By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s get a little bit wiser today.

December 2025

The S&P 500 was flat in December.

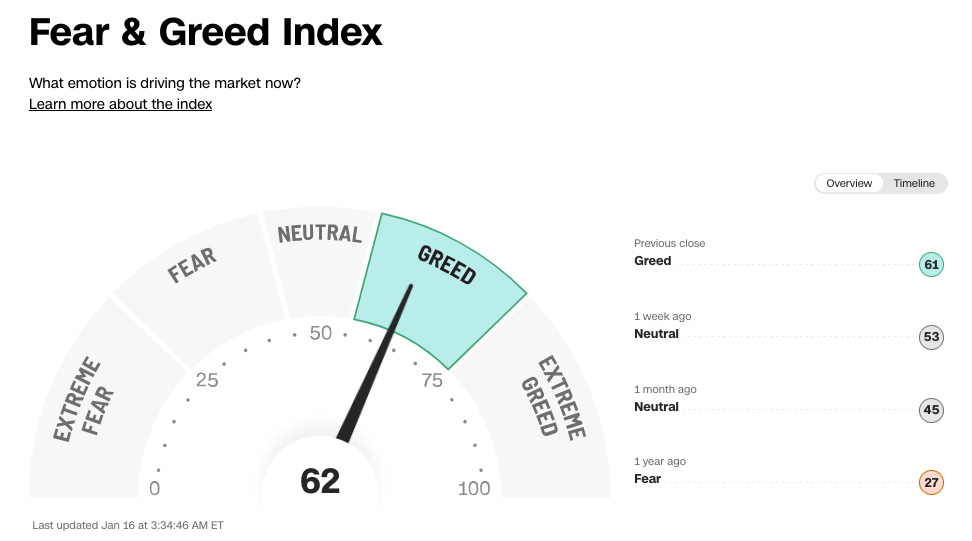

Investors are neutral today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

Here are the worst performers of the past month:

