By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s become a little bit wiser today.

November 2025

The S&P 500 increased by +2.8% in October.

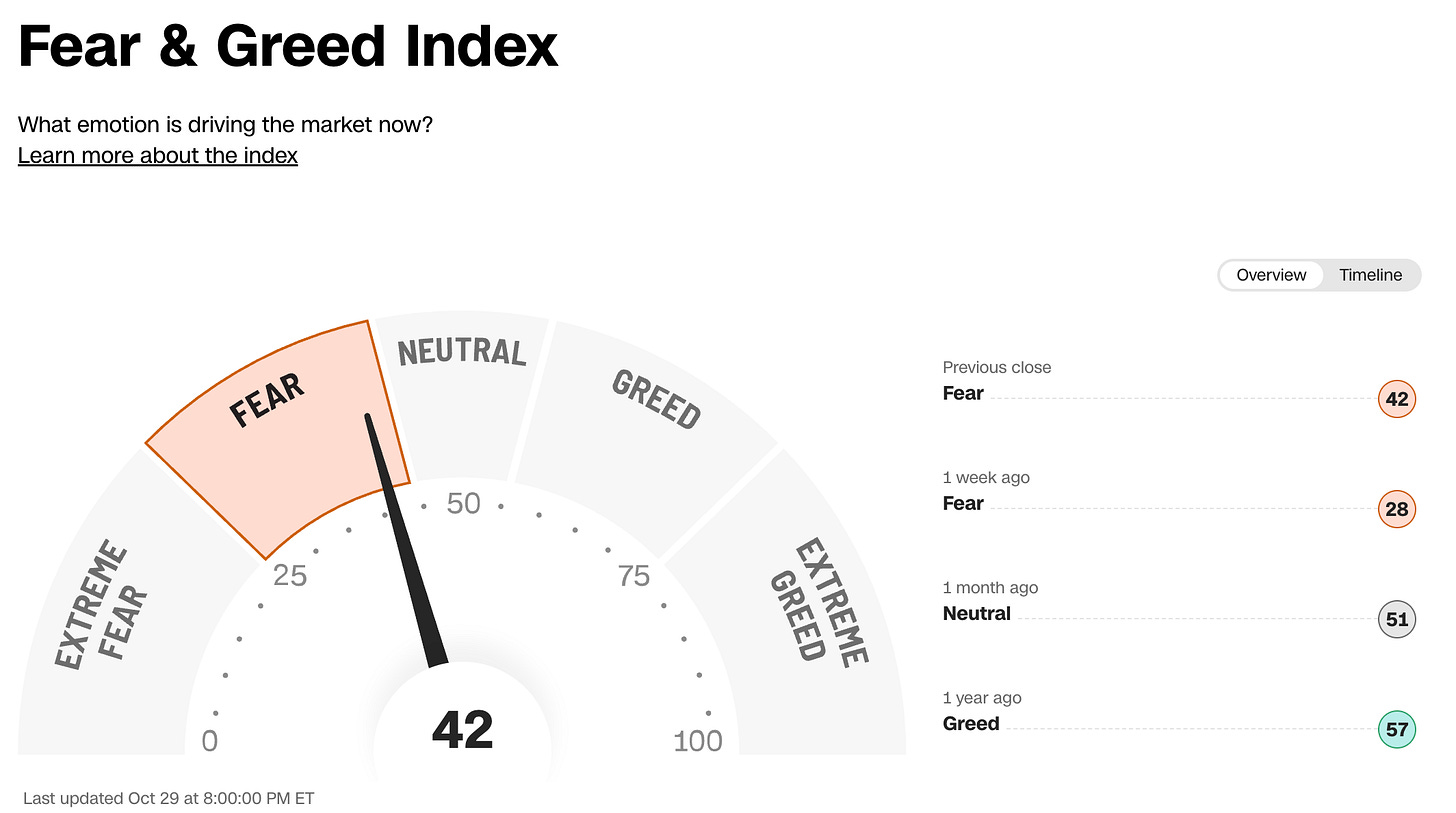

Investors are fearful today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

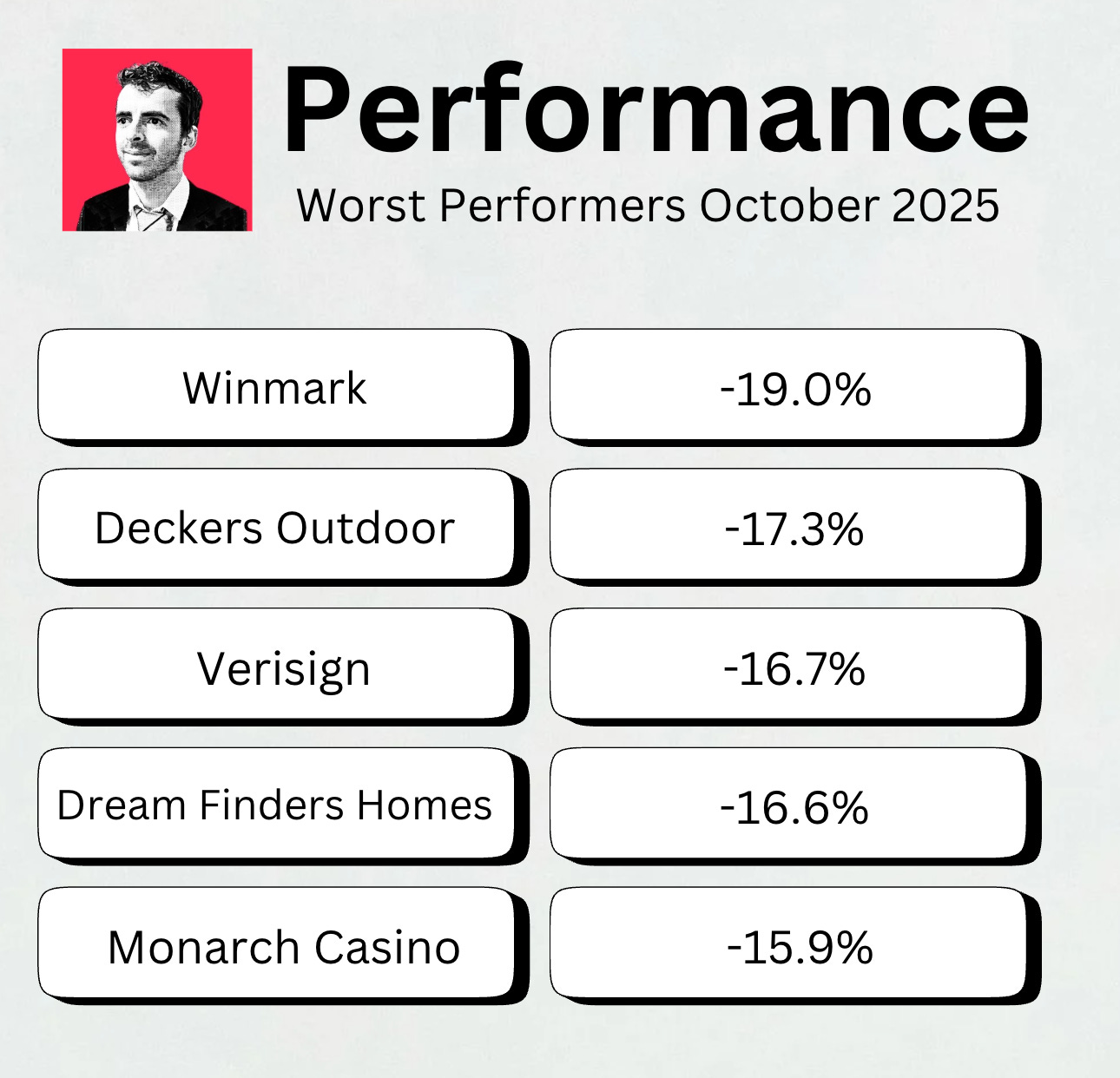

Worst performers

The cheaper we can buy great companies, the better.

Here are the worst performers of the past month:

Dream Finders Homes is starting to look interesting for investors with a higher risk appetite.

The stock is currently trading around the same level as it was at the time of its IPO in 2021:

Best performers

Here are the best performers of October:

