By monthly tradition, you’ll get an update on our Best Buys of the month.

What’s going on in the markets? And what are our favorite stocks?

Let’s become a little bit wiser today.

September 2025

The S&P 500 increased by 4.1% in September.

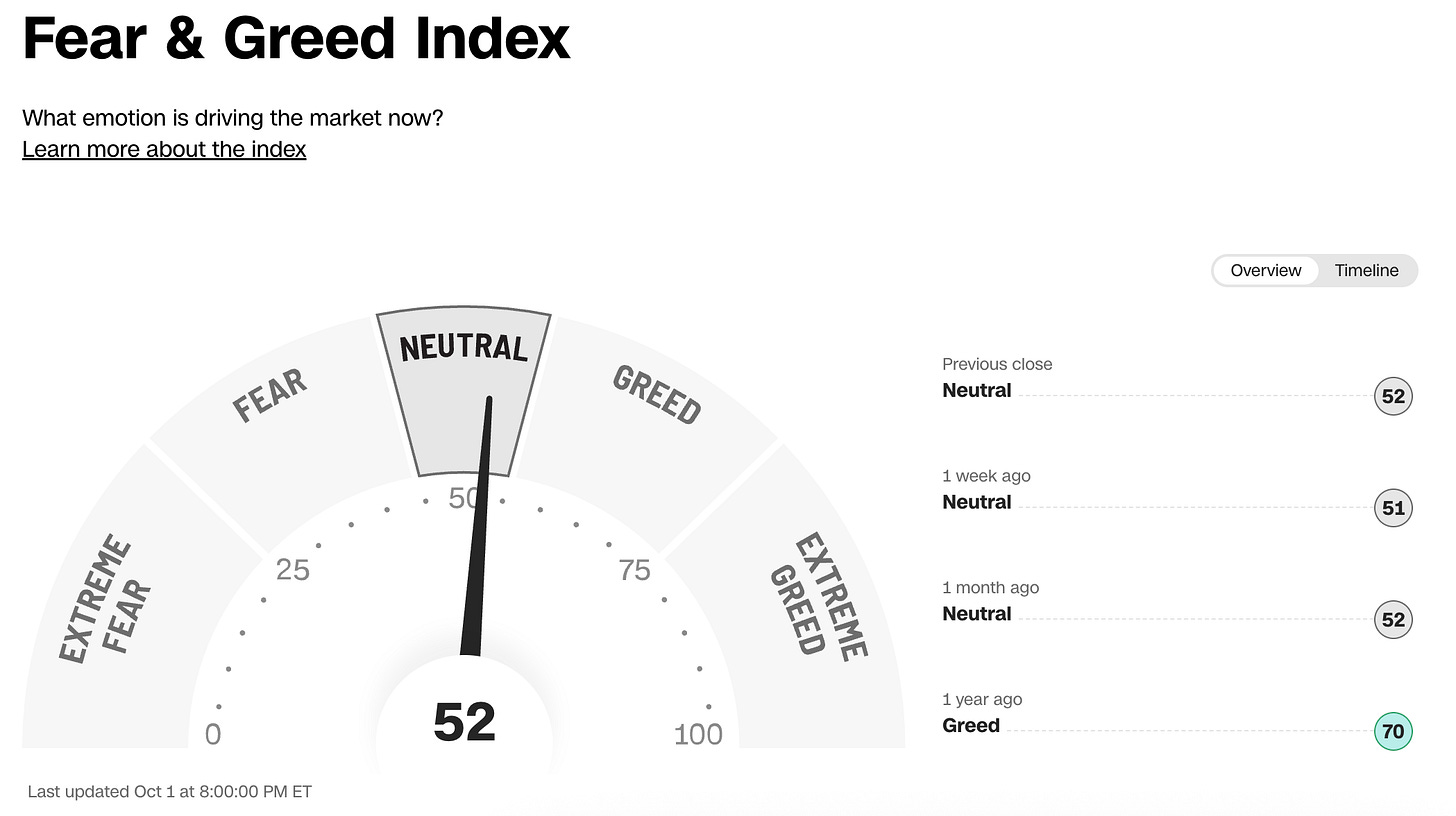

Investors are “Neutral” today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

