By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s become a little bit wiser today.

May 2025

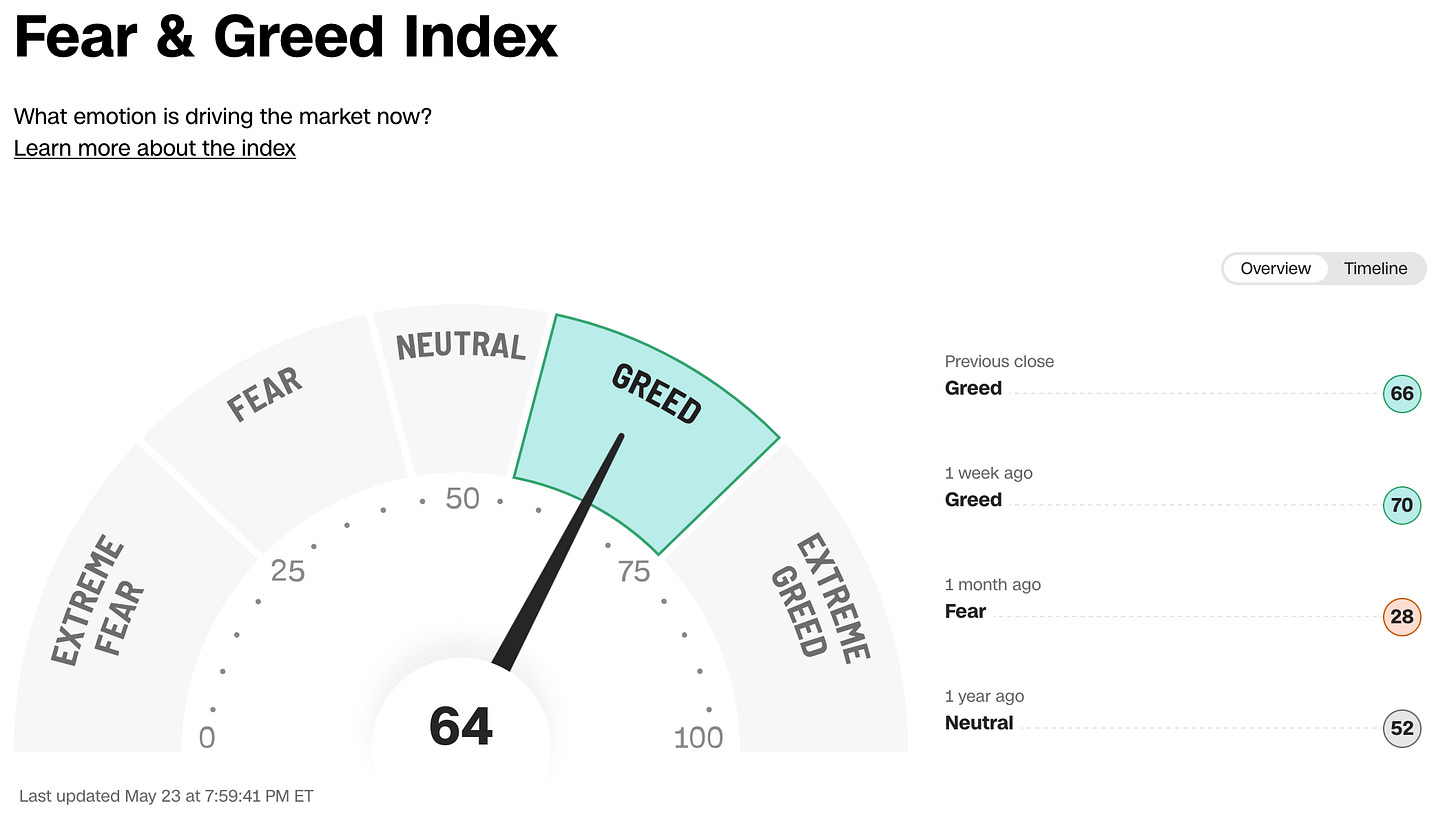

In May, the S&P 500 increased by 5.6%.

The Fear & Greed Index went from ‘Extreme Fear’ last month to ‘Greed’ Mode today.