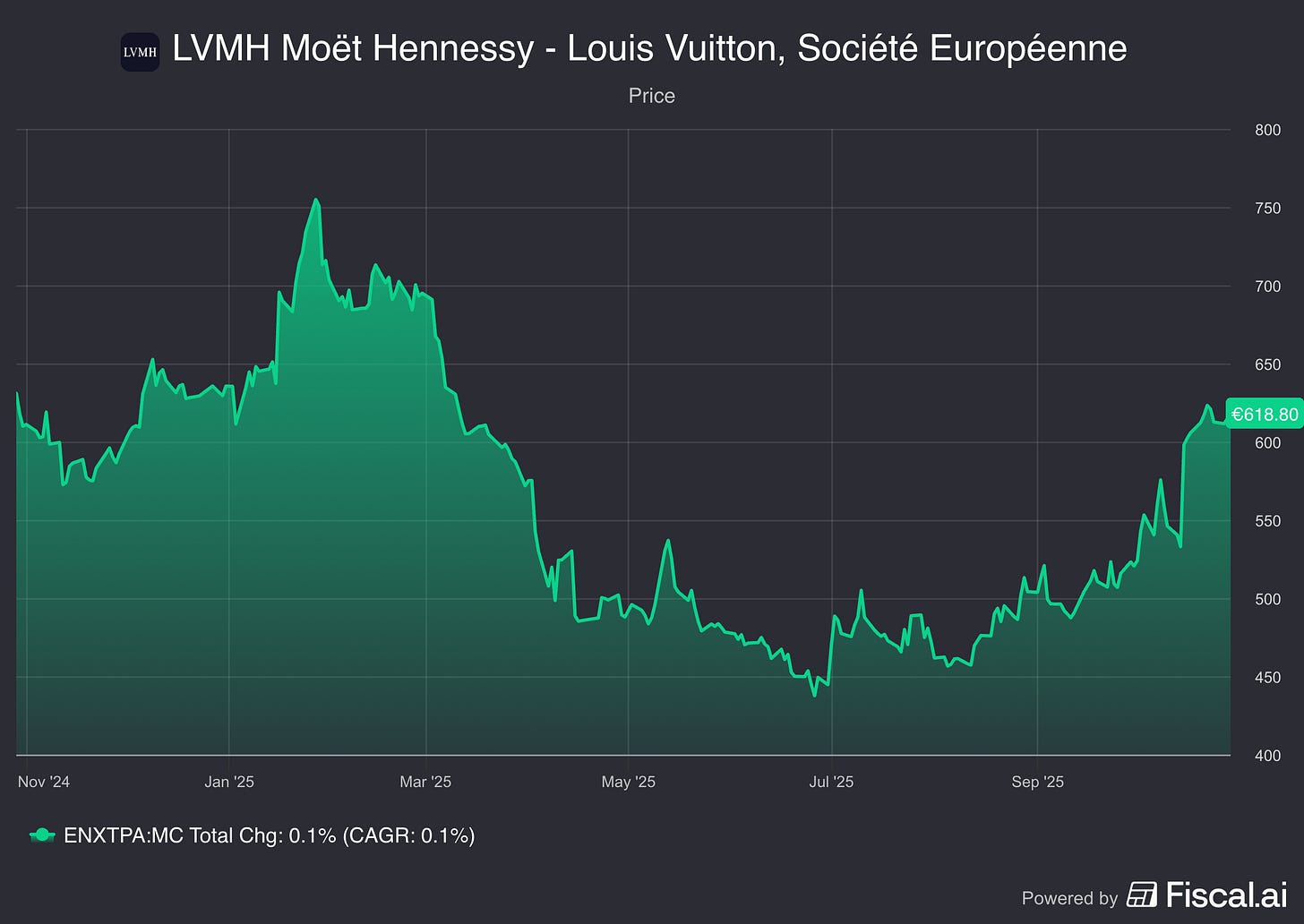

LVMH returns to growth after 4 quarters of decline.

The stock price jumped after they published great results:

Spotlight: Accenture plc ($ACN)

How does Accenture make money?

Accenture is a global professional services company. They help businesses with technology, consulting, and digital transformations. Their clients include big names like governments, tech companies, banks, and healthcare giants. They offer two main types of work: consulting projects, which are short-term, and managed services, which are long-term contracts.Brief introduction

Accenture is a leader in its field.

But this year, the stock has fallen nearly 40%.

It’s facing challenges like canceled contracts, slower revenue growth, and uncertainty from AI.

But Accenture has a solid client base, strong financials, and key advantages that will likely help it bounce back.

The company has been around for decades, helping top companies implement technology and improve operations.

AI is creating uncertainty in consulting, but Accenture remains one of the most trusted names in the industry.

Competitive advantage

Accenture has a competitive advantage based on two pillars:

Switching costs

Intangible assets

Switching costs

The company is deeply embedded in the operations of its clients, helping with everything from strategy to big tech projects.

These long-term relationships make it tough for clients to switch. It would be very costly and disruptive.

The fact that 195 of their top 200 clients have stayed for over 10 years shows how strong these connections are.

Intangible assets

Accenture has a globally recognized brand and strong ties with C-suite executives at major enterprises.

It has a reputation for being a “safe choice”.

Think about the career and reputational risk that comes with choosing a lesser-known and cheaper alternative.

Imagine hiring the cheaper consulting company that crashed the website and deleted the data base.

Accenture’s trusted reputation gives it premium positioning, and preferential access to large projects.

Why is the stock cheap?

The company’s growth has slowed, and there are worries about how AI could impact its business.

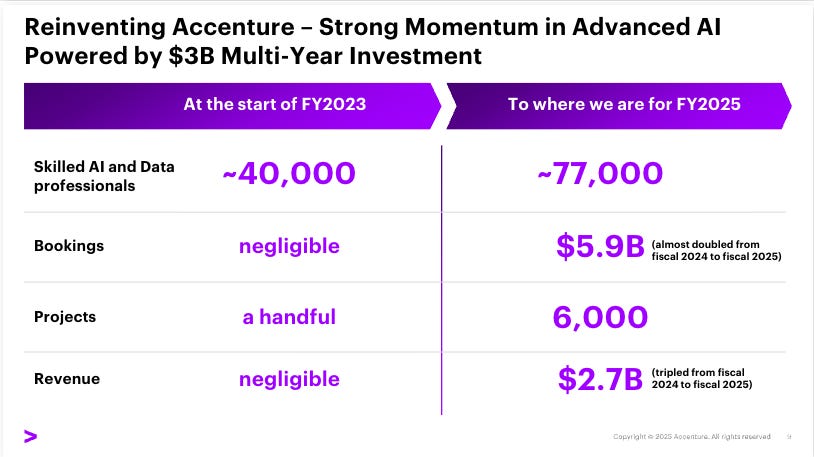

They are investing heavily in AI, which has led to restructuring and job cuts. Despite these issues, I believe the market is overreacting for several reasons:

Accenture’s deep client relationships give it stability, especially in uncertain times

