By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s become a little bit wiser today.

April 2025

In April, the S&P 500 decreased by 1.1%.

The Fear & Greed Index went from ‘Extreme Fear’ Mode to ‘Fear’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

RH is on the Worst Performance List twice in a row. The stock has declined by over 50% since January.

Best performers

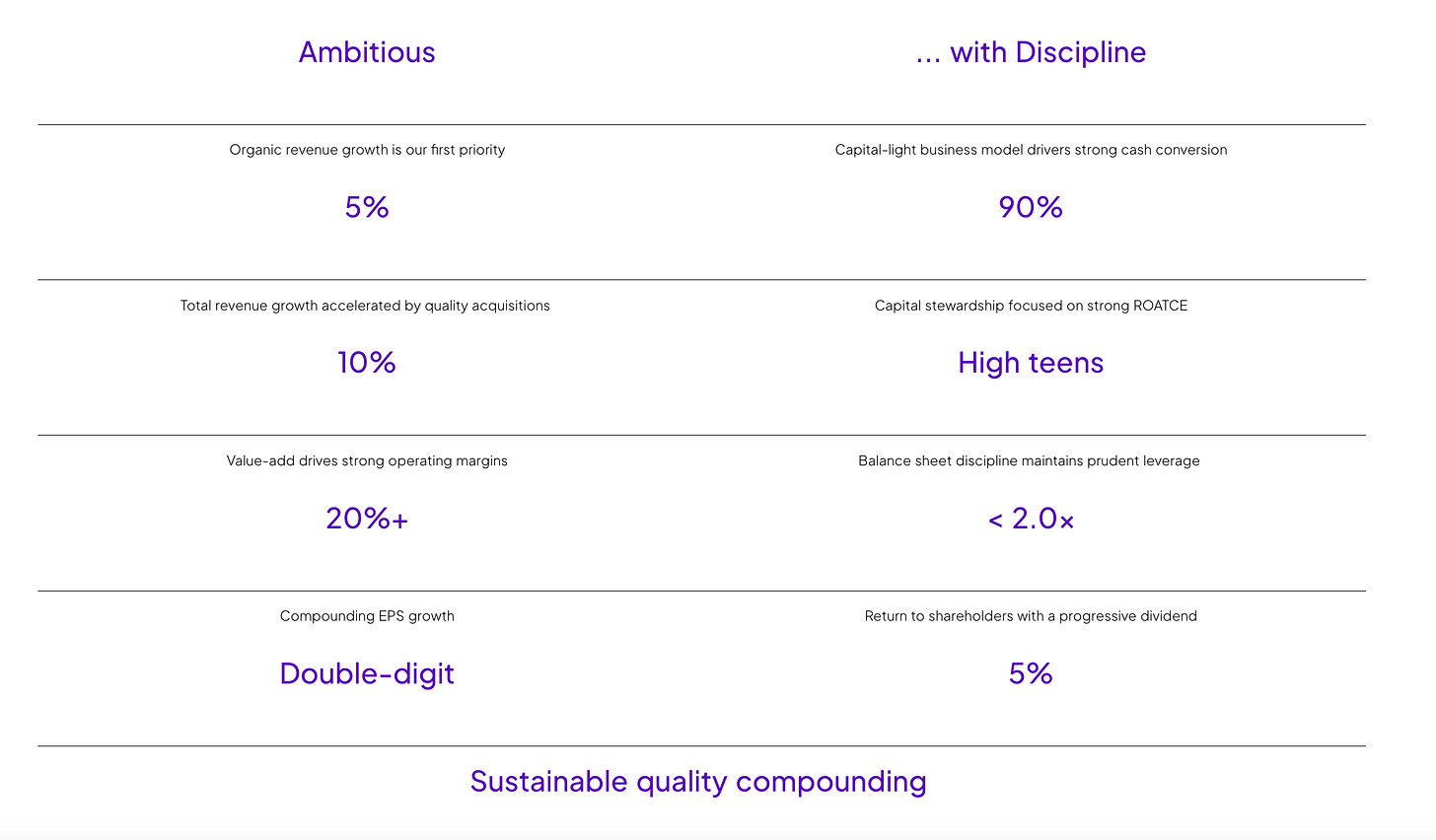

Spotlight: Diploma PLC ($LON:DPLM)

How does the company make money?

