Buying 2 Stocks

Adding to the Portfolio

Hi Partner 👋

Investing regularly is the easiest way to get rich.

That’s why we will add some more to Our Portfolio.

We’ll buy two stocks that are both trading at very attractive valuation levels if you ask me.

The power of Dollar-Cost Averaging

Let me tell you a little secret. But don’t tell anyone…

… It’s impossible to time the market.

There are only two kinds of people who can do this: fortunetellers and liars.

That’s why trying to time the market is a loser’s game if you ask me.

When you try to time the market, you need to be right twice:

Selling: you need to determine the right moment to sell

Buying: you need to determine the right moment to enter the market again

And guess what?

The best days on the stock market usually take place just after the worst ones.

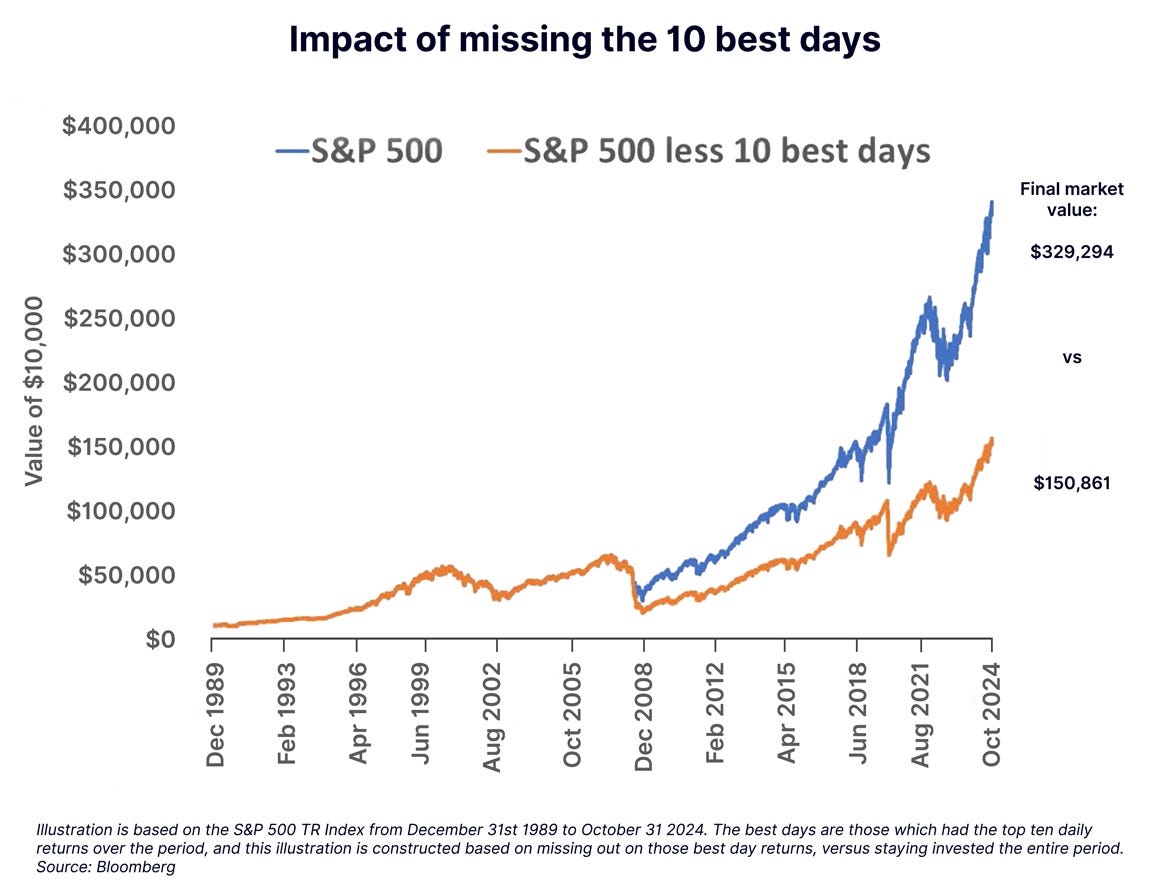

Just imagine you missed the 10 best trading days over the past 27 years…

… Your returns would only be a fraction of what they would be.

The easiest solution for this?

Always stay invested (time in the market > timing the market)

Regularly add to your portfolio

That’s why we are adding to Our Portfolio every single month.

The ultimate goal?

Let Our Portfolio generate $1 in Free Cash Flow per minute for us.

This would result in:

$60 per hour

$1,440 per day

$10,080 per week

$43,200 per month

$525,600 per year

It’s not a question IF we will achieve this.

It’s a question WHEN we will achieve this.