They are a leader in AI, which could be a major growth area in the coming years

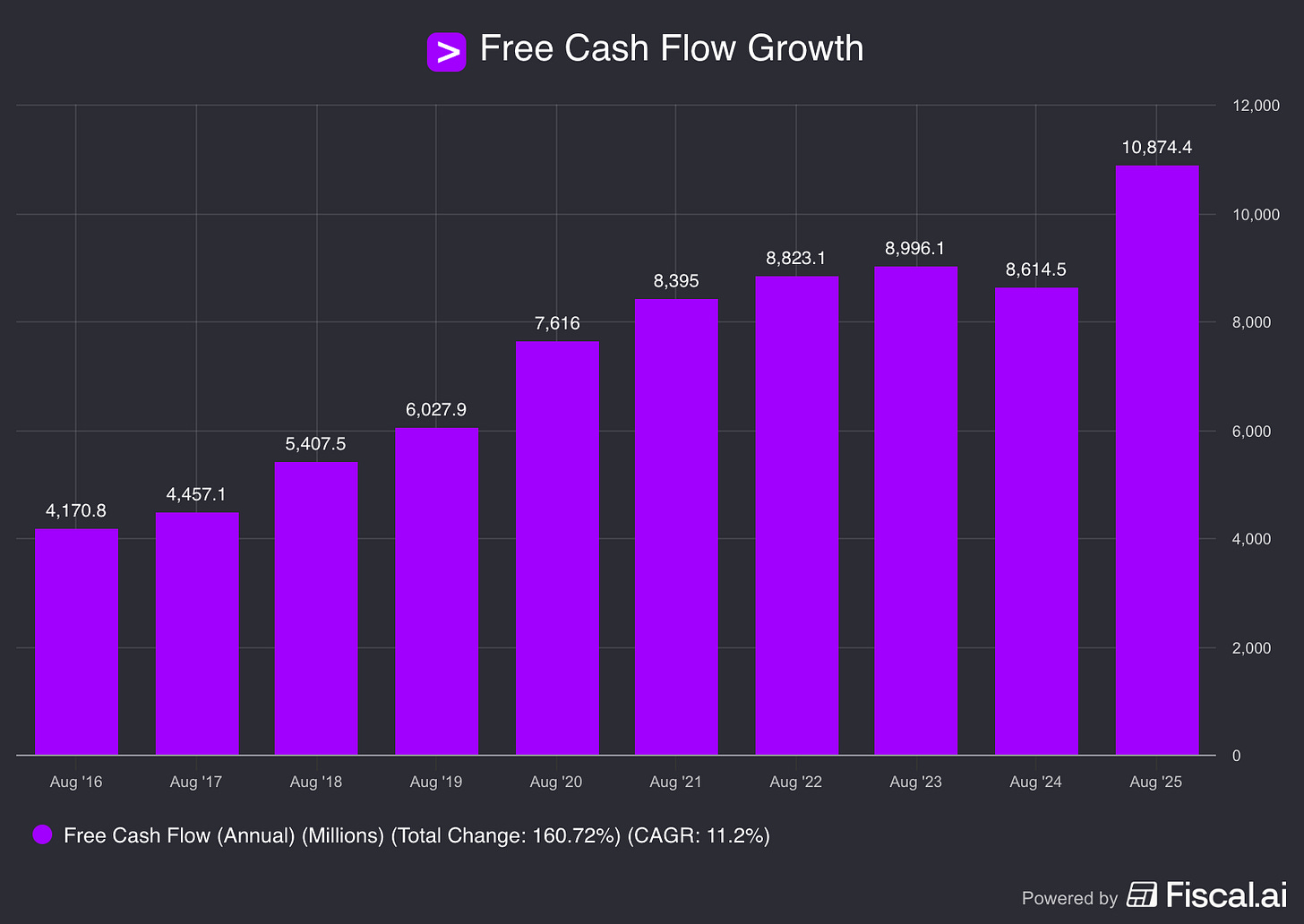

Their balance sheet is strong, and their earnings (and dividend) have grown consistently for over a decade

