Copart is one of the Greatest Compounders in the United States.

An investment of $10,000 in Copart turned into $3.2 million (!) since 1994.

Let’s teach you everything you need to know about this beautiful company.

Copart - General Information

👔 Company name: Copart

✍️ ISIN: US2172041061

🔎 Ticker: CPRT

📚 Type: Owner-Operator Stock

📈 Stock Price: $48.7

💵 Market cap: $46.8 billion

📊 Average daily volume: $207 million

Onepager

Here’s a onepager with the essentials of Copart:

(Click on the picture to expand)

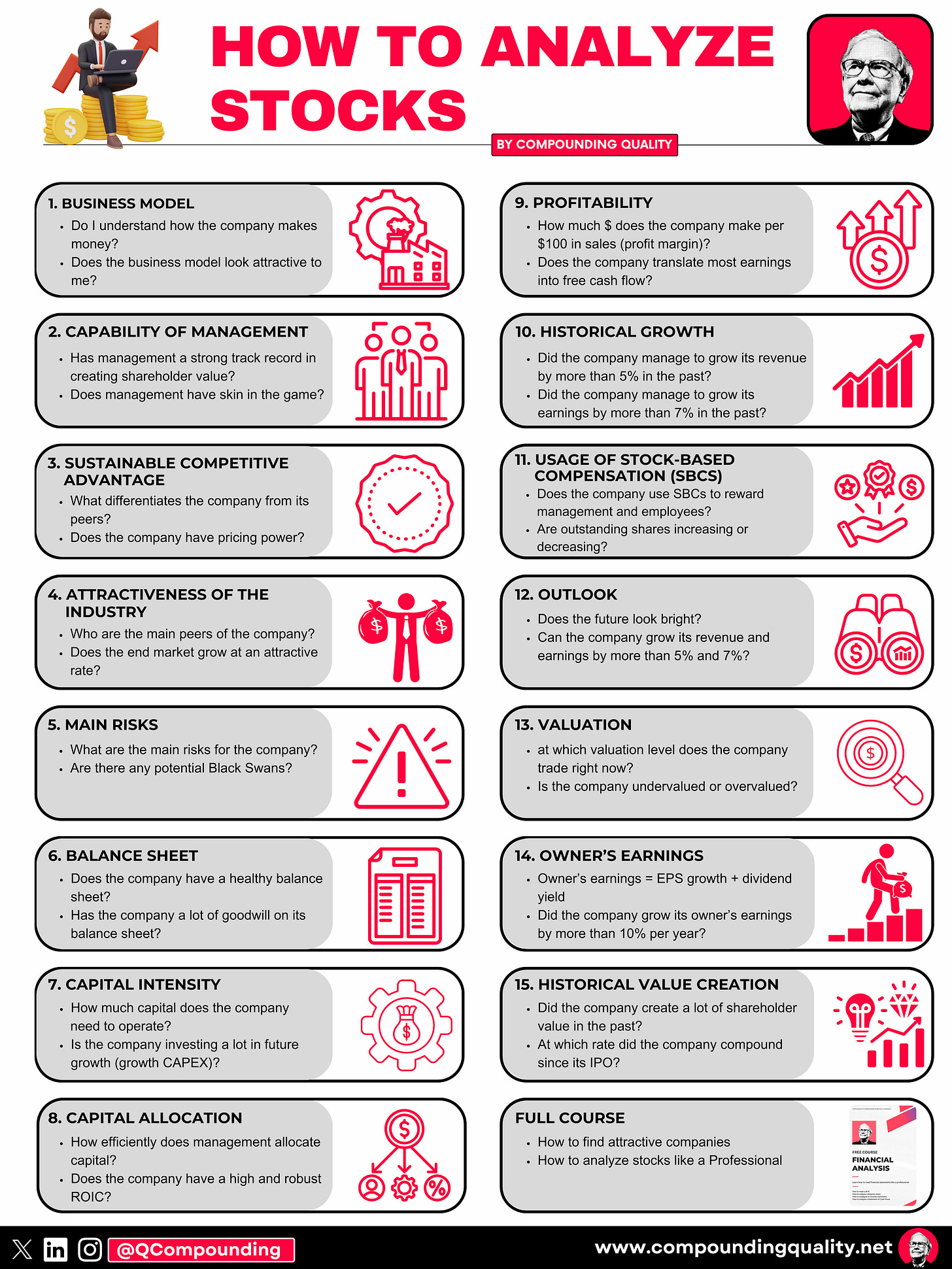

15-Step Approach

Now let’s use our 15-Step approach to analyze the company.