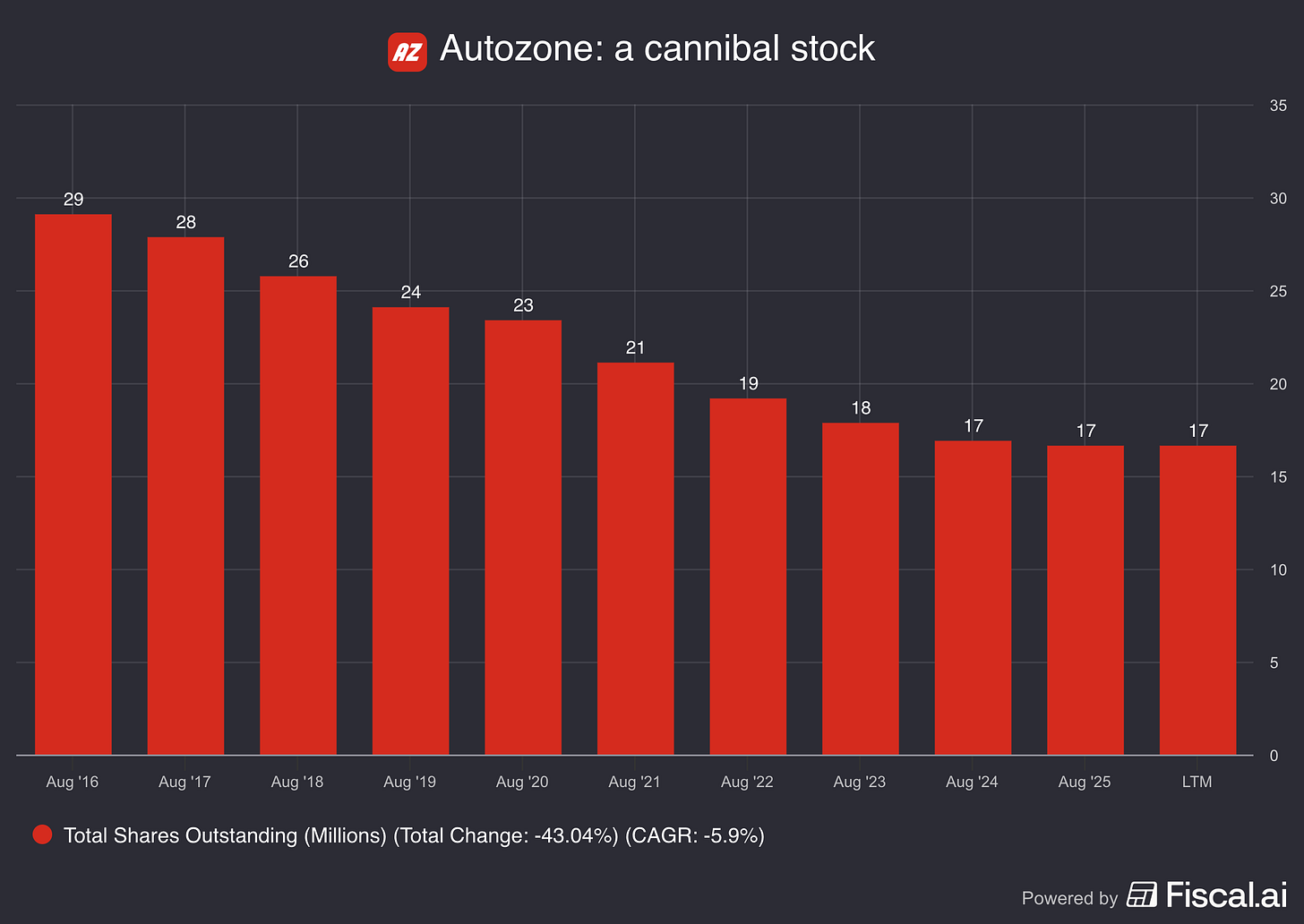

A lower stock price is actually a good thing for Autozone.

Why? It’s a Cannibal Stock.

This way, the company can buy back shares at more attractive valuation levels:

Best performers

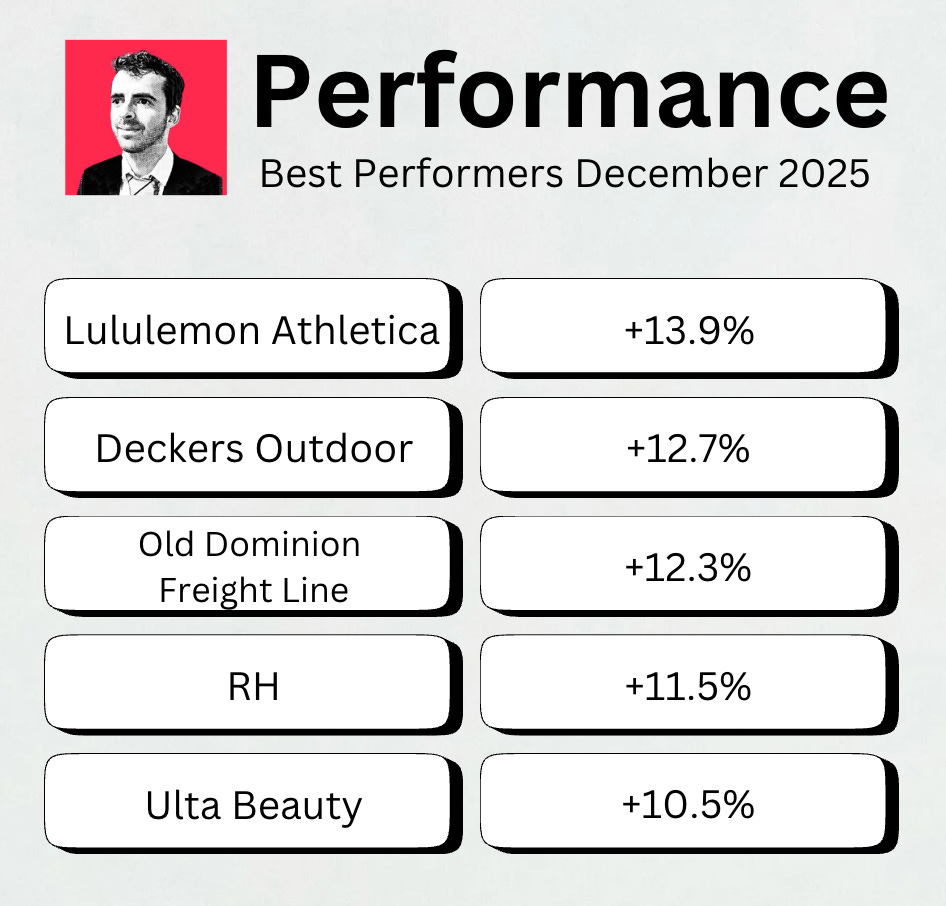

These stocks had a year-end rally:

Retailers like Ulta Beauty and RH had an excellent year-end.

Spotlight: 3i Group ($III)

How does 3i Group make money?

3i Group is a holding company. They are a UK-based investment company focused primarily on private equity and infrastructure. Unlike software companies that sell products, 3i makes money by investing its own balance sheet into high-quality businesses and growing their value over time.3i Group is an interesting holding company with one crown jewel: Action.

Let’s start with some history first.

Brief introduction

3i was founded in 1945 as the Industrial and Commercial Finance Corporation.

Over time, 3i transitioned away from being a diversified private equity manager into a highly focused, conviction-driven investor.

Its strategy today is based on one simple rule: Let your winners run.

Action is a prime example of that.

