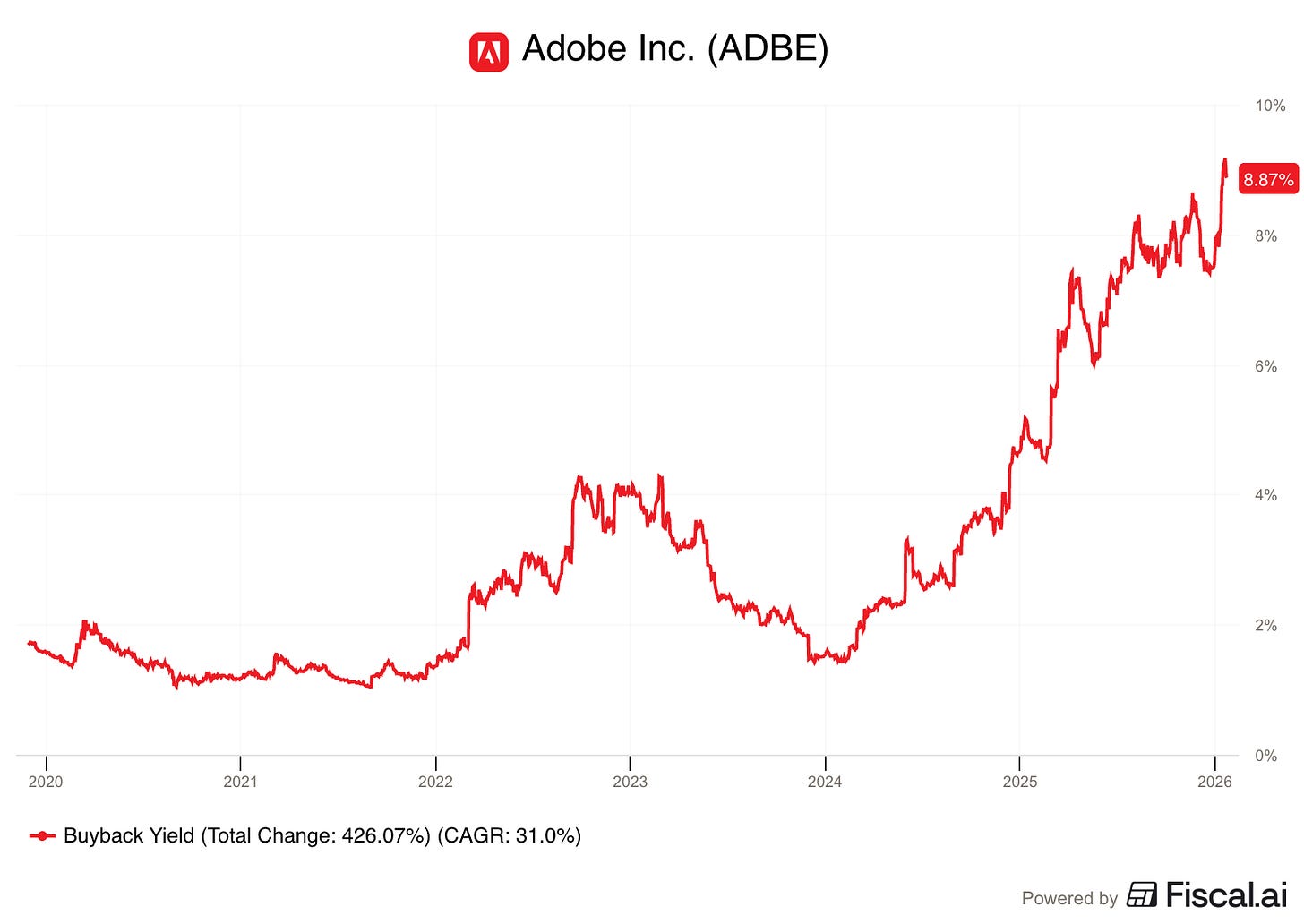

This means Adobe is buying back its own shares at cheaper and cheaper valuation levels.

Something that hasn’t declined?

Adobe’s revenue and earnings.

This creates a very interesting set up.

The market thinks AI will replace Adobe’s software in the future.

I think that’s unlikely.

Here are a few reasons why:

High Switching Costs: Professionals are trained on Adobe products in school, and companies have been using their products for years. Switching to a competitor would mean retraining entire teams and rebuilding workflows from scratch.