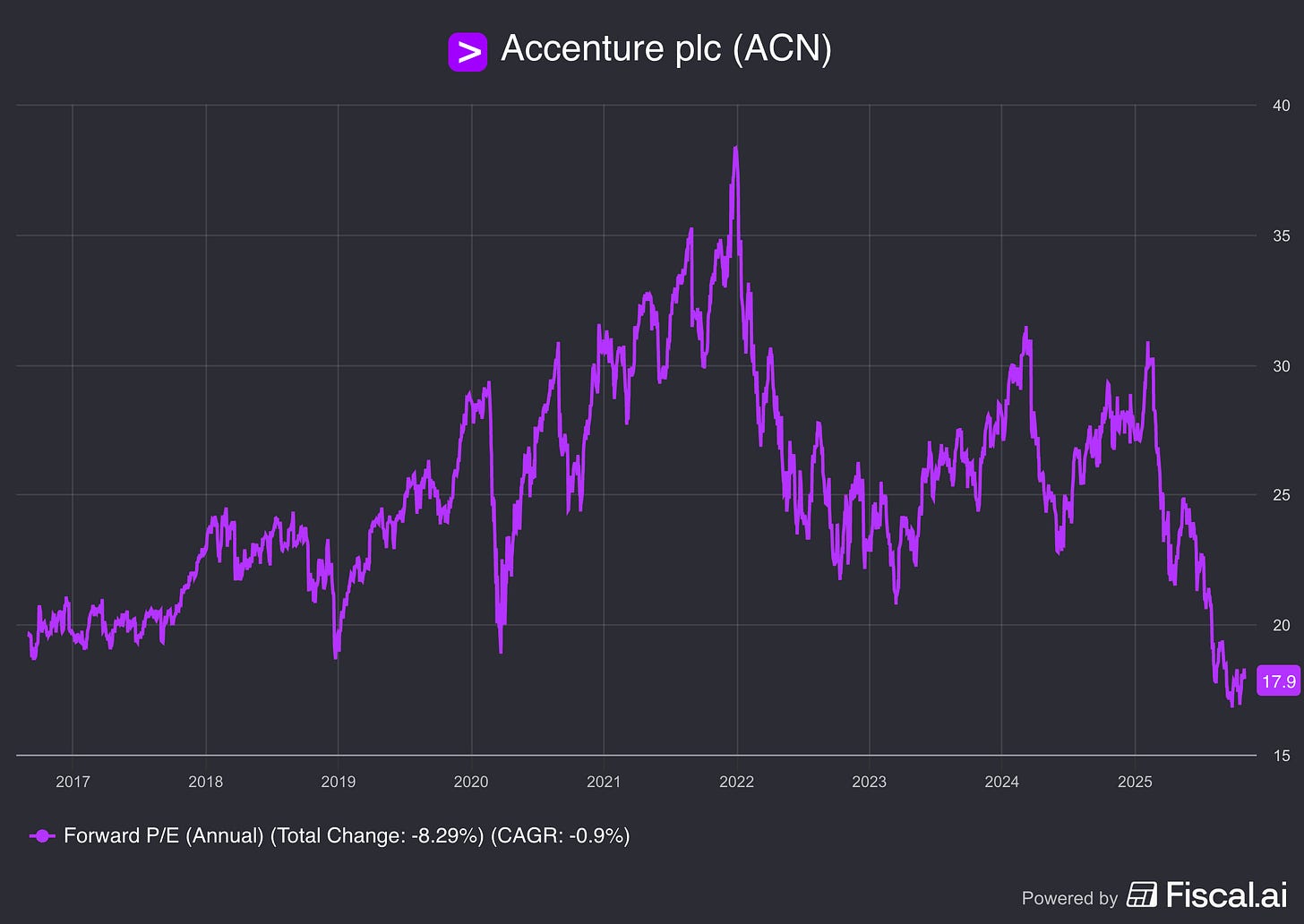

At a Forward PE of 17.9x, the stock is trading near its lowest point since 2017.

It could present a good buying opportunity for long-term investors.

Fundamentals

Here’s what Accenture’s fundamentals look like:

Debt/Equity: 0.3x (Debt/Equity < 1x? ✅)

ROCE: 26.5% (ROCE > 15%? ✅)

5-Yr Revenue CAGR: 9.5% (5-Yr Revenue CAGR > 7%? ✅)

FCF-Margin: 15.6% (FCF-Margin > 10%? ✅)

P/FCF: 14.7x (P/FCF < 20x? ✅)

These fundamentals look very healthy.

Conclusion

Accenture is going through a rough patch, but the business remains strong.

The stock’s decline has created an opportunity to buy a high-quality company at a discount.

Accenture’s moat, dividend history, and future growth potential make it interesting for both dividend and quality investors.

Best Buys November 2025

Now, let’s dive into our five favorite stocks for November 2025.

This month, we’re featuring Dividend Growth Companies from Our Watchlist.

Why? Because Compounding Dividends 2.0 is launching this month!

5. Domino’s Pizza ($DPZ)

How does Domino’s make money?

Domino’s is the #1 pizza company in the world. It makes the majority of its money through its franchise model. Franchisees pay Domino’s a percentage of sales, which helps the company grow without taking on too much risk.But what really makes Domino’s special is its focus on technology.

They’re a technology company that happens to sell pizza.

The company uses tech to make ordering and delivery faster. Their loyalty program drives repeat customers and more carryout orders.

One of the things that drove Domino’s strong growth recently was their “Best Deal Ever” promotion.

Something very interesting about this?

Management said they couldn’t have done it a few years ago.

The only reason it’s possible now is because of the technology Domino’s has invested in:

“Best Deal Ever also highlights the operational excellence our system has achieved. We wouldn’t have been able to execute this kind of a promotion just a few years ago. The myriad of ever-changing topping combinations customers are putting together requires best-in-class operations. That was unlocked by franchisees leveraging our training programs and Dom.OS systems”

What makes Domino’s a great compounder?

