Buffett’s Secret: Patience Over Skill

The Snowball that builds your fortune

As a young kid, I always loved playing in the snow with my brother.

Many years later, I came to realize there was great investment wisdom in this.

Let’s explore how playing in the snow can make you a lot of money.

1. The Snowball Effect

What were you doing when you were 11 years old?

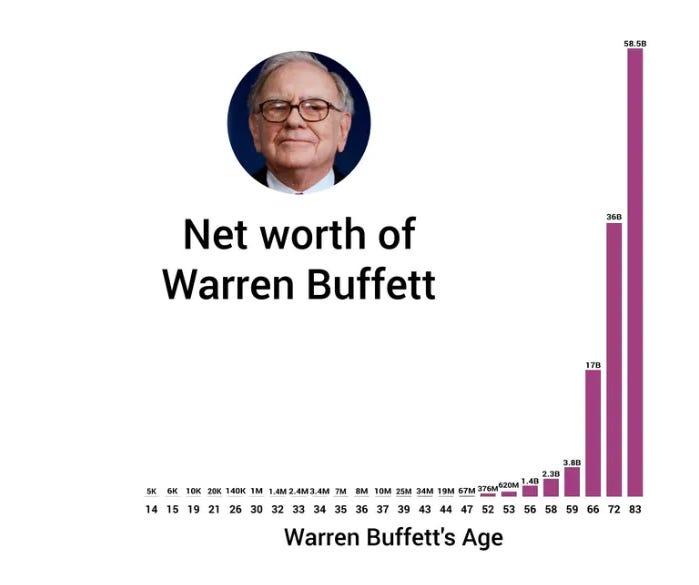

Warren Buffett was buying his first stock.

Perhaps that’s the biggest reason why we all know Buffett instead of other successful investors.

Warren had a lot of time to let the magic of compounding work for him.

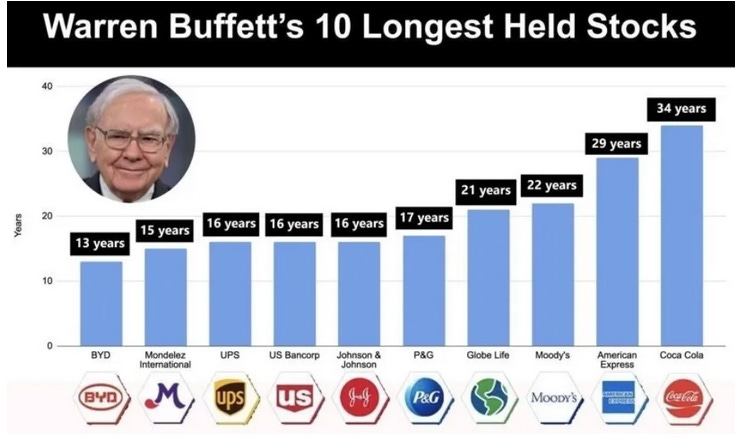

“His skill is investing, but his secret is time.” - Morgan HouselDon’t get me wrong, Buffett is an exceptional investor.

He has an average return of 19.8%. This means he doubled his money every 3.6 years!

But what if he had started investing when he was 30 and retired at 70?

Let’s say he started with $100,000.

In that case, his net worth would ‘only’ be $137 million.

This amount sounds impressive until you realize that it’s less than 0.1% of his actual net worth.

The secret behind these shocking numbers? The Power of Compounding.

Compounding is like a snowball rolling downhill, small at first, but then it grows bigger and faster until it explodes in size.

But it starts small.

After some time, it’s still small. That’s when most people quit. And then, ‘all of a sudden,’ it becomes exponential.

Time is your best friend as an investor.

“Money makes money. And the money that money makes, makes money.” - Benjamin Franklin2. Warren’s Investing Philosophy

Just like Buffett, you have a massive advantage too.

You don’t have to reinvent the wheel.