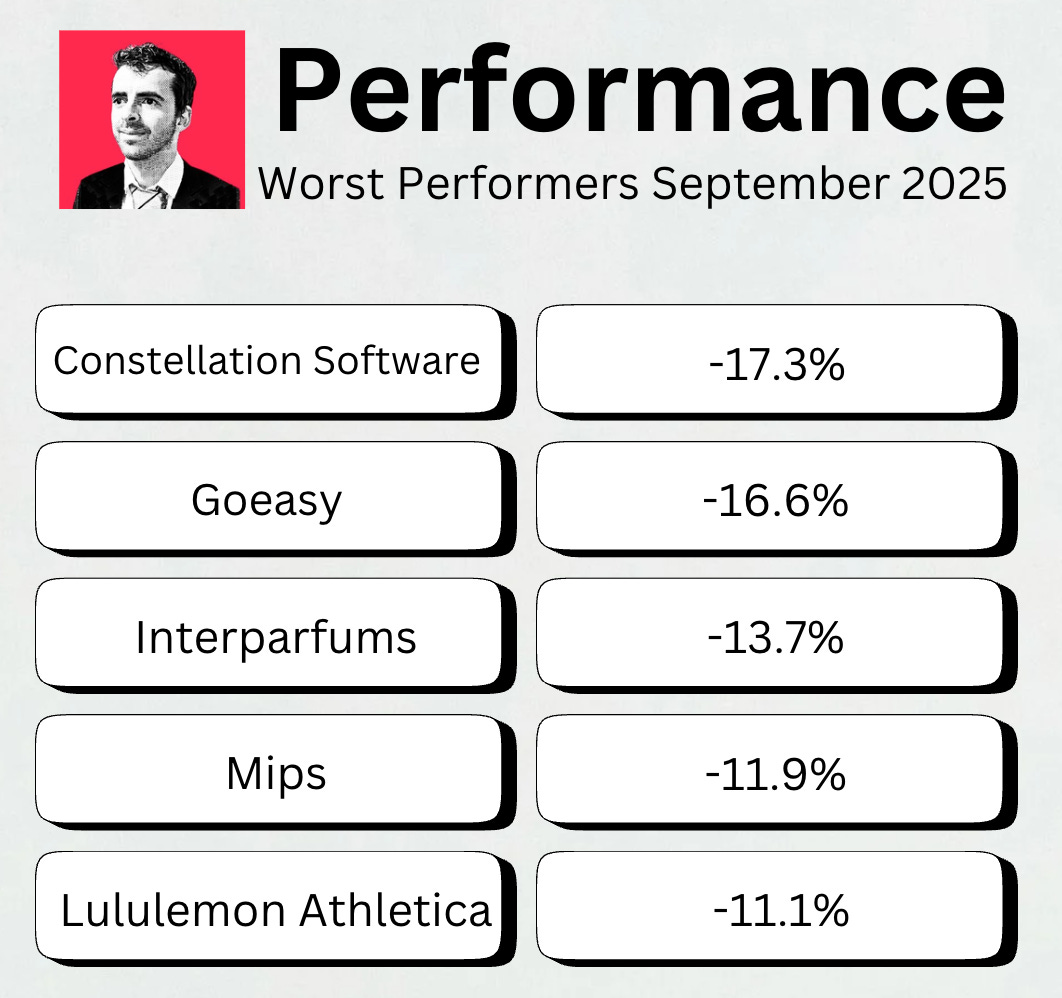

Worst performers

The cheaper we can buy great companies, the better.

Here are the worst performers of the past month:

Constellation Software is starting to look very interesting.

Best performers

Here are the best performers of September:

ASML did exceptionally well.

Investors had been waiting for this rebound for a while now:

Performance

Here’s what the performance of Our Portfolio looks like.

So far, Our Portfolio has achieved an average yearly return of 15.6%.

Our Portfolio would double every five years if it continues to perform this well.

I use Interactive Brokers to execute all my transactions. Discover more about Interactive Brokers here.

Spotlight: Watches of Switzerland Group ($WOSG)

How does WOSG make money?