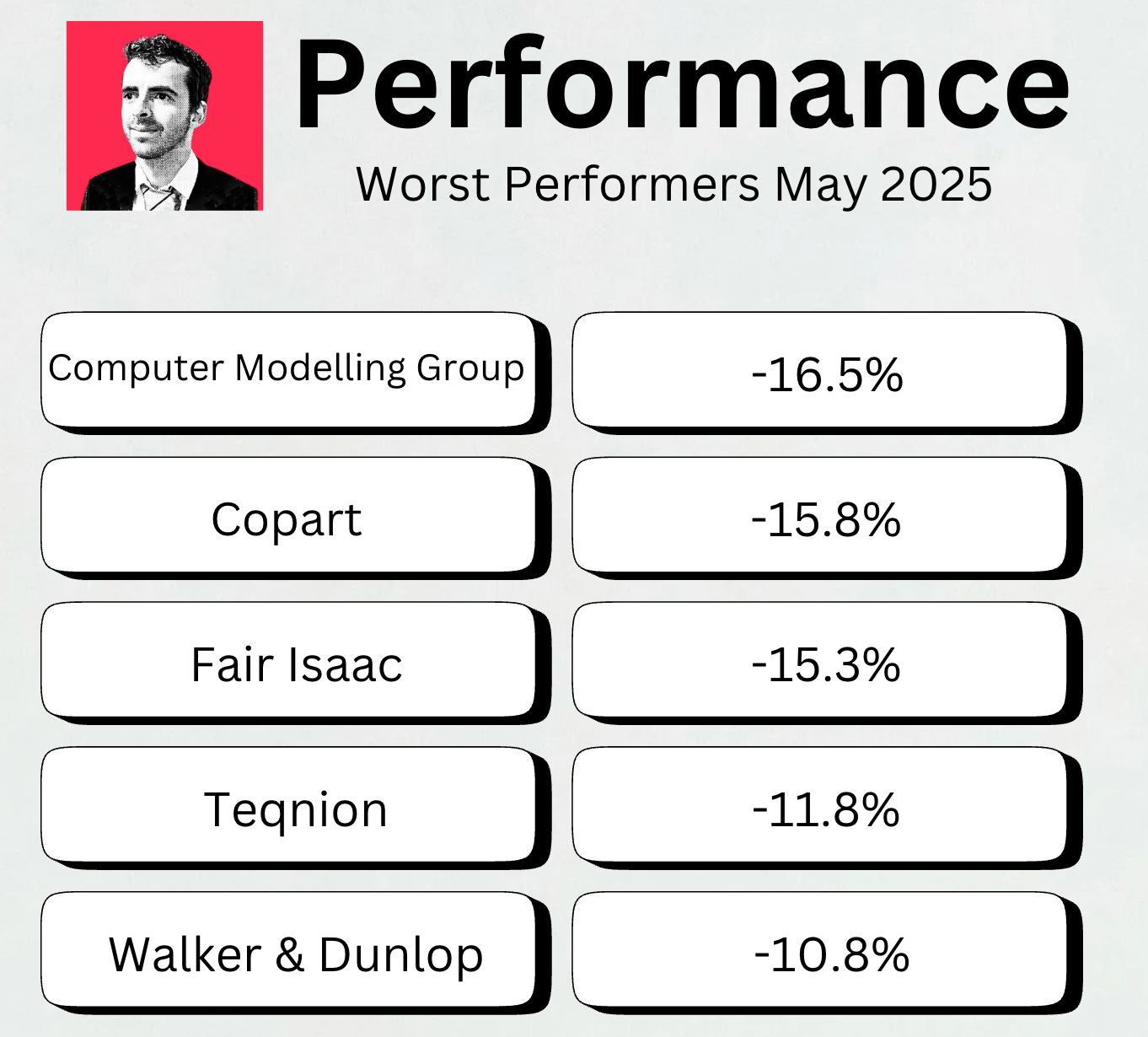

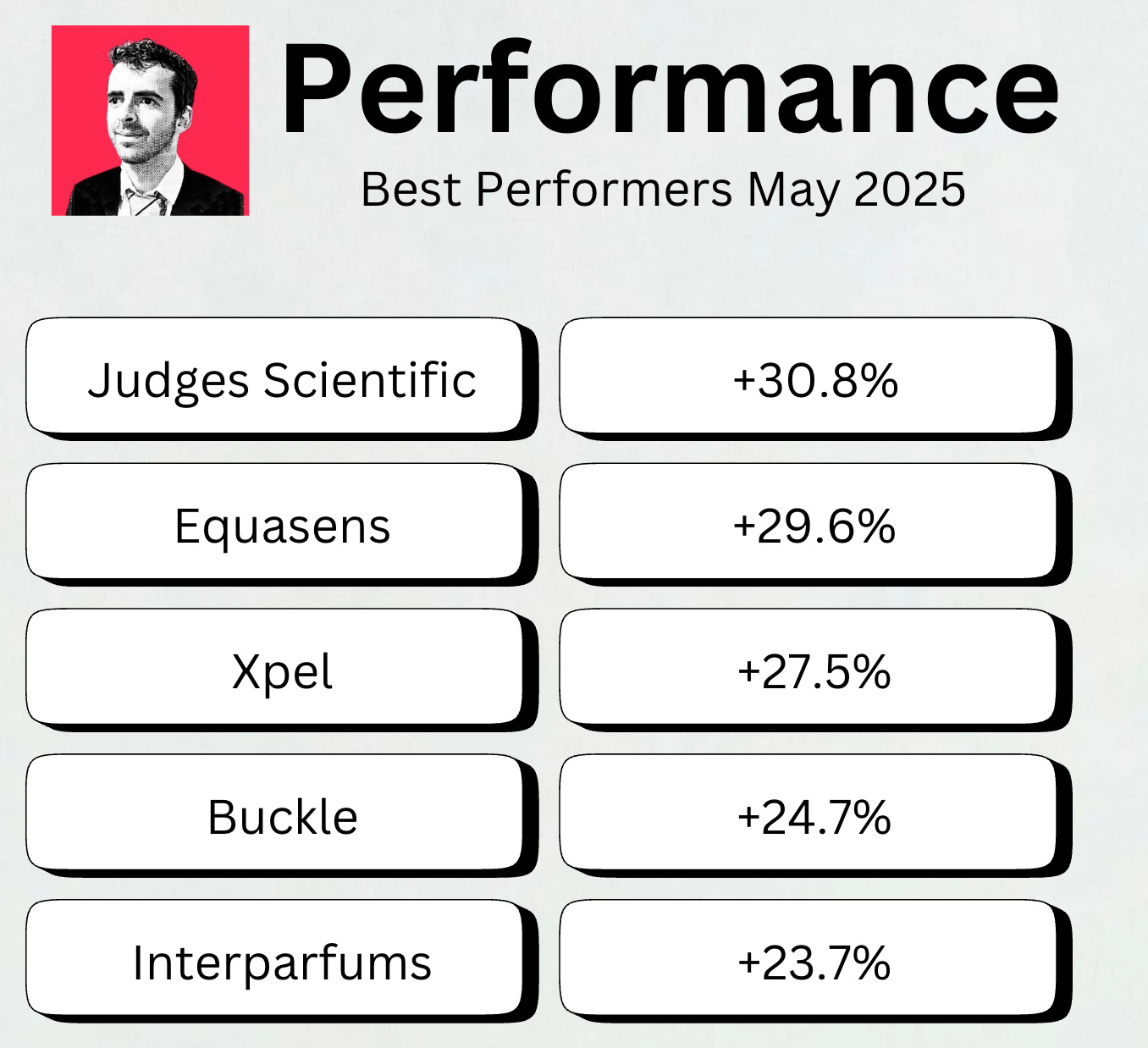

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

It’s nice to see Copart and Fair Isaac are cooling down.

While I think they are still too expensive today, I would be interested in both companies at the right price.

Best performers

Performance

Here’s what the performance of Our Portfolio looks like.

It’s great to see that we are outperforming the S&P 500 without owning any Big Tech.

I use Interactive Brokers to execute all my transactions. Discover more about Interactive Brokers here.

Spotlight: Appfolio ($APPF)

How does the company make money?

