A small Canadian business is quietly copying Constellation Software’s winning formula.

It is a cash-generating machine backed by a top-tier M&A team ready to deploy capital.

Let’s uncover this hidden gem.

CMG - General Information

👔 Company name: Computer Modelling Group (CMG)

✍️ ISIN: CA2052491057

🔎 Ticker: TSE: CMG

📚 Type: Oligopoly

📈 Stock Price: CAD 6.86 ($5.0)

💵 Market cap: CAD 566.2 million ($412,5 million)

📊 Average daily volume: CAD 2.0 million ($1.5 million)

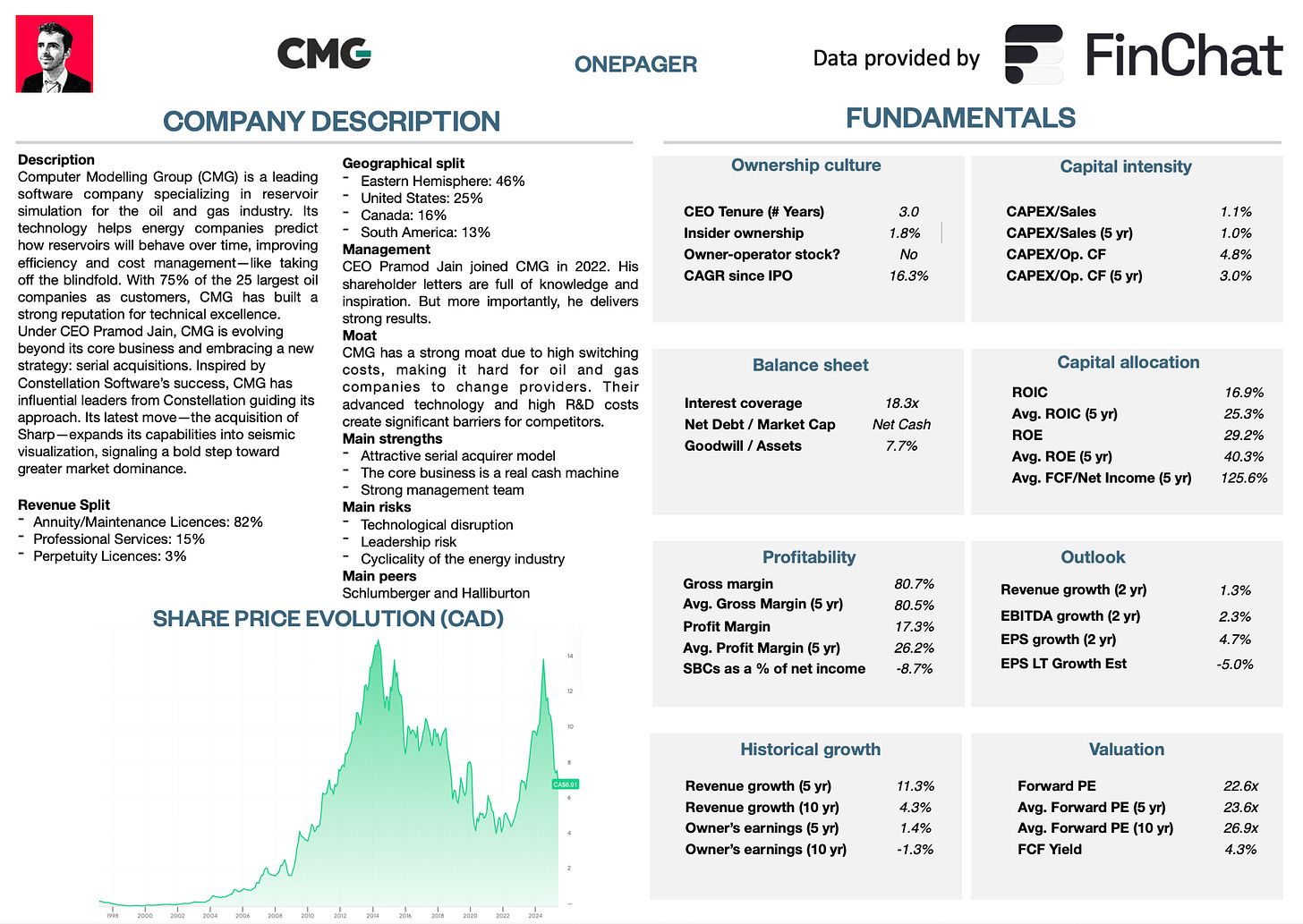

Onepager

Here’s a onepager with the essentials of CMG (click on the picture to expand):

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give CMG a score on each of these 15 metrics.