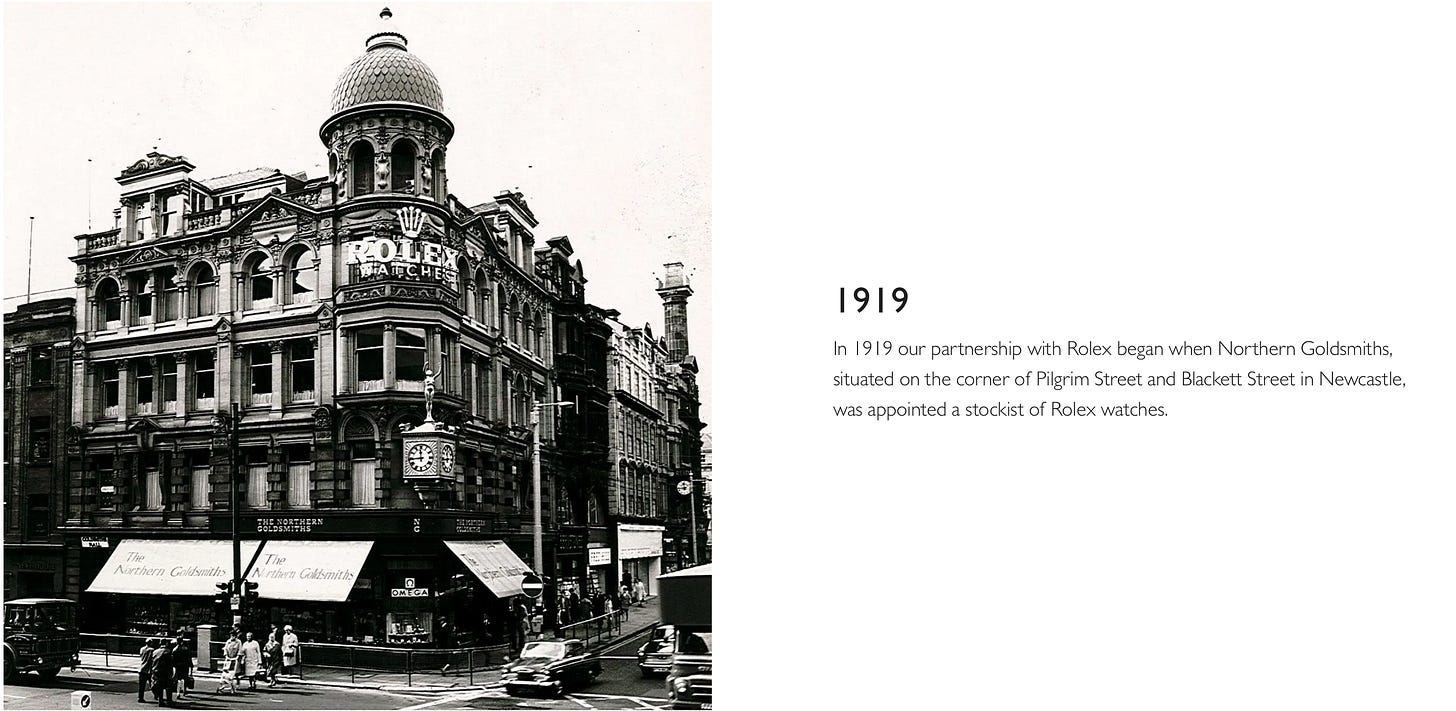

Watches of Switzerland is a retailer of luxury jewelry with a presence in the UK and the US. Their +100-year relationship with Rolex makes it a quality business. Roughly 50% of their sales come from Rolex.Brief introduction

A company I would love to own? Rolex. It’s the Ferrari of the watch industry. Rolex completely dominates its industry.

Despite the high price, customers are willing to wait over five years to get their watch.

Warren Buffett once even said:

“If Rolex ever goes public, please give them my number.”Unfortunately, Rolex isn’t publicly traded. But that’s exactly why Watches of Switzerland is so interesting. You can think of them as a guardian of a Rolex.

Rolex doesn’t sell watches directly. Instead, they sell through authorized retailers. Ninety jewelry stores in the UK are licensed to sell Rolex, and 41 of them are owned by WOSG.

They are now investing heavily in the U.S. to create the same dominance there.

WOSG is the closest you can get to a “Rolex investment”.

Competitive advantage

There is a saying in the watch industry:

“It’s harder to get a license to sell Rolex than to get a license to print money”.Entering this market is nearly impossible. It’s not only a strong moat, it’s also durable.

WOSG was Rolex’s first retailer partner. Their relationship goes back to 1919! This tells you something about the competitive advantage period (CAP).

Given the strength of the relationship and the mutual importance, the economics of WOSG look more like a Rolex subsidiary than a typical retail company.

Why is the stock cheap?

Seems like a wonderful company, right? Now, let’s take a look at the price chart. Since 2022, they have been down over 75%.

The reason? Rolex acquired Bucherer, another watch retailer. Because of this acquisition, investors worry that Rolex will cut supply to WOSG stores.

I don’t think this will happen for four reasons:

Bucherer is mainly active in Switzerland, so it doesn’t compete directly with WOSG. WOSG is active in the UK and the US.

Bucherer founder didn’t have a successor. As a result, you can see the acquisition as brand protection for the company.

WOSG just opened the biggest Rolex shop in the world on Bond Street, London. They wouldn’t invest this much if they didn’t believe in the continuity with Rolex.

Rolex is a non-profit charitable trust. It means that they can never distribute profits to shareholders. Most of their profits gets donated nowadays to projects in Geneva, Switzerland.

I think the market is overpanicking. As a result, WOSG now trades at less than 8x Free Cash Flow.