The Industry Standard: Adobe created the PDF and the standard file formats for the creative world. To collaborate with anyone else in the industry, you have to use Adobe products.

AI Integration: By embedding its Firefly AI directly into existing tools, Adobe ensures users don’t need to look elsewhere for new technology.

In December, Adobe said the number of AI credits used has grown by 3x from the quarter before.

The market thinks AI will disrupt Adobe’s business, but right now it looks like AI could be helping it.

Right now, Adobe is buying back almost 9% of its shares every single year.

It’s a very interesting Cannibal Stock.

4. Fortinet ($FTNT)

How does Fortinet make money?

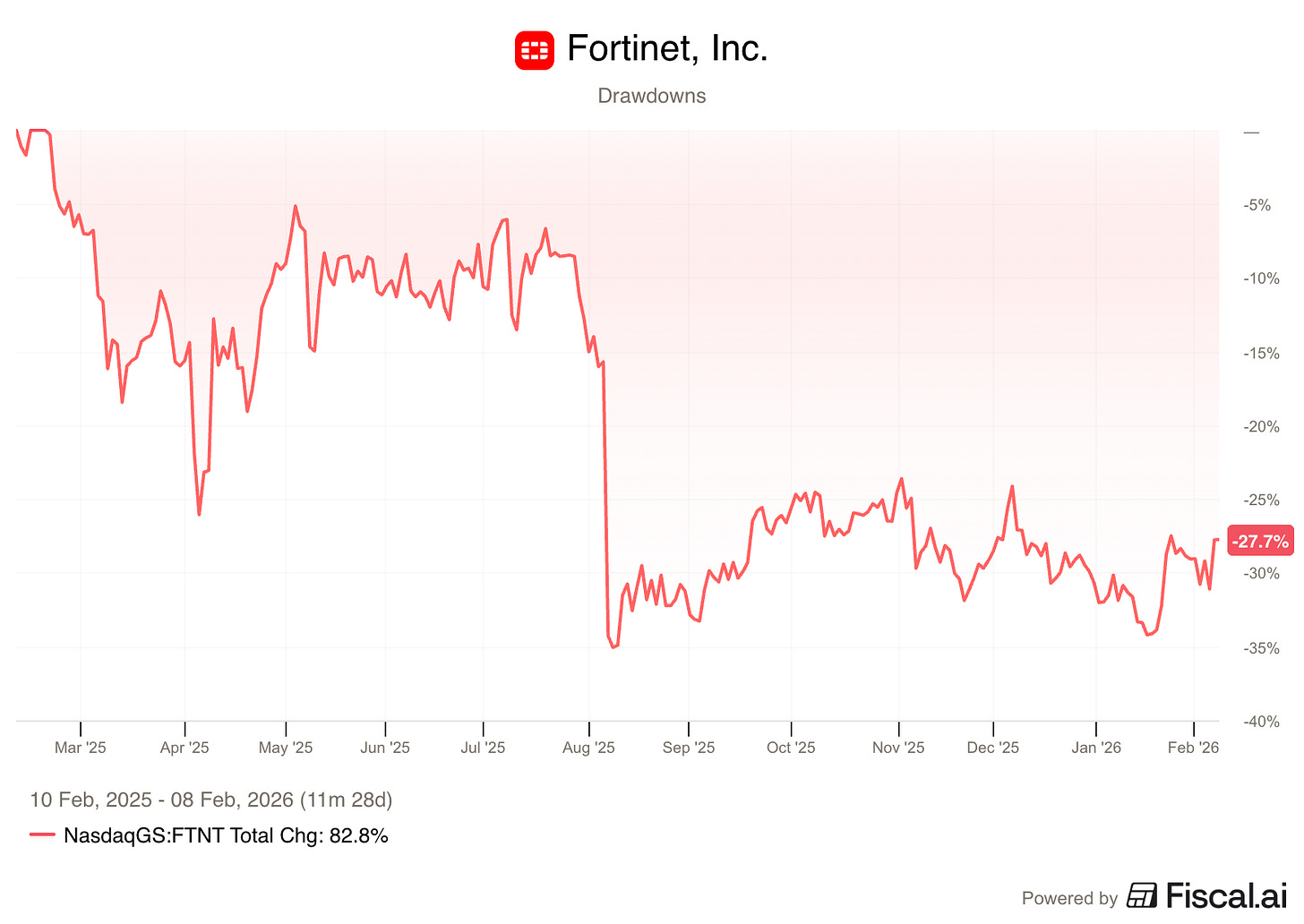

Fortinet makes money by selling cybersecurity products and services that protect networks, users, and cloud environments from cyberattacks. Their customers range from small businesses to large enterprises and governments.Fortinet is another company that’s seen a significant drawdown in its stock price recently.