This results in a Total Quality Score.

1. Do I understand the business model?

Computer Modelling Group (CMG) creates software for simulating oil and gas reservoirs.

Their technology helps companies predict how reservoirs will behave over time. It’s like taking off the blindfold for these businesses.

This allows more efficient and cost-effective management of energy resources.

As a result, 75% of the 25 largest oil companies are customers of CMG.

With 65% of its revenue being recurring, their software is very sticky.

While their core business is interesting, Computer Modelling Group is becoming well-known for a different reason.

CEO Pramod Jain is slowly transitioning CMG into a serial acquirer.

And he seems to know how to do it.

Chris Mayer, who recently bought shares, wrote:

"One stock I bought recently is Computer Modelling Group, listed in Canada. There is a certain Constellation Software influence here. Mark Miller is chairman of the board. The largest shareholder is a Constellation board member. And the head of acquisitions is an ex-CSI guy. The CEO, Pramod Jain, gets it.Constellation Software is the best serial acquirer in the world.

It has created huge shareholder value by buying Vertical Market Software (VMS) companies.

Now, (former) Constellation leaders are helping CMG. This could be a big deal.

CMG’s latest move? The acquisition of Sharp.

Sharp is a software tool that helps engineers interpret seismic data.

Their software transforms large data sets into a ‘simple’ visualization.

2. Is management capable?

Pramod Jain joined Computer Modelling Group in 2022 as the CEO.

At the end of each quarter, Pramod writes a shareholder letter.

I have read them, and he impressed me.

Here is what he wrote in his most recent letter:

"A colleague recently challenged me with the question 'what is that one word that you stand for?' It was an easy answer for me because it is a deeply held and long-standing belief. That one word is 'compounding'. Compounding is said to be the 8th wonder of the world and in both my personal and professional life, I believe 'bring a 1% improved version of yourself every day and you’ll be 37 times better in a year'. Our

employees know this well as I’ve repeated it often since joining CMG. It is something I strive to do every day."Another word that keeps coming back in his letters is ‘extreme ownership’. This means Pramod will always take full responsibility for his own mistakes.

All of this sounds great.

But words are cheap, actions speak louder.

So let’s dive into some numbers.

