Building An Empire

Kelly Partners Group published its trading update this week.

The stock is up almost 30% since we first bought it.

Let’s dig into the results and tell you everything you need to know.

Kelly Partners Group

Kelly Partners Group is a professional services firm that offers accounting, taxation, and consulting services to private businesses and high-net-worth individuals.

It can be seen as a serial acquirer just like Constellation Software. They are trying to build ‘The Berkshire Hathaway of Accounting’.

Results first half 2024

Kelly Partners Group published great results.

The stock is up +17% since the beginning of the year.

Here are some key takeaways:

Results

Revenue: $52.9 million (+23.1%)

Since 2022, KPG’s revenue grew by 60%

NPATA (Net Profit After Tax Adjusted): $4.4 million (+25.0%)

Cash Flow from Operations: $11.5 million (+22%)

EBITDA margin: 30.6% (+0.3%)

Expansion to the United States

KPG expanded to Los Angeles (USA) in January 2023 and successfully established partnerships with two accounting businesses to date

The two US businesses account for $6.5 million of revenue (6% of the Group)

Strategy

Become Australia’s global accounting firm for private business owners

Dividend

KPG currently pays a monthly dividend of $0.44 per share (+10%)

The company has grown its dividend per share by 10% per year since the IPO

The good news? From now on, dividends will cease and instead be invested in further growth. This is something we LOVE to see as KPG has plenty of attractive reinvestment opportunities

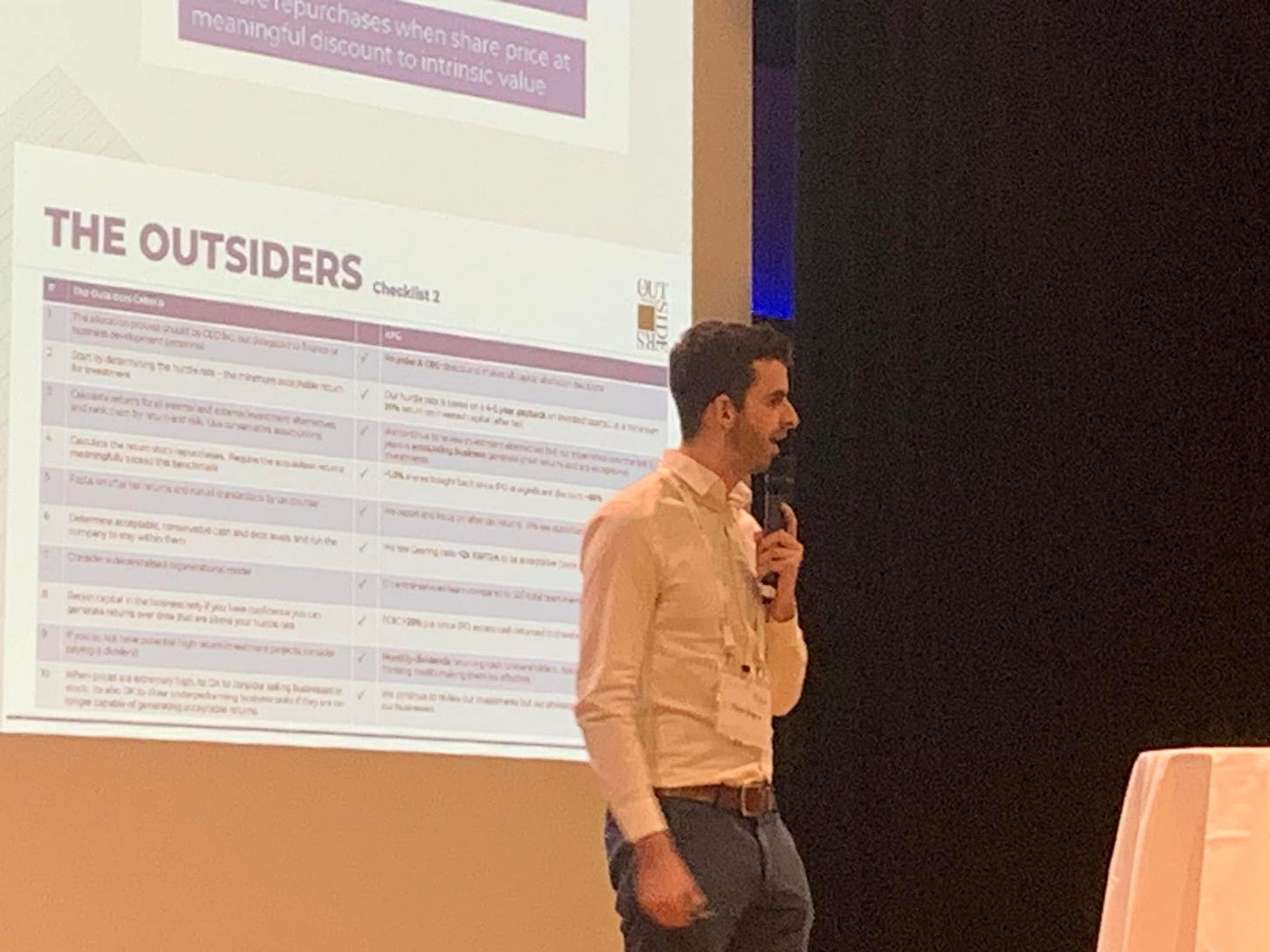

VALUEx Klosters

This week, I was at Value X Klosters (Zwitserland).

It’s a Value Investor Conference hosted by Guy Spier (author of The Education of a Value Investor).

Several millionaires and even billionaires attended the event. The company I pitched to the group? Kelly Partners Group.

For those interested, you can find the slide deck I used here:

Update investment case

Since we first bought the company in November, KPG’s stock price increased by 30%.

But is it still an attractive investment opportunity today?

Let’s find out.