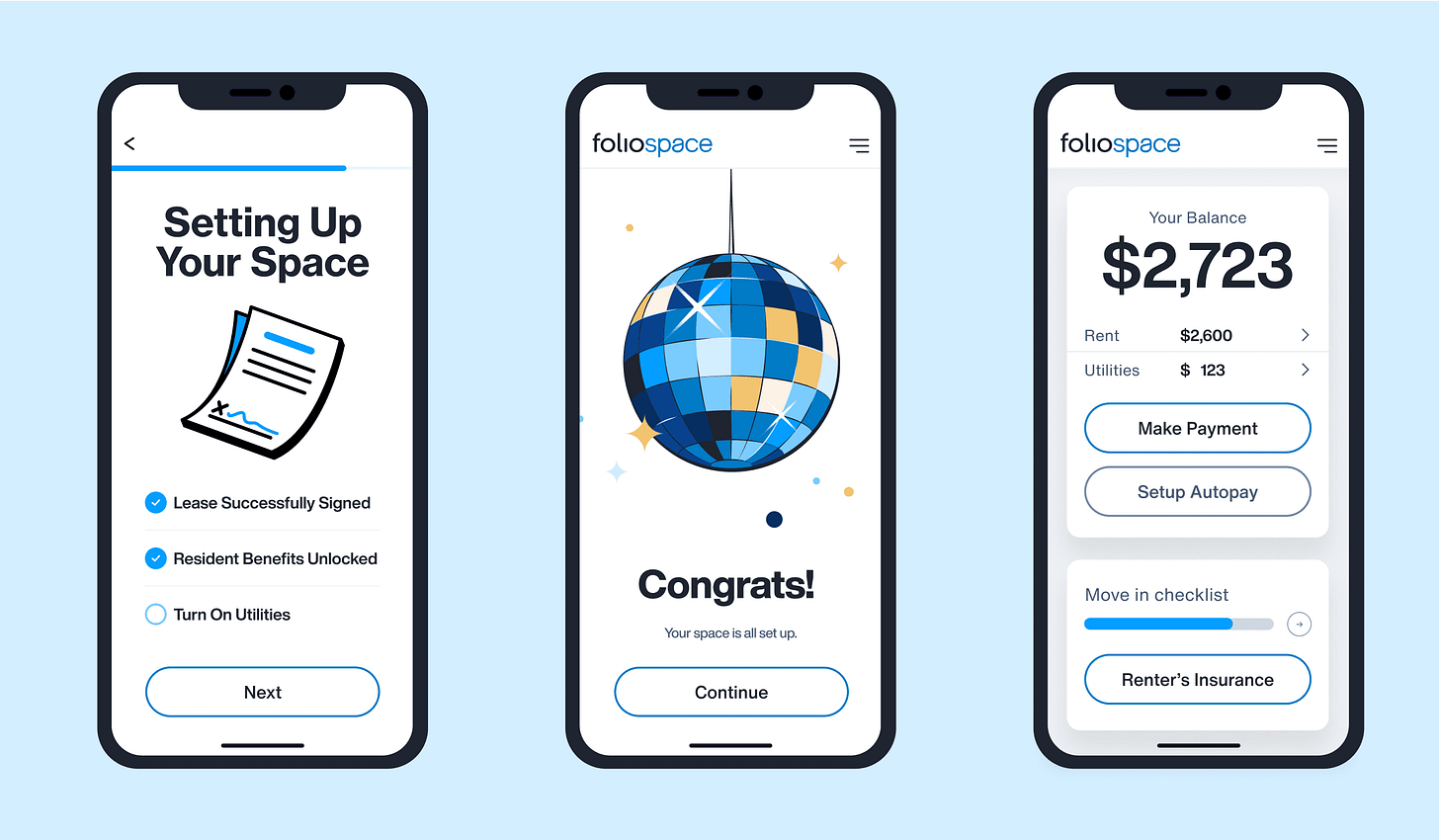

AppFolio makes money by charging monthly subscription fees to property managers for using its software. It also earns revenue from extra services like payment processing, tenant screening, and maintenance coordination.Mark Leonard once said the following: “There are two main companies Constellation Software could learn from: Appfolio and Veeva.”

AppFolio’s tools help manage rental homes, collect rent, screen tenants, and work with investors, all in one place.