Instead, look at what the most successful investors did and apply it to your strategy.

“I am a big fan of copying. I think that’s one of the best ways to learn. So, I like to find the best investors and copy them. I am a shameless copycat.” - Mohnish PabraiWant to copy Buffett?

Buy quality businesses: Warren looks for companies with strong fundamentals, competitive advantages (moats), and consistent cash flows

Think long-term: Just like you need air, compounding needs time

“Our favourite holding period is forever.” - Warren Buffett3. From $1,000 To a Million

The best thing about compounding?

Your initial snowball doesn’t even have to be big.

Can you save $1,000 a year?

If you invest $1,000 at a 10% annual return (the S&P 500 historical return), it will become $117,000 in 50 years.

If you add just $100 per month for 50 years, it becomes over $1 million.

Small changes can have massive results.

Are you a coffee drinker?

Every dollar you invest will be worth over $100 in 50 years.

4. Some Examples

In 1626, the Manhattan-based Indians sold Manhattan to the Dutch for $24.

Today, Manhatten is worth over $100 billion.

What a fantastic deal for the Dutch!

But wait… What if the Indians invested the $24 they received from the Dutch in stocks instead?

It would be worth $12,000,000,000,000 today (assumption: 7%/year return).

Can you read the number? It’s $12.0 trillion.

The lessons?

The Indians were great negotiators

Stocks are one of the best investments in the long term

Never underestimate the Power of Compounding

5. Build Your Own Snowball?

Just like Buffett, let time be your friend.

The best time to start investing is not now, it was yesterday.

Look for businesses with the following characteristics:

High returns on capital (ROIC > 15%)

Many reinvestment opportunities

A strong competitive advantage

Great examples are Constellation Software ($CSU), Dino Polska ($DNP), and LVMH ($MC).

Chuck Akre is another investor.

He created the ‘Three-Legged Stool’ approach to spot Compounding Machines:

6. Extreme Patience

Compounding is simple, but not easy.

The difference?

It’s simple because the theory behind it is not so hard to understand. One simple formula can capture all the magic:

Good Decisions + Time + Consistency = Life-Changing ResultsIt’s not easy because it comes with a lot of psychological challenges.

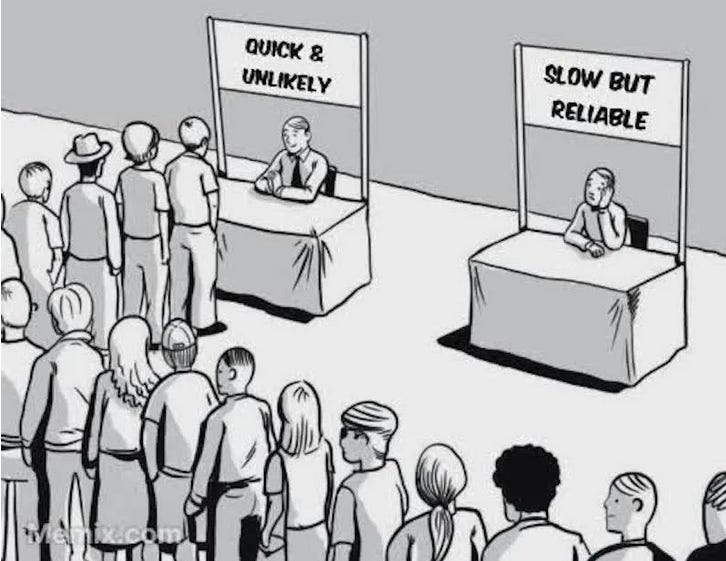

The biggest challenge of compounding?

It can take a long time before you see the payoff. You have to be able to take action and stay consistent without seeing immediate results.

It takes a long time, and it starts slowly, very slowly, and then before you know it, it becomes exponential.

Jeff Bezos: “Warren, you are the the second richest man in the world, and yet you have the simplest investment thesis. How come others didn’t follow you?”