Diploma PLC makes money by selling essential, high-margin components for industries like aerospace, medical, and industrial machinery. They grow profits through organic sales and by acquiring small specialist businesses with recurring revenue.Diploma is a Serial Acquirer you might have never heard of. Just like most successful serial acquirers, they use a decentralized structure.

The group structure looks as follows:

Here’s what their sectoral and geographical split looks like:

The British company has a market cap of £5.3 billion ($6.8 billion) and created a tremendous amount of shareholder value in the past.

Since 2001, an investment in Diploma PLC returned over 12,000% (CAGR: 22.8%).

Johnny Thomson has been the CEO since 2019. In six years, he spent over £1 billion on acquisitions.

The fundamentals of Diploma PLC look as follows:

Debt/Equity: 0.6x

Net Profit Margin: 13.1%

ROIC: 11.4%

Forward PE: 24.8x

Expected Long-Term EPS Growth: 10%

CAGR since 2001: 22.8%

Best Buys May 2025

Now let’s dive into our favorite stocks for May 2025.

I only mention companies that can’t be found within the Portfolio today.

Let’s mix things up a bit this month and look at five smaller companies.

I am thinking about launching an exclusive series about Tiny Titans.

Those are Micro Cap Quality Stocks with tremendous upside potential.

It uses exactly the same philosophy as Compounding Quality, but focuses on very small companies. Think about trying to invest in Apple twenty years ago.

Please note that we'll never write about these companies via Compounding Quality (they are not in our current coverage) as we would influence the stock price too much with almost 500,000 readers.

Because these companies are so small, the series will be very exclusive. Maximum 200 people will be allowed and it will be quite expensive.

If you are interested, you can put yourself on the waiting list here.5. Dream Finders Home ($DFH)

How does the company make money?

Dream Finders Homes builds and sells residential homes in the U.S., including starter homes and family homes. They copied the very succesful business model of NVR.Dream Finders Homes (DFH) is a fast-growing homebuilder that follows the same asset-light strategy as NVR, a legendary 1000-bagger.

DFH focuses on affordable, customizable homes for first-time buyers in high-growth U.S. markets. They use land options instead of buying land outright, which reduces risk and increases flexibility.

Patrick Zalupski is the Founder and CEO. Insiders own over 70% of the company.

Dream Finders Home is growing very aggressively, and the company is trading at very cheap valuation levels. DFH currently trades at a Forward PE of 7.8x.

The reason I haven’t bought yet? I have some concerns around customer complaints and the fact that the CEO sold shares while he said in his shareholders’ letters that he wouldn’t do so.

For investors with a higher risk appetite, Dream Finders Home could be interesting.

We already wrote a Full Investment Case about the company. You can find it here.

4. Deckers Outdoor ($DECK)

How does the company make money?

Deckers Outdoor makes money by designing and selling premium footwear—mainly through its UGG and HOKA brands — via both direct-to-consumer channels like its own websites and stores, and wholesale partners such as department stores and specialty retailersA shoe company in our Top 5 this month? Yes.

There are two main reasons for this:

Deckers Outdoor is a phenomenal company

The company is down 40% (!) YTD

A phenomenal company

Deckers Outdoors sells products like slippers, sheepskin boots, running shoes, sports shoes, and much more.

Their products are sold through company-owned stores, online platforms, and various retail partners worldwide.

What’s impressive to see? Deckers Outdoor operates at a Net Profit Margin of 19.1% and ROIC of 51.7%. That’s phenomenal for a shoe company!

Over the past 10 years, they have grown their Revenue and EPS by 10.8% and 23.3% per year, respectively.

Another interesting fact? They bought HOKA in 2012 for $1.1 million. Last year, HOKA generated over $1.8 billion (!) in revenue.

Down 40% YTD

Deckers Outdoor is down 40% YTD.

There are 3 main reasons:

Slower Growth: HOKA's sales growth slowed down to ‘only’ 24% in Q3 FY2025

Inventory Issues: The company faced some inventory shortages, leading to expected sales declines next quarter

Tariff Concerns: New U.S. tariffs on global imports, including footwear, have increased production costs for Deckers, which relies heavily on Asian manufacturing

When we look at the evolution of the valuation, it looks as follows:

The fact that the valuation declined is interesting for Deckers Outdoors, as they are frequently buying back shares.

Last year, Deckers Outdoor bought back shares for $414 million. When they would do the same at today’s stock price, this would imply a buyback yield of 2.5%.

Our Earnings Growth Model gives an expected return of 13.3%.

Now let’s dive into the Top 3.