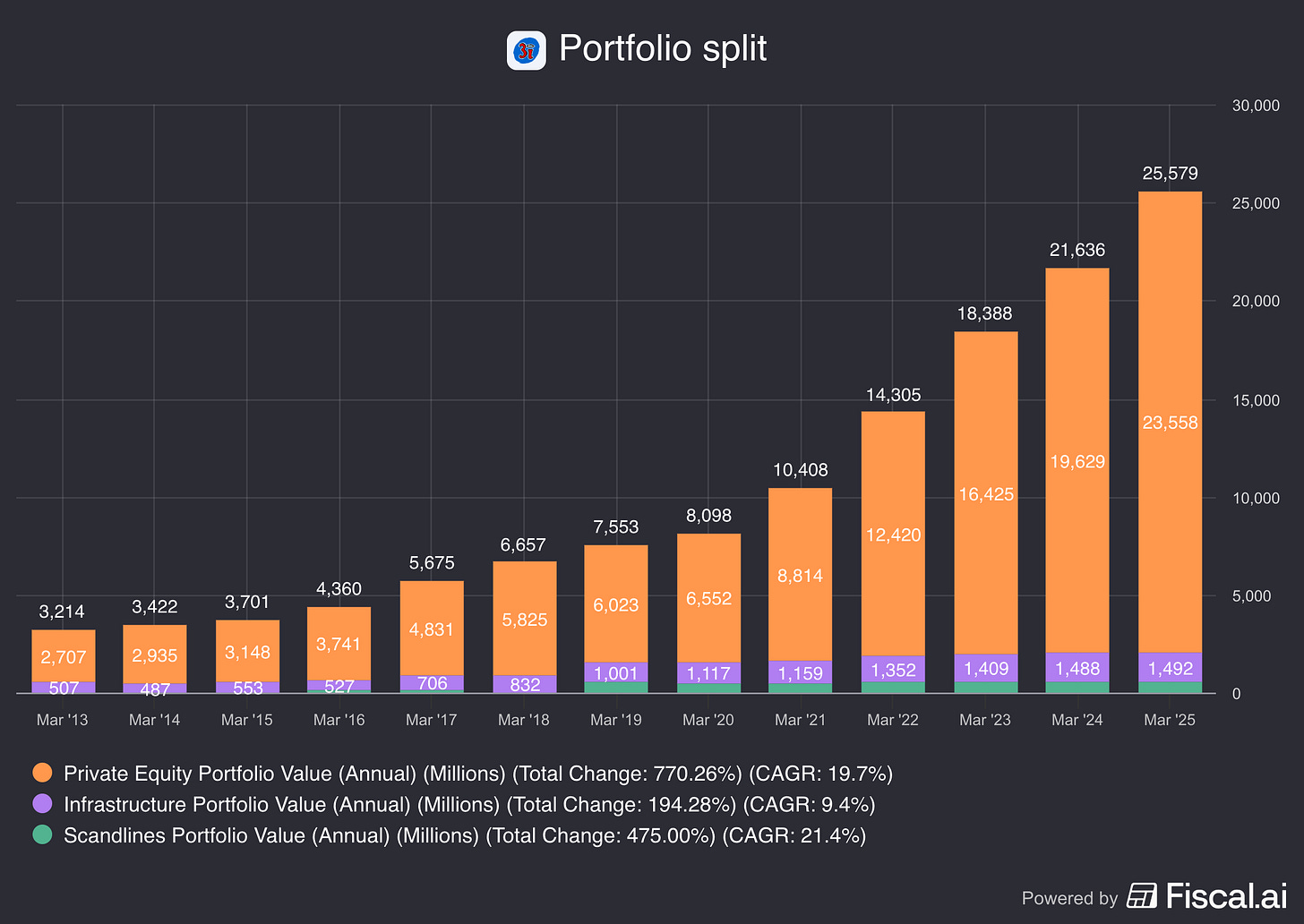

On March 31st, 2025, Action formed 76% of the Private Equity portfolio.

This is by far the most important part of 3i Group’s whole Portfolio:

An investment in 3i Group is basically an investment in Action. So let’s dive into the retailer every European loves.

Action

Action is the engine behind 3i’s success.

The business operates a hard-discount model. They sell everyday non-food items at very low prices.

They have a cost advantage based on their size:

Bigger size allows Action to buy products in bulk

Bulk buying lowers product costs

Lower costs mean lower prices for customers

Lower prices attract more customers

More customers lead to more growth, strengthening Action’s advantage

This creates a powerful cycle where everyone benefits.

It’s a competitive advantage in which customers win too. Just like Amazon and Costco.

Why is the stock cheap?

An amazing company, right?

Now, let’s take a look at the price chart. Since October 2025, the stock declined by almost 20%.

The reason?

Action’s like-for-like growth was ‘just’ 6.5%. Investors expected this number to be 6.8%.

Investors were totally upset by the 0.3% difference. I kid you not.

What is like-for-like growth?

Like-for-like growth measures how much sales or performance have changed for the same set of stores over time. It excludes the impact of new openings.This is short-term noise if you ask me.

So let’s zoom out and focus on the intrinsic value growth of 3i Group.