It looks cheap if you ask me. Management is also trying to take advantage of this and has recently authorized a plan to repurchase £25 million worth of shares (roughly 3% of the Market Cap).

Fundamentals

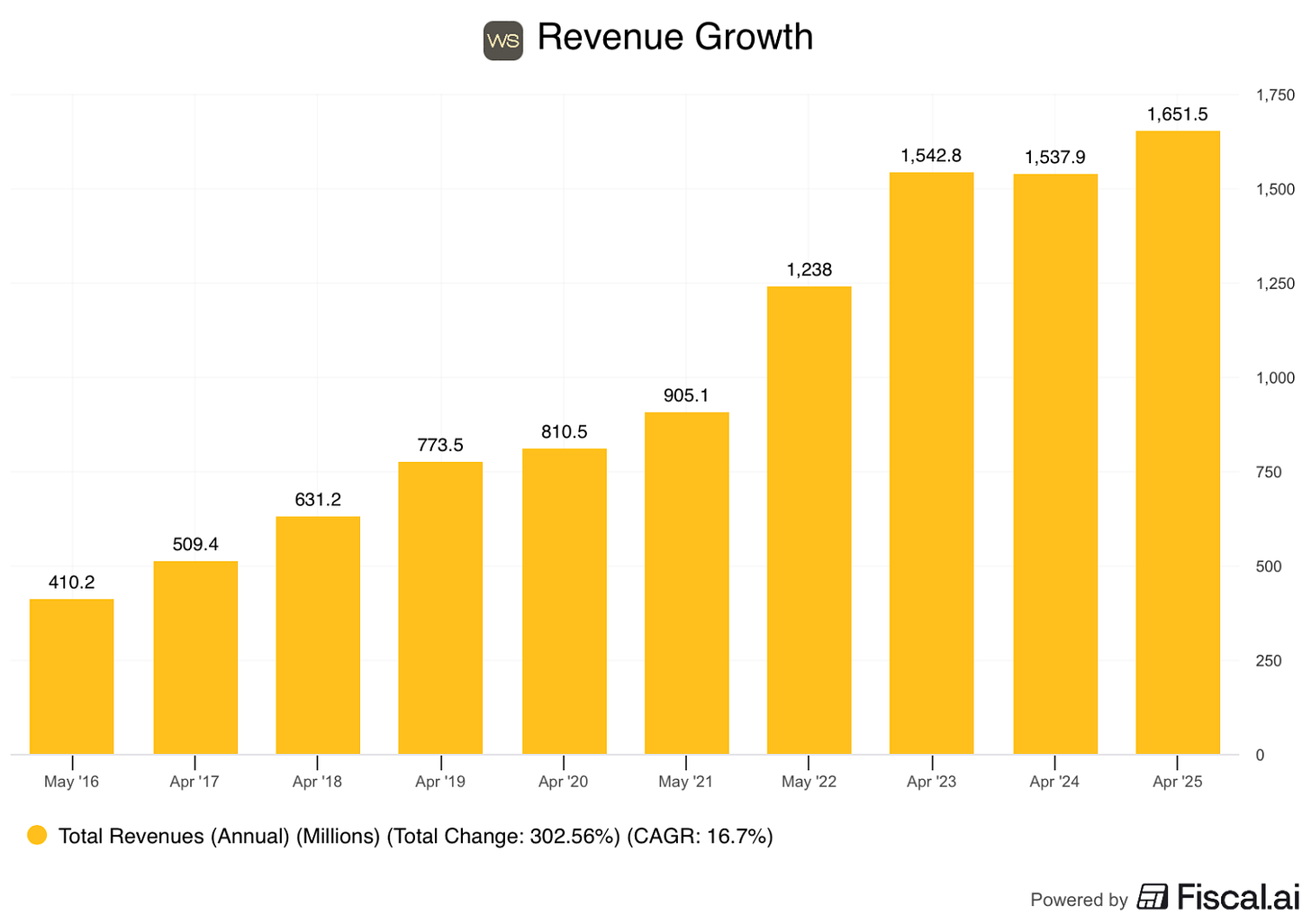

Here’s what the fundamentals look like:

Debt/Equity: 1.2x (Debt/Equity < 1x? ❌)

ROCE: 19.0% (ROCE > 15%? ✅)

5-Yr Revenue CAGR: 15.3% (5-Yr Revenue CAGR > 7%? ✅)

FCF-Margin: 7.0% (FCF-Margin > 10%? ❌)

P/FCF: 7.5x (P/FCF < 20x? ✅)

We would prefer to see lower debt levels, but given the long waiting lists for Rolex and the clear visibility of future income, we think WOSG can run at a slightly higher debt level.

