🔍 Capital allocation

Everything you need to know about capital allocation

Capital allocation is the most important task of management.

It can make or break a company.

In this article I’ll teach you everything you need to know.

What is capital allocation?

A company that is profitable generates cash.

To give you a few examples:

Apple generates cash from selling iPhones

McDonalds generates cash from selling hamburgers

Tesla generates cash from selling electric vehicles

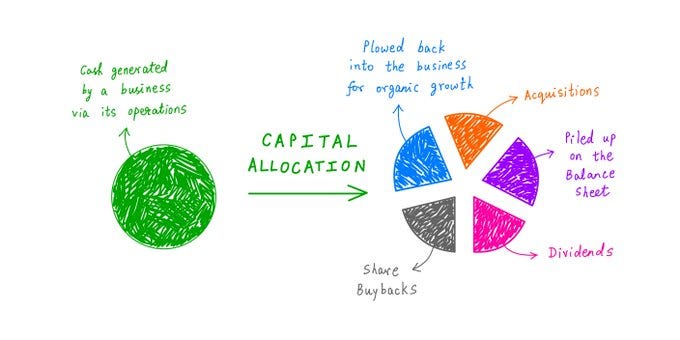

Capital allocation is what follows after a company generated cash. It’s the decision about what the company will do with the money it earned.

Management should put cash back to work at the most attractive rate of return. It’s their moral duty towards shareholders.

Track record management

It’s important to understand that most CEOs reached the top of their company because they were excellent in sales, marketing, R&D, …

This means that most CEOs have no practical capital allocation experience at all when they get promoted to the CEO role.

That’s remarkable as capital allocation is BY FAR the most important task of management.

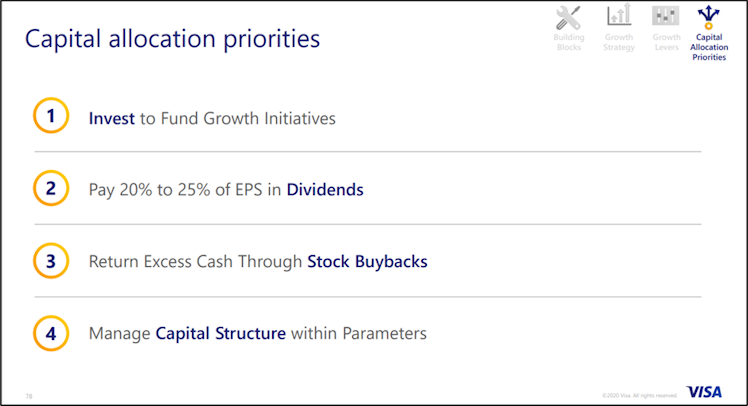

As an investor it’s important to seek for companies which clearly define how they allocate capital.

Here’s a great example of Visa which shows you how it should be done:

You want to invest solely in companies where management has a great capital allocation track record.

If you select companies managed by great capital allocators, you’ll end up with very good investment results.

Capital allocation options

In general, a company has 4 capital allocation options:

Organic growth

Strengthen the balance sheet

M&A

Return capital to shareholders (dividends and/or share buybacks)

1. Organic growth

Organic growth is the most preferred capital allocation choice.

You want to invest in companies which can reinvest a lot of their earnings in future growth opportunities at attractive rates of return.

It’s essential that the company has a high and stable ROIC when it reinvests a lot in organic growth.

Why? Because something magical happens when a company has a high ROIC in combination with plenty of reinvestment opportunities.

Let’s look at an example:

Not So Quality Inc.

Invested capital in year 0 = $100 million

ROIC = 5%

Reinvests all its earnings to grow organically

Quality Inc.

Invested capital in year 0 = $20 million

ROIC = 25%

Reinvests all its earnings to grow organically

When both companies reinvest all their earnings at a ROIC of 5% and 25% respectively, the evolution of their net profit looks as follows:

As you can see, after 10 years the net profit of Quality Inc. is 5.7x as high as the one of Not So Quality Inc.!