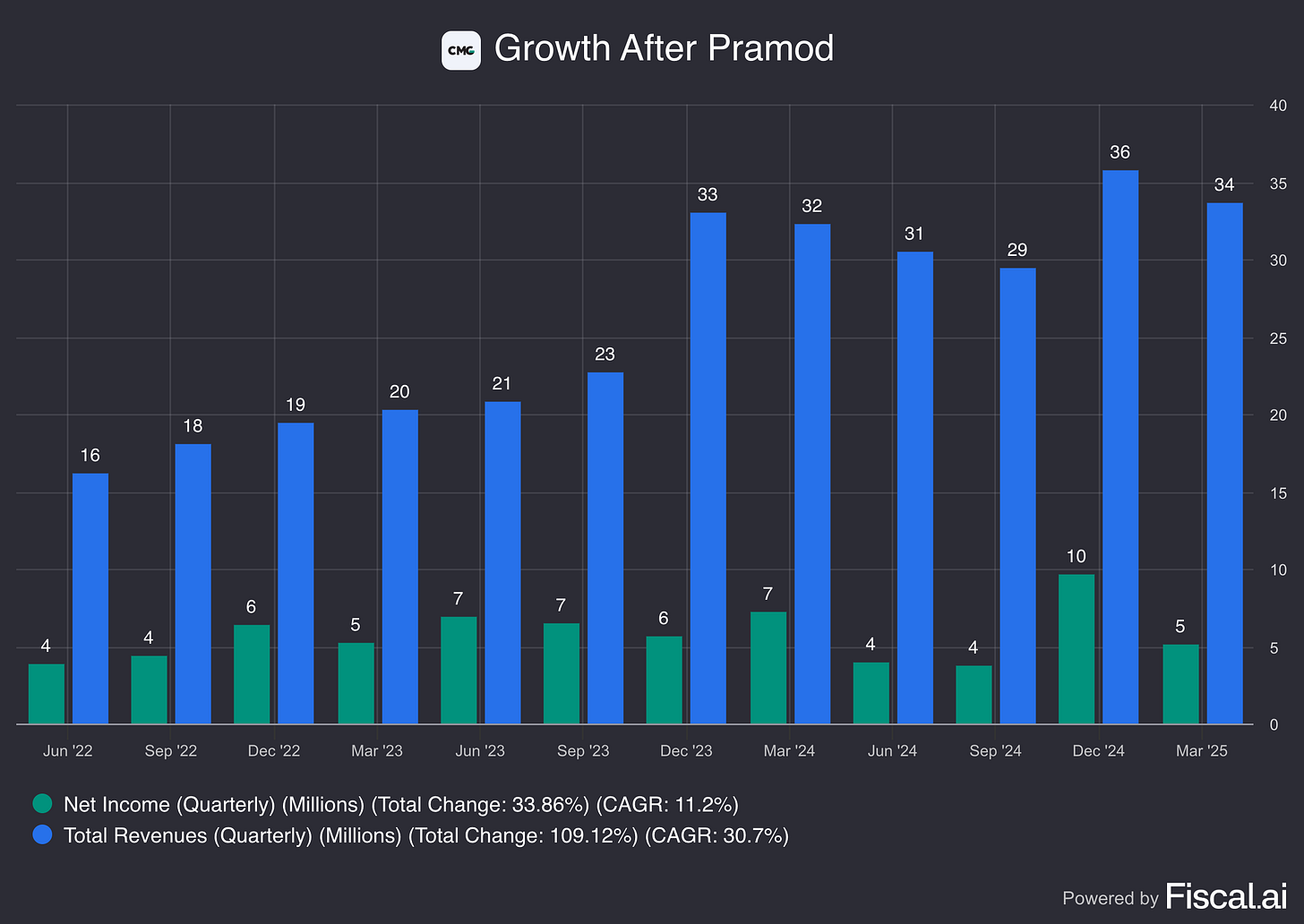

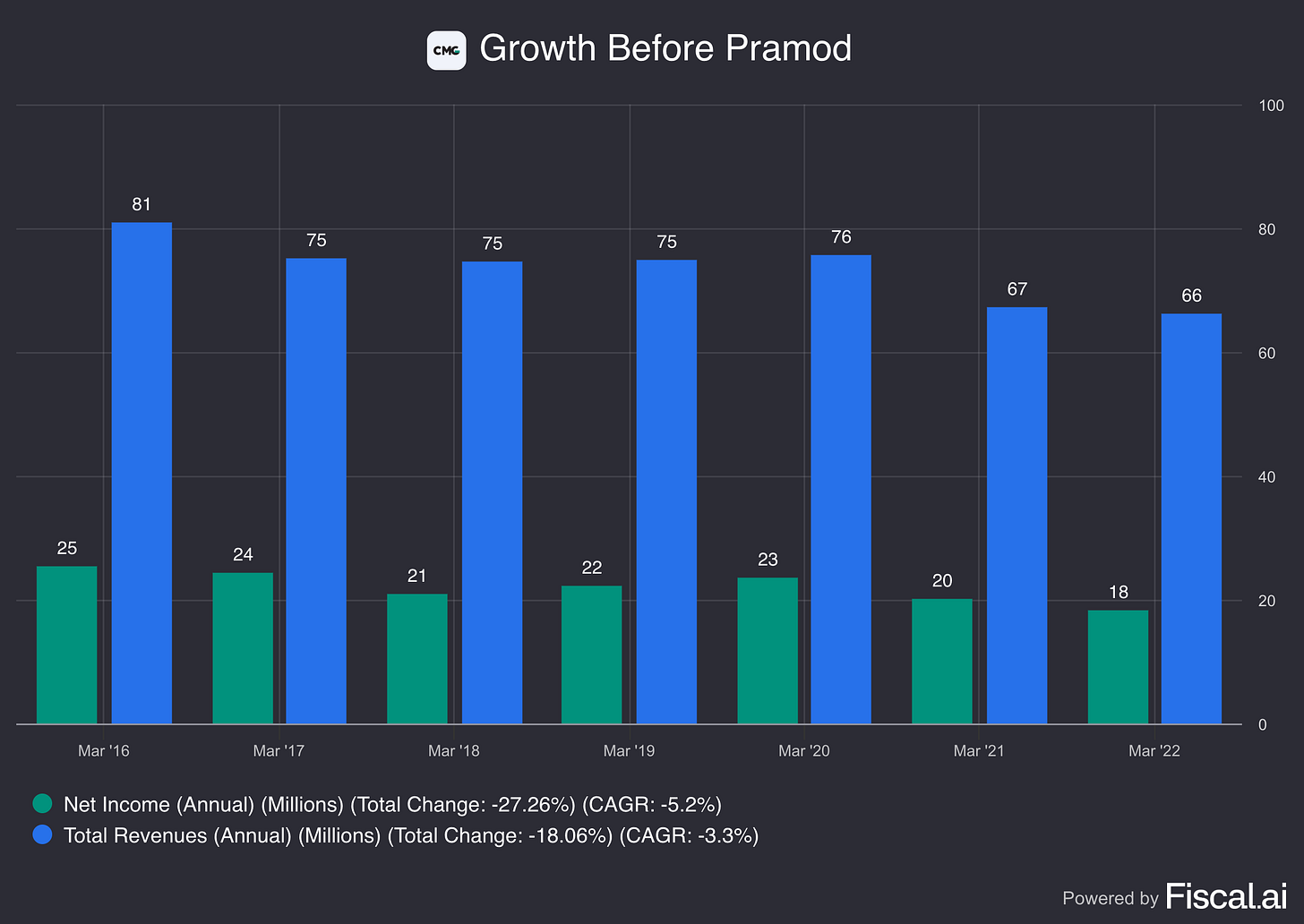

Since he joined CMG not so long ago (2022), it’s hard to speak of a track record.

Nevertheless, he is growing Revenue and Net Income at an interesting rate.

As you can see, the average Revenue Growth since Pramod joined is 26.3% per year

And this while the growth before he joined was negative.

It seems like Pramod practices what he preaches.

But is he also a great capital allocator? You will find the answer later.

What’s also interesting is the largest shareholder of CMG.

Edgepoint holds 25.3% of CMG and is managed by Andrew Poster, another Constellation Software board member.

As a result, insider ownership stands at 27.1%.

3. Does the company have a sustainable competitive advantage?

Computer Modelling Group has a moat for sure. And it’s a deep one.

Their biggest competitive advantage? High switching costs.

Once CMG’s software is integrated, it becomes costly and time-consuming for oil and gas companies to switch to a different provider. Engineers also prefer to stick with familiar tools.

But don’t take my word for it, look at the impressive contract renewal rate of over 98%.

Another major advantage is the complexity of its technology.

Developing software that accurately simulates oil and gas reservoirs isn’t a weekend coding project, it requires significant expertise.

The R&D investment needed to compete with CMG is both time-consuming and expensive. This creates high barriers to entry.

According to Pramod, CMG also benefits from strong brand recognition.

The durability of the moat comes from its strong collaboration with universities.

The next generation of engineers is being trained with CMG’s tools, not with the tools of competitors. This is a smart move.

This is exactly the same as what Autodesk and Adobe are doing.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 80.7% (Gross Margin > 40%? ✅)

Return On Invested Capital (ROIC) 16.9% (ROIC > 15%? ✅)

4. Is the company active in an attractive end market?

Constellation Software has more than 1,000 subsidiaries.

CMG, on the other hand, has only done two meaningful acquisitions with Bluware and Sharp.

Just like Sharp, Bluware is a company that makes special software and services to help scientists understand seismic data.

Bluware has a specific focus on cloud technology.

A comparison between Constellation and CMG isn’t exactly fair.

But it tells you one thing: CMG has a long runway ahead.