Warren Buffett: “Because no one wants to get rich slowly.”

Investing is a marathon, not a sprint.

“The quickest way to get rich is to go slow” - Morgan Housel7. Warren Buffett’s Portfolio

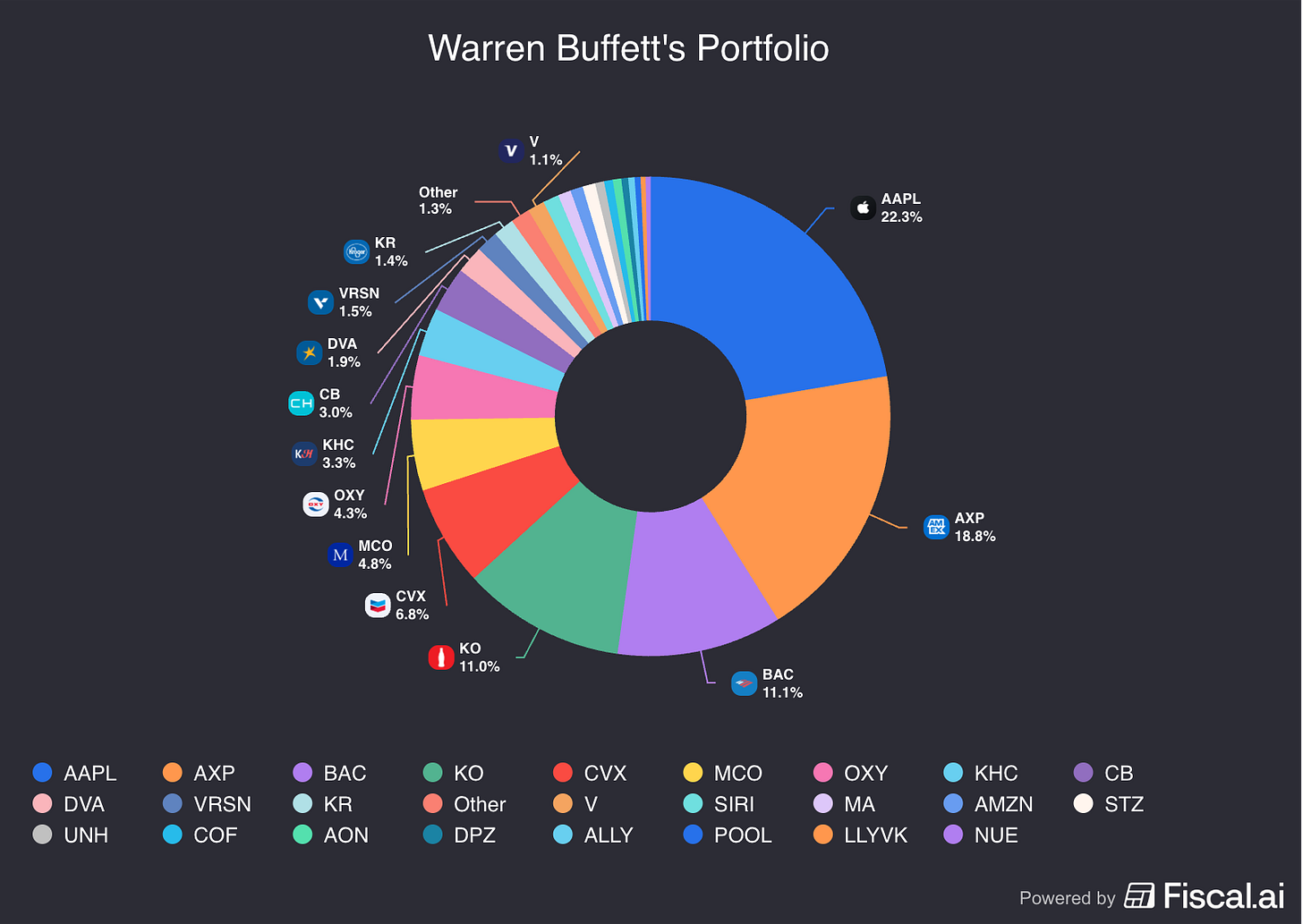

Berkshire Hathaway owns phenomenal companies.