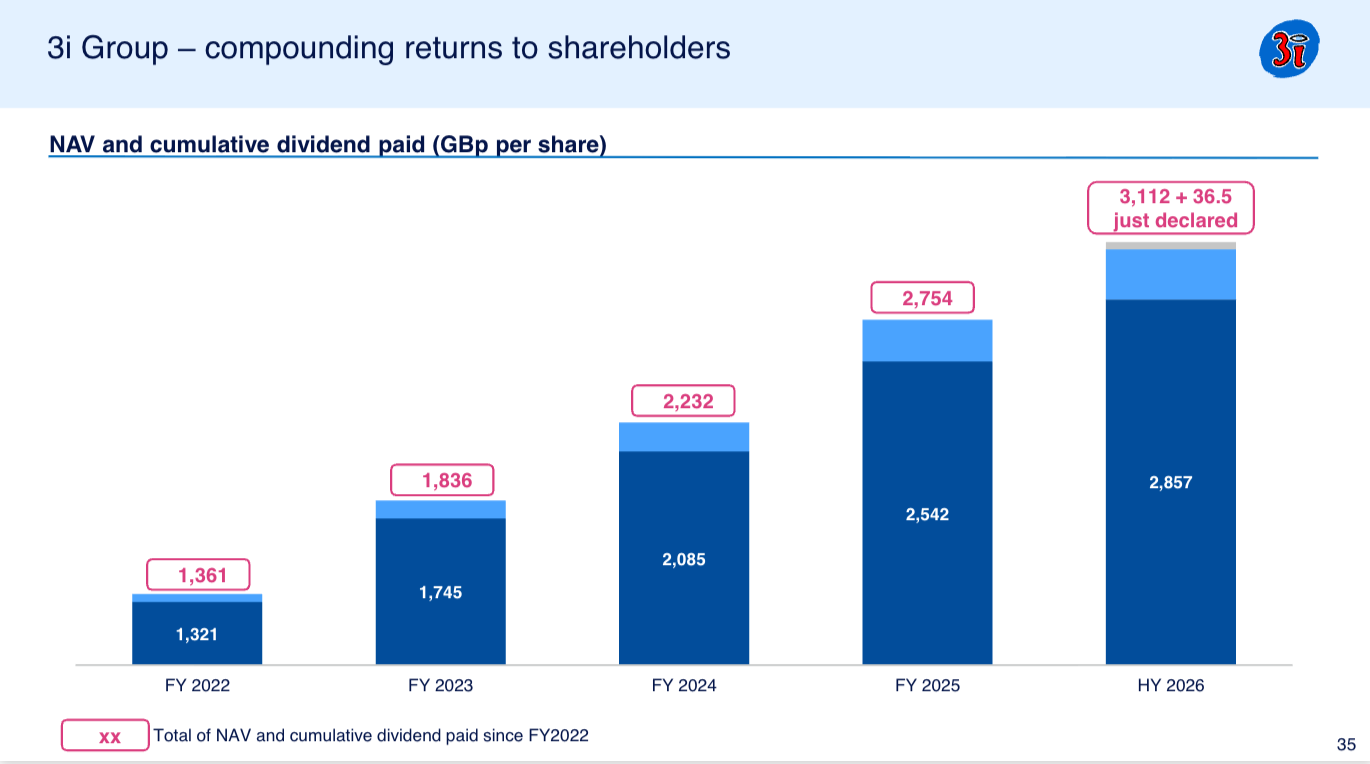

As you can see, 3i Group’s NAV (intrinsic value) doubled (!) in the last three years:

3i Group delivered excellent returns for shareholders over the past years:

"This is the fifth consecutive year we have delivered a total return over 20%; over this same period, our average annual total return was 30%." - CEO Simon Borrows Zooming out even more, you’ll see the magic of compounding put to work:

Best Buys January 2026

Now, let’s dive into our five favorite stocks for January 2026.

We only talk about companies that aren’t in Our Portfolio today. Why? We love all companies we own.

Partners have 24/7 access to the Portfolio here.

The 5 examples we talk about in this article can be considered as serious candidates for the Portfolio.

5. Pool Corporation ($POOL)

How does Pool Corporation make money?

Pool Corporation makes money by distributing swimming pool supplies, equipment, and outdoor living products. It is the largest wholesale distributor of pool-related products in the world.Someone who owns Pool Corporation? Berkshire Hathaway (Warren Buffett).

The reason?

Pool is the largest wholesale distributor of swimming pool supplies, equipment, parts, and related outdoor living products globally.

It serves roughly 125,000 wholesale customers across multiple continents.

Pool Corporation’s advantage comes down to one simple idea: economies of scale.

The larger your company, the easier and cheaper you can operate.