A Not-So-Deep-Dive (NSDD) about WOSG has been written and will be published soon.

Best Buys October 2025

Now, let’s dive into our five favorite stocks for October 2025.

We only talk about companies that aren’t in Our Portfolio today. Why? We love all companies in Our Portfolio.

The 5 examples we talk about in this article can be considered as serious candidates for the Portfolio.

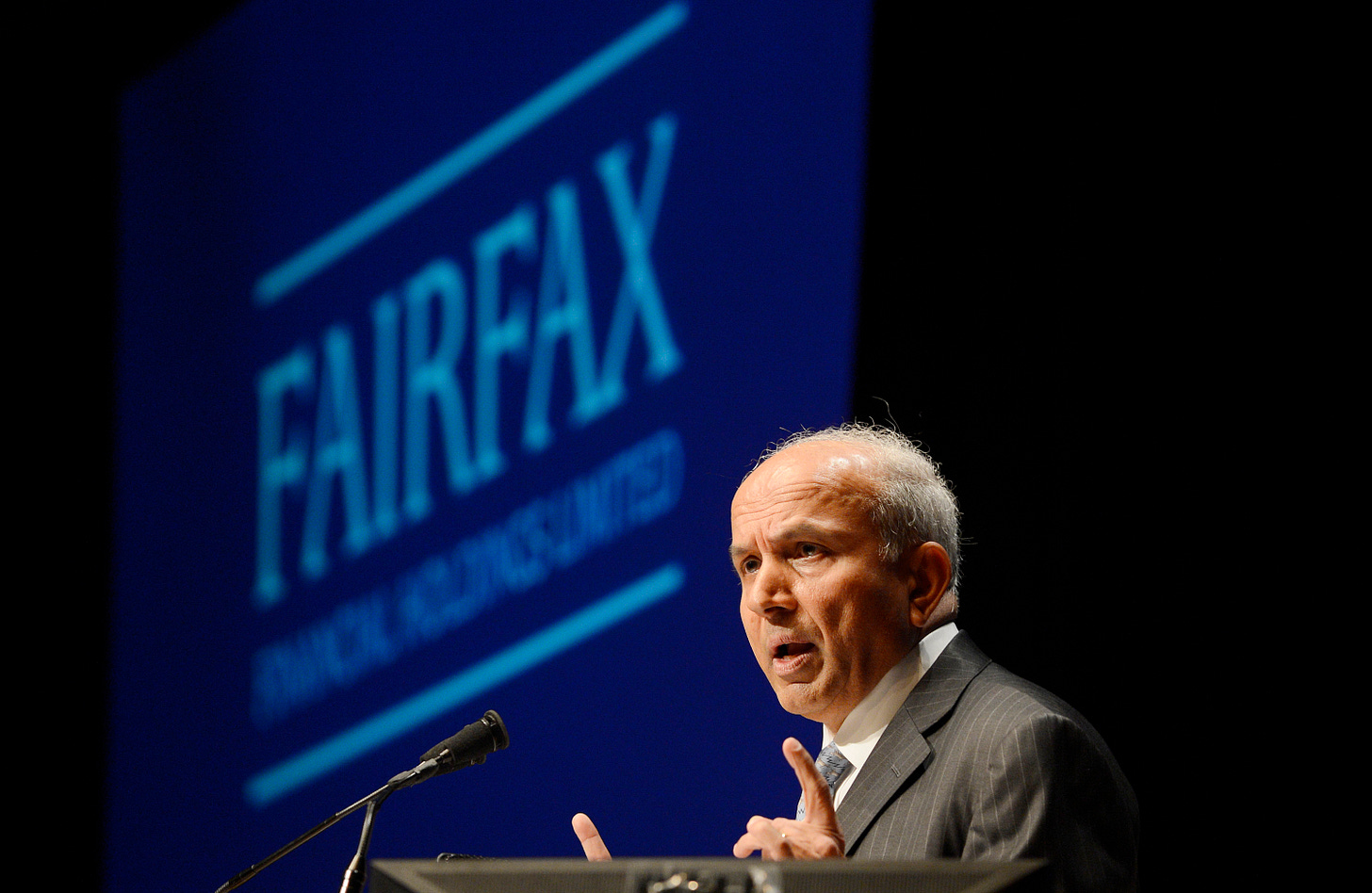

5. Fairfax Financial ($FFH)

How does Fairfax make money?