At the end of this article, we’ll give Copart a score on each of these 15 metrics which results in a Total Quality Score.

1. Do I understand the business model?

Copart makes money via online vehicle auctions. They are active in the buying and selling of used and salvage vehicles. Every day, Copart has more than 175,000 vehicles up for auction.

The American company makes money from fees charged to both buyers and sellers participating in its online auctions.

Sellers such as insurance companies, salvage yards, and individuals, enlist Copart's services to auction off damaged or surplus vehicles. Copart charges sellers listing fees and a percentage of the final sale price.

Buyers, including automotive dealers, dismantlers, and the general public, pay a buyer's premium on top of the winning bid.

Copart’s platform provides a global marketplace, connecting buyers and sellers across various regions.

The company employs a bidding system where buyers place competitive bids on vehicles of interest. Copart enhances its revenue through ancillary services, such as vehicle transportation and storage, offered to both buyers and sellers.

Additionally, the company monetizes its global network of facilities, leveraging its physical infrastructure for storage and processing of vehicles. Copart's business model thrives on the efficient and transparent facilitation of the automotive auction process through its online platform, contributing to its position as a leader in the salvage vehicle market.

Here’s a great visualization of Copart’s business model:

2. Is management capable?

Willis Johnson founded Copart in 1982 out of a single scrap yard in California.

Today, he serves as chairman of the board of directors and he still owns 6.66% of the company.

The story about Willis Johnson and the early days of Copart have been published in the book ‘Junk to Gold’, a must read for everyone who wants to learn more about Copart.

Today, Willis Johnson’s son-in-law Jay Adair is still the co-CEO of Copart together with Jeff Liaw. Jay Adair owns 3.75% of Copart.

In total, insiders own 11.14% of the company. This means we’re talking about an Owner-Operator stock.

Copart has performed really well under Willis Johnson and Jay Adair.

3. Does the company have a sustainable competitive advantage?

Copart has a sustainable competitive advantage based on network effects and economies of scale.

Network effects: The more buyers and sellers use Copart’s auction, the better the selling prices for sellers and the easier it is for buyers to find the vehicle they need. Copart’s auction platform is the largest in the world with 750,000 users in 170 countries. This is virtually impossible to match for new entrants

Economies of scale: It took Copart decades to acquire the number of locations it owns today. Insurers operate all over the country so Copart's many locations have the advantage that there is always one nearby. Due to its size, Copart can usually guarantee to pick up damaged vehicles within 24 hours. To transport the vehicles, the company has its own fleet at its disposal and if that is not enough, it can rely on relationships with external transport companies.

Companies with a sustainable competitive advantage are often characterized by a high and robust Gross Margin and ROIC:

We aim for a Gross Margin > 40% and ROIC > 15%. Copart ticks both boxes.

4. Is the company active in an attractive end market?

In the years to come, Copart should benefit from 2 main growth drivers:

Higher total loss frequency:

Total loss frequency is the number of vehicles that are declared total losses instead of being repaired.

Rising auction prices

Rising auction prices result in higher commissions for Copart.

In the United States, Copart is active in a duopoly together with Insurance Auto Auctions (IAA). Both ompanies have a market share of roughly 40%.

While IAA isn’t a listed company, fundamentally Copart is a way better business.

5. What are the main risks for the company?

Some of the main risks for Copart:

The most important clients for Copart are large insurance clients. These clients can have some pricing power compared to Copart

More safety in cars will result in less accidents and less cars that are declared total loss

A slowdown in the economy or a recession can lead to reduced demand for used and salvaged vehicles

Changes in regulations related to salvage vehicle auctions

Can Copart succesfully expand internationally?

The rise of electric vehicles, ridesharing, and autonomous driving

Now let’s dive into the fundamentals of Copart.