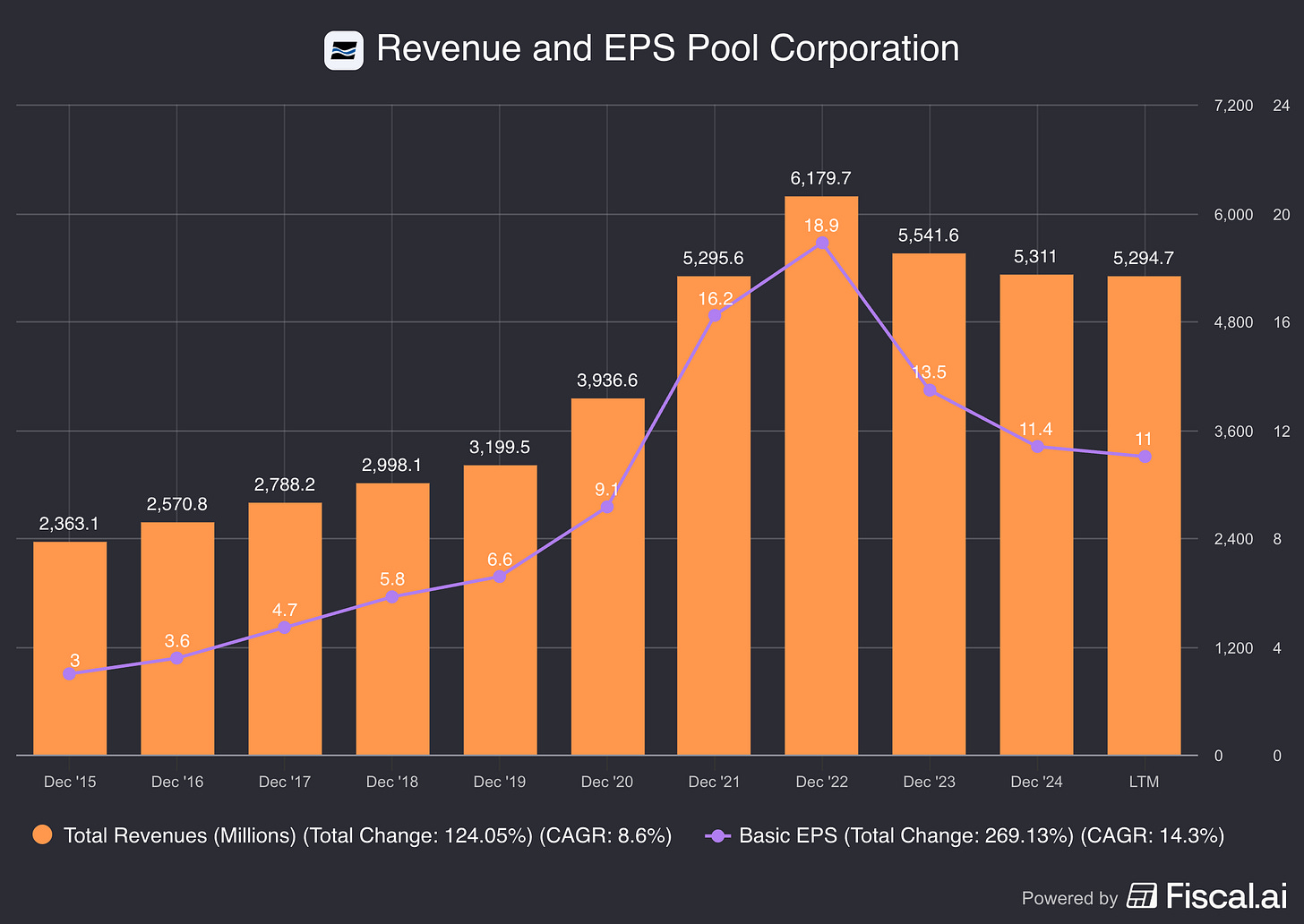

Pool Corp benefited from a jump in new pool construction demand during the COVID.

Since 2022, demand has dropped due to a weak macroeconomic environment.

As a result, revenue and earnings have declined:

And yet… We think Pool Corporation remains an amazing company.

4. Fortinet ($FTNT)

How does Fortinet make money?

Fortinet makes money by selling cybersecurity products and services that protect networks, users, and cloud environments from cyberattacks. Their customers range from small businesses to large enterprises and governments.The name Fortinet comes from two words:

Fortress

Network

It reflects the company’s original mission: building a strong digital fortress around networks.

The company was founded in 2000 by brothers Ken Xie (CEO) and Michael Xie (CTO).

Together, they still own 15% of the company.

But despite being billionaires… They avoid publicity, flashy spending, and social media.

This is exactly what you want to see as an investor.