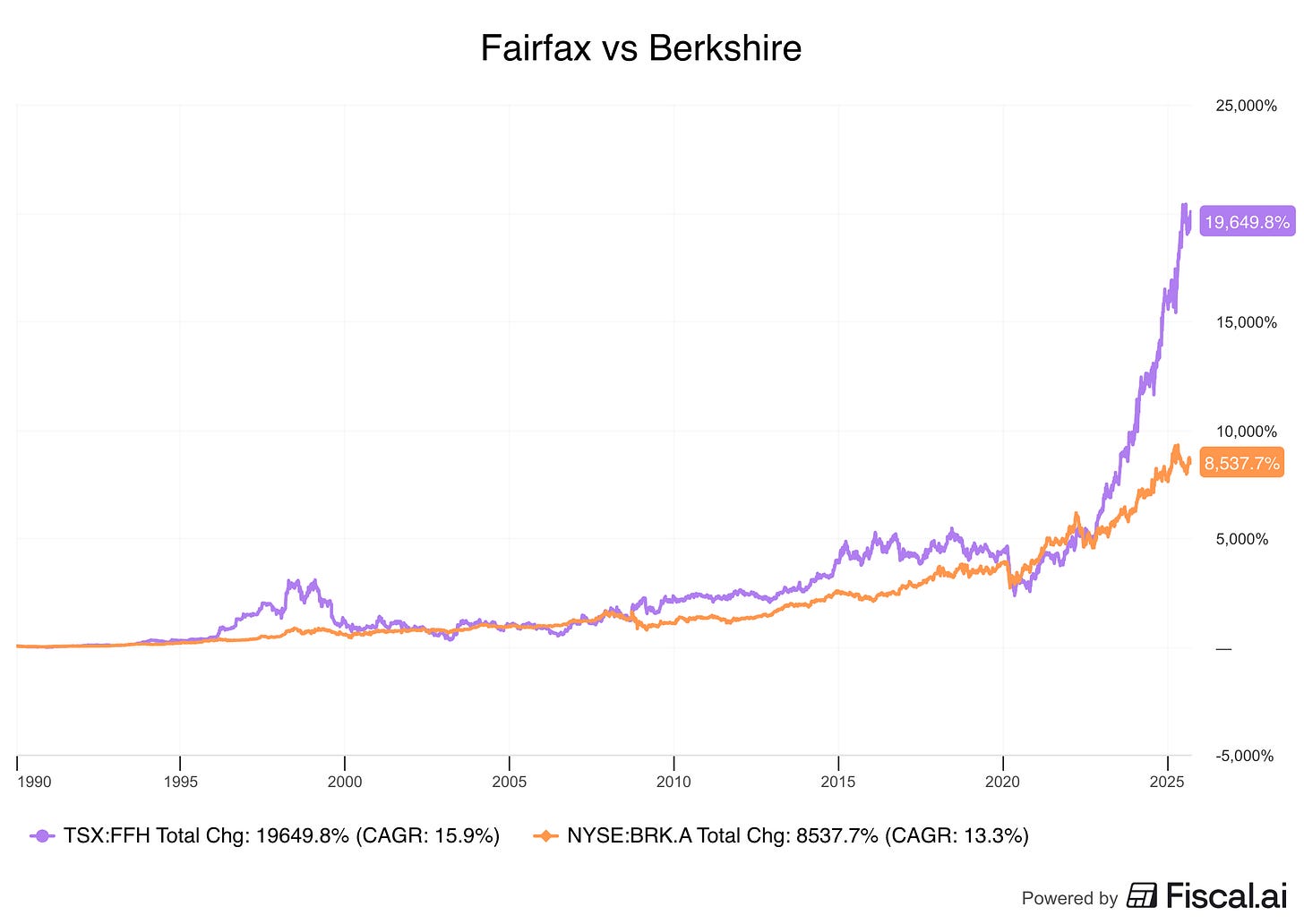

Fairfax is often called “The Berkshire Hathaway of Canada”. There are two similarities between Berkshire and Fairfax. First, insurance is the cornerstone of their financial empire. This insurance float is then used to invest wisely. Since 1985, Fairfax’s book value per share has compounded at a CAGR of 18.7%. And second, they are both run by an excellent capital allocator. Talking about excellent capital allocators…

… Fairfax was founded in 1985 in Toronto by an Indian immigrant, Prem Watsa.

Today, Watsa is still the CEO. His nickname? The Canadian Warren Buffett.

Something else I find extremely interesting? Fairfax donates 1%-3% of its pretax profit to charities that employees support. Since 1991, they have donated roughly $500 million.

This tells you something about the culture of this business. It’s also a smart way to create an emotional skin in the game.

Watsa’s philosophy:

“Do Good By Doing Well”

When reading Prem Watsa’s shareholder letters, he always seems to come back to this one question: “How do I make sure that Fairfax still exists in 100 years?” We love this long-term focus. I assume his charitable approach helps in achieving this goal.