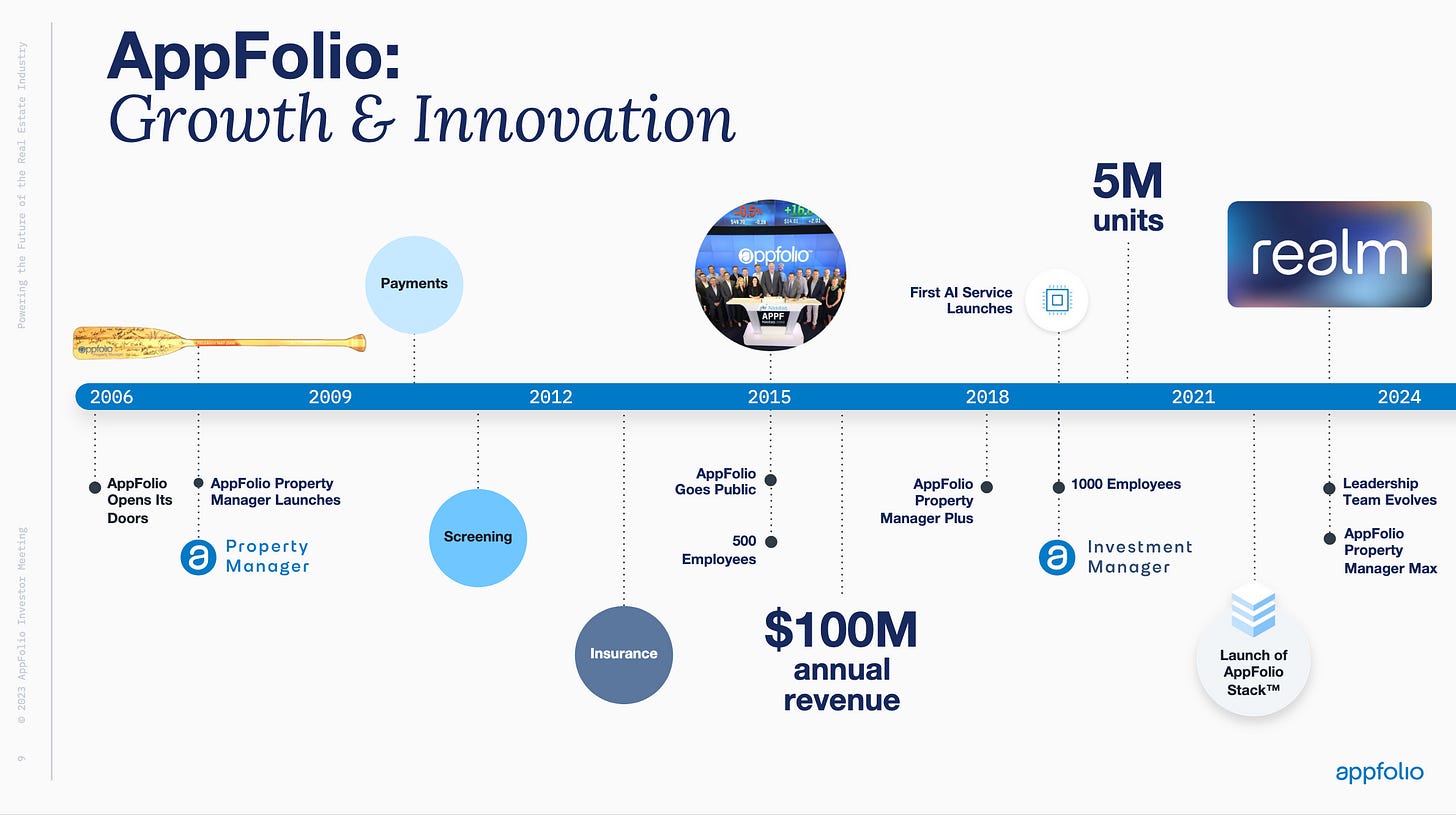

They also offer additional services, including online payments and insurance. The company started in 2006 and is based in California.

Since its IPO in 2015, AppFolio has compounded at an average annual growth rate of 31.1%.

There is still plenty of room for growth. Analysts expect the company to grow its EPS by 18% in the long term.

The fundamentals of AppFolio look as follows:

Debt/Equity: 0.1x

Net Profit Margin: 23.9%

ROIC: 13.1%

Forward PE: 39.3x

Expected Long-Term EPS Growth: 18.0%

CAGR since 2015: 31.1%

Here’s a business timeline:

Best Buys June 2025

Now let’s dive into our favorite stocks for June 2025.

I only mention companies that can’t be found within the Portfolio today.

5. Pool Corporation ($POOL)

How does the company make money?