The selling pressure is caused by the following:

Fears of AI disruption in security software

Reports that China has banned foreign security software from being used in certain sectors

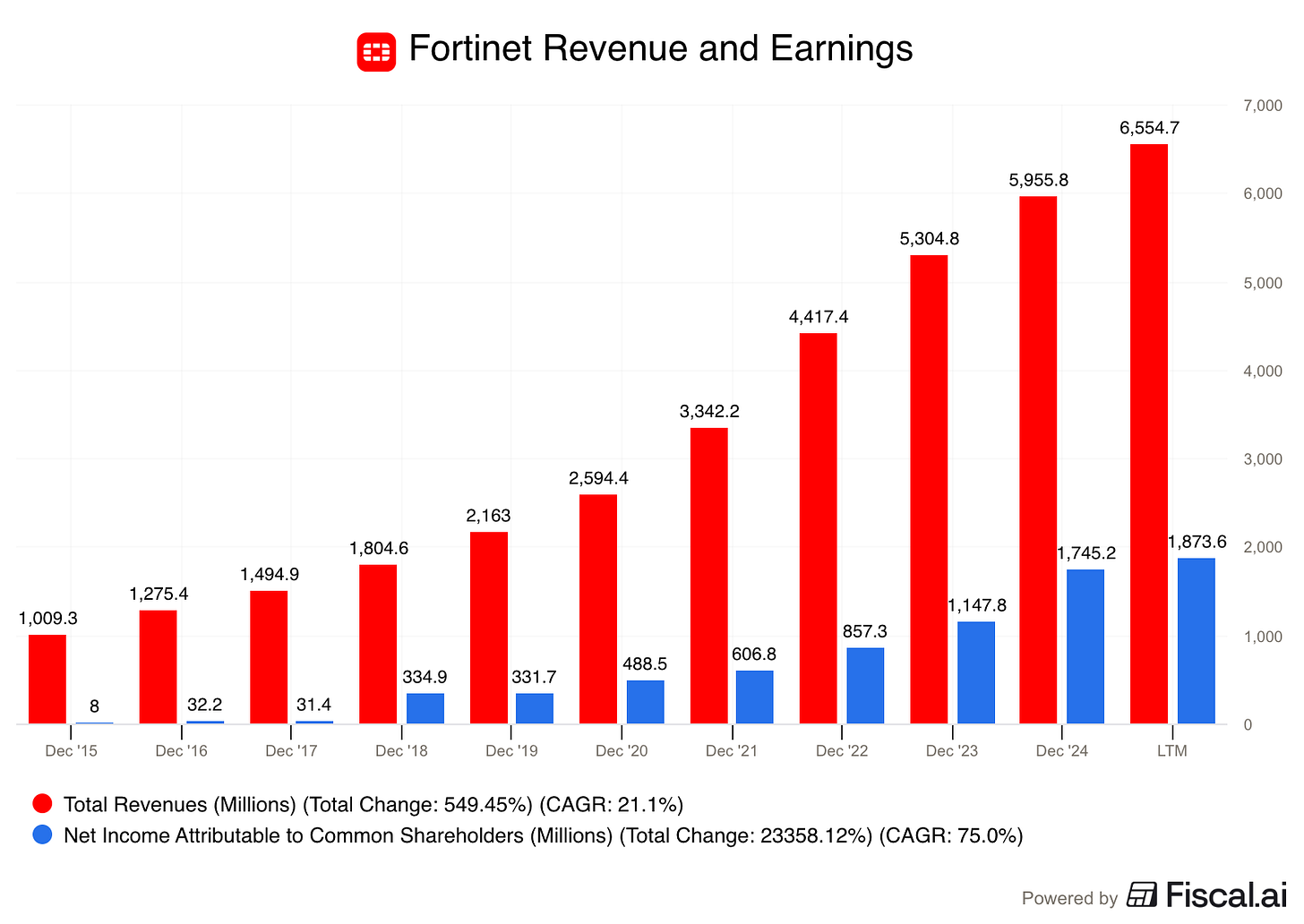

But Fortinet is still an amazing company.

