Dino Polska Deep Dive Part 1

Hi Partner 👋

I’m Pieter and welcome to a 🔒 subscriber-only edition 🔒 of Compounding Quality.

In case you missed it:

If you haven’t yet, subscribe to get access to these posts, and every post.

Dino Polska has a unique business.

They can reinvest ALL free cash flow in organic growth.

That’s exactly how Compounding Machines are created.

Today, we’ll analyze their business model. Enjoy!

Dino Polska

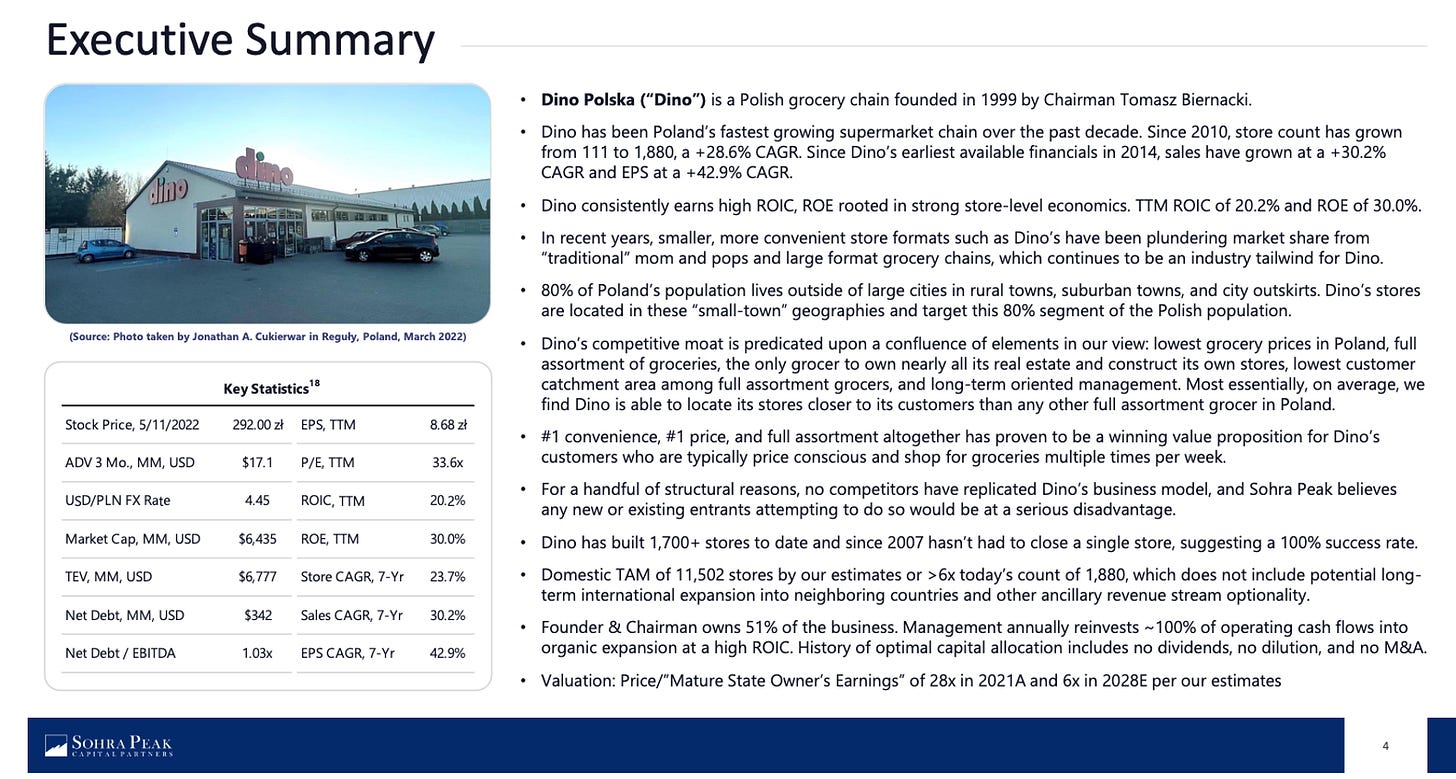

👔 Company name: Dino Polska

✍️ ISIN: PLDINPL00011

🔎 Ticker: $DNP.WA

📚 Type: Owner-Operator Stock

📈 Stock Price: 415.9 PLN

💵 Market cap: 40.8 billion PLN ($10.4 billion)

📊 Average daily volume: 83.9 million PLN ($21.1 million)

Do I understand the business model?