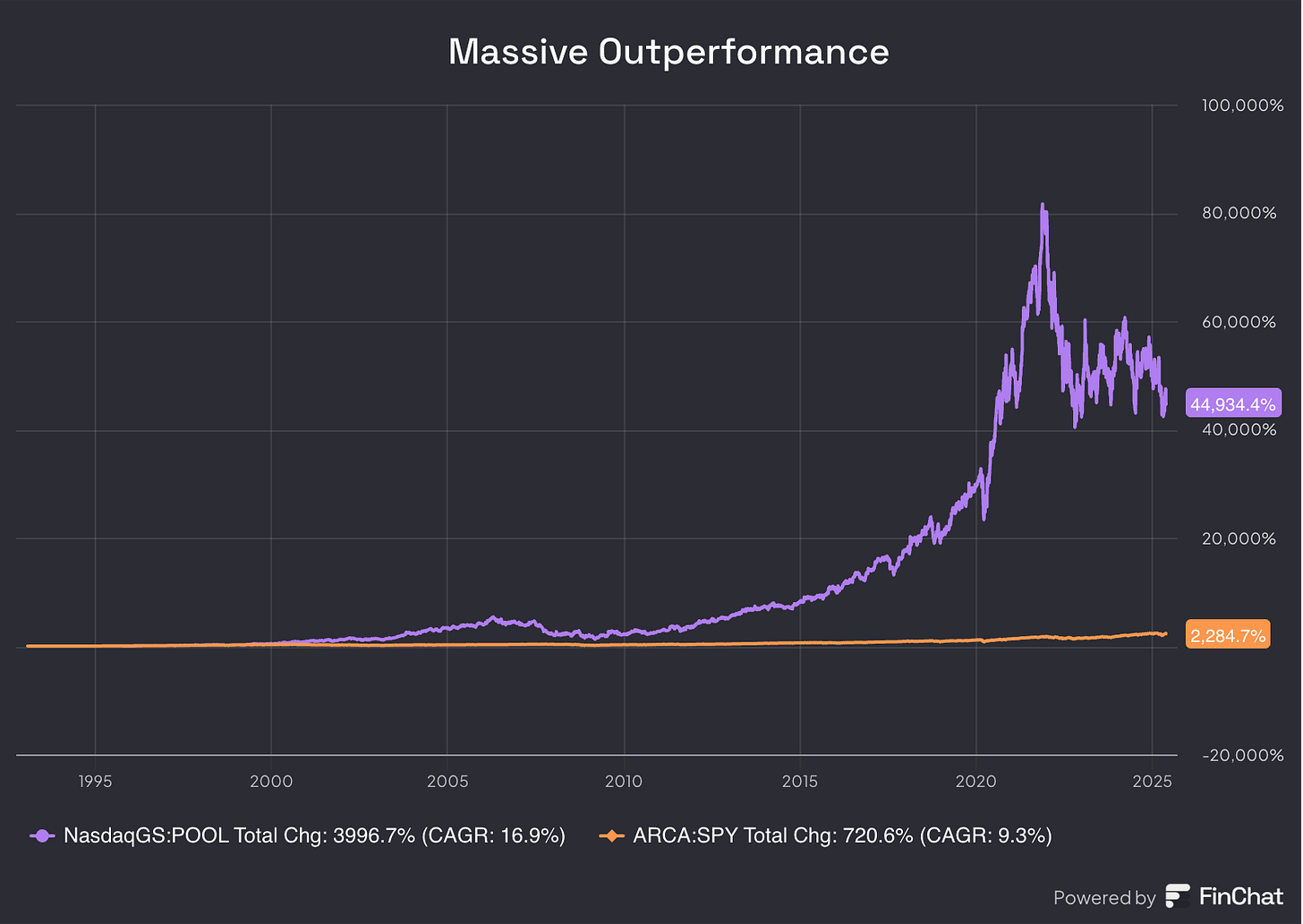

Pool Corporation makes money by selling pool supplies, equipment, and outdoor living products to contractors and retailers. Most of its revenue comes from maintenance and repair items, with additional income from new pool construction and renovation products.Pool Corporation is one of those silent compounders that beat the market by a massive margin in the past:

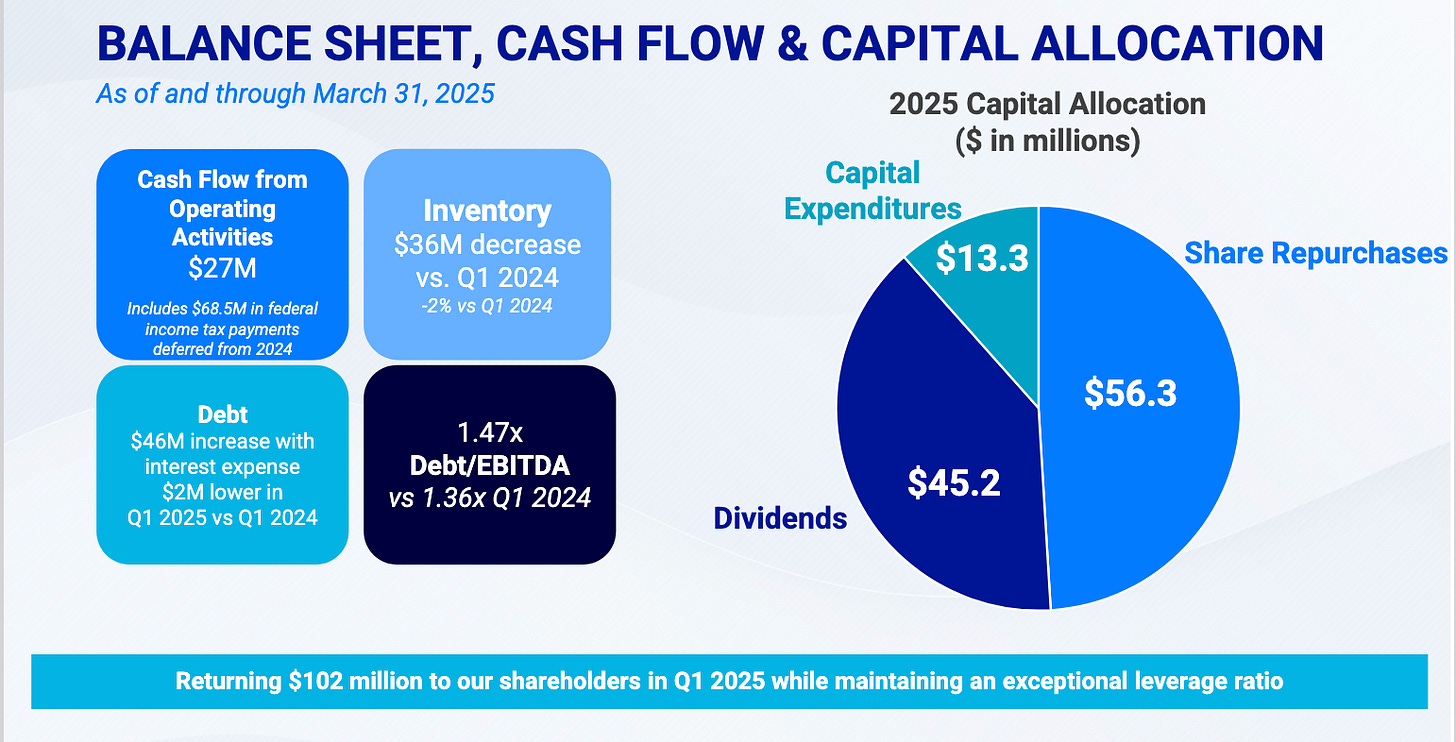

The company is known for its healthy balance sheet, attractive profitability, and great capital allocation skills:

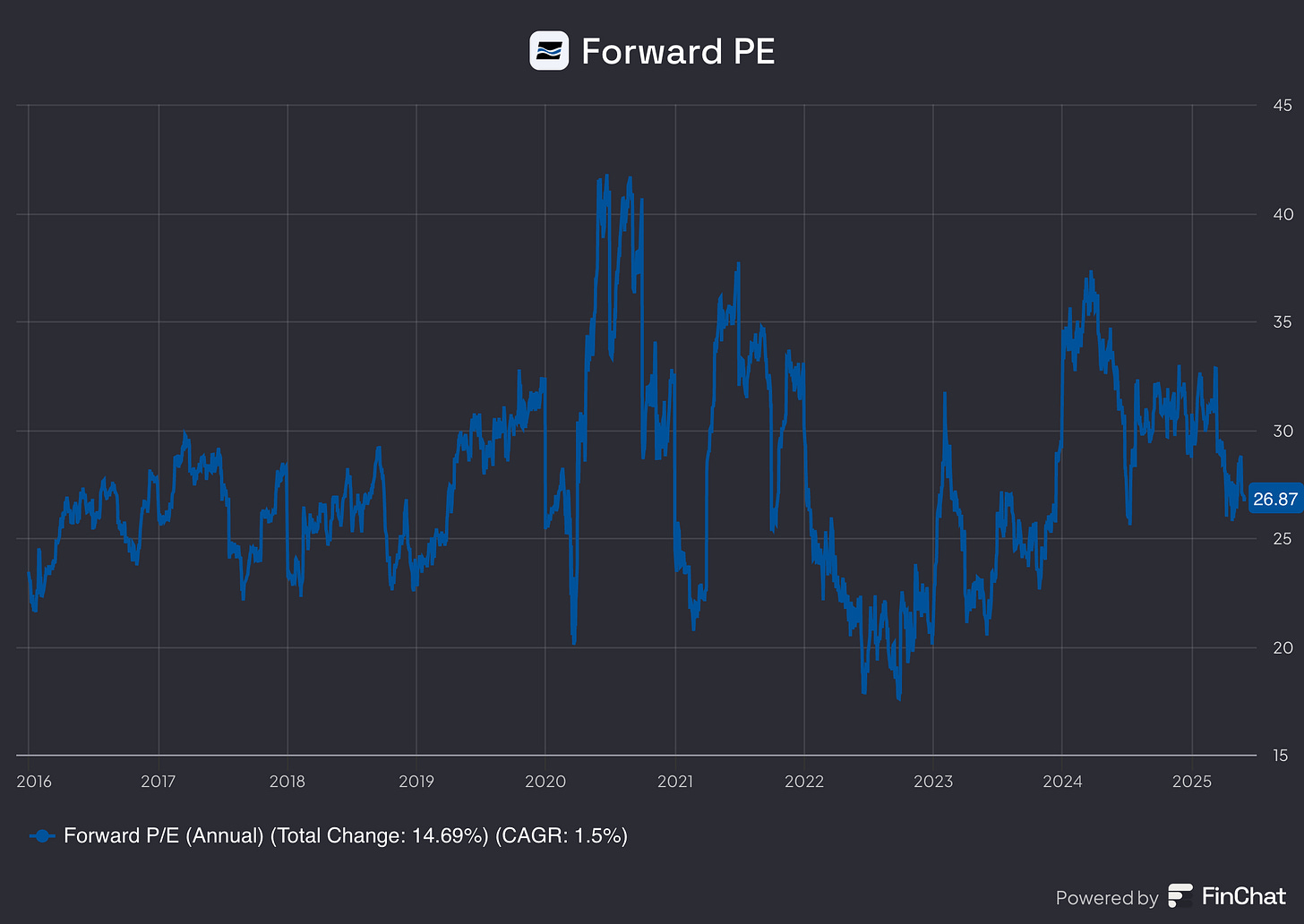

Pool Corporation has been on my radar for quite a while. Finally, the stock started to become a bit more attractive again.

Our Earnings Growth Model gives an expected return of 9.0%.

Here’s what the evolution of the Forward PE looks like:

Another interesting fact? Berkshire Hathaway bought almost 900,000 shares of Pool Corporation last quarter.