But it will take a while…

… At a FCF Yield of 5%, we would need a Portfolio of $10.5 million to reach this goal.

How long would it take us under the following assumptions?

Our Portfolio is currently worth $1.4 million

We add $50,000 every single month

We achieve a return of 12% per year

In this case, it would take us a little bit more than 7 years.

This is something to look forward to. Generating $1 in Free Cash Flow per minute is a big deal (> $500,000 per year).

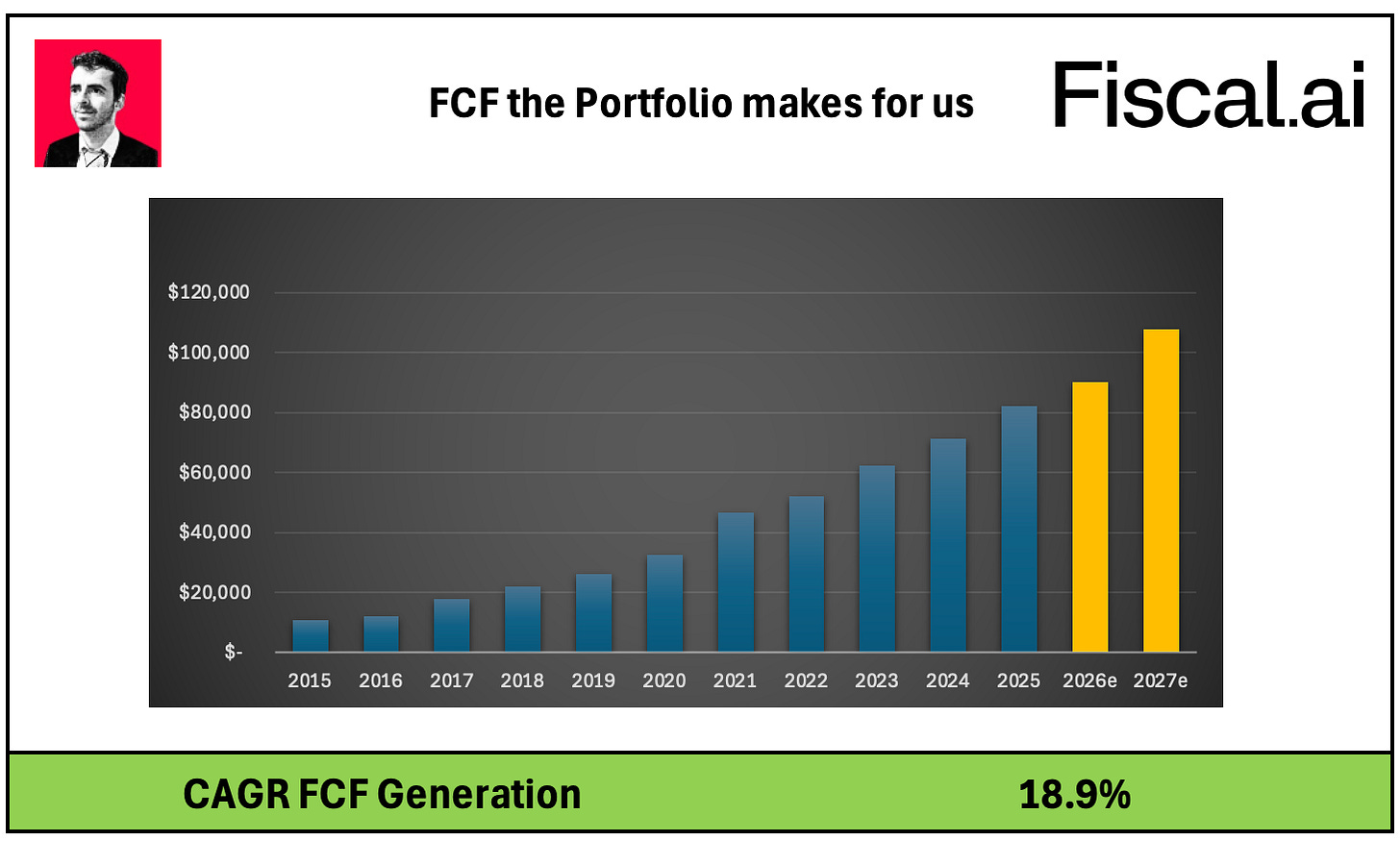

Here’s what the evolution of the Free Cash Flow for Our Portfolio looks like:

You are not convinced yet that stocks are always the best investment?

Read this quote from Warren Buffett.

And if you aren’t convinced after reading it, please read it again.

Adding to the Portfolio

Today, we will add to two positions within Our Portfolio.