It was founded in 2000 by brothers Ken Xie (CEO) and Michael Xie (CTO).

Together, they still own 15% of the company.

Cybersecurity is very important for every business out there.

Which is why Fortinet just keeps growing its revenue and earnings.

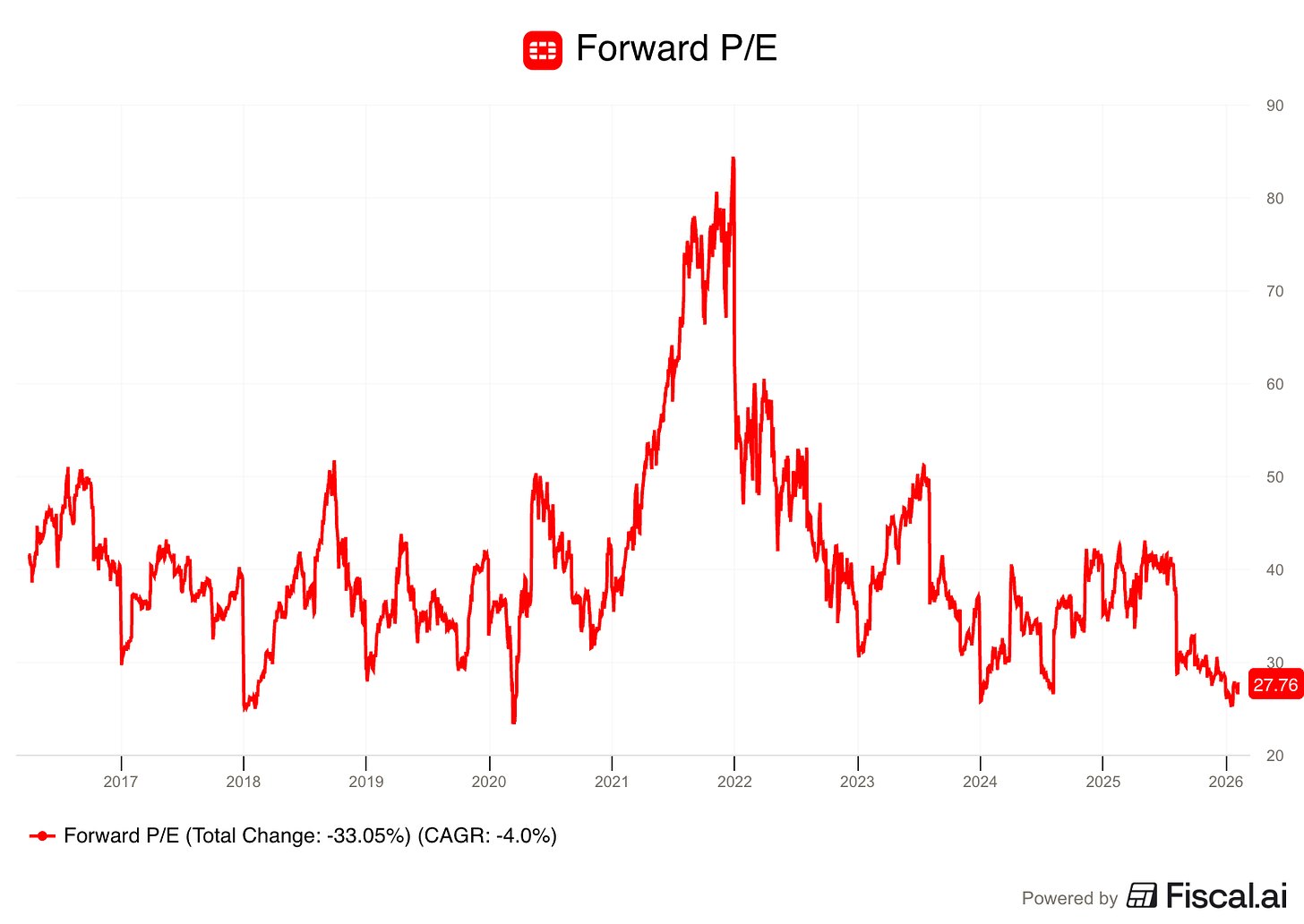

With the continued decline in its share price, Fortinet is trading at attractive valuation levels:

Now let’s dive into the top 3.