🏰 Bullsh*t earnings

#QualityTuesday

Quality Tuesday

It’s #QualityTuesday!

In this series, we will teach you 5 things about the stock market in less than 5 minutes.

1️⃣ Wonderful companies at a fair price

As a quality investor, you want to buy wonderful companies at a fair price.

Does this strategy work? YES.

Between 1990 and 2021, QARP (Quality At Reasonable Price) managed to outperform the index by 7.4% (!) per year.

2️⃣ Bullsh*t earnings

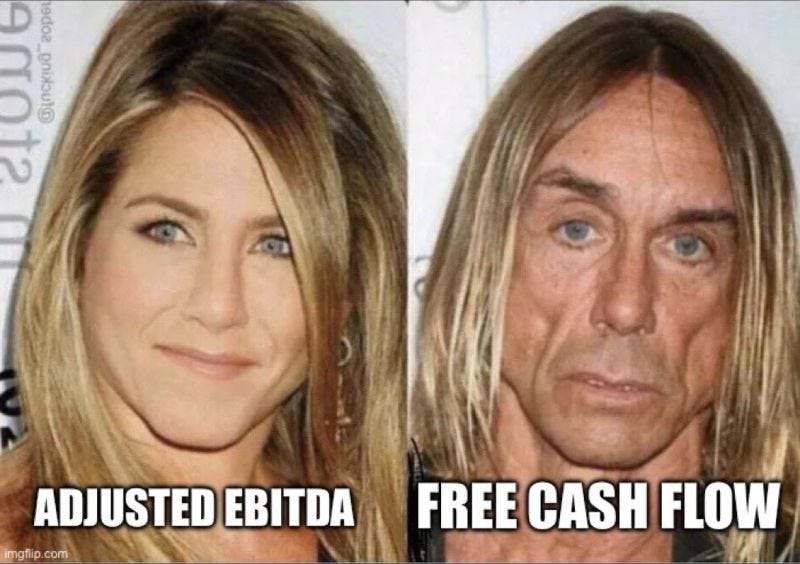

Never look at the adjusted EBITDA of a company. Management can fool you with this metric.

Charlie Munger even goes one step further. He stated that every time you see the word EBITDA, you should replace it with bullsh*t earnings.

In the end, free cash flow per share growth is all what matters.

3️⃣ One simple investment quote

As an investor, you are the owner of the companies you invest in. Act like it.

“Stocks aren’t lottery tickets. There’s a company attached to every share.” – Peter Lynch

4️⃣ TED Talks

TED Talks are a great way to learn about any subject.

Here are 8 great TED Talks about money and investing:

5️⃣ Example of a Quality Company

Garmin provides navigation, communications, and information devices. The company’s key focus is on GPS-enblad products. Think about GPS products for marine, aviation and fitness markets.

Profit Margin: 21.7%

ROIC: 16.9%

Earnings Yield: 5.1%

Exp. yearly EPS Growth (3 yr): 4.8%

Insider ownership: 20.0%

More articles from Compounding Quality

Do you want to read more? Here are our 5 latest articles:

Contact details

Do you want to read more from us? Please subscribe to our Substack where we provide investors with investment insights on a weekly basis.

If you have any suggestions to further improve our posts, or do you want certain topics to be covered? Send us an email:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. We have read over 500 investment books and spend more than 50 hours per week researching stocks.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Always a great quote

Great once again. What’s the second largest bullsh*t term, then? 😉