4. NVR ($NVR)

How does the company make money?

NVR makes money by building and selling homes under brands like Ryan Homes and NVHomes. They also make money by offering mortgage and settlement services to homebuyers.I love cannibals.

At least when we’re talking about stocks.

Cannibal stocks ‘eat up themselves’ (they heavily repurchase their own shares). As a result, your stake in the company as a shareholder increases. You can find more information about the concept here.

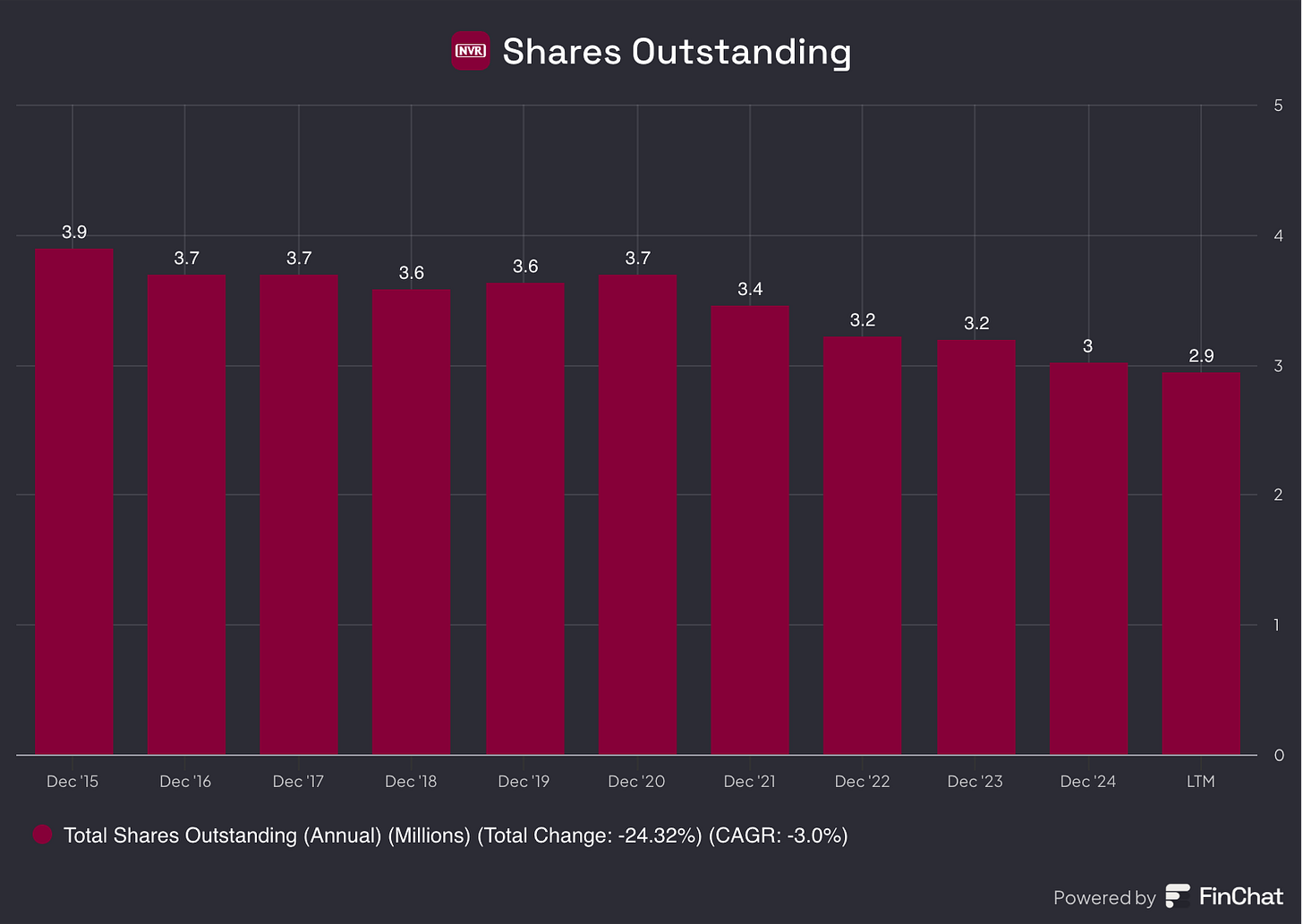

Over the past 10 years, NVR bought back 24.3% of its outstanding shares.

This also means that your stake in the stock as an investor increased by almost 25%, and this while you didn’t need to do anything (just sit and wait).

Homebuilders are an interesting niche that I would love to be invested in one day. You can read our analysis about the market here.

NVR is down almost 30% from its peak. This might offer opportunities. The company currently trades at a Forward PE of 16.6x.

Now let’s dive into the top 3.