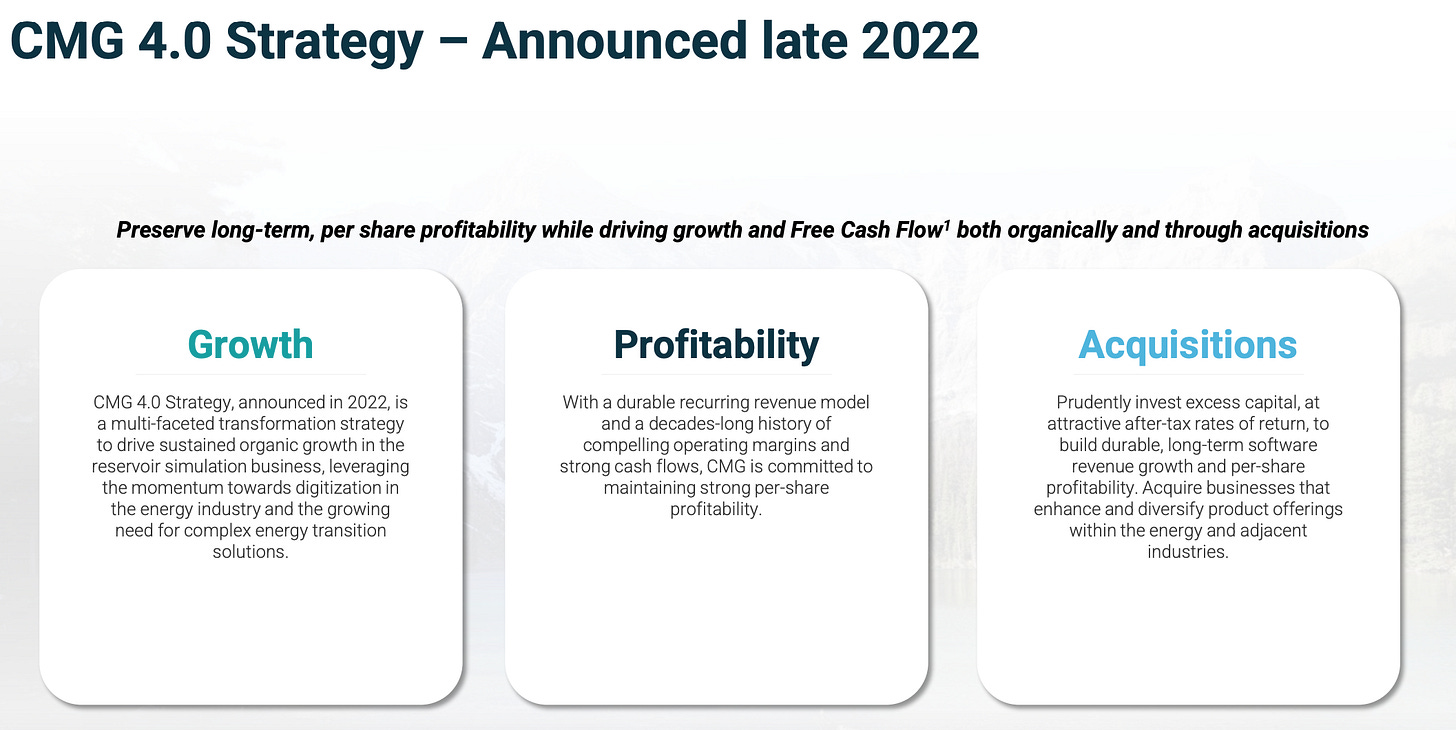

They combine this runway with a clear strategy which they call CMG 4.0:

Growth refers to organic growth in the simulation business

Profitability (more on this later)

Acquisitions are where the real compounding will happen

5. What are the main risks for the company?

Investing in CMG, like any other investment, comes with risks.

One of the biggest concerns is the energy industry's cyclical nature. Since CMG serves this sector, fluctuations in energy markets could directly impact its revenue.

Another risk is technological disruption.

To stay ahead, CMG must continue innovating and ensuring it has the best technology in the industry. Falling behind could mean losing ground to competitors.

There’s also the question of organic growth.

Ideally, CMG would expand both organically and through acquisitions, but the long-term growth of its core business remains uncertain to me.

However, the most significant risk is leadership.

Pramod Jain, the CEO, has played a major role in transforming CMG. If he were to leave, it could be a serious setback for the company.

