🏰 Why you should invest in boring companies

It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

1️⃣ Boring is Beautiful

Do you know why boring companies outperform the market?

There are three main reasons:

They are essential

They have no replacement

They generate a stable and predictable cash flow

That’s why quality investors tend to outperform the markets.

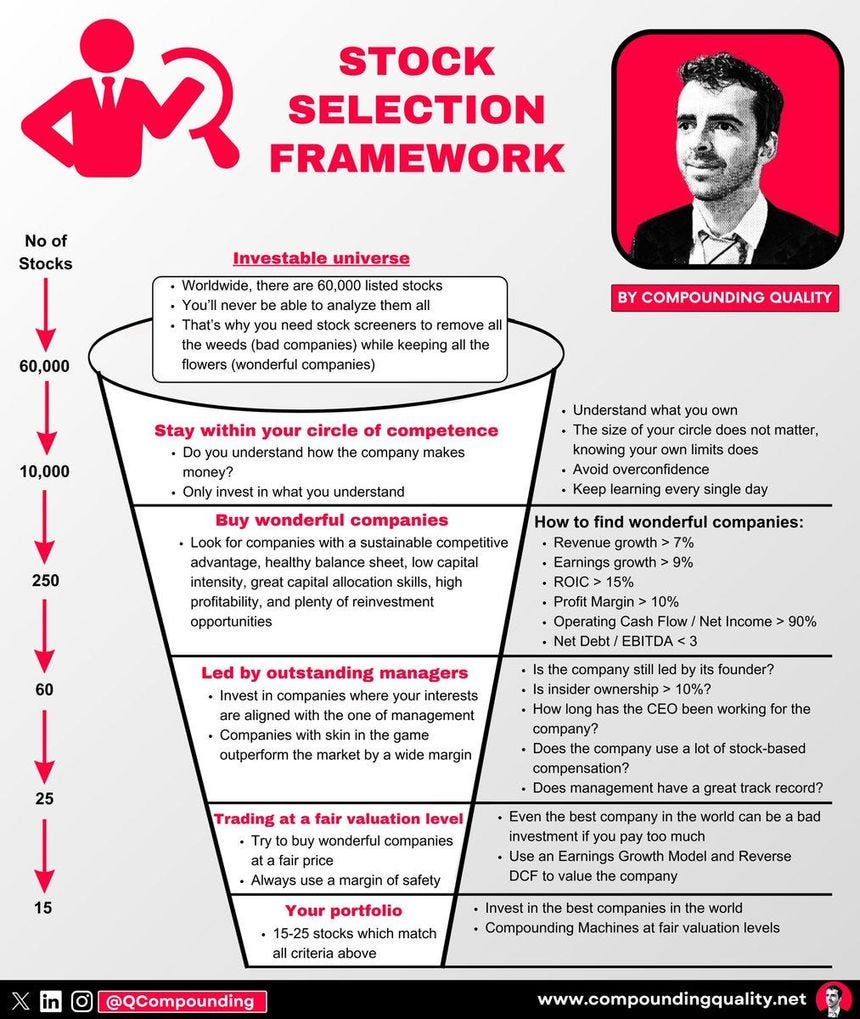

Here’s a guide to select great stocks:

2️⃣ How to beat the market

Joel Greenblatt is one of the best investors in the world.

Between 1985 and 2005, his Magic Formula generated a return of 33% (!) per year.

His book “The Little Book That Still Beats the Market” is pure gold.

You want to get the essentials? Here’s a 3-page summary:

3️⃣ One simple investment quote

Investing is simple, but not easy.

It should be very boring. Like watching paint dry or grass grow.

If you want excitement, you should go to Las Vegas.

4️⃣ Interview Chris Mayer

Do you know Chris Mayer?

He wrote the excellent book 100 Baggers.

In the past, we interviewed Chris Mayer. You can read it here:

5️⃣ Stock Pitch: Intuitive Surgical ($ISRG)

How does the company make money?

Intuitive Surgical makes money by selling da Vinci surgical robots. It generates recurring revenue from instruments, accessories, and service contracts used in every procedure.Intuitive Surgical is a quality healthcare tech leader with a strong moat and high switching costs.

Picture this: every time a hospital buys a robotic surgery system, ISRG gets a new customer for life.

And hospitals worldwide are buying these systems faster than ever.

Net Cash Position

Net Profit Margin: 28.4%

ROIC: 18.4%

Forward P/E: 47.8x

Return since 2001 (CAGR): +26.6%

Everything in life compounds

Pieter (Compounding Quality)

PS You are not a Partner of Compounding Quality yet? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Is Intuitive Surgical a good example of a boring company? Just feels like it might not be..

Good