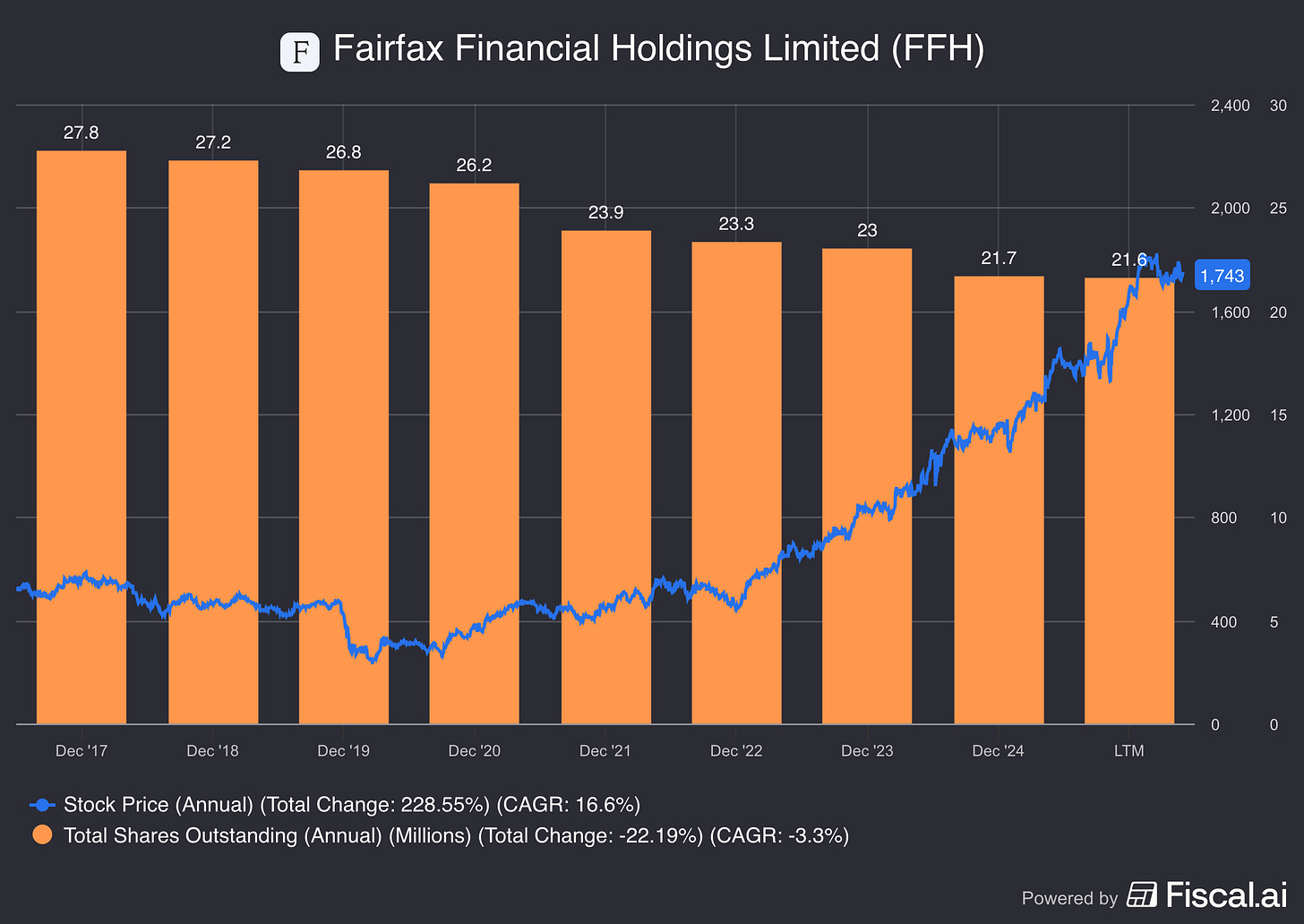

In recent years, Watsa has also been an aggressive buyer of his own shares. Since these repurchases, the share price has grown rapidly. It proves Watsa’s excellent capital allocation skills.

Interestingly, Fairfax has outperformed Berkshire since 1990 at a CAGR of 15.9% versus 13.3% for Berkshire:

4. Brookfield Corporation ($BN)

How does Brookfield Corporation make money?