How did I calculate this?

Net profit = ROIC * Invested Capital

Year 0:

Net profit Not So Quality Inc. in year 0 = 5%*$100 million = $5 million

Net profit Quality Inc. in year 0 = 25%*$20 million = $5 million

In year 1, invested capital increases with the net profit of year 0 as both companies reinvest all their earnings in organic growth

Year 1:

Net profit Not So Quality Inc. in year 1 = 5%* $105 million = $5,25 million

Net profit Quality Inc. in year 1 = 25%*$25 million = $6,25 million

The example above beautifully shows you why a company with a high ROIC active in an industry with a clear secular trend creates a compounding machine.

Great examples of secular trends are cybersecurity, urbanization, electronic payments, and obesity.

2. Strengthen the balance sheet

A company can also use the cash it generates to pay down its debt.

This is especially an attractive option when the company is in bad financial shape.

A healthy balance sheet gives companies flexibility.

Just take Microsoft for example where Bill Gates insisted that Microsoft should always keep enough cash in its bank account to keep the company alive for 12 months when Microsoft would generate no revenue at all.

3. M&A

Research has proven that 60-90% (!) of all acquisitions destroy value.

That’s why you should always be cautious when a company announces a big acquisition.

In general, it’s very hard to predict which M&A activities will create value and which won’t.

Managers can also have their personal agenda as acquisitions result in more revenue and more employees. This usually translates into a higher salary and more prestige for the CEO.

In general, I am not very enthusiastic about acquisitions for the reasons mentioned above.

For me personally, large M&A activities only make sense when 2 criteria are met:

Management has skin in the game: when the acquisition destroys value, this also has negative implications for management

The company has proven to be a successful (serial) acquirer in the past: these kind of companies often have an unique culture

Examples of great serial acquirers: Danaher, Constellation Software and Lifco

4. Return capital to shareholders

Last but not least, a company can also return capital back to shareholders via dividends and/or share buybacks.

A company usually returns capital back to shareholders when they don’t have any other attractive growth opportunities.

When a company pays out a dividend, always look at the dividend yield and the payout ratio of the company. Dividend aristocrats are stocks that increased their dividend every year for at least 25 years.

Regarding share buybacks, it’s important to underline that share buybacks only create value when the stock is undervalued.

This is very logical as buying back your own shares can be seen as an investment in your own company. As an investor you also only want to buy stocks when they are undervalued.

You aren’t convinced yet? Let’s give an example.

Let’s say Company A and Company B both have 1 million shares outstanding and you own 1% of both.

Company A:

Stock price: $10

P/E: 5x

Company A will buy back shares for $3 million

Company B:

Stock price: $50

P/E: 25x

Company B will buy back shares for $3 million

When Company A buys back shares for $3 million, it can buy back 300,000 shares. As a result the number of outstanding shares decreases to 700,000 and your stake increase from 1% to 1,42%.

When Company B buys back shares for $3 million, it can only buy back 60,000 shares. As a result the number of outstanding shares decreases to 940,000 and your stake increase from 1% to 1,06%.

The example above shows that the more cheaply valued the stock, the more value share buybacks create for you as a shareholder.

Do you want to learn more about stocks which are heavily buying back their own shares? In this article you can find 15 examples.

Conclusion

That’s it for today.

You want to learn more?

William Thorndike’s excellent book The Outsiders is a must read. His book gives examples of 8 CEOs that managed to outperform the S&P500 by a wide margin thanks to their excellent capital allocation skills.

Furthermore, Michael Mauboussin’s paper is a must read too:

Last but not least, I want to share this great capital allocation visual with you. It was made by Vishal Khandelwal.

The end

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

Your newsletter is the most educational and well written newsletter on investing that I have seen.

What can I say? Like the rest of your articles, this blew me away with its clarity and simplicity.