He owns a lot of great companies that I like too.

There are three businesses that clearly stand out to me.

3. Pool Corp ($POOL)

How does the company make money?

Pool Corporation distributes swimming pool supplies and equipment. A key part of its growth strategy is buying other companies, which makes it a serial acquirer.What I like about Pool Corp:

A lot of their sales are recurring in nature (around 60%)

Excellent capital allocation skills with an ROIC of 28.5%

Pool Corp. is one of the best-performing US stocks ever

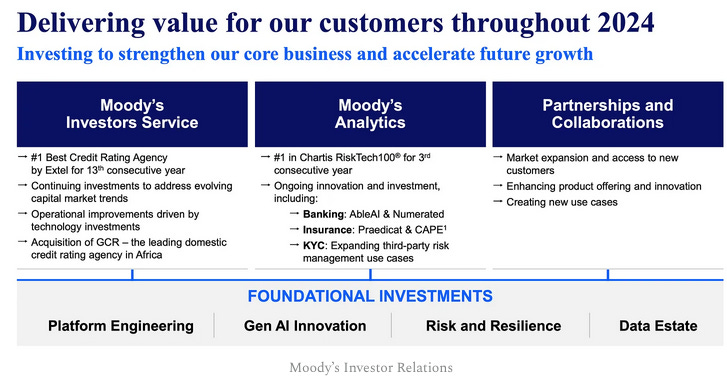

2. Moody’s Corp ($MCO)

How does the company make money?

Moody’s is a credit rating agency. It helps investors understand the risks of companies and governments.What I like about Moody’s:

Despite big mistakes during the financial crisis in 2008, the reputation is still strong, which proves a strong moat

Moody’s is very profitable with a Net Profit Margin of 29.0%

The company benefits from a lot of pricing power

1. Domino’s Pizza ($DPZ)

How does the company make money?

Domino’s Pizza makes money by selling pizza in its stores and earning fees from franchise owners. It also makes money by selling ingredients and supplies to its franchises.What I like about Domino’s Pizza:

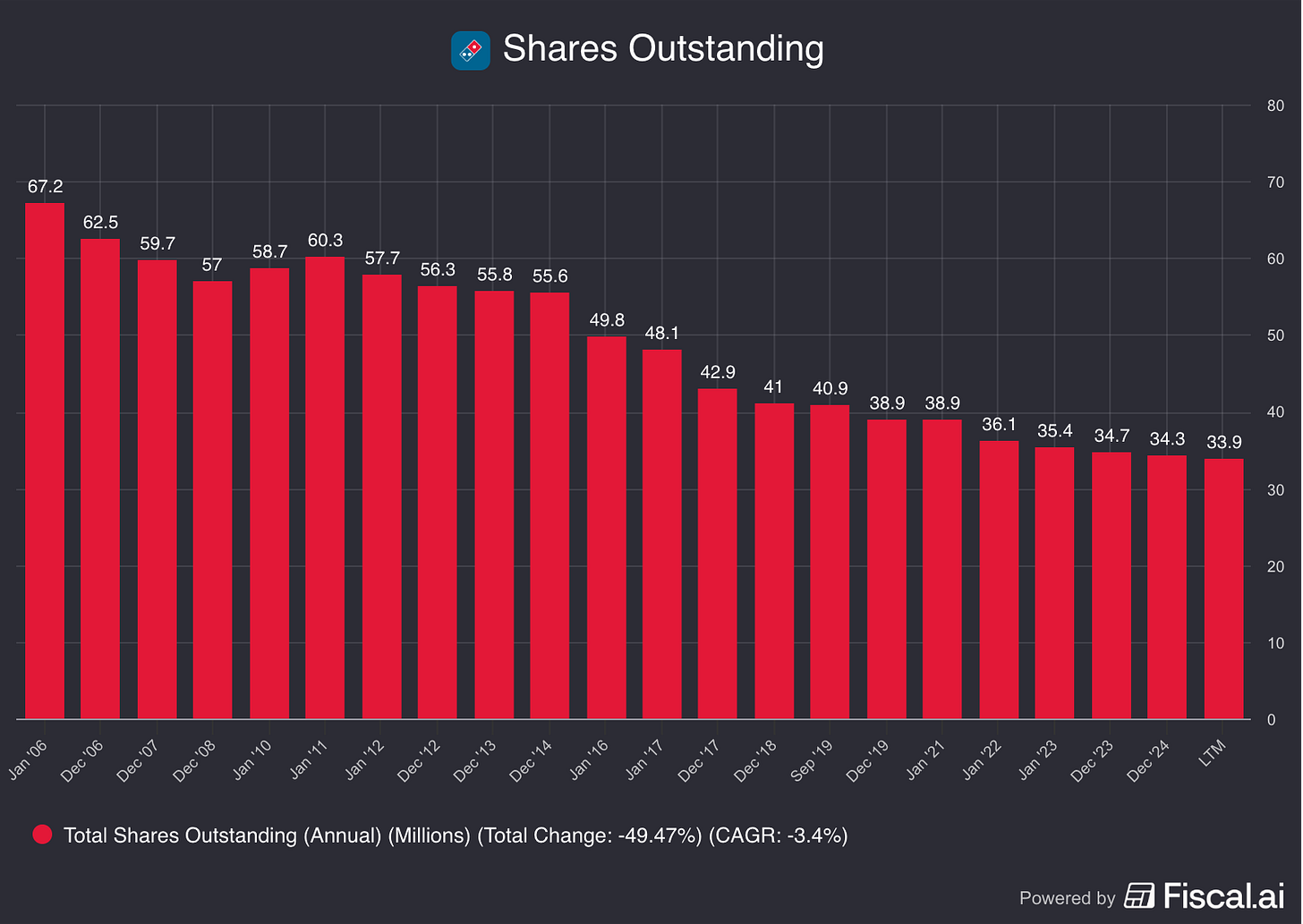

DPZ is a true cannibal stock, they bought 50% of their outstanding shares back in the last 20 years

The strong brand creates a great competitive advantage

The franchise business is very capital light and reduces risk

So now you received three interesting ideas:

Pool Corporation

Moody’s

Domino’s Pizza

But before you copy from the best investor, always do your own homework.

You can see what Buffett owns, but you don’t always know why.

“You can borrow someone else’s stock ideas, but you can’t borrow their conviction.” - Ian Cassel

8. Conclusion

Want to reshape your financial future? Use this rule:

“You are what you repeatedly do” - Aristotle Success doesn’t come from doing 10,000 things right. It comes from doing a couple of things right 10,000 times. Your financial habits are key!

The two best habits?

Save: Is that $4.0 coffee going to improve your life?

Invest: Buy quality businesses at fair prices!

“The best time to start investing was 20 years ago. The second-best time is now. I wish I had learned that sooner.”This is not who you want to be.

What’s stopping you from starting your investment snowball today?

And remember that once the snowball is running, don’t stop it! Time is your friend.

“The first rule of compounding is to never interrupt it unnecessarily” - Charlie MungerEverything In Life Compounds (especially snowballs)

Pieter (Compounding Quality)

PS You want to learn more about Compounding Quality? Discover everything you need to know here.

Book

Order your copy of The Art of Quality Investing here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Great article, less about stocks and more about wealth intelligence. could apply to any asset class really.

Great post.

Really enjoy your storytelling—it makes the timeless truth clear: time is the ultimate edge in investing.