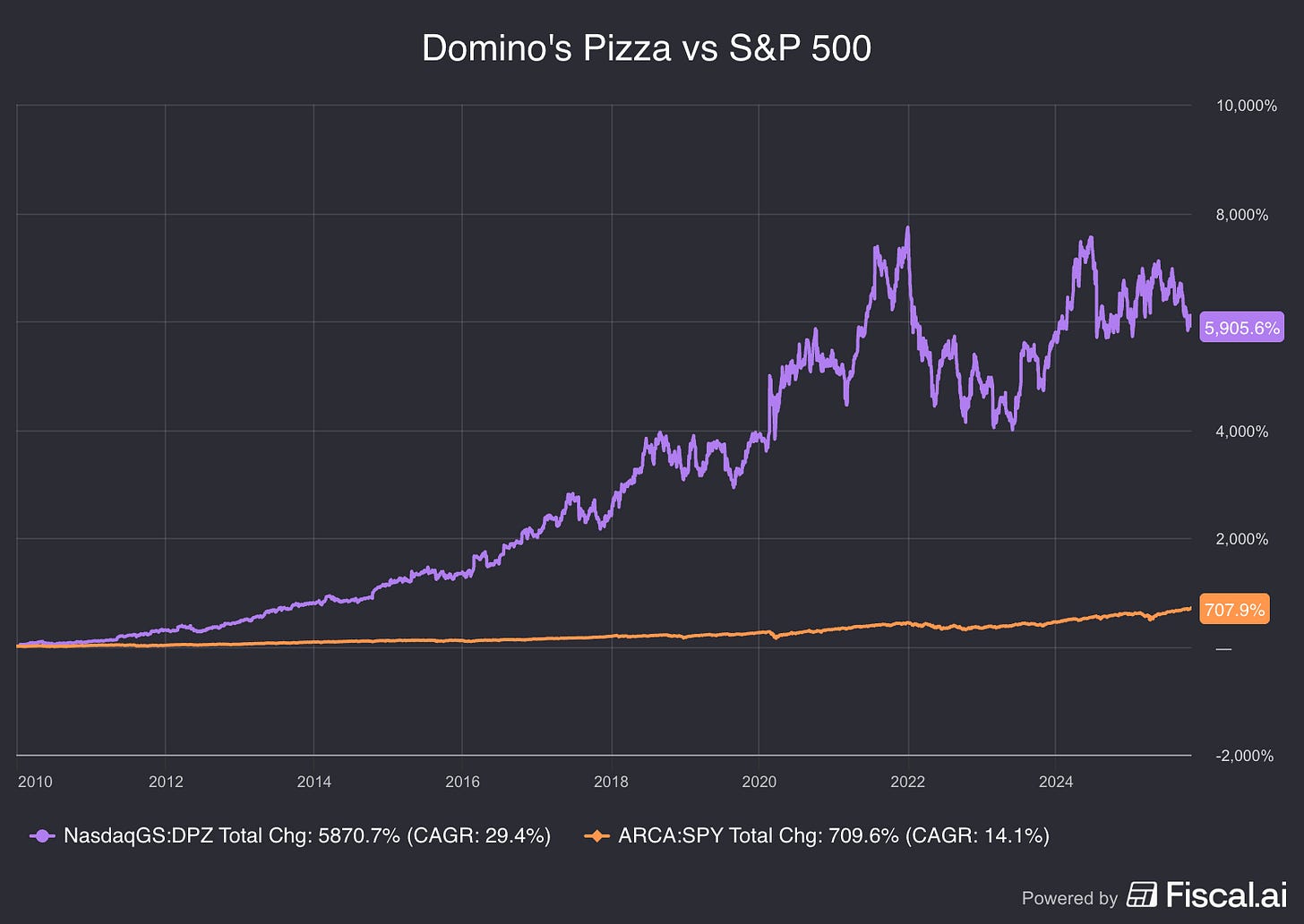

Since 2010, Domino’s has been a star performer.

The stock has compounded by more than 20% per year since 2010.