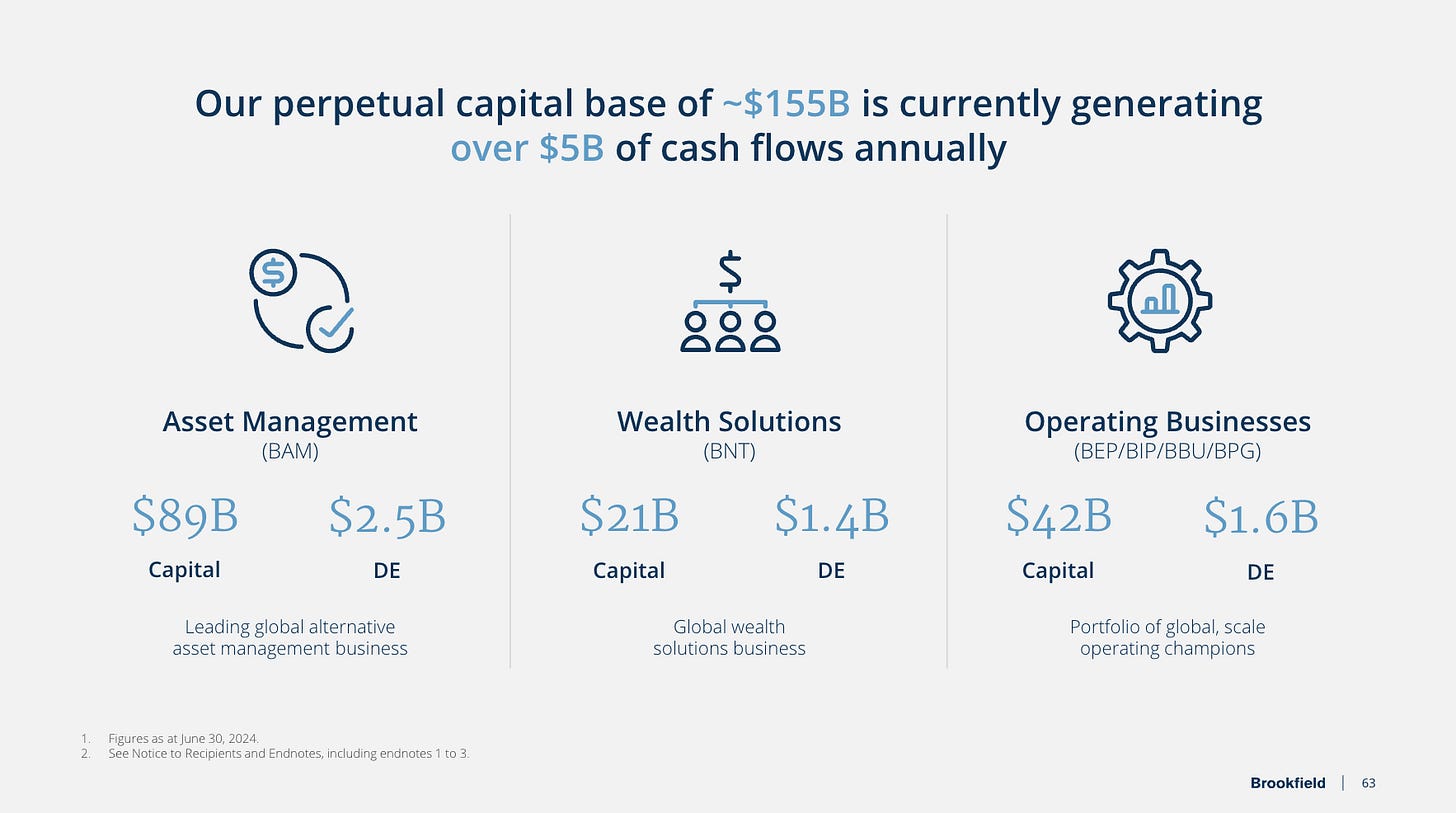

Brookfield Corporation makes money by owning and managing real assets. Think about real estate, infrastructure, renewable energy, and private equity—while also earning fees from managing investments for clients.Brookfield Corporation earns money in three ways:

Asset Management: Brookfield Asset Management (BAM) collects steady management and performance fees from pension funds, insurers, and sovereign wealth funds.

Insurance Solutions: through Brookfield Reinsurance, it locks in long-term capital (annuities and float) that can be reinvested at high returns.

Direct Investments: Brookfield owns controlling stakes in listed vehicles like Brookfield Infrastructure, Renewable Partners, and Business Partners, plus a global real estate portfolio. Together these generate about $5 billion in free cash flow every year

Bruce Flatt has been Brookfield’s CEO since 2002 and has an amazing track record in creating shareholder value.

Bruce Flatt is famous for his disciplined value approach:

Buy high-quality assets during crises

Improve them operationally

Recycle capital at the right time

And make no mistake… Brookfield has been a phenomenal compounder.

Since 2001, the stock compounded at 17.7% per year, massively outperforming the S&P 500.

Now let’s dive into the top 3.