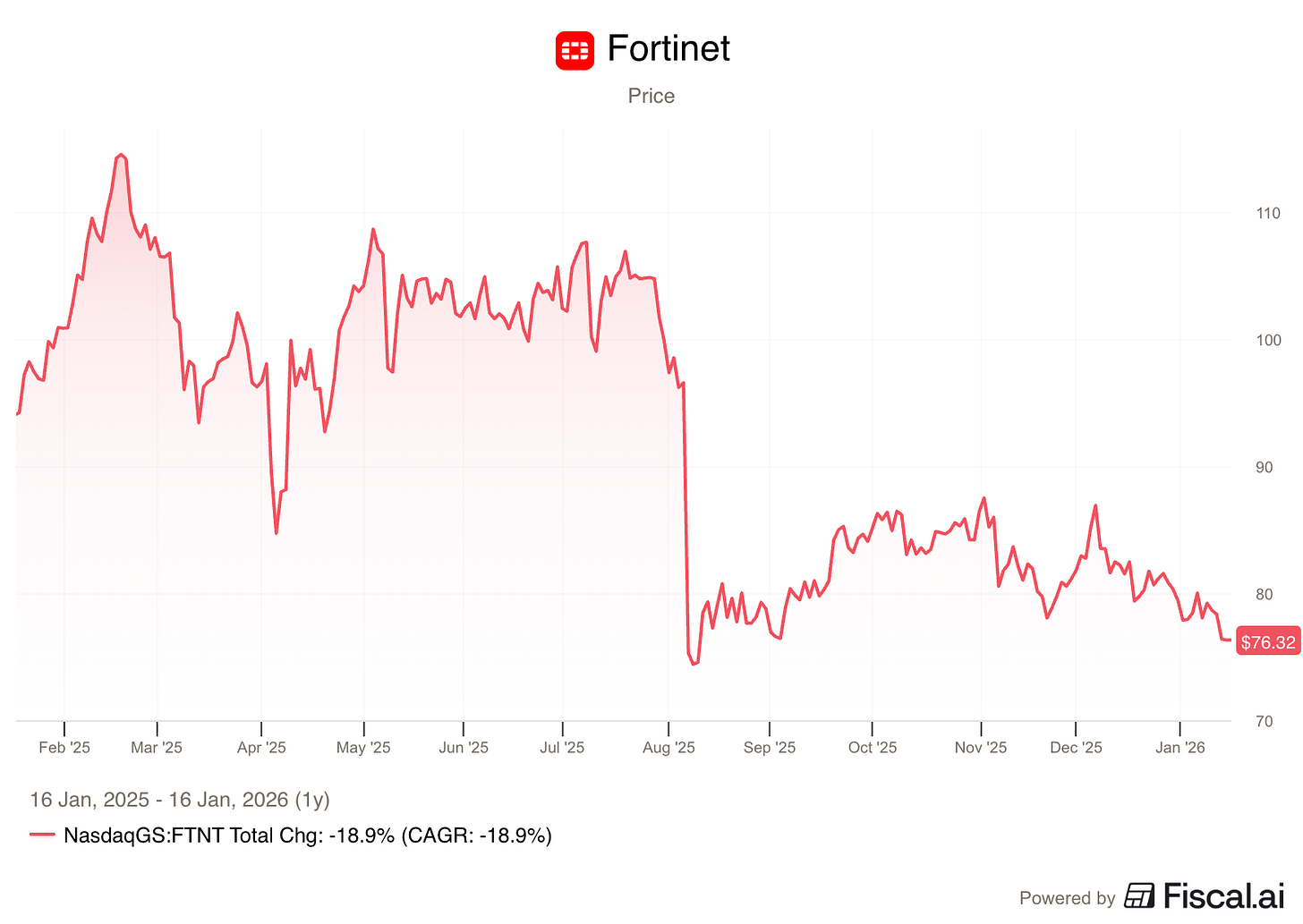

The stock is currently down 18.9% from its all-time high:

Investors were disappointed with the lowered guidance last summer.