Dino Polska, founded in 1999, is a Polish grocery company comprising medium-sized grocery supermarkets close to clients’ places of residence in rural areas. Dino Polska is one of the fastest-growing retail grocery networks in Poland measured by the number of stores and revenues.

The Polish compounder continues to develop its network rapidly. It’s one of the only quality companies that can still reinvest all its free cash flow (!) in organic growth.

History

Here’s a brief history of the company:

1999: Dino Polska was founded by Tomasz Biernacki. That year they opened their first store in West Poland (Wielkopolska)

2002: The first distribution center was created in Krotoszyn

2003: Dino Polska acquired a fresh meat supplier (Agro-rydzyna)

2004-2009: The company started focusing on mid-sized supermarkets in rural areas

2010: Founder Tomasz Biernacki sold 49% of his Dino Polska shares to Enterprise Investors. This provided funding for rapid store growth

Dino Polska evolved from 111 stores in 2010 to 628 in 2016

2017: Enterprise Investors sold its stake through Dino Polska’s IPO

Today: Dino Polska has 2,340 stores today

Business model

Dino Polska’s business model is based on a standardized store design, equipped with parking places for its customers and supplied with fresh products every day of the week. The company focuses on compact stores in less urbanized areas like small towns, villages, and suburban districts.

On average, a Dino Polska store encompasses 4,300 square feet (about 400 square meters). Each location offers a selection of approximately 5,000 different products, with a notable 95% being brand-name products.

Think about bread, rolls, milk, eggs, flour, sugar, fresh fruits, butter, cereal, cold cuts, cheeses, meats, cooking oils, sodas, frozen foods, instant coffee, ...

A meat counter is a standard feature within every store. Dino Polska prides itself on obtaining the bulk of its products directly from the manufacturers or their primary agents rather than through wholesalers, a strategy that leads to enhanced profit margins. The company maintains close ties with local Polish producers and offers regional brands, which provide cost-effective alternatives to premier national and international labels.

The logistics network of Dino Polska includes eight distribution centers, each responsible for supplying about 300 stores. The company's ownership of approximately 90% of its store properties facilitates uniformity in in-store design and grants greater freedom in selecting store locations.

Dino Polska typically targets around 3,500 residents per store. Targeting smaller communities allows Dino to avoid head-to-head competition with stores that demand a more dense population (larger discounters and hypermarkets).

Even though Dino is trying to occupy niche locations, the store economics do not demand the company to become a monopoly in the catchment area. Research shows that an average customer only buys about a third of their groceries at Dino.

One of the beautiful things about Dino Polska is that its business model is very scalable. It comprises centralized management supported by suitable IT systems, a logistics network based on eight distribution centers, and a transportation network managed by Dino Polska.

Dino Polska sources most products directly from producers or their main representatives. The large and constantly growing volumes of orders they place with suppliers accrue benefits in the form of economies of scale.

These drivers, combined with operational leverage and store network maturation, should increase the company’s profitability in the future.

Owning every store

While most rivals lease their stores, Dino Polska has purchased all real estate for its stores since 2010.

To achieve this, founder and CEO Tomasz Biernacki founded Krot-Invest in 2013. This company is solely dedicated to the construction of Dino stores. This gives Dino Polska the advantage of speeding up the building process and eliminating unnecessary negotiations or potential lawsuits with construction companies. Usually, it takes 2 years to build a store and it costs around $1.5 million.

Today, Dino Polska owns 95% of its stores. All these stores are standardized. They are each around 400 square meters in size, sell the same products, and are arranged similarly.

This relentless standardization gives Dino Polska an advantage as it’s easier for them to predict the revenue and profits per store with a higher level of accuracy. It is also noteworthy that Dino is the only grocery chain in Poland that owns its real estate. They also have the most standardized stores in Poland.

A study of Sohra Capital concludes that owning real estate is less expensive than leasing for grocery chains in Poland. They conclude that at year 7 and beyond, owning and constructing is a less expensive financial obligation than leasing. As most of Dino’s stores should last for multiple decades, owning the stores makes sense for Dino Polska and it even gives them a competitive advantage over peers.

Now let’s dive into the most attractive part of Dino’s business model.