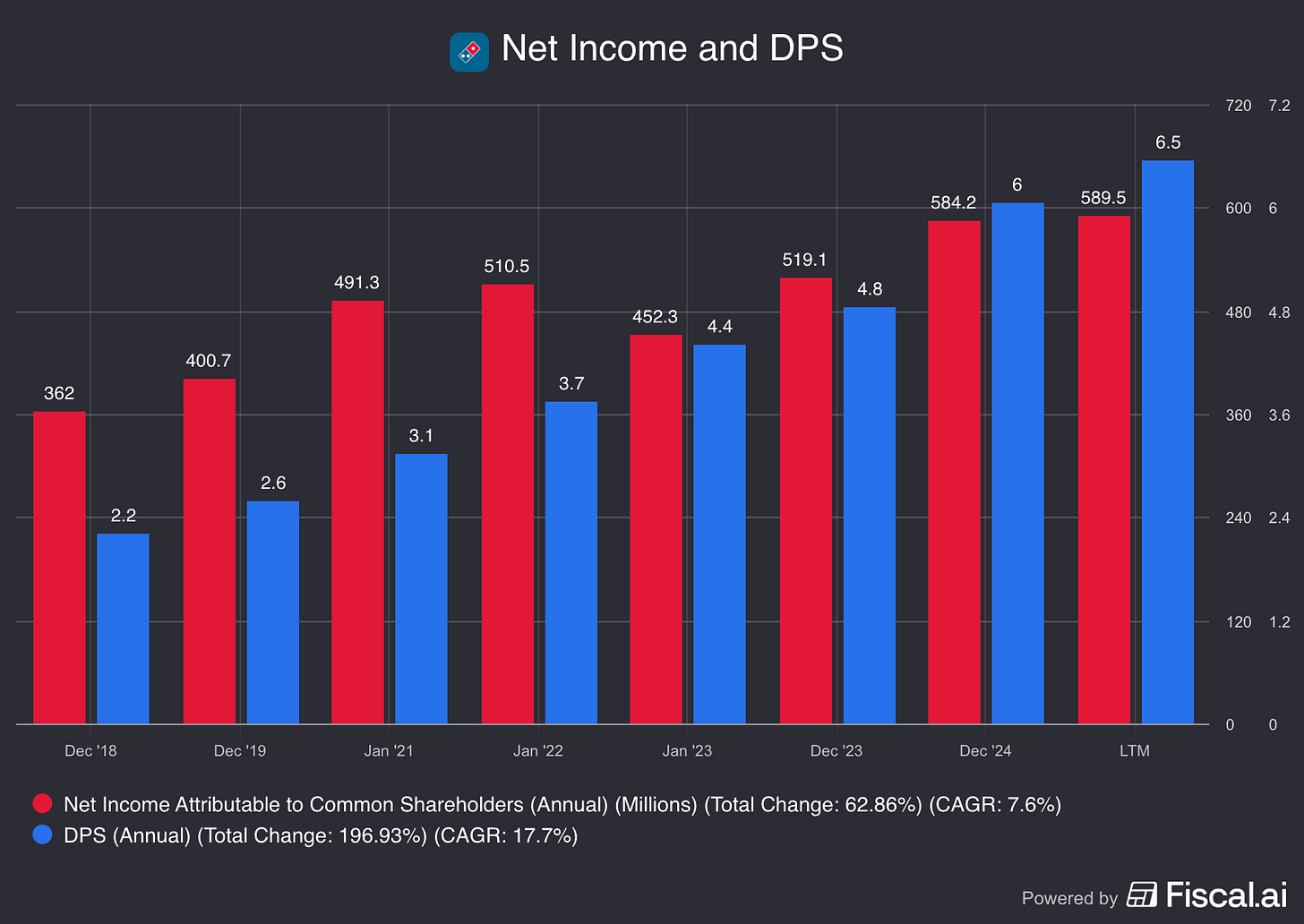

The company is a consistent dividend grower and has increased its dividend every year for over a decade.

One more reason to love Domino’s?

They have the right incentives in place:

To own a Domino’s, you must have worked at a Domino’s

If you own a Domino’s, you can’t own other businesses

When the Franchisees succeed, Domino’s succeeds

The company’s scale, brand, and focus on franchisee success give it a big advantage in a tough market.

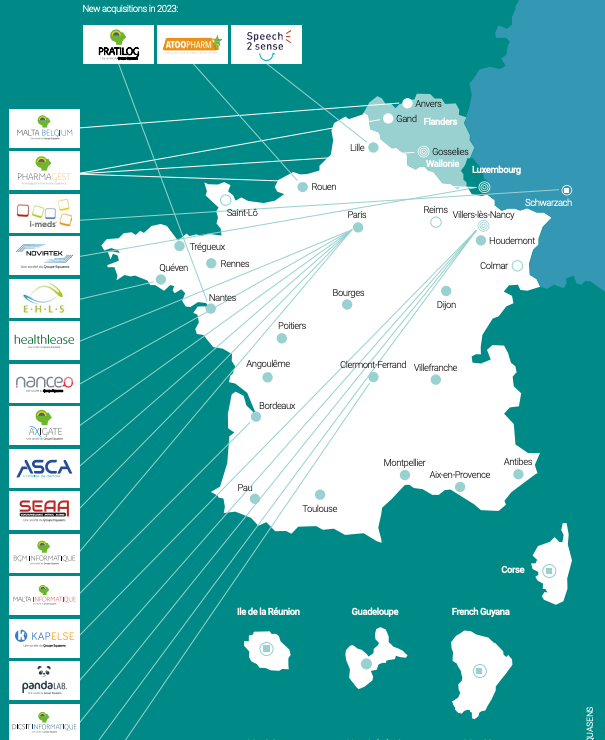

4. Equasens ($EQS)

How does Equasens make money?