It’s just short-term noise if you ask me.

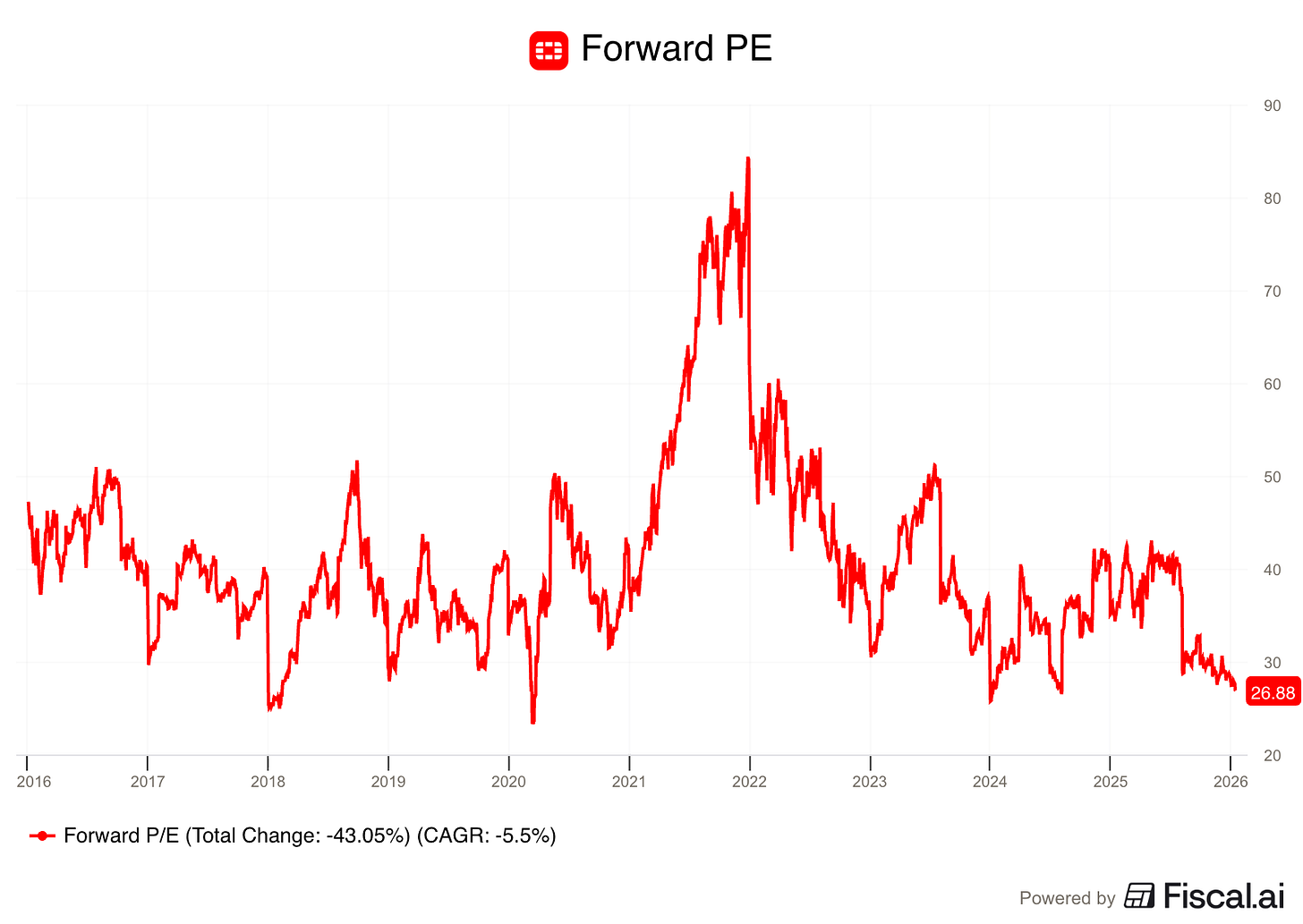

As a result, the company is trading at attractive valuation levels:

Now let’s dive into the top 3.