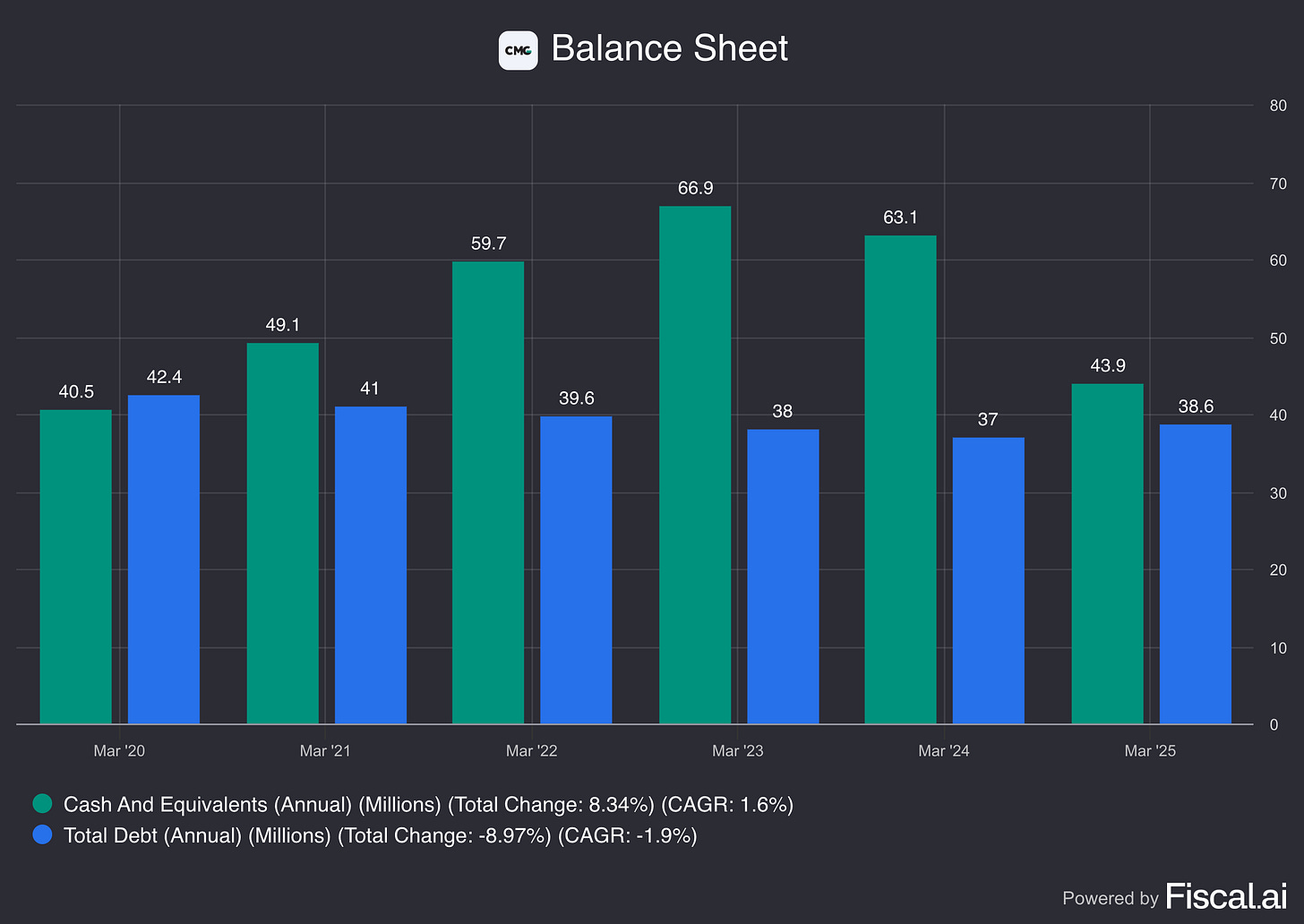

6. Does the company have a healthy balance sheet?

I look at 3 ratios to determine the healthiness of CMG’s balance sheet:

Interest Coverage: 18.3x (interest coverage > 15x? ✅)

Net Debt/FCF: Net Cash Position of CAD 5.3 million (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 7.7% (Goodwill to assets < 20%? ✅)

Computer Modelling Group has a very healthy balance sheet.

A Net Cash Position is very conservative.

This approach doesn’t surprise me as the CEO wrote:

"Leverage can be an effective tool but, in my career, I have also seen what happens when it goes unchecked. My priority is to deploy our Free Cash Flow primarily and to potentially use leverage strategically to supplement on an as needed basis. Most importantly, I want to reassure our shareholders that I believe in maintaining a strong balance sheet

and that financial leverage should be used carefully and opportunistically to enhance shareholder value without taking on undue risk." - Pramod Jain7. Does the company need a lot of capital to operate?

I prefer to invest in companies with a CAPEX/Sales lower than 5% and CAPEX/Operating Cash Flow lower than 25%.

Here’s what things look like for CMG:

CAPEX/Sales: 1.1% (CAPEX/Sales? < 5%? ✅)

CAPEX/Operating cash flow: 4.8% (CAPEX/Operating CF? < 25%? ✅)

CMG doesn’t need a lot of capital to operate.

This means that there’s more fuel available for the acquisition engine.

Let’s now take a look at the most important metric.

8. Is the company a great capital allocator?

Capital allocation is the most important task of management.