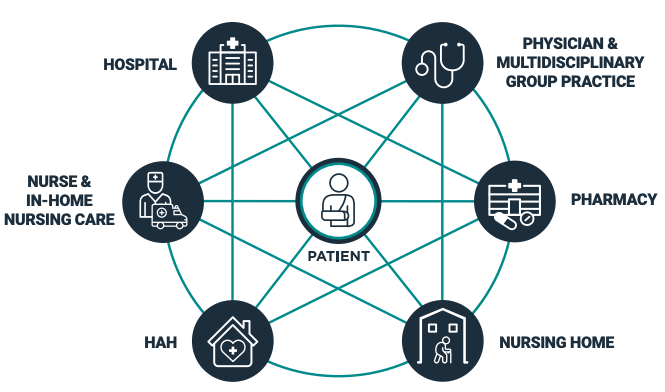

Equasens is a French company that specializes in IT solutions for managing pharmacies, healthcare products, and services, focusing on improving patient care. Most of Equasens’ revenue comes from software licensing, maintenance, and service contracts.

These contracts often involve recurring fees, providing a stable revenue stream.

In addition, they sell software modules, hardware, and provide training and support to their clients.

Equasens can be considered a market leader in a niche.

They focus on providing end-to-end solutions for healthcare professionals, particularly in the French-speaking market.

It’s a segment larger, more generalized competitors may overlook.

This specialization allows them to build deeper relationships and tailor their offerings more effectively.

What makes Equasens a great compounder?

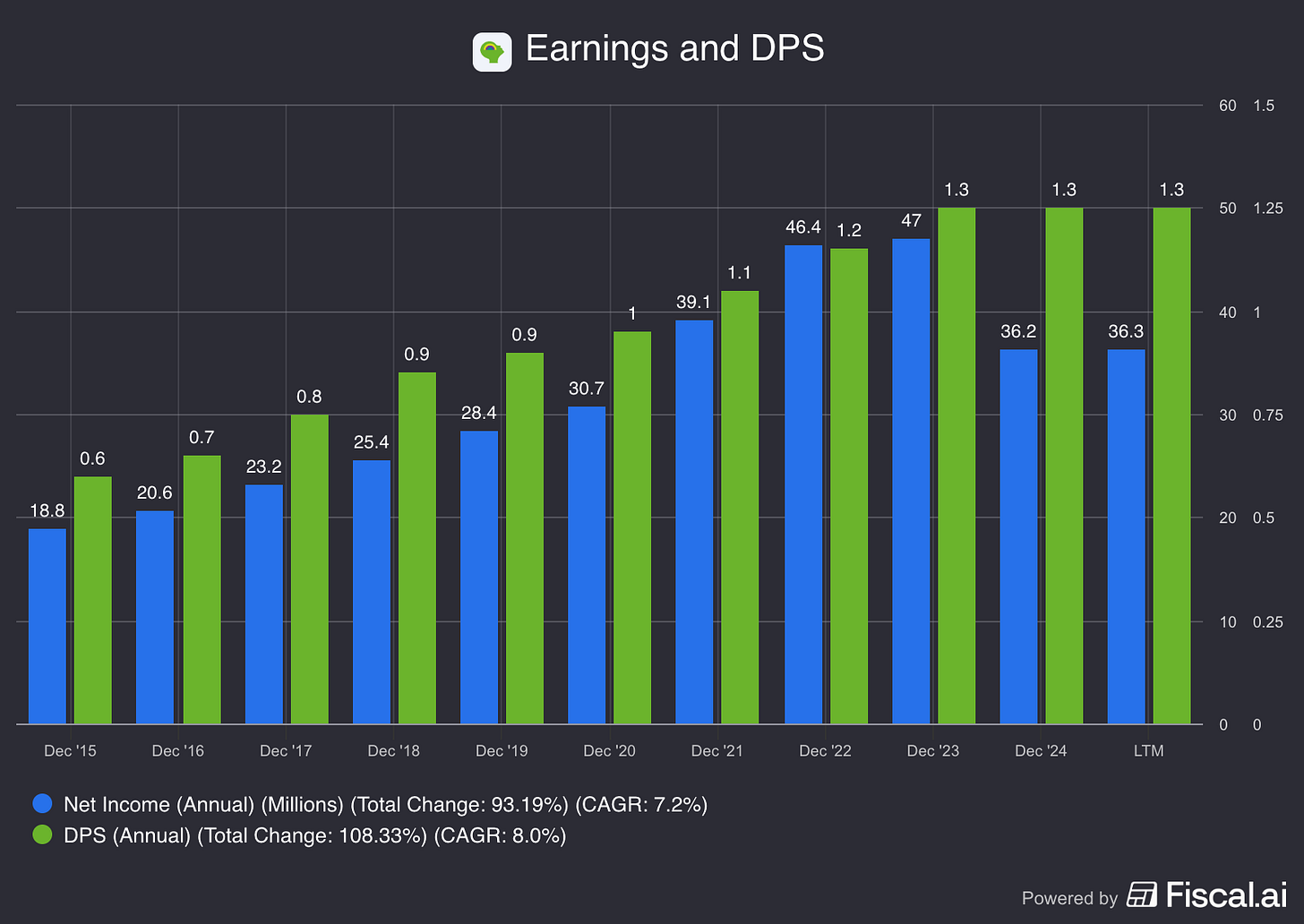

Equasens has grown its earnings and dividends consistently.

Thanks to its stable business model in the healthcare sector they can grow very reliably.

The company should continue to benefit from an aging population and the continued digitization of healthcare.

Now let’s dive into the top 3!