The Warren Buffett of accounting.

That’s how the CEO and Founder of our next buy is called.

Seldomly have I met an Owner-Operator with such great principles.

Changing the accounting industry

Our next buy is an Owner-Operator Quality Stock.

The company can be seen as a serial acquirer in chartered accounting businesses that assists small and medium enterprises, private business owners, and high-net-worth individuals to manage their accounting, taxation, audit, and wealth management activities. Today, the Group has 77 operating partners, servicing 15,000 SME client groups. The company operates in a regional oligopoly and can be seen as a market leader in a niche (small CPA firms).

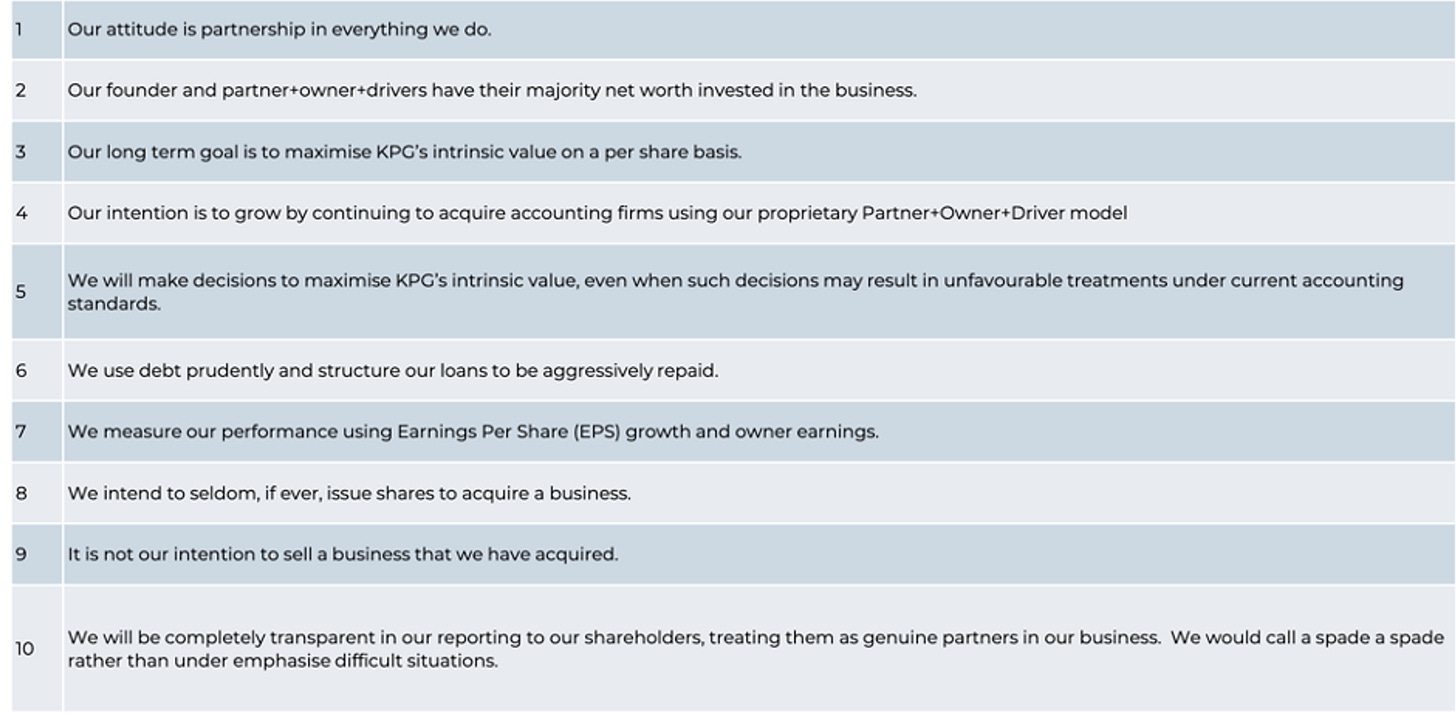

The company’s Owner’s Manual beautifully shows what the business wants to stand for:

The founder and CEO of the Group still owns 50% of the shares outstanding. Management focuses relentlessly on creating shareholder value.

An example? Everyone who joins the company is obliged to read Jim Collin’s excellent book ‘From Good to Great’ within the first 6 months of employment. If you don’t and he finds out, you’re fired.

It’s also great to see that Lawrence Cunningham (vice-chairman on the Board of Directors of Constellation Software) is active in the Board of Directors and that William Thorndike (author of the excellent book ‘The Outsiders’) owns shares of the company.

“We try to compound money officially for a very long period of time. This will create the most shareholder value over time.”

“One of my personal heroes, Warren Buffett notes that ‘while our form is corporate, our attitude is partnership.’ Similarly, we see you as a partner in our business.”

This serial acquirer tries to take advantage of a ‘great business poorly done’. Here’s why the company was founded:

“The problem was that I didn’t think that accounting firms were run intelligently as businesses. They weren’t run to help their people and they weren’t run to really help their clients. They were really a place where a technically minded person could impress themselves with their own technical skills. I thought we could do better.”

Acquired companies benefit from many advantages compared to working on their own:

Accountants have 40% more time to focus on what matters (their clients)

Margins will improve and revenue will increase, resulting in increasing profits

Working capital will be reduced by roughly two-thirds

The company’s end market looks attractive as taxes are getting more complex. The consensus states that the global market size for taxes will grow at a CAGR of 10.8% until 2027.

The main risks for the company can be found in the fact that it will be very important for them to expand successfully to the United States. Furthermore, a lot of their success is built on the vision of the founder and CEO. When he would leave the company / he retires / something happens to him, it will be hard to find a replacement.

The ‘Berkshire Hathaway of accounting’ uses some gearing to complete acquisitions. Currently, the company has a Net Debt / Free Cash Flow of 4.5x. Usually, we would prefer lower gearing ratios but given the fact that the company is growing exponentially and invests heavily in future growth, the gearing looks fair to us. The company has a low capital intensity (CAPEX/Sales: 3.1%) and is a great capital allocator. The entire philosophy of their capital allocation policy is based on William Thorndike’s book The Outsiders (remember that Thorndike is a shareholder of the company). The business focuses on organic growth and M&A. Over the past 5 years, the company’s ROIC averaged 17.2%. The company doesn’t use Stock-Based Compensation to reward management and employees. The reason? They don’t want to dilute existing shareholders. A great example of excellent leadership.

The company has a high and stable Gross Margin which indicates that they have pricing power. Over the past 5 years, their Gross Margin has averaged 51.2%. Their Profit Margin and FCF Margin have averaged 8.6% and 22.2% respectively over the same period.

There is a clear secular trend in tax solutions. The company has grown its revenue at a phenomenal CAGR of 31% since its IPO in 2007. The future looks bright too. The company expects to grow its revenue by 15.5%-27.1% in FY24. Over the past 3 years, they have grown their Owner’s Earnings by almost 30% (!) per year.

Today, the company trades at a forward Price/NPATA of 21.3x and our Earnings Growth Model as well as our Reverse DCF indicates that the company is undervalued. Our Earnings Growth Model states that the stock should compound with 15.4% per year over the next 10 years. Our Reverse DCF concludes that the company should grow its Free Cash Flow by 9.1% per year to return 10% per year to shareholders. These estimates are too conservative according to Compounding Quality.

Finally, we like to invest in companies with a very strong track record. The Group managed to compound its stock price by 28.3% per year since its IPO in 2007. That’s a phenomenal figure.

Now let’s tell you which company we are talking about, prepare our transaction for Monday, and share the full investment case of 38 (!) pages with you.